John Paulson was recently quoted as saying that he believed Bank Of America would double in value by 2011. He expects BAC to earn $27.2 billion in 2011. With nine billion shares outstanding this would equal an EPS of three for BAC, at a 10X multiple that translates into a $30 stock. Meredith Whitney stated shortly afterwards day that she thought banks were grossly overvalued. She stated that while it is possible that BAC will double in value eventually, she thought his timing was off. The story made a lot of waves with people arguing over whom is right about the banking sector and BAC in particular.

I wrote a previous article where I questioned some of the numbers that Paulson used to get to his 2011 EPS estimate of $3 per share. I think that he is not taking into account the large dilution which is inevitable once BAC returns Tarp funds.

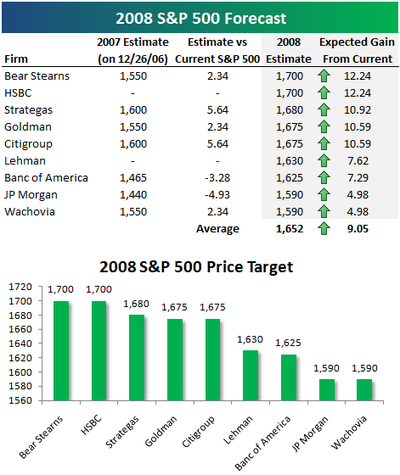

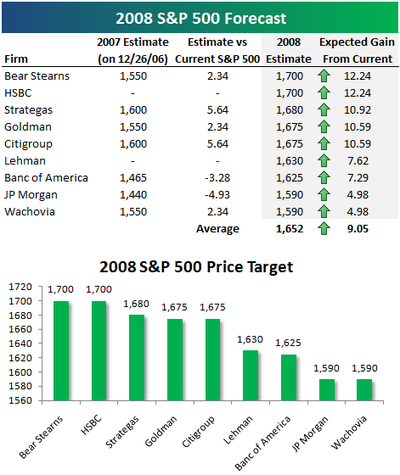

However I think the whole argument moot. As a value investor I do not think anyone can predict short term movements of the market. Short term movements in the market is dependent far more on emotion and popularity than on fundamentals. As Benjamin Graham said "In the short run, the market is a voting machine, but in the long run it is a weighing machine." Therefore even if Bank Of America's EPS is three, four or even five dollars a share in 2011 there is no guarantee that the stock will trade at a certain multiple. Therefore it is impossible to predict what the price of the stock will be even if it were possible to precisely earnings per share. Below is a chart of just one example of how wrong analysts can be. Wachovia and JP Morgan were the closest of all the analysts. Wachovia and JP Morgan had an end of year target of 1590, the S&P finished off the year at 903 only 687 points off. There is no way to predict short term movements in the market and therefore neither of them can predict what BAC will be trading at in two years from now.

Disclosure: No Positions

I wrote a previous article where I questioned some of the numbers that Paulson used to get to his 2011 EPS estimate of $3 per share. I think that he is not taking into account the large dilution which is inevitable once BAC returns Tarp funds.

However I think the whole argument moot. As a value investor I do not think anyone can predict short term movements of the market. Short term movements in the market is dependent far more on emotion and popularity than on fundamentals. As Benjamin Graham said "In the short run, the market is a voting machine, but in the long run it is a weighing machine." Therefore even if Bank Of America's EPS is three, four or even five dollars a share in 2011 there is no guarantee that the stock will trade at a certain multiple. Therefore it is impossible to predict what the price of the stock will be even if it were possible to precisely earnings per share. Below is a chart of just one example of how wrong analysts can be. Wachovia and JP Morgan were the closest of all the analysts. Wachovia and JP Morgan had an end of year target of 1590, the S&P finished off the year at 903 only 687 points off. There is no way to predict short term movements in the market and therefore neither of them can predict what BAC will be trading at in two years from now.

Disclosure: No Positions