Nowadays, many people seem to be bullish on the BRICs( Brazil, Russia, India, China). The bulls expect these countries to experience rapid growth in the future and therefore argue that their equities should be purchased. But how much growth can we expect, and what is the macro picture like in these countries? Let us examine each country one by one.

Brazil: The country experienced a massive economic crisis only eleven years ago. Has so much changed then, and is this time different? Bulls will argue that Brazil is the eighth largest economy in the world, but it was also the eighth largest economy in 1999 when it devalued its currency.

There are also signs the economy is overheating. Brown Brothers Harriman’s Win Thin wrote recently:

Some of the numbers are deteriorating sharply for Brazil, including the external accounts, and should help limit BRL upside. Exports remain robust, but imports are going through the roof and leading to worsening trade and current account balances. June current account gap was reported at a much higher than expected -$5.2 bln, and pushed the 12-month total to -$40.9 bln or -2.1% of GDP, the highest since Oct. 2002. FDI flows have held up OK, but now only covers less than two thirds of the current account gap.

Russia: To state Russia has massive demographic problems would be an understatement. The population peaked in 1991 and has been declining ever since. The UN expects the population of Russia to decline as much as a third by 2050. In addition, Muslims are a growing percentage of the Russian population this will likely cause increasing social tensions with the mostly Orthodox Christian population. Russia is run by corrupt politicians and robber barons, and there are poor protections for investors rights. Russia also had its own economic crisis in 1998, when it defaulted on its debt. Now the Government is even more authoritarian and there is no way to predict if the Government would just default as it did in the past.

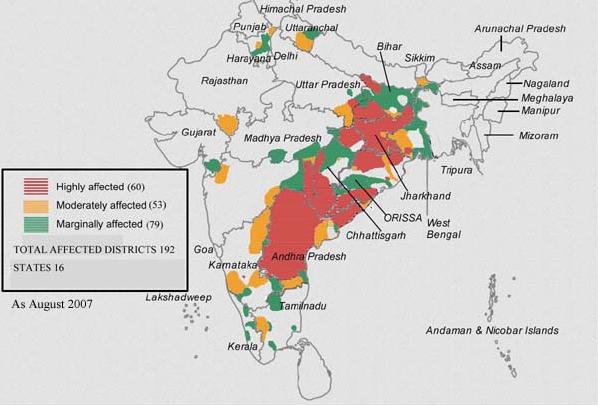

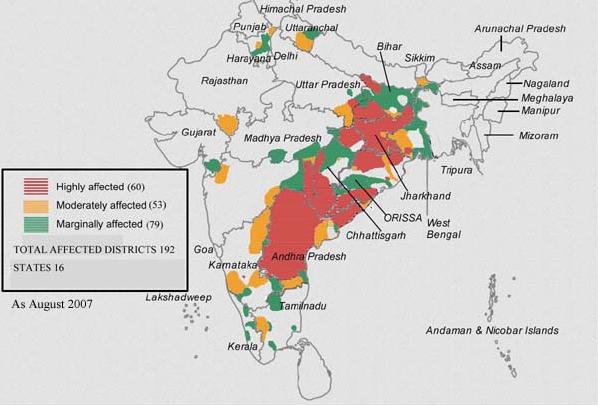

India: Faces massive problems from the Maoist insurgency in the East. The insurgency has been going on for decades, and the intensity has only been increasing recently. Below is a map which shows how a large swath of the country is affected by this conflict. In the west, India has constant problems with its arch enemy Pakistan. The countries have fought several wars, in addition to many near wars. However, now both countries have large nuclear stockpiles and a war would be an utter disaster for both countries. Any future terrorist attack, or inadvertent border skrimish, has the potential to lead to an all out nuclear war.

China: Has similiar problems with Russia in regards to corrupt Government officials. The whole rural inner area of the country is poor and many people are migrating to the richer coastal region. The economy is entirely reliant on shipping low quality products at low prices to America. However, China is now in competition with other countries that are producing similar goods at low costs and shipping them off to the west. China is fighting an Islamic insurgency near the Mongolian border. There is huge civil unrest in the country, with massive riots and recent suicides among disgruntled workers. China has been manipulating its currency in order to help its export driven economy. Recently, the Government allowed the yuan to float, but do not expect much change to the currency manipulation.

Finally there is the problem of the housing bubble in China. Kennth Rogoff, Robert Shiller, Jim Chanos and other great minds have all stated that China is experiencing a bubble. While it is hard to get exact statistics on the Chinese economy, here is one frightening statistics: Housing property value/ annual disposable income NATIONWIDE is at 8, while the number was at nine in Tokyo at the height of the Japanese bubble. This dispells the argument among China bulls that there might be a housing bubble in cities like Shanghai, and Bejing, but it is not a nationwide problem.

How about valuations? Do these countries have low valuations that would justify investment even with all the macro problems?

Brazil: EWZ ETF PE 14

Russia: RSX ETF PE 10

India: EPI ETF PE 14

China: FXI ETF PE 14

While the valuations seem to be fair, most of the bull BRIC investors seem to be relying on future growth. If one is investing based on the rapid growth of these economies, one must be prepared to assume huge macro risks.

Disclosure: None

Brazil: The country experienced a massive economic crisis only eleven years ago. Has so much changed then, and is this time different? Bulls will argue that Brazil is the eighth largest economy in the world, but it was also the eighth largest economy in 1999 when it devalued its currency.

There are also signs the economy is overheating. Brown Brothers Harriman’s Win Thin wrote recently:

Some of the numbers are deteriorating sharply for Brazil, including the external accounts, and should help limit BRL upside. Exports remain robust, but imports are going through the roof and leading to worsening trade and current account balances. June current account gap was reported at a much higher than expected -$5.2 bln, and pushed the 12-month total to -$40.9 bln or -2.1% of GDP, the highest since Oct. 2002. FDI flows have held up OK, but now only covers less than two thirds of the current account gap.

Russia: To state Russia has massive demographic problems would be an understatement. The population peaked in 1991 and has been declining ever since. The UN expects the population of Russia to decline as much as a third by 2050. In addition, Muslims are a growing percentage of the Russian population this will likely cause increasing social tensions with the mostly Orthodox Christian population. Russia is run by corrupt politicians and robber barons, and there are poor protections for investors rights. Russia also had its own economic crisis in 1998, when it defaulted on its debt. Now the Government is even more authoritarian and there is no way to predict if the Government would just default as it did in the past.

India: Faces massive problems from the Maoist insurgency in the East. The insurgency has been going on for decades, and the intensity has only been increasing recently. Below is a map which shows how a large swath of the country is affected by this conflict. In the west, India has constant problems with its arch enemy Pakistan. The countries have fought several wars, in addition to many near wars. However, now both countries have large nuclear stockpiles and a war would be an utter disaster for both countries. Any future terrorist attack, or inadvertent border skrimish, has the potential to lead to an all out nuclear war.

China: Has similiar problems with Russia in regards to corrupt Government officials. The whole rural inner area of the country is poor and many people are migrating to the richer coastal region. The economy is entirely reliant on shipping low quality products at low prices to America. However, China is now in competition with other countries that are producing similar goods at low costs and shipping them off to the west. China is fighting an Islamic insurgency near the Mongolian border. There is huge civil unrest in the country, with massive riots and recent suicides among disgruntled workers. China has been manipulating its currency in order to help its export driven economy. Recently, the Government allowed the yuan to float, but do not expect much change to the currency manipulation.

Finally there is the problem of the housing bubble in China. Kennth Rogoff, Robert Shiller, Jim Chanos and other great minds have all stated that China is experiencing a bubble. While it is hard to get exact statistics on the Chinese economy, here is one frightening statistics: Housing property value/ annual disposable income NATIONWIDE is at 8, while the number was at nine in Tokyo at the height of the Japanese bubble. This dispells the argument among China bulls that there might be a housing bubble in cities like Shanghai, and Bejing, but it is not a nationwide problem.

How about valuations? Do these countries have low valuations that would justify investment even with all the macro problems?

Brazil: EWZ ETF PE 14

Russia: RSX ETF PE 10

India: EPI ETF PE 14

China: FXI ETF PE 14

While the valuations seem to be fair, most of the bull BRIC investors seem to be relying on future growth. If one is investing based on the rapid growth of these economies, one must be prepared to assume huge macro risks.

Disclosure: None