As you probably guessed from the title of this article, I am a fan of Ben Graham. Looking at the fundamental ratios it seems obvious that the recent price of Netflix at $110 per share is extremely high relative to the intrinsic value. At $110 per share, Netflix reminds me of the cases of “irrational exuberance” that Graham discusses in Securities Analysis.

In this article I will briefly explore:

(1) The intrinsic value of Netflix based on the discounted projected earnings of its DVD-by-mail business.

(2) What must happen to bring the intrinsic value of Netflix to $110 per share.

(3) The challenges Netflix faces in transitioning to the “online on-demand streaming movies and TV shows business” (which I will refer to as the “Online Streaming business”) and the resulting uncertainty of its future earnings.

I think the facts demonstrate that a price of $110 per share for Netflix is extremely speculative and many times its intrinsic value.

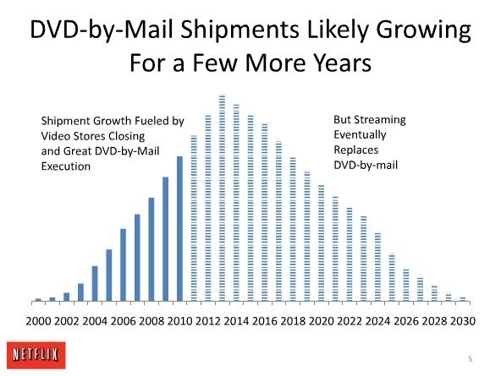

The graph below (including the title and the text to the right and left) are from the “Netflix Buyer Opportunity” slide presentation, which was posted on www.netflix.com/Jobs on May 28, 2010. The graph shows management’s expectations of the future growth, decline, and lifespan of Netflix’s current core business, which is DVD-by-mail subscription service. As the graph shows, Netflix expects its DVD-by-mail business to start declining in 2014 and never recover. Netflix plans to replace the lost revenue by transitioning to the Online Streaming business, which is a similar but different business.

1. Intrinsic value of Netflix based on the discounted projected earnings of its DVD-by-mail business:

I have taken the liberty of translating the above graph to produce an estimate of discounted earnings. I assumed that all earnings available to stockholders are either distributed in dividends or reinvested so the intrinsic value of the company increases or decreases by a commensurate amount. Even though Netflix’s bonds were paying about 8.5% on the date of this writing, I was optimistic and used a 10% discount rate, instead of 12%.

Estimated Present Value of Netflix’s Future Earnings

from its DVD-By-Mail Business (000’s omitted)

| Year | Y | G | FV | PV (d=10%) | PV eps |

| 2010 | 1 | 15.38% | $133,685 | $121,531 | $2.33 |

| 2011 | 2 | 15.56% | $154,480 | $127,669 | $2.44 |

| 2012 | 3 | 11.54% | $172,305 | $129,455 | $2.48 |

| 2013 | 4 | 12.07% | $193,100 | $131,890 | $2.52 |

| 2014 | 5 | -4.62% | $184,188 | $114,366 | $2.19 |

| 2015 | 6 | -6.45% | $172,305 | $97,261 | $1.86 |

| 2016 | 7 | -10.34% | $154,480 | $79,273 | $1.52 |

| 2017 | 8 | -3.85% | $148,538 | $69,294 | $1.33 |

| 2018 | 9 | -10.00% | $133,685 | $56,695 | $1.08 |

| 2019 | 10 | -8.89% | $121,802 | $46,960 | $0.90 |

| 2020 | 11 | -12.20% | $106,948 | $37,485 | $0.72 |

| 2021 | 12 | -13.89% | $92,094 | $29,344 | $0.56 |

| 2022 | 13 | -6.45% | $86,152 | $24,955 | $0.48 |

| 2023 | 14 | -6.90% | $80,211 | $21,122 | $0.40 |

| 2024 | 15 | -22.22% | $62,386 | $14,935 | $0.29 |

| 2025 | 16 | -28.57% | $44,562 | $9,698 | $0.19 |

| 2026 | 17 | -33.33% | $29,708 | $5,878 | $0.11 |

| 2027 | 18 | -30.00% | $20,795 | $3,740 | $0.07 |

| 2028 | 19 | -28.57% | $14,854 | $2,429 | $0.05 |

| 2029 | 20 | -60.00% | $5,942 | $883 | $0.02 |

| 2030 | 21 | -50.00% | $2,971 | $401 | $0.01 |

| Discount rate | 10% |

| Sum of all PV's: | $1,125,265 |

| Current outstanding shares | 52,260 |

| Per share: | $21.53 |

| Current price: | $115 |

Y = compounding period

G = earnings growth rate

FV = future value of predicted earnings

PV = present value of earnings

PV eps = present value of earnings per share

d = discount rate

In summary, the present value of Netflix’s DVD-by-mail business is about $1.125B, or $21.53 per share.

2. What must happen to bring Netflix’s intrinsic value to $110 per share:

The present value of Netflix’s DVD-by-mail business is only 20% of the recent price of $110. For the intrinsic value of the company to be $110 per share, Netflix’s Online Streaming business must be several times more profitable than the DVD-by-mail business. Given the challenges Netflix faces in transitioning to a new business, any attempt at determining an intrinsic value based on their new business model would be highly conjectural.

3. The challenges Netflix faces in transitioning to the Online Streaming business and the resulting uncertainty of its future earnings:

Netflix has become dominant in the DVD-by-mail business and has competitive advantages that currently give it a high level of protection against competition in that business (it has a “moat” in the DVD-by-mail business). Their management, by its own admission, expects that its core business, DVD-by-mail subscription service, will start an irreversible decline in 2014. In order for the intrinsic value to be $110 per share, they will have to transition to a different business and the new business will have to be several times more profitable that the current business. Netflix believes they can successfully transition to the Online Streaming business. However, it will be highly competitive.

The business model that Netflix has proposed to replace their DVD-by-mail business is an online subscription service offering on-demand streaming movies and TV shows (“Online Streaming”). Whether they can be successful in the Online Streaming business is the key question. A summary of Netflix’s plan to gain a competitive advantage in the Online Streaming business seems to be:

1. Focus less on new DVD releases and more on older TV shows and movies.

2. Ubiquitous availability through several services and platforms.

3. Undercut competitors pricing (“low operating margin”).

4. Expand internationally.

5. Good customer service and expanded content.

6. A subscription revenue model.1

Netflix seems to envision itself as a supplementary service that a customer would use in addition to movie theaters, cable, etc. However, the profitability of the new business model is unknown and Netflix faces enormous competition. It will be very difficult for Netflix to establish competitive advantages in the Online Streaming business that are equivalent to the advantages it currently has in the DVD-by-mail business. As the graph above points out in the text to the left, one reason for its rapid growth has been the closing of video stores which reduced competition and drove customers to Netflix who were seeking a broad selection of DVDs. In contrast, the competition is just beginning in the Online Streaming business.

Amazon, Apple, and Google have all made it clear that they have intentions to expand and compete in this relatively new market. These three companies have an enormous advantage in size and spending power over Netflix and all of them are superbly run businesses with technological capabilities and name recognition equal to or superior to Netflix. In addition, there are other threats such as Hulu, (a joint-venture backed by content owners Disney/ABC, GE/NBC, and News Corp/Fox), HBO and other premium channel companies, cable companies, and Wal-Mart, to name just some of the other possible competitors. Any company with significant content or a large internet portal, such as Yahoo or Facebook, is a possible competitor. It seems to me that the parts of Netflix’s plan that are successful could easily be copied by competitors. In fact, Hulu has already announced that they are starting a $10-a-month video subscription service.

In competition with huge and well-loved businesses, can Netflix be successful? I am not attempting to suggest here that Netflix is a poorly run company. I think it is a fabulous company which has revolutionized the way we rent DVDs. It seems to have excellent management (although I have questions about their share repurchase plan) and their customer satisfaction quality has won awards. They are clearly the dominant company in the DVD-by-mail market. The problem is that the DVD-by-mail business is being replaced by on-demand video, which is more convenient

In my opinion, a share price of $110 is not justified by Netflix’s intrinsic value and I do not see any convincing reason to be optimistic about Netflix being able to gain a significant competitive advantage in the Online Streaming business.

Similarity of Netflix to AOL:

It is interesting to compare Netflix’s current situation to AOL’s in 1999, as AOL arguably was facing a similar dilemma as Netflix does now. Netflix’s current business is being replaced by a technological advance, much in the same way AOL’s slow dial-up internet service was replaced by fast internet. Like AOL was in 1999 prior to its merger with Time Warner, Netflix does not own content or a delivery mechanism for its service. In 1999, AOL had the advantage of being a major internet portal and when they merged with Time Warner in 2000 they acquired content and a cable system with 13 million customers to go with AOL’s 20 million subscribers. The merger was supposed to have provided a national and international platform to distribute and promote Time Warner’s products and logically it seemed to make sense, but it didn’t work as envisioned. In January 2000, prior to the merger, AOL’s market cap was $163B. Recently it was $2.3B – less than 2% of its market cap 10 years earlier. As the AOL experience shows, it is not easy to transition a business in the face of stiff competition. AOL had the advantage of already being an internet service provider, so they weren’t entering a new business, and they had a subscriber base of over 20 million. With the Time Warner merger they gained content and a cable company with 13 million customers. At that point they had 33 million total customers, content, a cable company and a major internet portal. All AOL had to do was keep the 20 million dial-up subscribers and transition them to fast internet. But in spite of those advantages, in 10 years AOL’s subscriber base decreased from 20 million to about 5 million.

Sources:

1 – Slide presentation by Netflix: www.netflix.com/Jobs

Disclosure: No position in Netflix stock

My blog: