Normally I'd preface this piece by saying when I see a bunch of nonsense Chinese small cap stocks rallying for weeks on end, combined with multiple parabolic moves in established "growthy" stocks it has traditionally marked a level of egregious actions by the bulls, that would indicate a short to intermediate term top. But I have been offering that logic for 3-4 weeks, and in the new paradigm market 'old school' views have been rendered moot. Hence, I will just say "buy stocks, QE2 fixes everything".

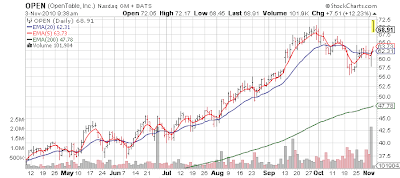

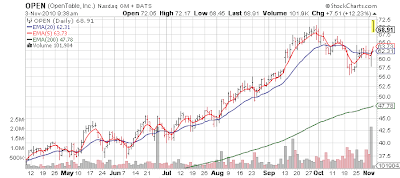

OpenTable (OPEN, Financial) reported last evening, and it appears to be the latest stock (in a now crowded line) to enjoy a "Riverbed day" - it is opening in the +15% range, and appears to be the new Netflix (NFLX, Financial). So to answer my question from last month [Sep 16, 2010: Does One Dare Short OpenTable?] - the answer is "at your own peril".

Via Reuters

OpenTable (OPEN, Financial) reported last evening, and it appears to be the latest stock (in a now crowded line) to enjoy a "Riverbed day" - it is opening in the +15% range, and appears to be the new Netflix (NFLX, Financial). So to answer my question from last month [Sep 16, 2010: Does One Dare Short OpenTable?] - the answer is "at your own peril".

Via Reuters

- OpenTable Inc (OPEN) the restaurant reservation platform, reported a higher third-quarter profit that topped Wall Street estimates as more restaurants used its services. The San Francisco-based company reported a net profit of $3.8 million, or 16 cents a share, compared with $896,000, or 4 cents a share, a year ago. Excluding items, the company earned 23 cents a share.

- Revenue rose 44 percent to $24.5 million.

- Analysts had expected a profit of 15 cents a share, excluding exceptionals, on revenue of $23.2 million, according to Thomson Reuters I/B/E/S.

- The company's installed restaurant base as of Sept. 30 was up 31 percent at 15,246, and seated diners jumped 54 percent to 15.9 million.

- The company generates substantially all of its revenue from its restaurant customers. OpenTable's revenue includes monthly subscription fees and a fee for each restaurant guest seated through online reservations.

- OpenTable has more than doubled in value this year.

If you are keeping track at home this company is on pace for about $100M in annual revenue (simply extrapolating this quarter's revenue x 4). That is not trailing 4 quarter revenue which is materially lower. OPEN's market valuation is currently in the $1.6B arena.... that is 16x forward 'my extrapolated sales'.

That type of valuation is iscensored for blood pressure.... well, don't worry about it. Just buy stocks. (I feel for Whitney Tilson who is short both NFLX and OPEN - he apparently still uses logic)

No position

Trader Marker

http://www.fundmymutualfund.com/

Trader Marker

http://www.fundmymutualfund.com/