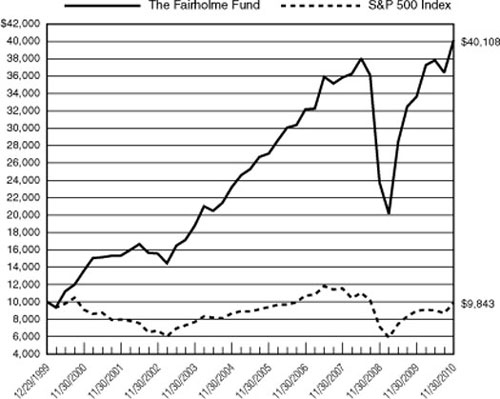

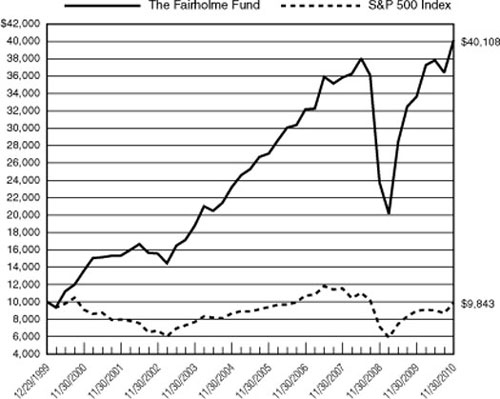

This is the portfolio update for Fairholme Fund. The fund is run by the best mutual fund manager Bruce Berkowitz. It gained 25.5% in the last year, and has rewarded almost 200% in the last 10 years, as the market gained just 16%.

If you don’t know, we track Bruce Berkowtiz in two portfolios, one is through his firm Fireholme Capital Management, the other is Fairholme Fund, which is reported here. The two portfolios have different fiscal periods. Tracking both of them helps us to follow Bruce Berkowitz’s trades more closely.

Driven by amazing performances, Fairholme Fund has seen its asset under management grown to almost $20 billion. The fund has about 68% of asset in stocks.

This is the performance chart of the fund:

As of 11/30/2010, Fairholme Fund owns 22 stocks with a total value of $12.3 billion. These are the details of the buys and sells.

This is the portfolio chart of Fairholme Fund. You can click on the legend of the chart to show/hide buys, sells, or holdings. Each ball on the chart represents a position in the portfolio. You can move your mouse on the balls to see the details of each position and click to see the details of all guru trades with this position.

This is the sector weightings of his portfolio:

These are the top 5 holdings of Fairholme Fund

New Purchase: Banco Santander S.a. (STD, Financial)

Fairholme Fund initiated holdings in Banco Santander S.a.. His purchase prices were between $9.74 and $13.46, with an estimated average price of $12.43. The impact to his portfolio due to this purchase was 0.23%. His holdings were 2,892,200 shares as of 11/30/2010.

Banco Santander SA is the biggest bank in Spain and the biggest international bank in Latin America as well. Banco Santander S.a. has a market cap of $99.49 billion; its shares were traded at around $12.09 with a P/E ratio of 9.3 and P/S ratio of 0.9. The dividend yield of Banco Santander S.a. stocks is 4.4%.

New Purchase: Teva Pharmaceutical Industries Ltd. (TEVA, Financial)

Fairholme Fund initiated holdings in Teva Pharmaceutical Industries Ltd.. His purchase prices were between $49.94 and $55.52, with an estimated average price of $52.58. The impact to his portfolio due to this purchase was 0.07%. His holdings were 177,400 shares as of 11/30/2010.

TEVA Pharmaceuticals USA, the business is to develop, manufacture, and market generic pharmaceuticals. Teva Pharmaceutical Industries Ltd. has a market cap of $50.64 billion; its shares were traded at around $54.1 with a P/E ratio of 12.8 and P/S ratio of 3.7. The dividend yield of Teva Pharmaceutical Industries Ltd. stocks is 1.3%. Teva Pharmaceutical Industries Ltd. had an annual average earning growth of 22.6% over the past 10 years. GuruFocus rated Teva Pharmaceutical Industries Ltd. the business predictability rank of 4-star.

Added: American Int'l Group Inc (AIG, Financial)

Fairholme Fund added to his holdings in American Int'l Group Inc by 27.77%. His purchase prices were between $35.07 and $45.61, with an estimated average price of $39.99. The impact to his portfolio due to this purchase was 2.73%. His holdings were 37,542,817 shares as of 11/30/2010.

American Int'l Group Inc has a market cap of $5.41 billion; its shares were traded at around $40 with and P/S ratio of 0.1.

Added: CIT Group Inc. New (CIT, Financial)

Fairholme Fund added to his holdings in CIT Group Inc. by 73%. His purchase prices were between $37.25 and $43.83, with an estimated average price of $40.76. The impact to his portfolio due to this purchase was 2.34%. His holdings were 17,301,229 shares as of 11/30/2010.

CIT Group Inc. is a bank holding company that provides financing and leasing capital for commercial companies throughout the world. Cit Group Inc. New has a market cap of $9.56 billion; its shares were traded at around $47.73 with and P/S ratio of 2.4.

Added: Bank Of America Corp. (BAC, Financial)

Fairholme Fund added to his holdings in Bank Of America Corp. by 27.66%. His purchase prices were between $11.09 and $13.95, with an estimated average price of $12.56. The impact to his portfolio due to this purchase was 1.49%. His holdings were 77,317,115 shares as of 11/30/2010.

Bank of America Corp. is one of the world's financial services companies. Bank Of America Corp. has a market cap of $144.12 billion; its shares were traded at around $14.29 with a P/E ratio of 16.6 and P/S ratio of 1. The dividend yield of Bank Of America Corp. stocks is 0.3%.

Added: Regions Financial Corp. (RF, Financial)

Fairholme Fund added to his holdings in Regions Financial Corp. by 52.28%. His purchase prices were between $5.21 and $7.54, with an estimated average price of $6.68. The impact to his portfolio due to this purchase was 1.46%. His holdings were 97,150,804 shares as of 11/30/2010.

Regions Financial Corporation is a regional bank holding company and hasbanking-related subsidiaries engaged in mortgage banking, credit life insurance, leasing, and securities brokerage activities with offices in various Southeastern states. Regions Financial Corp. has a market cap of $9.85 billion; its shares were traded at around $7.84 with and P/S ratio of 1.1. The dividend yield of Regions Financial Corp. stocks is 0.6%.

Added: Morgan Stanley (MS, Financial)

Fairholme Fund added to his holdings in Morgan Stanley by 11.81%. His purchase prices were between $24.19 and $27.77, with an estimated average price of $25.55. The impact to his portfolio due to this purchase was 0.71%. His holdings were 33,694,200 shares as of 11/30/2010.

MORGAN STANLEY is a preeminent global financial services firm that maintains market positions in each of its three primary businesses: securities; asset management; and credit services. Morgan Stanley has a market cap of $45.16 billion; its shares were traded at around $29.85 with a P/E ratio of 14.1 and P/S ratio of 1.4. The dividend yield of Morgan Stanley stocks is 0.7%. Morgan Stanley had an annual average earning growth of 6.4% over the past 10 years.

Added: Berkshire Hathaway (BRK.B, Financial)

Fairholme Fund added to his holdings in Berkshire Hathaway by 17.02%. His purchase prices were between $79.09 and $83.72, with an estimated average price of $81.99. The impact to his portfolio due to this purchase was 0.42%. His holdings were 4,477,650 shares as of 11/30/2010.

Berkshire Hathaway Inc. is a holding company owning subsidiaries engaged in a number of diverse business activities. Berkshire Hathaway has a market cap of $205.54 billion; its shares were traded at around $83.17 with a P/E ratio of 17.4 and P/S ratio of 1.8. Berkshire Hathaway had an annual average earning growth of 13.2% over the past 10 years.

Added: General Electric (GE, Financial)

Fairholme Fund added to his holdings in General Electric by 24.31%. His purchase prices were between $15.01 and $17.28, with an estimated average price of $16.24. The impact to his portfolio due to this purchase was 0.4%. His holdings were 15,921,200 shares as of 11/30/2010.

General Electric is one of the largest and most diversified industrial corporations in the world. General Electric has a market cap of $219.06 billion; its shares were traded at around $20.56 with a P/E ratio of 17.7 and P/S ratio of 1.4. The dividend yield of General Electric stocks is 2.7%. General Electric had an annual average earning growth of 14.1% over the past 10 years. GuruFocus rated General Electric the business predictability rank of 4-star.

Sold Out: Humana Inc. (HUM)

Fairholme Fund sold out his holdings in Humana Inc.. His sale prices were between $49.29 and $60.64, with an estimated average price of $54.26.

Humana, Inc. is a health services company that facilitates the delivery of health care services through networks of providers to its medical members. Humana Inc. has a market cap of $10.19 billion; its shares were traded at around $60.54 with a P/E ratio of 8.8 and P/S ratio of 0.3. Humana Inc. had an annual average earning growth of 23.5% over the past 10 years. GuruFocus rated Humana Inc. the business predictability rank of 3.5-star.

Sold Out: Hertz Global Holdings Inc. (HTZ)

Fairholme Fund sold out his holdings in Hertz Global Holdings Inc.. His sale prices were between $9.09 and $12.51, with an estimated average price of $10.96.

HERTZ GLOBAL HOLDING is the worlds largest general use car rental brand, operating from approximately 8,100 locations in 147 countries worldwide. Hertz Global Holdings Inc. has a market cap of $6.16 billion; its shares were traded at around $14.93 with a P/E ratio of 31.8 and P/S ratio of 0.9.

Sold Out: Tal International Group Inc. (TAL)

Fairholme Fund sold out his holdings in Tal International Group Inc.. His sale prices were between $22.44 and $30.05, with an estimated average price of $25.76.

TAL International Group, Inc. is a lessor of intermodal containers and chassis. Tal International Group Inc. has a market cap of $1.01 billion; its shares were traded at around $32.75 with a P/E ratio of 19.6 and P/S ratio of 2.8. The dividend yield of Tal International Group Inc. stocks is 4.8%. Tal International Group Inc. had an annual average earning growth of 4.3% over the past 5 years.

If you don’t know, we track Bruce Berkowtiz in two portfolios, one is through his firm Fireholme Capital Management, the other is Fairholme Fund, which is reported here. The two portfolios have different fiscal periods. Tracking both of them helps us to follow Bruce Berkowitz’s trades more closely.

Driven by amazing performances, Fairholme Fund has seen its asset under management grown to almost $20 billion. The fund has about 68% of asset in stocks.

This is the performance chart of the fund:

This is the portfolio chart of Fairholme Fund. You can click on the legend of the chart to show/hide buys, sells, or holdings. Each ball on the chart represents a position in the portfolio. You can move your mouse on the balls to see the details of each position and click to see the details of all guru trades with this position.

- New Purchases: STD, TEVA,

- Added Positions: AIG, CIT, BAC, RF, MS, BRK.B, GE,

- Sold Out: HUM, HTZ, TAL,

This is the sector weightings of his portfolio:

These are the top 5 holdings of Fairholme Fund

- GENERAL GROWTH PROPERTIES INC. (GGP) - 113,869,556 shares, 14.97% of the total portfolio. Position converted from debt and warrants holdings.

- AMERICAN INT'L GROUP INC (AIG) - 37,542,817 shares, 12.58% of the total portfolio. Shares added by 27.77%

- AIA GROUP LTD (AAIGF.PK) - 302,221,000 shares, 7.09% of the total portfolio. New Position

- The Goldman Sachs Group Inc. (GS) - 5,578,900 shares, 7.07% of the total portfolio.

- BANK OF AMERICA CORP. (BAC) - 77,317,115 shares, 6.87% of the total portfolio. Shares added by 27.66%

New Purchase: Banco Santander S.a. (STD, Financial)

Fairholme Fund initiated holdings in Banco Santander S.a.. His purchase prices were between $9.74 and $13.46, with an estimated average price of $12.43. The impact to his portfolio due to this purchase was 0.23%. His holdings were 2,892,200 shares as of 11/30/2010.

Banco Santander SA is the biggest bank in Spain and the biggest international bank in Latin America as well. Banco Santander S.a. has a market cap of $99.49 billion; its shares were traded at around $12.09 with a P/E ratio of 9.3 and P/S ratio of 0.9. The dividend yield of Banco Santander S.a. stocks is 4.4%.

New Purchase: Teva Pharmaceutical Industries Ltd. (TEVA, Financial)

Fairholme Fund initiated holdings in Teva Pharmaceutical Industries Ltd.. His purchase prices were between $49.94 and $55.52, with an estimated average price of $52.58. The impact to his portfolio due to this purchase was 0.07%. His holdings were 177,400 shares as of 11/30/2010.

TEVA Pharmaceuticals USA, the business is to develop, manufacture, and market generic pharmaceuticals. Teva Pharmaceutical Industries Ltd. has a market cap of $50.64 billion; its shares were traded at around $54.1 with a P/E ratio of 12.8 and P/S ratio of 3.7. The dividend yield of Teva Pharmaceutical Industries Ltd. stocks is 1.3%. Teva Pharmaceutical Industries Ltd. had an annual average earning growth of 22.6% over the past 10 years. GuruFocus rated Teva Pharmaceutical Industries Ltd. the business predictability rank of 4-star.

Added: American Int'l Group Inc (AIG, Financial)

Fairholme Fund added to his holdings in American Int'l Group Inc by 27.77%. His purchase prices were between $35.07 and $45.61, with an estimated average price of $39.99. The impact to his portfolio due to this purchase was 2.73%. His holdings were 37,542,817 shares as of 11/30/2010.

American Int'l Group Inc has a market cap of $5.41 billion; its shares were traded at around $40 with and P/S ratio of 0.1.

Added: CIT Group Inc. New (CIT, Financial)

Fairholme Fund added to his holdings in CIT Group Inc. by 73%. His purchase prices were between $37.25 and $43.83, with an estimated average price of $40.76. The impact to his portfolio due to this purchase was 2.34%. His holdings were 17,301,229 shares as of 11/30/2010.

CIT Group Inc. is a bank holding company that provides financing and leasing capital for commercial companies throughout the world. Cit Group Inc. New has a market cap of $9.56 billion; its shares were traded at around $47.73 with and P/S ratio of 2.4.

Added: Bank Of America Corp. (BAC, Financial)

Fairholme Fund added to his holdings in Bank Of America Corp. by 27.66%. His purchase prices were between $11.09 and $13.95, with an estimated average price of $12.56. The impact to his portfolio due to this purchase was 1.49%. His holdings were 77,317,115 shares as of 11/30/2010.

Bank of America Corp. is one of the world's financial services companies. Bank Of America Corp. has a market cap of $144.12 billion; its shares were traded at around $14.29 with a P/E ratio of 16.6 and P/S ratio of 1. The dividend yield of Bank Of America Corp. stocks is 0.3%.

Added: Regions Financial Corp. (RF, Financial)

Fairholme Fund added to his holdings in Regions Financial Corp. by 52.28%. His purchase prices were between $5.21 and $7.54, with an estimated average price of $6.68. The impact to his portfolio due to this purchase was 1.46%. His holdings were 97,150,804 shares as of 11/30/2010.

Regions Financial Corporation is a regional bank holding company and hasbanking-related subsidiaries engaged in mortgage banking, credit life insurance, leasing, and securities brokerage activities with offices in various Southeastern states. Regions Financial Corp. has a market cap of $9.85 billion; its shares were traded at around $7.84 with and P/S ratio of 1.1. The dividend yield of Regions Financial Corp. stocks is 0.6%.

Added: Morgan Stanley (MS, Financial)

Fairholme Fund added to his holdings in Morgan Stanley by 11.81%. His purchase prices were between $24.19 and $27.77, with an estimated average price of $25.55. The impact to his portfolio due to this purchase was 0.71%. His holdings were 33,694,200 shares as of 11/30/2010.

MORGAN STANLEY is a preeminent global financial services firm that maintains market positions in each of its three primary businesses: securities; asset management; and credit services. Morgan Stanley has a market cap of $45.16 billion; its shares were traded at around $29.85 with a P/E ratio of 14.1 and P/S ratio of 1.4. The dividend yield of Morgan Stanley stocks is 0.7%. Morgan Stanley had an annual average earning growth of 6.4% over the past 10 years.

Added: Berkshire Hathaway (BRK.B, Financial)

Fairholme Fund added to his holdings in Berkshire Hathaway by 17.02%. His purchase prices were between $79.09 and $83.72, with an estimated average price of $81.99. The impact to his portfolio due to this purchase was 0.42%. His holdings were 4,477,650 shares as of 11/30/2010.

Berkshire Hathaway Inc. is a holding company owning subsidiaries engaged in a number of diverse business activities. Berkshire Hathaway has a market cap of $205.54 billion; its shares were traded at around $83.17 with a P/E ratio of 17.4 and P/S ratio of 1.8. Berkshire Hathaway had an annual average earning growth of 13.2% over the past 10 years.

Added: General Electric (GE, Financial)

Fairholme Fund added to his holdings in General Electric by 24.31%. His purchase prices were between $15.01 and $17.28, with an estimated average price of $16.24. The impact to his portfolio due to this purchase was 0.4%. His holdings were 15,921,200 shares as of 11/30/2010.

General Electric is one of the largest and most diversified industrial corporations in the world. General Electric has a market cap of $219.06 billion; its shares were traded at around $20.56 with a P/E ratio of 17.7 and P/S ratio of 1.4. The dividend yield of General Electric stocks is 2.7%. General Electric had an annual average earning growth of 14.1% over the past 10 years. GuruFocus rated General Electric the business predictability rank of 4-star.

Sold Out: Humana Inc. (HUM)

Fairholme Fund sold out his holdings in Humana Inc.. His sale prices were between $49.29 and $60.64, with an estimated average price of $54.26.

Humana, Inc. is a health services company that facilitates the delivery of health care services through networks of providers to its medical members. Humana Inc. has a market cap of $10.19 billion; its shares were traded at around $60.54 with a P/E ratio of 8.8 and P/S ratio of 0.3. Humana Inc. had an annual average earning growth of 23.5% over the past 10 years. GuruFocus rated Humana Inc. the business predictability rank of 3.5-star.

Sold Out: Hertz Global Holdings Inc. (HTZ)

Fairholme Fund sold out his holdings in Hertz Global Holdings Inc.. His sale prices were between $9.09 and $12.51, with an estimated average price of $10.96.

HERTZ GLOBAL HOLDING is the worlds largest general use car rental brand, operating from approximately 8,100 locations in 147 countries worldwide. Hertz Global Holdings Inc. has a market cap of $6.16 billion; its shares were traded at around $14.93 with a P/E ratio of 31.8 and P/S ratio of 0.9.

Sold Out: Tal International Group Inc. (TAL)

Fairholme Fund sold out his holdings in Tal International Group Inc.. His sale prices were between $22.44 and $30.05, with an estimated average price of $25.76.

TAL International Group, Inc. is a lessor of intermodal containers and chassis. Tal International Group Inc. has a market cap of $1.01 billion; its shares were traded at around $32.75 with a P/E ratio of 19.6 and P/S ratio of 2.8. The dividend yield of Tal International Group Inc. stocks is 4.8%. Tal International Group Inc. had an annual average earning growth of 4.3% over the past 5 years.