AZZ Incorporated is a provider of electrical and industrial components, as well as galvanizing services. It’s a fairly small company, pays a fairly new dividend, and has a fairly strong balance sheet.

-Dividend Yield: 2.43%

-Revenue Growth: 18%

-Income Growth: 50% (but realistically, lower)

With a P/E of a bit over 15, I find AZZ to be moderately attractive at current prices. The company provides useful products and services, and should benefit as capital is deployed to improve aging infrastructure in the United States.

Electrical and Industrial Products

This segment of AZZ provides products for channeling electricity. These products, which are designed, manufactured, and installed by AZZ, distribute electricity between generators, transformers, switches, bus systems, and hazard lighting. In 2010, this segment contributed $203 million to total AZZ revenue and $41 million in operating income. Over 20% of revenue from this segment comes from international markets.

Galvanizing Services

Galvanizing is the process of applying molten zinc onto steel. This keeps the steel from corroding for up to 50 years. There are a wide range of steel products that can benefit from galvanizing, from utility products to transportation, and other areas. AZZ has over 20 galvanizing plants. In 2010, this segment contributed $154 million in revenue and $45 million in operating income.

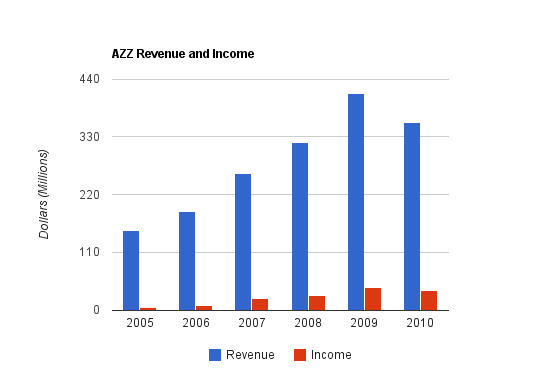

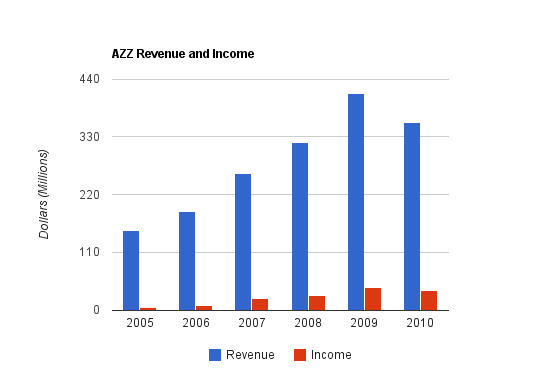

Over this period, AZZ has grown revenue by over 18% annually. Revenue over the trailing twelve month period is up to $365 million.

Net income over this period has grown by up to 50% annually, but this figure is exaggerated due to the low profitability in these earlier years of the table. Net income over the trailing twelve month period is down to $34 million.

Due to mild share dilution, EPS has grown slightly slower than income, so EPS has grown by 47% over this period.

Cash Flow has seen strong but erratic growth.

Over this time, AZZ has grown its shareholder equity by an average of 25% compounded annually.

Price to Book: 2.1

Return on Equity: 14%

This translates into $1 per year per share in dividends, for a dividend yield of 2.43% and a payout ratio of a bit under 40%.

In my opinion, dividend investors would do well to hold some value or smallcap dividend payers in their portfolio to add some extra upside to their portfolios. Some investors stick to rather concrete rules and stay strictly with long-term dividend growers, and that’s fine for many, but expanding into some other positions can sometimes be a good idea.

The idea with AZZ is that it’s a smallcap dividend payer that has a good history of company growth, and significant potential when it comes to infrastructure improvements. It’s no secret that the US has aging infrastructure, including transportation and utility infrastructure where AZZ provides products and services. As the US economy improves, and the infrastructure is modernized, AZZ stands to benefit. Galvanizing is used in bridge and highway construction, among other things, and their electrical products are used in standard utility upgrades and also in alternative energy construction (solar and wind, particularly).

The company has both organic growth and growth through acquisitions. AZZ spent $96 million on acquisitions for the fiscal year 2009, and $104 million for the fiscal year 2011 (which ends in February of 2011).

Full Disclosure:

As of this writing, I have no position in AZZ.

You can see my full list of individual holdings here.

-Dividend Yield: 2.43%

-Revenue Growth: 18%

-Income Growth: 50% (but realistically, lower)

With a P/E of a bit over 15, I find AZZ to be moderately attractive at current prices. The company provides useful products and services, and should benefit as capital is deployed to improve aging infrastructure in the United States.

Overview

AZZ Incorporated (NYSE: AZZ), founded in 1956, is a company that provides galvanizing services and electrical and industrial products. The company is fairly small, with a market capitalization of approximately half a billion dollars.Electrical and Industrial Products

This segment of AZZ provides products for channeling electricity. These products, which are designed, manufactured, and installed by AZZ, distribute electricity between generators, transformers, switches, bus systems, and hazard lighting. In 2010, this segment contributed $203 million to total AZZ revenue and $41 million in operating income. Over 20% of revenue from this segment comes from international markets.

Galvanizing Services

Galvanizing is the process of applying molten zinc onto steel. This keeps the steel from corroding for up to 50 years. There are a wide range of steel products that can benefit from galvanizing, from utility products to transportation, and other areas. AZZ has over 20 galvanizing plants. In 2010, this segment contributed $154 million in revenue and $45 million in operating income.

Revenue, Income, Cash Flow, and Metrics

AZZ has demonstrated strong, albeit somewhat erratic, growth over the last several years. For a company involved in industrial materials, they have performed rather solidly during the financial crisis.Revenue Growth

| Year | Revenue |

|---|---|

| 2010 | $357 million |

| 2009 | $412 million |

| 2008 | $320 million |

| 2007 | $260 million |

| 2006 | $187 million |

| 2005 | $152 million |

Income Growth

| Year | Income |

|---|---|

| 2010 | $38 million |

| 2009 | $42 million |

| 2008 | $28 million |

| 2007 | $22 million |

| 2006 | $8 million |

| 2005 | $5 million |

Due to mild share dilution, EPS has grown slightly slower than income, so EPS has grown by 47% over this period.

Cash Flow Growth

| Year | Operational Cash Flow | Free Cash Flow |

|---|---|---|

| 2010 | $83 million | $71 million |

| 2009 | $60 million | $40 million |

| 2008 | $39 million | $29 million |

| 2007 | $7 million | -$4 million |

| 2006 | $13 million | $6 million |

| 2005 | $6 million | $0 |

Equity Growth

| Year | Total Assets | Total Liabilities | Shareholder Equity |

|---|---|---|---|

| 2010 | $382 million | $154 million | $228 million |

| 2009 | $355 million | $168 million | $187 million |

| 2008 | $193 million | $47 million | $146 million |

| 2007 | $201 million | $90 million | $111 million |

| 2006 | $141 million | $54 million | $87 million |

| 2005 | $129 million | $53 million | $75 million |

Metrics

Price to Earnings: 15.3Price to Book: 2.1

Return on Equity: 14%

Dividends

AZZ is a new dividend payer. The company began paying $0.25 per share per quarter in the beginning of 2010. This trend continues in 2011, as the company declared the same quarterly dividend for the first quarter of 2011.This translates into $1 per year per share in dividends, for a dividend yield of 2.43% and a payout ratio of a bit under 40%.

Balance Sheet

AZZ has a moderately strong balance sheet, with a LT Debt/Equity ratio of 0.40, a current ratio of well above 2, an interest coverage ratio of over 7, and goodwill that consists of less than half of total equity.Investment Thesis

AZZ is a small company, a new dividend payer, and so far it’s not a dividend grower.In my opinion, dividend investors would do well to hold some value or smallcap dividend payers in their portfolio to add some extra upside to their portfolios. Some investors stick to rather concrete rules and stay strictly with long-term dividend growers, and that’s fine for many, but expanding into some other positions can sometimes be a good idea.

The idea with AZZ is that it’s a smallcap dividend payer that has a good history of company growth, and significant potential when it comes to infrastructure improvements. It’s no secret that the US has aging infrastructure, including transportation and utility infrastructure where AZZ provides products and services. As the US economy improves, and the infrastructure is modernized, AZZ stands to benefit. Galvanizing is used in bridge and highway construction, among other things, and their electrical products are used in standard utility upgrades and also in alternative energy construction (solar and wind, particularly).

The company has both organic growth and growth through acquisitions. AZZ spent $96 million on acquisitions for the fiscal year 2009, and $104 million for the fiscal year 2011 (which ends in February of 2011).

Risks

As an industrial materials and services provider, AZZ doesn’t have much of an economic moat. They are vulnerable to economic downturns, commodity costs, and have a high degree of competition from larger companies. Their galvanizing plants compete with other galvanizing services providers, but also compete with paint, which is much cheaper to apply but protects for about 1/5th as long. The cost of shipping limits the area for which AZZ can galvanize products to customers that are relatively nearby their galvanizing plants.Conclusion and Valuation

In conclusion, I find AZZ to be a rather attractive company at current prices. AZZ, due to its lack of any significant moat, and rather small size, can be considered rather risky, but their proven ability to remain profitable through this recent major recession combined with their focus on providing useful and necessary products and services mitigates risk to a certain extent. The stock has already performed magnificently in the past decade, but there’s still a large potential upside as the economic recovery continues and capital is spent on improving infrastructure.Full Disclosure:

As of this writing, I have no position in AZZ.

You can see my full list of individual holdings here.