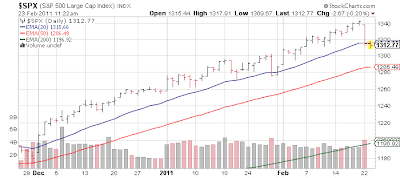

I have long said this is the unshortable market. The strength has been so unyielding, even breaking the 13 day moving average (not to mention something more serious) was impossible. In a normal market, the falling to the 20 day moving average is very normal, even in an uptrend. But those moments have been extremely rare the past 6 months. What I was looking for a month ago when the market broke down due to Egypt was a fall through the 20 day moving average - that did happen, and the market closed on the lows of the day (and week). In normal times that is a very bad development for the technical structure of the market. But I was wary. Why? Because it happened on a Friday, and since March 2009 almost all gains have come on (a) premarket surges Monday morning or (b) the first day of the month. And after the Friday Egypt was roiled came Monday + the first day of the month (Tuesday). Like clockwork the market gapped up Monday and was at yearly highs by Tuesday. So much for the technical condition.

This time around, Monday is still a few days away, as is the first day of the month. So the bears might have a small window of opportunity. Now neither of these days should really mean anything but the psychological impact of seeing those type of days always work for the bulls, feeds on itself. What would be truly striking would be a poor Monday premarket and/or a poor first day of the month - talk about a change in character.

Yesterday I said I'd like to see the 20 day moving average pierced, and then to close below it another day or two. Thus far today in the early going, the bears finally have some mojo. Of course the close is more important than intraday so we'll see what happens at 4 PM, but for the first time since November shorts actually have a level to play against. Once can short the index versus the 20 day moving average - if a burst of buying occurs the trade is over, and back to the unshortable market we go. But at least there is some downside opportunity now and perhaps a move to the 50 day moving average on the S&P 500 (1286). That would still be a shallow correction if it happened versus last Friday's highs, but at least a bone for the long suffering bears.

One thing to note - EVERYONE thinks this dip is a buying opportunity. In normal times, that would have be thinking it is not going to be so neat and easy. A nice 3-5% dip that can be bought, and we can all live happily after. The market *should* be messing with as many people as possible, so a nice cute short lived correction should not be what happens. But this has not been a normal market in a long time. Just in case there is any inkling of normalcy, a few out of the money puts 4-5 months out, would be an interesting insurance policy that could play out if we get something more serious - such as a break of the 50 day moving average, that really shakes some confidence.

This time around, Monday is still a few days away, as is the first day of the month. So the bears might have a small window of opportunity. Now neither of these days should really mean anything but the psychological impact of seeing those type of days always work for the bulls, feeds on itself. What would be truly striking would be a poor Monday premarket and/or a poor first day of the month - talk about a change in character.

Yesterday I said I'd like to see the 20 day moving average pierced, and then to close below it another day or two. Thus far today in the early going, the bears finally have some mojo. Of course the close is more important than intraday so we'll see what happens at 4 PM, but for the first time since November shorts actually have a level to play against. Once can short the index versus the 20 day moving average - if a burst of buying occurs the trade is over, and back to the unshortable market we go. But at least there is some downside opportunity now and perhaps a move to the 50 day moving average on the S&P 500 (1286). That would still be a shallow correction if it happened versus last Friday's highs, but at least a bone for the long suffering bears.

One thing to note - EVERYONE thinks this dip is a buying opportunity. In normal times, that would have be thinking it is not going to be so neat and easy. A nice 3-5% dip that can be bought, and we can all live happily after. The market *should* be messing with as many people as possible, so a nice cute short lived correction should not be what happens. But this has not been a normal market in a long time. Just in case there is any inkling of normalcy, a few out of the money puts 4-5 months out, would be an interesting insurance policy that could play out if we get something more serious - such as a break of the 50 day moving average, that really shakes some confidence.