St. Joe (JOE, Financial) earnings beat the street on every metric and Berkowitz will join the Board, getting his 4 directors on and the 4 he wanted out are gone. Britt Greene is also out as CEO (we can assume the new one will be of Bruce’s liking). Now that is over we need to look forward. I am still bullish on RE going forward and think JOE gives us an attractive entry point into the N. Fla market especially with Berkowitz on the Board just as HHC gives us one in Las Vegas, Texas and Maryland as well as commercial exposure in Vegas and Hawaii.

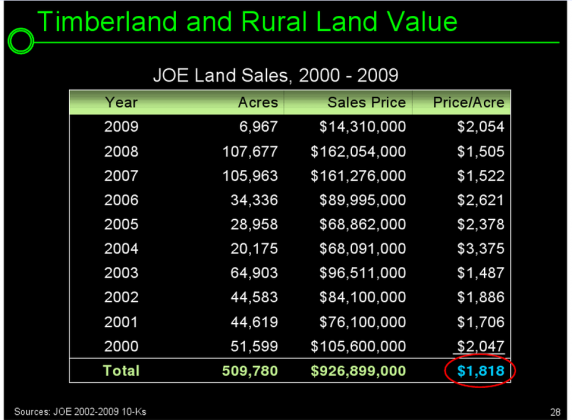

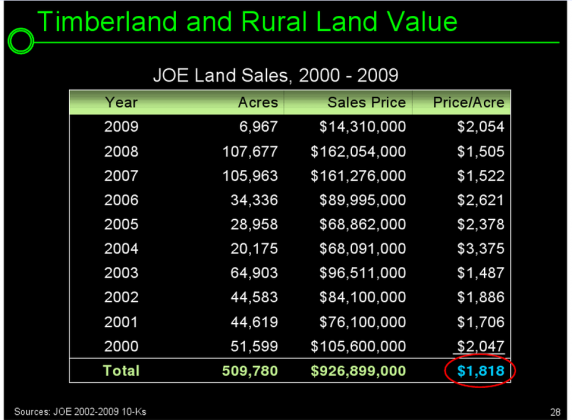

Here are 3 slides from his VIC presentation that were a focal point of his valuation of the company

Below he takes ten years of JOE’s land sales to come up with an average # for land valuation. Problem? Do you know what the sales price of rural land in 2000 has to do with land values today? NOTHING…..

If you want proof simply try to sell your home today at 2006 levels and lets see what happens or flashback to 2006 and make a seller an offer at 2000 levels. The only RE values that matter are today’s and what buyers think they will be tomorrow. Yesterday’s values matter not. But, it is a fun exercise.

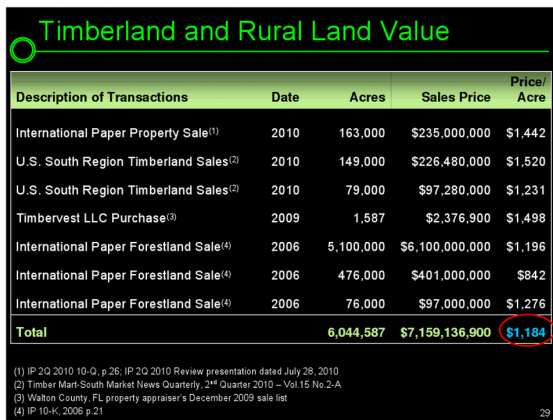

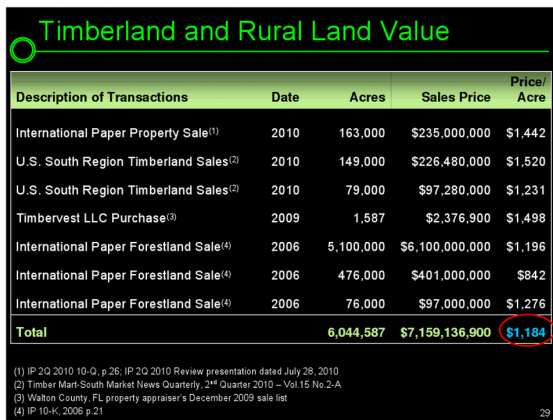

On slide two he uses land sales for other Timber Co’s. to come up with a acreage value. This also is not realistic as again 2006 land sales are irrelevant. Not only that, but the citing from Einhorn leaves out a MATERIAL factor in the first one from International Paper. Einhorn simply lists the sales price and acreage and then says the land sold a “x” per acre.

If we go to the IP 10Q: (Emphasis mine)

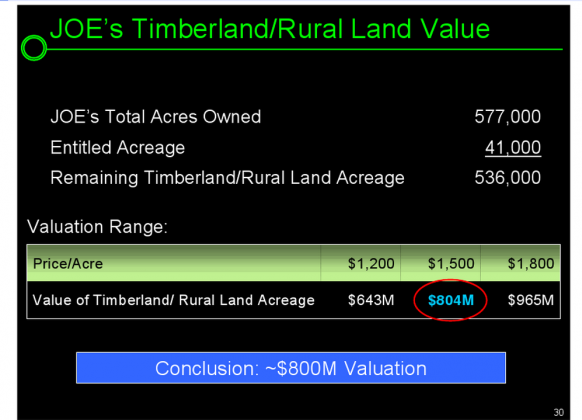

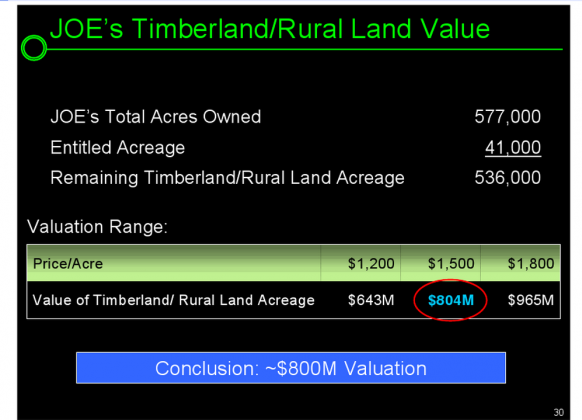

Using that data he “splits the difference” so to speak to come up with a number (below) from the two slides. So, what is JOE selling rural land for now?

Of course we must also note: “Average sales prices per acre vary according to the characteristics of each particular piece of land being sold and its highest and best use. As a result, average prices will vary from one period to another” ( From 10K pg 45). what this means is you simply cannot say acre “A” sold for “x” so everything left it worth what is left times “X”. To the point we have made in the past is that Einhorn’s thesis was wrong because that is precisely what he did. I did the same thing above (with far more accurate sales data) and got a value 3X higher than he did. I would say since I am using numbers from 2010 and he an average of 2000-9 mixed with dubious comps (discussed above) mine is the more accurate valuation.

I have listed my complaints with Einhorn on this in the past and all of them still hold. In fact, recent airport activity (above) further bolsters just how wrong he was on that aspect of his presentation. I am troubled by his selective use of the IP comp above though w/o an accurate disclosure of what type of sale it was. If you know anything about RE investing you would know that the transaction does not belong on the same page as a straight forward RE land sale. To be clear, I am not accusing him of hiding anything, the citations are there for those who actually decided to check them out, just that his inclusion of this transaction is not valid.

This along with what we have discussed I think has to severely discount or even dismiss Einhorn’s thesis entirely. I have to think that were it not Einhorn’s name on it, many people would have ripped into this a while ago. This is a case of reputation over accuracy?.

The St. Joe Company (NYSE: JOE) today announced a Net Loss for the full year ended 2010 of $(35.9) million, or $(0.39) per share, which included pre-tax charges of $27.1 million, or $0.12 per share after tax. This compares to a Net Loss of $(130.0) million, or $(1.42) per share, for the year ended 2009, which included pre-tax charges of $163.1 million, or $1.07 per share after tax.Now onto Einhorn:

For the fourth quarter of 2010, St. Joe had a Net Loss of $(2.7) million, or $(0.03) per share, which included pre-tax charges of $10.7 million, or $0.12 per share after tax. This compares to a Net Loss of $(58.7) million, or $(0.64) per share, for the fourth quarter of 2009, which included pre-tax charges of $84.0 million, or $0.56 per share after tax. Pre-tax charges for the fourth quarter of 2010 included $8.0 million, or $.05 per share after tax, for impairments on unconsolidated affiliates, real estate and other assets; $1.6 million, or $.06 per share after tax, for costs resulting from the Deepwater Horizon oil spill; and $1.1 million, or $0.01 per share after tax, of restructuring and other charges.

St. Joe’s President and CEO Britt Greene stated, “In 2010, St. Joe successfully navigated the challenging business landscape and positioned the Company well to take advantage of the many exciting growth opportunities in Northwest Florida and to create meaningful long-term value for shareholders.”

2010 HighlightsResidential Real Estate

- Celebrated the opening of the Northwest Florida Beaches International Airport with commencement of service by Southwest Airlines

- Launched VentureCrossings Enterprise Centre adjacent to the new airport

- Executed the Through the Fence/Master Access Agreement at the Northwest Florida Beaches International Airport District

- Leased a strategic airside parcel with immediate runway access at the new airport

- Completed the development plan for the initial phase of Breakfast Point and the re-programming of RiverTown’s first phase

- Expanded the builder programs in certain of our residential communities

- Successfully conveyed to the Florida Department of Transportation (FDOT) 2,148 acres as part of 2006 sale, facilitating future highway construction

- Expanded the service area of one of our existing mitigation banks

- Renegotiated and extended the Pulpwood Supply Agreement with Smurfit-Stone Container Corporation

- Relocated the Company’s corporate headquarters to Northwest Florida

- Segment Results

During the fourth quarter, St. Joe sold 13 homesites across its resort communities at an average price of $120,000, and 27 homesites across its primary communities at an average price of $50,000. For the full-year, the Company generated $8.7 million primarily from the sale of 41 resort homesites at an average price of $159,000 and 42 primary homesites at an average price of $52,000.

Commercial Real Estate

In the fourth quarter, St. Joe sold 1.7 acres in Bay County for $425,000, or $254,000 per acre. This parcel is adjacent to the Company’s Breakfast Point community and will be developed as a medical office facility. For the full-year, St. Joe sold 18.4 acres for $4.4 million, or $237,000 per acre, including a 10-acre sale to Wal-Mart for $2.5 million.

Also in 2010, as part of the Company’s commercial strategy to generate recurring revenues, St. Joe entered into build-to-suit leases with CVS on a 1.7-acre site in Port St. Joe and a Hardee’s franchisee on a 0.8-acre site in Panama City Beach. The Company also entered into a ground lease on a 2.1-acre site located near the new airport with Express Lane, which will construct a gas station, convenience store and restaurant.

In VentureCrossings, St. Joe has commenced development of the Company’s headquarters building and a long-term covered parking facility, and the Company is in the pre-development stages for a light industrial building.

Rural Land Sales

In its Rural Land Sales segment during the fourth quarter, the Company sold 266 acres for $1.5 million, or $5,500 per acre, and also transferred title to FDOT on 1,826 acres, generating $17.1 million of revenue. Additionally, during the fourth quarter St. Joe received $0.8 million of revenue from the sale of 12 mitigation bank credits.

For the full year, the Company sold 606 acres of rural land for $3.0 million, or $4,900 per acre. St. Joe also sold 21 mitigation bank credits for $1.4 million, or an average of $67,000 per credit, and generated $0.4 million from an easement transaction. Additionally, the Company recognized $20.6 million from previously deferred sales and conveyed 2,148 acres to FDOT as part of FDOT’s purchase of land from the Company in 2006.

Forestry

Forestry revenues during the fourth quarter of 2010 were $7.8 million, primarily from the sale of 312,000 tons of sawtimber and pulpwood. For the full-year, forestry revenues were $28.8 million, an increase of $2.2 million over 2009, due primarily to increased pricing of sawtimber and pulpwood.

Liquidity and Balance Sheet

At December 31, 2010, St. Joe had cash of $183.8 million, pledged treasury securities of $25.3 million and debt of $54.7 million, $25.3 million of which is defeased debt. The Company’s $125 million revolving credit facility remained undrawn at December 31, 2010.

Capital expenditures for the full year 2010 were $16.1 million, compared to $18.4 million for the same period in 2009. In addition, St. Joe incurred cash overhead costs of $56.7 million for the full year 2010, compared to $57.6 million for 2009. Cash overhead costs in 2010 included $4.9 million for litigation costs and $4.2 million for legal and environmental clean-up costs resulting from the Deepwater Horizon oil spill.

On February 8, 2011 the Company announced that it had engaged Morgan Stanley & Co., Inc. to assist it in the evaluation of financial and strategic alternatives to enhance shareholder value. St. Joe intends to consider the full range of available options including a revised business plan, operating partnerships, joint ventures, strategic alliances, asset sales, strategic acquisitions and a merger or sale of the Company, but there can be no assurance that the exploration of strategic alternatives will result in any transaction.

Land Holdings and Land Use Entitlements

On December 31, 2010, St. Joe owned approximately 574,000 acres, concentrated primarily in Northwest Florida. Approximately 403,000 acres, or 70 percent of the Company’s total land holdings, are within 15 miles of the coast of the Gulf of Mexico.

Here are 3 slides from his VIC presentation that were a focal point of his valuation of the company

Below he takes ten years of JOE’s land sales to come up with an average # for land valuation. Problem? Do you know what the sales price of rural land in 2000 has to do with land values today? NOTHING…..

If you want proof simply try to sell your home today at 2006 levels and lets see what happens or flashback to 2006 and make a seller an offer at 2000 levels. The only RE values that matter are today’s and what buyers think they will be tomorrow. Yesterday’s values matter not. But, it is a fun exercise.

On slide two he uses land sales for other Timber Co’s. to come up with a acreage value. This also is not realistic as again 2006 land sales are irrelevant. Not only that, but the citing from Einhorn leaves out a MATERIAL factor in the first one from International Paper. Einhorn simply lists the sales price and acreage and then says the land sold a “x” per acre.

If we go to the IP 10Q: (Emphasis mine)

On July 22, 2010, the Company announced that it had signed an agreement to sell 163,000 acres of properties located in the southeastern United States to an affiliate of Rock Creek Capital (the Partnership) for $200 million. A minimum of $160 million will be received at closing, with the balance, plus interest, to be received no later than three years from closing. In addition, the Company will receive 20% of the Partnership’s net profits after it achieves certain financial returns.I’d say that is a little more than a little omission. IP sold off some land to raise cash but is holding an interest in the results of said timber land, that in no way qualifies the transaction to be listed as an outright “land sale” on Einhorn’s presentation. Of course the sale price will be lower if the buyer has to fork over 20% of future profits to the seller. I am also shocked that no one out there seems to have actually looked at his comps and citations to see of they are valid, they aren’t. This in fact reminds me of Hovde and GGP in December of 2009 in his used of comps that were invalid.

Using that data he “splits the difference” so to speak to come up with a number (below) from the two slides. So, what is JOE selling rural land for now?

For the full year (2010), the Company sold 606 acres of rural land for $3.0 million, or $4,900 per acreHmmm… that is more than a little bit north of the $1500 an acre Einhorn comes to (erroneously). In a worst case scenario, he should have used the $2000 an acre from 2009. We should just take the “most recent sales” data, which is, you know, how RE is comped and sold. Doing it the right way we get a value of the rural land of $2.5B (530k acres x $4900/acre) which is more than the value of the entire company right now. This is giving the value of the entitled acreage is nothing and you’d have to assume that the price of Florida beach RE does not rise……ever….

Of course we must also note: “Average sales prices per acre vary according to the characteristics of each particular piece of land being sold and its highest and best use. As a result, average prices will vary from one period to another” ( From 10K pg 45). what this means is you simply cannot say acre “A” sold for “x” so everything left it worth what is left times “X”. To the point we have made in the past is that Einhorn’s thesis was wrong because that is precisely what he did. I did the same thing above (with far more accurate sales data) and got a value 3X higher than he did. I would say since I am using numbers from 2010 and he an average of 2000-9 mixed with dubious comps (discussed above) mine is the more accurate valuation.

I have listed my complaints with Einhorn on this in the past and all of them still hold. In fact, recent airport activity (above) further bolsters just how wrong he was on that aspect of his presentation. I am troubled by his selective use of the IP comp above though w/o an accurate disclosure of what type of sale it was. If you know anything about RE investing you would know that the transaction does not belong on the same page as a straight forward RE land sale. To be clear, I am not accusing him of hiding anything, the citations are there for those who actually decided to check them out, just that his inclusion of this transaction is not valid.

This along with what we have discussed I think has to severely discount or even dismiss Einhorn’s thesis entirely. I have to think that were it not Einhorn’s name on it, many people would have ripped into this a while ago. This is a case of reputation over accuracy?.