Becton Dickinson is a global health company that focuses on durable medical supplies and medical devices.

5-Year Performance:

Revenue Growth: 6%

Income Growth: 13%

Dividend Growth: 6.5%

Current Dividend Yield: 2.08%

BDX stock has gone up and down over the past year, finishing roughly where it started and therefore missing out on the broader stock rally during the same period. I consider the company a moderate buy at the current level.

BD Medical

BD Medical contributes by far the largest percent of revenue, with $3.796 billion or 52% of Becton Dickinson’s total revenue. A bit over $2 billion of this comes from medical and surgical systems. Slightly over $1 billion comes from pharmaceutical systems, and the remainder comes from diabetes care. These products come in the form of needles, syringes, and drug-delivery systems, and the major customers are hospitals, clinics, physicians’ offices, government agencies, and healthcare workers.

BD Diagnostics

BD Diagnostics pulls in the second largest amount of revenue, with $2.319 billion or approximately 31% of BD’s total revenue. It is about evenly split up, with over $1 billion in revenue each from Preanalytical Systems and Diagnostic Systems. This segment concerns specimen collection, identification, testing, and specific systems, and the major customers are hospitals, laboratories, blood banks, physicians’ offices, and so forth.

BD Biosciences

BD Biosciences is the smallest segment, with $1.257 billion in revenue, or 17% of the total. From this, close to $1 billion comes from cell analysis, and the remaining $300 million comes from discovery labware. The products are mainly kits for cell analysis, cell imaging systems, and laboratory products.

Over 55% of total revenue comes from outside of the US.

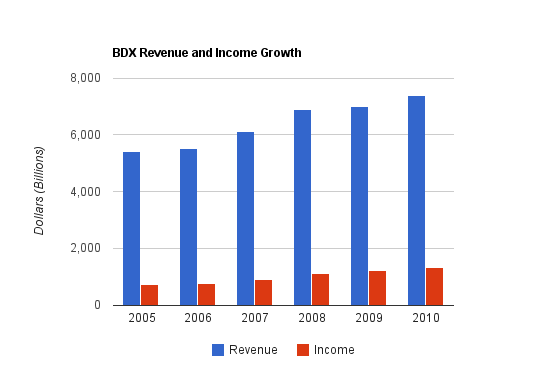

Becton Dickinson has grown revenue by an annualized growth rate of more than 6% over this period.

Becton Dickinson has grown net income by nearly 13% annually over this period.

Operating cash flow has grown at an annualized rate of nearly 6.5% over this period.

Price to Book: 3.6

Return on Equity: 25%

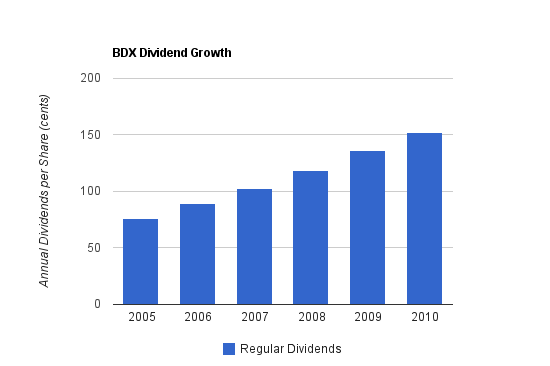

Dividends increased at a compounded rate of 15% over this period. The most recent increase was a bit under 11%.

With a dividend yield of around 2%, this obviously isn’t a good choice for a high-yield investment. But with a combination of dividend yield and impressive long term dividend growth potential, BDX is in a position to provide solid total returns.

It’s worth mentioning that in the previous quarter, the company did dramatically increase its debt position by $1 billion, and the above debt/equity ratio takes this into account. This seems substantial, and it is. But from a broader perspective, the company went from an extremely strong financial position to a moderately strong financial position. On an absolute basis, the balance sheet is still very appealing. The company is using the money for share repurchases, likely because interest rates are currently extremely low and they won’t stay like this forever. This isn’t alarming to me (I neither have a strong opinion for or against), but worth keeping an eye on to ensure that it doesn’t turn into a trend and that the balance sheet continues to stay in good shape. Based on management’s expectations for share repurchases this year and next year (with next year being greatly reduced compared to this year), this seems to be a context-dependent event based on current rates.

In 2010, the company divested their Ophthalmic Systems unit, their surgical blades unit, and a few other units to streamline their resources towards other areas.

In terms of new products, the company launched the world’s smallest pen needle last year, which is proposed to reduce pain for diabetes patients. The BD Diagnostics segment has plans to launch new products next year. BD Biosciences has a new Advanced Bioprocessing facility in Miami Florida.

The company recently opened plants in Hungary and Mexico. The company expects increasing revenue to come from emerging markets in China, India, and South America, and has plans to expand facilities in some regions.

Diverse revenues are key here, and a pillar of stability for the company. BDX has revenue streams from a number of different countries, and no single customer contributed more than 10% of revenues.

I think the macro environment is well in place to support BDX. Developing countries are increasingly demanding adequate health care, and the US has an aging population. This is a great way to be involved in the health care industry without being involved with the risky pipelines and patent loss issues of big pharmaceutical companies. I’m impressed by its ability to steadily grow during healthy economic periods and quietly persevere during terrible economic environments.

All of this comes at a moderate P/E of under 16 right now, and the dividend yield, while unimpressive, is higher than it has been in recent years. Due to both long-term growth and stability, as well as the solid and growing dividend, I consider myself a buyer as long as the stock price stays at or below the lower $80”²s.

Consider having a look at an article I published a month ago on Seeking Alpha. It’s a bit time sensitive, but also discusses some of Becton Dickinson’s shareholder friendliness and shows an effective chart illustrating share repurchases and dividends combined. It makes for a nice complimentary read:

Becton Dickinson

Full Disclosure: Long BDX

5-Year Performance:

Revenue Growth: 6%

Income Growth: 13%

Dividend Growth: 6.5%

Current Dividend Yield: 2.08%

BDX stock has gone up and down over the past year, finishing roughly where it started and therefore missing out on the broader stock rally during the same period. I consider the company a moderate buy at the current level.

Overview

Becton Dickinson is a truly global health care company. Founded in 1897, and employing 29,000 people in 50 countries, Becton Dickinson develops, manufactures, and sells a wide range of medical devices and instruments. Revenue for 2010 was $7.372 billion. Becton Dickinson is currently organized into three main segments.BD Medical

BD Medical contributes by far the largest percent of revenue, with $3.796 billion or 52% of Becton Dickinson’s total revenue. A bit over $2 billion of this comes from medical and surgical systems. Slightly over $1 billion comes from pharmaceutical systems, and the remainder comes from diabetes care. These products come in the form of needles, syringes, and drug-delivery systems, and the major customers are hospitals, clinics, physicians’ offices, government agencies, and healthcare workers.

BD Diagnostics

BD Diagnostics pulls in the second largest amount of revenue, with $2.319 billion or approximately 31% of BD’s total revenue. It is about evenly split up, with over $1 billion in revenue each from Preanalytical Systems and Diagnostic Systems. This segment concerns specimen collection, identification, testing, and specific systems, and the major customers are hospitals, laboratories, blood banks, physicians’ offices, and so forth.

BD Biosciences

BD Biosciences is the smallest segment, with $1.257 billion in revenue, or 17% of the total. From this, close to $1 billion comes from cell analysis, and the remaining $300 million comes from discovery labware. The products are mainly kits for cell analysis, cell imaging systems, and laboratory products.

Over 55% of total revenue comes from outside of the US.

Revenue, Income, Cash Flow, and Metrics

Becton Dickinson has a long history of consistent top line and bottom line growth, as well as dividend growth. In addition, the company repurchases numerous shares to ensure that EPS grows faster than net company income.Revenue Growth

| Year | Revenue |

|---|---|

| 2010 | $7.372 billion |

| 2009 | $6.987 billion |

| 2008 | $6.898 billion |

| 2007 | $6.121 billion |

| 2006 | $5.513 billion |

| 2005 | $5.414 billion |

Income Growth

| Year | Income |

|---|---|

| 2010 | $1,318 million |

| 2009 | $1,231 million |

| 2008 | $1,127 million |

| 2007 | $890 million |

| 2006 | $752 million |

| 2005 | $722 million |

Cash Flow Growth

| Year | Operational Cash Flow |

|---|---|

| 2010 | $1,659 million |

| 2009 | $1,658 million |

| 2008 | $1,618 million |

| 2007 | $1,236 million |

| 2006 | $1,104 million |

| 2005 | $1,221 million |

Metrics

Price to Earnings: 15.8Price to Book: 3.6

Return on Equity: 25%

Dividends

Becton Dickinson has a low dividend yield, at only 2.08%, but strong dividend growth and 38 consecutive years of dividend increases. In 2010, the company returned 66% of operating cash flow to shareholders in the form of dividends and share repurchases. Its earnings dividend payout ratio is less than 30%.Dividend Growth

| Year | Dividend | Yield |

|---|---|---|

| 2010 | $1.52 | 1.90% |

| 2009 | $1.36 | 1.90% |

| 2008 | $1.185 | 1.50% |

| 2007 | $1.02 | 1.30% |

| 2006 | $0.89 | 1.40% |

| 2005 | $0.755 | 1.30% |

With a dividend yield of around 2%, this obviously isn’t a good choice for a high-yield investment. But with a combination of dividend yield and impressive long term dividend growth potential, BDX is in a position to provide solid total returns.

Balance Sheet

BDX’s balance sheet is fairly strong. The LT Debt/Equity ratio is 0.51, which is quite solid. Goodwill makes up only approximately 15% of shareholder equity. The current ratio is approximately 3, which is a very healthy position. The interest coverage ratio is extremely high due to the company’s good credit rating and careful borrowing.It’s worth mentioning that in the previous quarter, the company did dramatically increase its debt position by $1 billion, and the above debt/equity ratio takes this into account. This seems substantial, and it is. But from a broader perspective, the company went from an extremely strong financial position to a moderately strong financial position. On an absolute basis, the balance sheet is still very appealing. The company is using the money for share repurchases, likely because interest rates are currently extremely low and they won’t stay like this forever. This isn’t alarming to me (I neither have a strong opinion for or against), but worth keeping an eye on to ensure that it doesn’t turn into a trend and that the balance sheet continues to stay in good shape. Based on management’s expectations for share repurchases this year and next year (with next year being greatly reduced compared to this year), this seems to be a context-dependent event based on current rates.

Investment Thesis

Both the historical and projected performance of BDX is impressive. The company has a long history of growth, and targets double-digit EPS growth into the future. In addition, the company targets continually increasing research and development expenditure. R&D expense has grown by an average of over 10% per year on average over the last four years.In 2010, the company divested their Ophthalmic Systems unit, their surgical blades unit, and a few other units to streamline their resources towards other areas.

In terms of new products, the company launched the world’s smallest pen needle last year, which is proposed to reduce pain for diabetes patients. The BD Diagnostics segment has plans to launch new products next year. BD Biosciences has a new Advanced Bioprocessing facility in Miami Florida.

The company recently opened plants in Hungary and Mexico. The company expects increasing revenue to come from emerging markets in China, India, and South America, and has plans to expand facilities in some regions.

Risks

Like any company, Becton Dickinson has risks. Due to its size, BDX faces international political issues and lawsuits. Due to health care reform in the US, BDX faces the possibility of reduced profit margins. For instance, beginning in 2013, the company will have to pay a 2.3% excise tax on most of its US products. Regulation on medical devices is becoming more and more stringent. BDX is dependent on effective research and development, having spent more than $400 million in 2010. Currency risk is also an ever-present issue for an international company such as BDX.Diverse revenues are key here, and a pillar of stability for the company. BDX has revenue streams from a number of different countries, and no single customer contributed more than 10% of revenues.

Conclusion and Valuation

In my opinion, the risk/reward ratio is very appealing based on its growth and stability, and so this company may be a good choice for a reasonably safe, long-term pick. With 15% 5-year dividend growth on a current 2% yield, 13% 5-year income growth, and substantial share buybacks, BDX has been a very shareholder friendly company. It is appropriately leveraged, and draws the majority of its revenue internationally.I think the macro environment is well in place to support BDX. Developing countries are increasingly demanding adequate health care, and the US has an aging population. This is a great way to be involved in the health care industry without being involved with the risky pipelines and patent loss issues of big pharmaceutical companies. I’m impressed by its ability to steadily grow during healthy economic periods and quietly persevere during terrible economic environments.

All of this comes at a moderate P/E of under 16 right now, and the dividend yield, while unimpressive, is higher than it has been in recent years. Due to both long-term growth and stability, as well as the solid and growing dividend, I consider myself a buyer as long as the stock price stays at or below the lower $80”²s.

Consider having a look at an article I published a month ago on Seeking Alpha. It’s a bit time sensitive, but also discusses some of Becton Dickinson’s shareholder friendliness and shows an effective chart illustrating share repurchases and dividends combined. It makes for a nice complimentary read:

Becton Dickinson

Full Disclosure: Long BDX