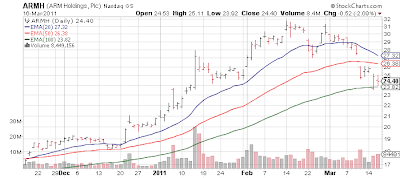

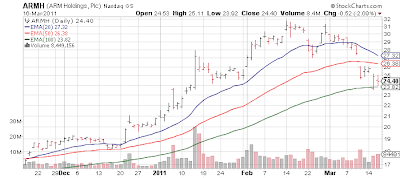

For those interested in ARM Holdings (ARMH, Financial) the stock has become much more attractive in terms of valuation (still not cheap - just cheap(er)) and entry point, than it was 2-3 weeks ago.

The stock has lost nearly a quarter of its value in that time and now sits right above the 200 day moving average. This is also an area the stock tested a few times in January 2011. One could definitely take a swing here and abandon ship if this support level is broken - the stock held up quite well during yesterday's market carnage all things considered.

ARMH took a dramatic hit last Thursday when a few brokerage houses spoke of a potential gut of tablets. Which shows how quickly things can change considering the tablet market is essentially in its infancy (and we're already talking glut!) Via Forbes

----------------------------

The WSJ this morning ran an interesting backstory on this company - including the fact Apple had a strong hand in ARM Holding's evolution; some snippets below:

[ Feb 1, 2011: ARM Holdings Continues to Squash Critics with Latest Earning Report]

No position

The stock has lost nearly a quarter of its value in that time and now sits right above the 200 day moving average. This is also an area the stock tested a few times in January 2011. One could definitely take a swing here and abandon ship if this support level is broken - the stock held up quite well during yesterday's market carnage all things considered.

ARMH took a dramatic hit last Thursday when a few brokerage houses spoke of a potential gut of tablets. Which shows how quickly things can change considering the tablet market is essentially in its infancy (and we're already talking glut!) Via Forbes

- Even before the tablet market gets off the ground, worries have surfaced about a glut. While Apple launches sales of the iPad 2, most other tablet manufacturers – and there are a zillion of them – have just begun rolling out products, or plan to do so in the months ahead. And already, there are concerns that there are too many competitors – and not enough demand for non-iPad tablets to match the expected production. J.P. Morgan analyst ....asserted that we could be headed for a huge over-supply of non-iPad tablets in the second half of this year.

- In his note, Deshpande write that delayed tablet launches could result in order cuts for some chip vendors. And he notes that all the current tablet processors are based on ARM designs – so reduced chip demand could affect ARM’s royalty revenues. And he notes that “this end market is one of the key reasons for the current bullishness on ARM.” The analyst maintains an Underweight rating on the shares.

----------------------------

The WSJ this morning ran an interesting backstory on this company - including the fact Apple had a strong hand in ARM Holding's evolution; some snippets below:

- It's a company that's changing the world, powering the computing revolution that is putting cooler graphics, faster games and amazing apps in everyone's pocket. And you've never heard of it. The company is ARM Holdings PLC, a British microprocessor firm founded 21 years ago in a turkey barn. While still relatively small, ARM is upending the chip business, posing perhaps the most nettlesome challenge yet to giant Intel Corp.

- ARM's chips have become the most popular standard for cellphones and tablets and are found in hundreds of millions of other devices, from digital cameras to disk drives. Its market share in handsets is more than 90%, and its stock has tripled over the past 15 months.

- ARM's growing cachet—and the threat it poses to Intel—was on display March 2, when Apple CEO Steve Jobs presented the iPad 2 to journalists and technophiles. He emphasized how the tablet's processor—which is based on ARM technology—is twice as fast as the previous one, all the while keeping battery life at an impressive 10 hours.

- "Without ARM, it would take a device the size of a computer to accomplish what the smartphones in our pockets are capable of," says analyst Francis Sideco of researcher IHS iSuppli.

- Battery life is key. It's why, in handsets, ARM's chip architecture dominates. Intel's brawny processors are speedier, making them ideal for PCs. Compared to ARM's, however, they gulp electricity, making them a bad fit for battery-powered devices.

- In 1990, Apple wanted a chip for its new personal digital assistant, the Newton. It formed a joint venture with Acorn that was later renamed ARM Holdings. Apple threw in $1.5 million, according to Mr. Hauser. Acorn contributed its 12-person chip design team. Befitting a tech start-up, ARM's first headquarters near Cambridge, England, was a converted turkey barn. Acorn eventually died, but ARM prospered. Apple made $800 million on its investment.

- At its start, ARM made a business decision: Rather than make chips itself, ARM would license its technology to others. ARM had in essence developed a particularly well-designed chip brain—and chose to sell the blueprint to other chip companies that could fashion full-fledged "systems on a chip" around it. These ended up dominating handsets because they integrated so many functions into a single chip, making powerful phones possible.

- Today Texas Instruments Inc., Qualcomm Inc., Samsung Electronics Co. and others use ARM designs, paying small licensing and royalty fees for the privilege. It's a deeply profitable business—with gross margins of 94%, compared with 65% for Intel last year.

- Intel wants to crack into the phone market, and it plans to release a new chip this year that it predicts will match ARM's in both power consumption and performance.

- But even if Intel delivers a comparable chip, the company could have trouble making headway in handsets. Device-makers can play all the potential suppliers of ARM chips off against each other, keeping costs down. A bigger hurdle may be persuading mobile-software developers to write Intel-compatible code.

- ARM's biggest challenge may be living up to investors' lofty expectations.Its shares fetch almost 70 times its 2011 expected earnings.

- In January ARM got a boost when Microsoft Corp. said its next Windows operating system would work with ARM chips. That means they now have a better chance of getting into PCs, too.

- Ironically, Intel could have saved itself the trouble. Mr. Hauser recalls that before designing its own chip, Acorn approached Intel about using its technology. "They said get lost," recalls Mr. Hauser. "If they had given us [their chip], we never would have done the ARM."

[ Feb 1, 2011: ARM Holdings Continues to Squash Critics with Latest Earning Report]

No position