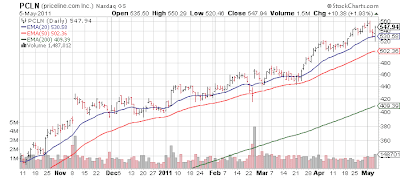

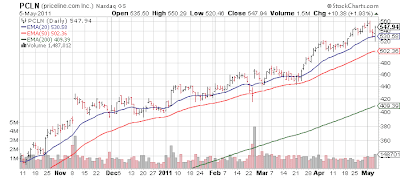

One of my worst blunders of 2010 was selling Priceline.com (PCLN, Financial) in the low $200s after booking a very nice gain. In the 15 or so months since, it has rallied another 150%-ish. As Homer Simpson would say, "DOH!"

I would think at some point the expectations would be too high for this company to continue to beat, but that day has yet to come. The company just reported a $2.66 versus $2.45 expectation on a 38.5% year over year revenue growth rate. International sales, which are now almost half of the business, were blockbuster (+80%)! They just moved guidance well over analysts $4.40 for the next quarter as well.

Via earnings report:

Guidance

The Priceline Group said it was targeting the following for second quarter 2011:

I would think at some point the expectations would be too high for this company to continue to beat, but that day has yet to come. The company just reported a $2.66 versus $2.45 expectation on a 38.5% year over year revenue growth rate. International sales, which are now almost half of the business, were blockbuster (+80%)! They just moved guidance well over analysts $4.40 for the next quarter as well.

Via earnings report:

- The Group hadrevenues in the first quarter of $809.3 million, a 38.5% increase over a year ago. The Group's international operations contributed revenues in the first quarter of $389.1 million, an 80% increase versus a year ago (approximately 79% on a local currency basis).

- The Group's gross profit for the first quarter was $505.8 million, a 58.5% increase from the prior year. International operations contributed gross profit in the first quarter of $388.2 million, an 81% increase versus a year ago (approximately 79% growth on a local currency basis).

- Non-GAAP net income in the 1st quarter was $137.0 million, a 57.1% increase versus the prior year. Non-GAAP net income was $2.66 per diluted share, compared to $1.70 per diluted share a year ago. First Call analyst consensus for the first quarter 2011 was $2.44 per diluted share.

- "In the first quarter, the Group benefited from strong growth in our global hotel business, particularly at Booking.com and Agoda," said Jeffery H. Boyd, Priceline president and chief executive officer. "Room nights booked grew by 55.8% and our international gross bookings grew by 79% compared to prior year first quarter. The Group's hotel business continues to benefit from improving ADRs, a continuing shift from offline to online bookings, increased penetration of core European and North American markets and outstanding growth in new markets throughout the Asia-Pacific region and South America."

- "The Group's global rental car operations grew rental car days booked by 64.7% in the first quarter 2011 as compared to the prior year. A significant portion of this growth can be attributed to the Group's acquisition of TravelJigsaw and its international car hire operations, which continues to grow at impressive rates. Priceline.com's airline ticketing business returned to positive growth in the first quarter, with a 2.1% gain in ticket sales and improving growth in opaque ticket sales."

Guidance

The Priceline Group said it was targeting the following for second quarter 2011:

- Year-over-year increase in total gross travel bookings of approximately 53% - 58%.

- Year-over-year increase in international gross travel bookings of approximately 76% - 81% (an increase of approximately 53% - 58% on a local currency basis).

- Year-over-year increase in domestic gross travel bookings of approximately 8% to 13%.

- Year-over-year increase in revenue of approximately 36% - 41%.

- Year-over-year increase in gross profit of approximately 57% to 62%.

- Non-GAAP EBITDA of approximately $310 million to $320 million.

- Non-GAAP net income of between $4.70 and $4.90 per diluted share.