Emerson Electric Company (EMR, Financial) is a broad industrial technology company that sells necessary products around the world.

-Revenue growth over the past five years: 2%

-Income growth over the past five years: 5%

-Cash flow growth over the past five years: 8%

-Dividend Yield: 2.50%

-Balance Sheet: Fairly Strong

Shares look reasonably valued at the current price in my opinion. The stock carries a high valuation, but this is due to expectations of continued and significant rebounding and growth in earnings through 2012. Overall, I find the price to be reasonable, but without any margin of safety.

Process Management

Emerson’s largest business segment, Process Management, accounts for 28% of revenue. The Process Management segment provides control systems, monitoring systems, asset optimization, components, and services. Only about one third of the revenue from this particular segment comes from the United States, with the rest being spread out rather equally from Europe, Asia, and the rest of the world.

Network Power

Emerson’s Network Power segment accounts for 27% of revenue. In this segment, Emerson provides power products and solutions for data centers and telecommunications networks. This includes AC power systems, DC power systems, cooling systems, embedded computing and power, and service (including 24-hour service). Only about 40% of the revenue from this particular segment comes from the United States, with Asia accounting for another 34% of this revenue.

Industrial Automation

Emerson’s Industrial Automation segment accounts for 20% of revenue. They provide a variety of automation products for companies, including industrial equipment, power systems, motors and drives, mechanical power transmission, and fluid automation. Revenue from this particular segment comes strongly from Europe and the United States, though Asia and other areas provide revenue as well.

Climate Technologies

Emerson’s Climate Technologies segment accounts for 17% of revenue. Emerson provides compressors, temperature controls and electronics, and sensors, as well as a variety of other products and services, to provide homeowners and businesses with the tools needed for heating, air conditioning, refrigeration, and overall climate control. Slightly over half of the revenue from this particular segment comes from the United States, while the rest is spread out fairly equally around several other parts of the world.

Appliances and Tools

Emerson’s Appliances and Tools segment accounts for 8% of revenue. They produce a variety of products in this segment, ranging from commercial motors to ceiling fans. Over 80% of the revenue from this particular segment comes from within the United States.

Using the trailing twelve month period as a proxy for 2011 results, Emerson has an average annual revenue growth of between 2% and 3% over the last five years.

Emerson has had an average of 5% annual income growth over this five year period. EPS growth was over 6%, taking into account share repurchases.

Emerson has grown cash flow by about 4% on average per year over the past five years, but most of this was due to 2007”²s growth.

Price to Cash Flow: 14

Price to Book Value: 3.9

Return on Equity: 22%

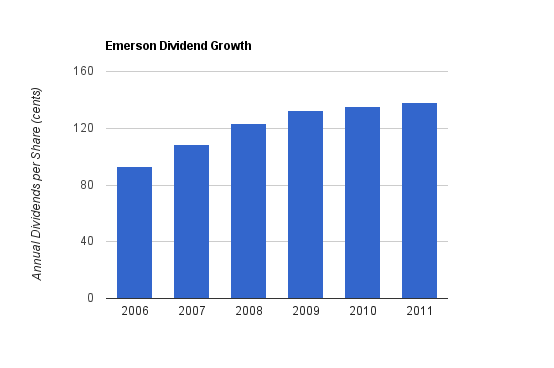

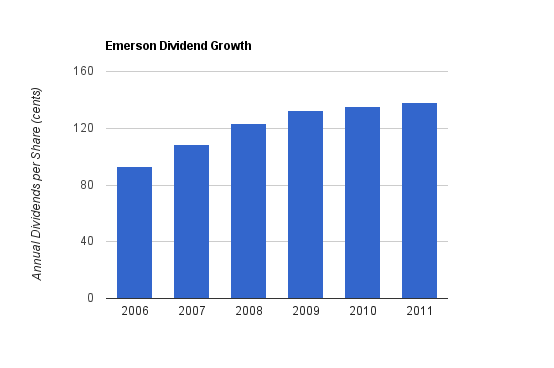

The figured displayed for the 2011 total dividend multiples the current quarterly dividend by four, but in reality, the fourth dividend of the year will likely be a bit higher. Over these past five years, Emerson has raised its dividend by over 8% per year on average. Between 2009 and 2010, however, Emerson decided to only raise its dividend by a tiny 1.5%; a token increase to preserve its unbroken chain of dividend increases. Then, the quarterly raise in 2010 was only 3%, and it is yet to be seen what the next quarterly increase will be, announced later this year.

EMR’s dividend payout ratio is currently about 45%, and their dividend yield is about 2.50%. So the payout is moderate in size and quite safe. The payout ratio is reduced compared to the last two years, since EPS has rebounded while dividend growth has been kept to a minimum. This shows the opportunity for Emerson to make more meaningful dividend increases in the future.

Emerson is an engineering company that doesn’t require a huge amount of technical expertise to invest in. The products are straightforward, easily understood in principle, not flashy, and they have long product life times. They sit in the back room and keep the business running. Emerson also has a role to play in clean energy, providing products and services to control and optimize various forms of energy production.

Even in the deepest part of the recession, although EMR was very much affected, the cyclical company continued to produce a profit. Their stable financial condition, necessary products, and geographical spread around the world allowed them to weather the storm. In fact, Emerson spent $2 billion for acquisitions during 2010, which is up significantly from previous years. Specifically, the largest acquisitions were Avocent, which provides a host of technologies for data centers, and Chloride, which provides uninterruptible power supplies.

It’s not too hard to argue that being a leading player in the data center industry is going to be a good long term growth area for Emerson. In addition to continued growth in emerging markets, data centers play a key role in the shift of computing hardware from the client side to the server side. Various online media sources and business tools all need to run in data centers, and data centers need to be supported by multiple redundant systems and continually improved cooling technology. Emerson provides a broad set of products and services that support data centers, and recent acquisitions should strengthen its already strong position.

Combine these necessary products and services with a company culture that has produced over a half-century of consecutive dividend increases, and I expect Emerson to continue to do well for years to come. Their balance sheet and cash flow are fairly strong, and the company exists within growing industries and operates around the world.

Full Disclosure: I own shares of EMR at the time of this writing.

You can see my full list of individual holdings here.

-Revenue growth over the past five years: 2%

-Income growth over the past five years: 5%

-Cash flow growth over the past five years: 8%

-Dividend Yield: 2.50%

-Balance Sheet: Fairly Strong

Shares look reasonably valued at the current price in my opinion. The stock carries a high valuation, but this is due to expectations of continued and significant rebounding and growth in earnings through 2012. Overall, I find the price to be reasonable, but without any margin of safety.

Overview

Emerson Electric Company (NYSE: EMR) is a Fortune 500 industrial technology company based in Missouri. The company was founded over 120 years ago and provides a very large array of technology products and services. The company draws 43% of its revenue from the United States, 21% from Europe, 23% from Asia, and 13% from other places of the world. With over 125,000 employees, Emerson uses its technology to help the world run.Business Segments

The company currently consists of five business segments:Process Management

Emerson’s largest business segment, Process Management, accounts for 28% of revenue. The Process Management segment provides control systems, monitoring systems, asset optimization, components, and services. Only about one third of the revenue from this particular segment comes from the United States, with the rest being spread out rather equally from Europe, Asia, and the rest of the world.

Network Power

Emerson’s Network Power segment accounts for 27% of revenue. In this segment, Emerson provides power products and solutions for data centers and telecommunications networks. This includes AC power systems, DC power systems, cooling systems, embedded computing and power, and service (including 24-hour service). Only about 40% of the revenue from this particular segment comes from the United States, with Asia accounting for another 34% of this revenue.

Industrial Automation

Emerson’s Industrial Automation segment accounts for 20% of revenue. They provide a variety of automation products for companies, including industrial equipment, power systems, motors and drives, mechanical power transmission, and fluid automation. Revenue from this particular segment comes strongly from Europe and the United States, though Asia and other areas provide revenue as well.

Climate Technologies

Emerson’s Climate Technologies segment accounts for 17% of revenue. Emerson provides compressors, temperature controls and electronics, and sensors, as well as a variety of other products and services, to provide homeowners and businesses with the tools needed for heating, air conditioning, refrigeration, and overall climate control. Slightly over half of the revenue from this particular segment comes from the United States, while the rest is spread out fairly equally around several other parts of the world.

Appliances and Tools

Emerson’s Appliances and Tools segment accounts for 8% of revenue. They produce a variety of products in this segment, ranging from commercial motors to ceiling fans. Over 80% of the revenue from this particular segment comes from within the United States.

Revenue, Earnings, Cash Flow, and Margins

Emerson was hit hard by the recession, as they sell many of their products and services to businesses that encountered severe financial troubles. The company, however, has decades of consistent growth, through peaks and recessions. They maintained profitability throughout the low point in the economy, and increased investment during the most difficult periods.Revenue Growth

| Year | Revenue |

|---|---|

| TTM | $22.647 billion |

| 2010 | $21.039 billion |

| 2009 | $20.915 billion |

| 2008 | $24.807 billion |

| 2007 | $22.572 billion |

| 2006 | $20.133 billion |

Income Growth

| Year | Income |

|---|---|

| TTM | $2.370 billion |

| 2010 | $2.164 billion |

| 2009 | $1.724 billion |

| 2008 | $2.412 billion |

| 2007 | $2.136 billion |

| 2006 | $1.845 billion |

Operating Cash Flow Growth

| Year | Cash Flow |

|---|---|

| TTM | $3.048 billion |

| 2010 | $3.292 billion |

| 2009 | $3.086 billion |

| 2008 | $3.293 billion |

| 2007 | $3.016 billion |

| 2006 | $2.512 billion |

Metrics

Price to Earnings: 19Price to Cash Flow: 14

Price to Book Value: 3.9

Return on Equity: 22%

Dividends

Emerson has increased their dividend for 54 consecutive years, which is absolutely remarkable. For over half of a century, there has not been one year where Emerson did not raise their dividend for shareholders. There have, however, been periods of economic or company difficulty that resulted in reduced dividend growth, and the company is currently in one of those periods. Becoming a 50 year consecutive dividend increaser is difficult enough; becoming one in a fairly cyclical industry is more so.Dividend Growth

| Year | Dividend | Yield |

|---|---|---|

| 2011 | >$1.38 | 2.50% |

| 2010 | $1.35 | 2.70% |

| 2009 | $1.325 | 3.30% |

| 2008 | $1.23 | 2.50% |

| 2007 | $1.0875 | 2.30% |

| 2006 | $0.93 | 2.30% |

EMR’s dividend payout ratio is currently about 45%, and their dividend yield is about 2.50%. So the payout is moderate in size and quite safe. The payout ratio is reduced compared to the last two years, since EPS has rebounded while dividend growth has been kept to a minimum. This shows the opportunity for Emerson to make more meaningful dividend increases in the future.

Share Repurchases

Over the past five years, Emerson has repurchased approximately $3.6 billion worth of its own shares. The company significantly slowed down its repurchases in 2010 to use capital for acquisitions, which I think is a better choice.Balance Sheet

Emerson Electric has a LT Debt to Equity ratio of 40% and a Total Debt to Equity ratio of 48%. Goodwill, however, consists of over 80% of shareholder equity, due to Emerson’s acquisitions. The interest coverage ratio is 13, which is quite solid. Overall, Emerson’s balance sheet is very robust.Investment Thesis

Emerson produces technology and services that keep the world running. Process Management control systems allow manufacturers to do what they do, and Network Power allows data centers and telecommunications networks to do what they do. The segments of this large business provide the necessary tools to keep the developed world operating as it does, and help the developing world continue to improve the standard of living. Fundamental backbone infrastructure requires companies like Emerson to exist and grow. As the world continues to develop and modernize, Emerson has an ocean of opportunities to grow as long as it can continue to compete.Emerson is an engineering company that doesn’t require a huge amount of technical expertise to invest in. The products are straightforward, easily understood in principle, not flashy, and they have long product life times. They sit in the back room and keep the business running. Emerson also has a role to play in clean energy, providing products and services to control and optimize various forms of energy production.

Even in the deepest part of the recession, although EMR was very much affected, the cyclical company continued to produce a profit. Their stable financial condition, necessary products, and geographical spread around the world allowed them to weather the storm. In fact, Emerson spent $2 billion for acquisitions during 2010, which is up significantly from previous years. Specifically, the largest acquisitions were Avocent, which provides a host of technologies for data centers, and Chloride, which provides uninterruptible power supplies.

It’s not too hard to argue that being a leading player in the data center industry is going to be a good long term growth area for Emerson. In addition to continued growth in emerging markets, data centers play a key role in the shift of computing hardware from the client side to the server side. Various online media sources and business tools all need to run in data centers, and data centers need to be supported by multiple redundant systems and continually improved cooling technology. Emerson provides a broad set of products and services that support data centers, and recent acquisitions should strengthen its already strong position.

Combine these necessary products and services with a company culture that has produced over a half-century of consecutive dividend increases, and I expect Emerson to continue to do well for years to come. Their balance sheet and cash flow are fairly strong, and the company exists within growing industries and operates around the world.

Risks

Like any company, Emerson has risks. Notably, Emerson took a rather large financial hit in this recession. EMR is reliant upon the health of businesses around the world to continue to operate, and has a variety of competitors from around the globe. It is well positioned within appealing industries, and to preserve its status and maintain its margins, it’s going to have to compete against other businesses that want a share in the growth. There is integration risk for acquisitions, risk of acquisitions not providing enough synergy to justify their costs, and currency risks.Conclusion and Valuation

Emerson stock is not cheap right now with a P/E of about 19. Still, I think in the long term, EMR is going to prosper as a company. Using the analyst forecasts for the EPS growth between 2010 and 2011, and 2011 and 2012, the PEG ratio is around 1. I expect that after this rather long rebound from the market bottom to a couple years out, the valuation will come down a bit as the EPS grows to fill in the stock price. I personally think the current $55 represents a reasonable entry price for this stock at this time with the intention of long term holding, but admittedly does not offer a comfortable margin of safety. It may be worthwhile to wait for any potential dips.Full Disclosure: I own shares of EMR at the time of this writing.

You can see my full list of individual holdings here.