Pepsico (PEP, Financial) is a leading international beverage and snack food company.

-Five year average revenue growth: 12%

-Five year average income growth: 9%

-Five year average cash flow growth: 7.5%

-Dividend Yield: 3.26%

-Most Recent Dividend Increase: 7.3%

-Balance Sheet: Mediocre

I think Pepsico would likely make a solid long-term investment when purchased at the current price in the mid-$60s range.

Pepsi- carbonated beverages like Pepsi, Mountain Dew, Sierra Mist, Sobe Lifewater, Amp, and their water brand Aquafina

Frito Lay- chips and snacks like Lays, Doritos, Tostitos, Sun Chips, and 100 Calorie Snacks

Tropicana- fruit juices

Quaker- Healthier food choices like Quaker Oats, Life cereal, and granola bars

Gatorade- sports drinks and Propel fitness water

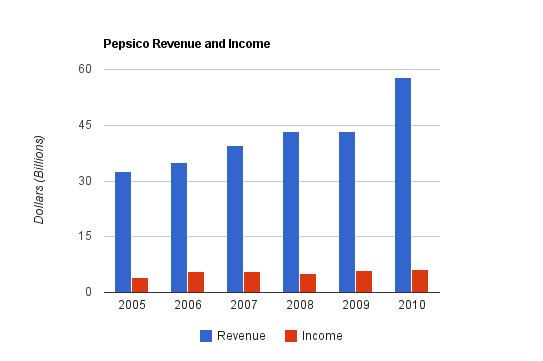

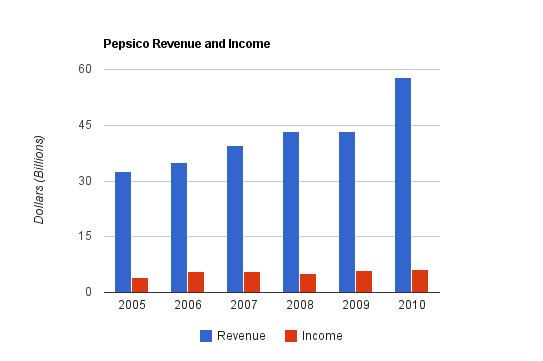

Pepsi has seen 12% average annual revenue growth over the past five years. A slowdown occurred for 2009, but for the 2010 numbers, Pepsi has purchased its major North American bottlers.

Pepisco has seen 9% compounded income growth over the past five years.

EPS grew by over 10% compounded annually, based on Pepsico’s share repurchases.

Pepsico has experienced 7.5% annual cash flow growth over the past five years.

Price to Book: 4.7

Return on Equity: 30%

Net Profit Margin: 10%

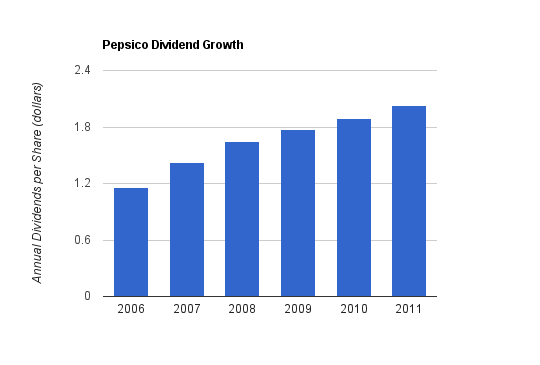

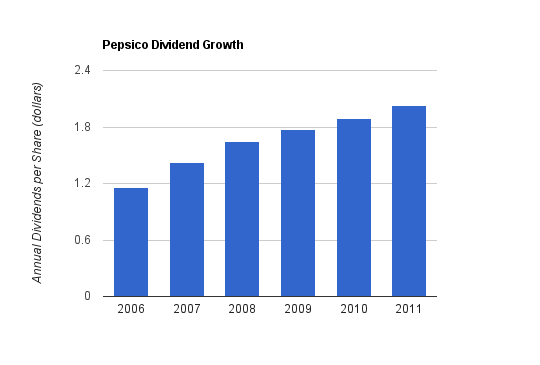

Pepsi has grown their dividend by nearly 12% annually over the last five years. The 2011 figure projects the current dividend for the remainder of the year, which is a safe assumption. The quarterly dividend increase for 2011 was 7.3%.

As of 2010, Pepsico authorized a repurchase of up to $15 billion worth of stock through 2013. With a market cap of about $100 billion, this represents about 15% of company stock.

Based on activity over the last few years, Pepsico seems to have a reasonable management team. Coca Cola (KO), the larger beverage company, has actually been playing catch-up to Pepsico in terms of business actions. Pepsico began making healthier acquisitions, and Coca Cola is finally realizing the health trend and doing the same. Pepsico acquired bottling operations, and later Coca Cola did the same.

The chairman and CEO, Indra Nooyi, seems to have a solid vision for Pepsi. She has overseen the divestiture of KFC, Taco Bell, and Burger King and the acquisitions of Tropicana and Quaker, radically transforming the health value of the company’s products. There are some that suggest that she is not the best person for the job, based on Pepsico’s slowing growth, but I think the long-term aspects of positioning the company into healthier spaces, and performing actions that result in mirror moves by Coca Cola, are more important than pure growth metrics. Growth inevitably slows a bit as a company grows large, and what becomes more important than simply the scale of the growth are the sustainability and consistency of the growth.

Pepsico’s sustainability objectives are many: increase healthy ingredients in foods, decrease sodium and added sugar in key brands by 25 percent, decrease saturated fats in key brands by 15 percent, only advertise healthy foods to children under 12, eliminate the direct sale of full-sugar soft drinks to primary and secondary schools by 2012, and to continue to contribute to wellness programs through their Pepsico Foundation.

Pepsico’s environmental objectives are also many: improve water and electricity efficiency by 20% by 2015, increase beverage container recycling to 50% by 2018, reduce packaging weight by 350 million pounds, and reduce fossil fuel usage per unit of production by 25% by 2015.

I’m rather confident in Pepsico’s current management team to produce sustainable growth over the next several years. They’ve been making proactive decisions on growth while also realizing their health benefits and drawbacks and adjusting their product portfolio and advertising audience accordingly. I think their focus on health is a key advantage over Coca Cola, although Coca Cola has advantages of its own.

There are always risks, however, and PEP is not immune. Their profits depend on commodity costs and transportation costs. There also seems to be a long-term downward trend of soda consumption in North America, meaning that Pepsico has to continually re-shape its business with healthier options if it is going to prosper in the long term. PEP also faces issues when it comes to using water, as water is a scarce resource in some parts of the world and it causes political and environment problems when a company as large as Pepsico uses too much water in a given region. Pepsico’s increased debt gives it less of a cushion to handle downturns and other problems, and so the company should rightly trade at a valuation lower than a company like Coca Cola, which has also taken on substantial debt but not to the extent of Pepsico.

A nice thing about an investment in Pepsico is that a significant portion of the total shareholder return comes from dividends and share repurchases. This grants a relatively secure return, and shows that the company is primarily focused on building shareholder value.

Full Disclosure: I own shares in KO and have no position in PEP at the time of this writing.

-Five year average revenue growth: 12%

-Five year average income growth: 9%

-Five year average cash flow growth: 7.5%

-Dividend Yield: 3.26%

-Most Recent Dividend Increase: 7.3%

-Balance Sheet: Mediocre

I think Pepsico would likely make a solid long-term investment when purchased at the current price in the mid-$60s range.

Overview

Pepsico is one of the leading beverage and snack food companies in the world. Although Pepsi-Cola is their largest brand, the company extends far beyond merely that single brand into a variety of beverages and snacks. PEP is a consistent dividend performer. The company has over 19 billion-dollar brands, which is up from 11 billion-dollar brands in 2000.Brands

Pepsico has the following main brands:Pepsi- carbonated beverages like Pepsi, Mountain Dew, Sierra Mist, Sobe Lifewater, Amp, and their water brand Aquafina

Frito Lay- chips and snacks like Lays, Doritos, Tostitos, Sun Chips, and 100 Calorie Snacks

Tropicana- fruit juices

Quaker- Healthier food choices like Quaker Oats, Life cereal, and granola bars

Gatorade- sports drinks and Propel fitness water

Revenue Mix

- Pepsico food brings in 49% of revenue while beverages bring in the remaining 51%.Revenue, Income, Cash Flow and Metrics

PEP has seen a slowdown in their growth over the past few years, but overall the company is healthy and expanding, and most of their money goes back to create shareholder value.Revenue Growth

| Year | Revenue |

|---|---|

| 2010 | $57.8 billion |

| 2009 | $43.2 billion |

| 2008 | $43.3 billion |

| 2007 | $39.5 billion |

| 2006 | $35.1 billion |

| 2005 | $32.6 billion |

Income Growth

| Year | Income |

|---|---|

| 2010 | $6.32 billion |

| 2009 | $5.95 billion |

| 2008 | $5.14 billion |

| 2007 | $5.66 billion |

| 2006 | $5.64 billion |

| 2005 | $4.08 billion |

EPS grew by over 10% compounded annually, based on Pepsico’s share repurchases.

Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2010 | $8.45 billion |

| 2009 | $6.80 billion |

| 2008 | $7.00 billion |

| 2007 | $6.93 billion |

| 2006 | $6.08 billion |

| 2005 | $5.85 billion |

Metrics

Price to Earnings: 16Price to Book: 4.7

Return on Equity: 30%

Net Profit Margin: 10%

Dividend Growth

PEP is currently offering a 3.26% dividend yield. Previously, it was difficult to find Pepsi stock offering a yield of over 3%, but based on the recent market dip and Pepsico’s increasing dividend, their yield is now well over 3%.Dividend Growth

| Year | Dividend | Yield |

|---|---|---|

| 2011 | $2.025 | 3.20% |

| 2010 | $1.89 | 2.90% |

| 2009 | $1.775 | 3.10% |

| 2008 | $1.65 | 2.60% |

| 2007 | $1.425 | 2.20% |

| 2006 | $1.16 | 1.90% |

Share Repurchases

Pepsico had a net $9 billion share repurchase between the three years of 2006, 2007 and 2008.As of 2010, Pepsico authorized a repurchase of up to $15 billion worth of stock through 2013. With a market cap of about $100 billion, this represents about 15% of company stock.

Balance Sheet

Pepsico took on considerable leverage in order to expand the business by buying their North American bottlers. The considerable growth on the income statement for 2010 and onwards comes at a cost, and that cost is in the form of debt. Pepsico now has a debt/equity ratio of 117%, and shareholder equity consists of nearly 70% goodwill. The interest coverage ratio is still solid at 10, but considerably lower than before the acquisition. Overall, Pepsico has a stable balance sheet, and the healthy interest coverage ratio is promising, but it’s not nearly as appealing as it was a few years ago, and is a considerable price to pay for the acquisition. I expect that Pepsi will be using profits to pay down and further stabilize their balance sheet over time, which would be money that won’t be going to dividends and share repurchases.Investment Thesis

In 2010, Pepsico completed its mergers with PepsiAmericas and the Pepsi Bottling Group so that the combined company could control cost and develop beverages and get them to markets more quickly. Coca Cola (KO, Financial) copied this move and acquired their largest North American bottler as well. These are strategies to turn around their falling North American carbonated beverage sales. This boosted revenue and to a lesser extent, income, as can be seen the presented numbers above, but weakened the balance sheet, since Pepsi had to take on debt to finance the operation, and acquired considerable goodwill.Based on activity over the last few years, Pepsico seems to have a reasonable management team. Coca Cola (KO), the larger beverage company, has actually been playing catch-up to Pepsico in terms of business actions. Pepsico began making healthier acquisitions, and Coca Cola is finally realizing the health trend and doing the same. Pepsico acquired bottling operations, and later Coca Cola did the same.

The chairman and CEO, Indra Nooyi, seems to have a solid vision for Pepsi. She has overseen the divestiture of KFC, Taco Bell, and Burger King and the acquisitions of Tropicana and Quaker, radically transforming the health value of the company’s products. There are some that suggest that she is not the best person for the job, based on Pepsico’s slowing growth, but I think the long-term aspects of positioning the company into healthier spaces, and performing actions that result in mirror moves by Coca Cola, are more important than pure growth metrics. Growth inevitably slows a bit as a company grows large, and what becomes more important than simply the scale of the growth are the sustainability and consistency of the growth.

Pepsico’s sustainability objectives are many: increase healthy ingredients in foods, decrease sodium and added sugar in key brands by 25 percent, decrease saturated fats in key brands by 15 percent, only advertise healthy foods to children under 12, eliminate the direct sale of full-sugar soft drinks to primary and secondary schools by 2012, and to continue to contribute to wellness programs through their Pepsico Foundation.

Pepsico’s environmental objectives are also many: improve water and electricity efficiency by 20% by 2015, increase beverage container recycling to 50% by 2018, reduce packaging weight by 350 million pounds, and reduce fossil fuel usage per unit of production by 25% by 2015.

I’m rather confident in Pepsico’s current management team to produce sustainable growth over the next several years. They’ve been making proactive decisions on growth while also realizing their health benefits and drawbacks and adjusting their product portfolio and advertising audience accordingly. I think their focus on health is a key advantage over Coca Cola, although Coca Cola has advantages of its own.

Risks

Pepsico operates in a relatively defensive industry and has what appears to be a very high quality management team.There are always risks, however, and PEP is not immune. Their profits depend on commodity costs and transportation costs. There also seems to be a long-term downward trend of soda consumption in North America, meaning that Pepsico has to continually re-shape its business with healthier options if it is going to prosper in the long term. PEP also faces issues when it comes to using water, as water is a scarce resource in some parts of the world and it causes political and environment problems when a company as large as Pepsico uses too much water in a given region. Pepsico’s increased debt gives it less of a cushion to handle downturns and other problems, and so the company should rightly trade at a valuation lower than a company like Coca Cola, which has also taken on substantial debt but not to the extent of Pepsico.

Conclusion and Valuation

With a great set of brands, considerable international exposure, and a variety of increasingly healthy products to balance out their unhealthy ones, I feel that Pepsico is well positioned to grow its sales and profits for a very long time. Although I don’t think the stock is a bargain, I feel that it’s a premier company trading at a reasonable price, and should present a fairly safe dividend growth investment into the next decade. Pepsi trades at a lower valuation than Coca Cola, and therefore offers a larger dividend yield with comparable growth.A nice thing about an investment in Pepsico is that a significant portion of the total shareholder return comes from dividends and share repurchases. This grants a relatively secure return, and shows that the company is primarily focused on building shareholder value.

Full Disclosure: I own shares in KO and have no position in PEP at the time of this writing.