Introduction

A more detailed description regarding the fundamentals of RightNow’s (RNOW) business are detailed here.

The following discussion pertains to the radical change in RightNow’s capital structure, the stock repurchase program, and the worrisome relationship of those two elements with the company’s CEO, Greg Gianforte. Additionally, this article offers an important perspective regarding the management team’s intentions and the integrity of the Board of Directors.

Every RightNow Technologies shareholder needs to read and understand the following discussion.

Inside The Stock Repurchase Program

As outlined previously, a stock repurchase program should work as follows:

Stock repurchase programs are presumably intended to increase shareholder value. Ideally, the process would work something like this:

- Management determines that the company’s stock is undervalued

- Management announces its intention to repurchase stock

- Management repurchases stock until the stock is no longer undervalued or until the allotted repurchase funds are deplete

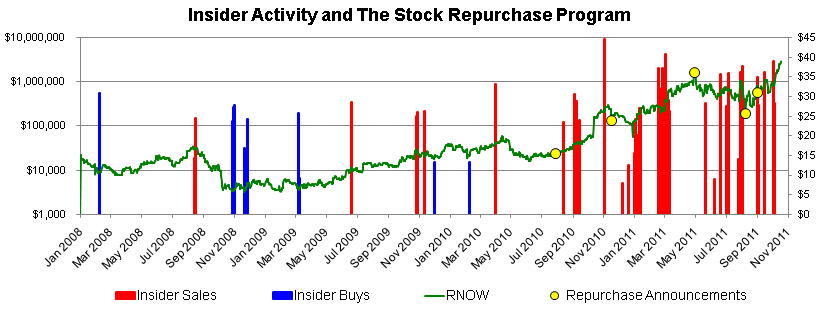

Unfortunately for RightNow’s shareholders, the stock repurchase program appears more like a perquisite for Mr. Gianforte than a value creating strategy for shareholders. The scheme seemingly adheres to SEC Rule 10b-18; however, the financing behind the stock repurchase program raises some questions.

As of mid October, 2011, the company is authorized to repurchase a whopping $80M of stock. When the size and timing of this program are viewed in the context of almost any valuation metric, it is truly stunning. The Board of Directors can not be oblivious to these facts; instead, it has presumably authorized this stock repurchase program for a reason. The following figure addresses one possible reason.

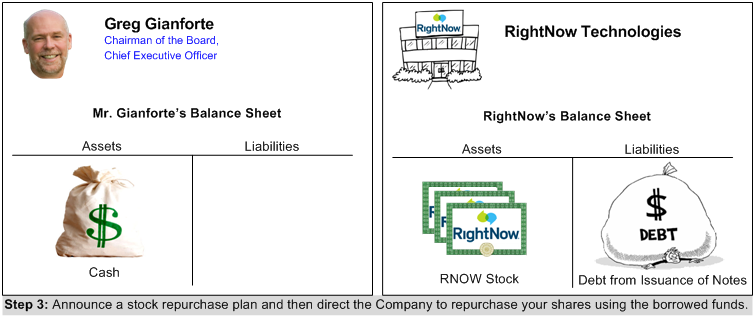

As illustrated above, the stock repurchase program seems to be a stealth mechanism for Mr. Gianforte to unload his shares without impacting the market price. If the current valuation were reasonable, then Mr. Gianforte’s actions might not be so disconcerting. However, from a valuation perspective, Mr. Gianforte’s decision to sell is wise.

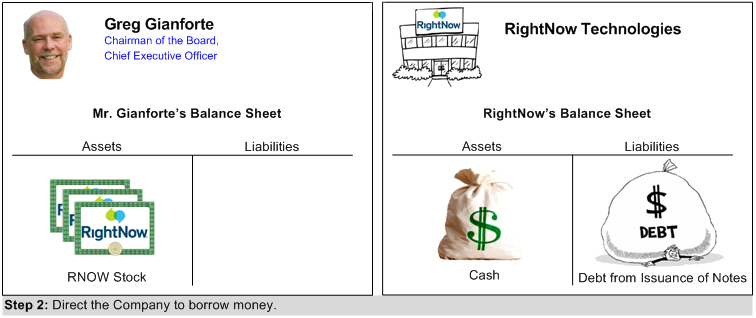

The other element concerning the stock repurchase program involves its financing. Last fall, shortly after the summer announcement of the stock repurchase program, RightNow announced that it was going to borrow $175M. The purpose of the funds was outlined in a November 17, 2010 press release (emphasis added):

RightNow intends to use the net proceeds from the offering for general corporate purposes, which may include financing potential acquisitions and strategic transactions, stock repurchases, and working capital.

In effect, Mr. Gianforte cajoled his Board of Directors into borrowing money to repurchase his shares!

Incredibly, the story gets worse. The $175M was borrowed using Convertible Senior Notes. Fortunately, the interest rate is only 2.50%. Unfortunately, the convertibility could be very dilutive to shareholders. Depending on circumstance, Senior Note holders are allowed to convert their Notes into between 31.3588 and 40.7664 shares for every $1,000. Since RightNow currently has 33M shares outstanding, an additional 5.5M to 7.1M new shares will be meaningful.

Initially, $175M may not seem worrisome, but, consider that RightNow’s best ever annual pre-tax earnings were only $12.2M. Additionally, RightNow has been unprofitable in nearly as many years as it has been profitable. Under these circumstances, extinguishing this debt will require nearly all of the company’s earnings over the next decade or shareholders will need to endure considerable dilution.

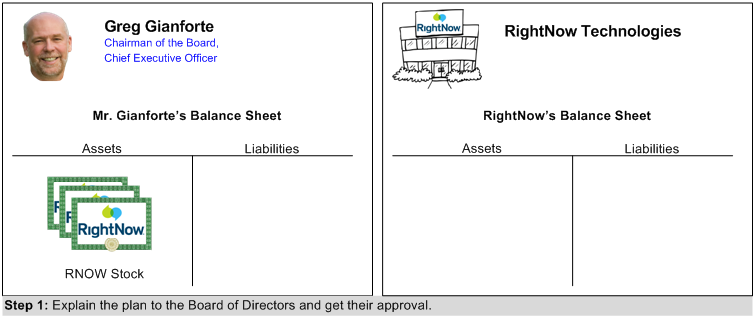

Here is how the scheme works:

Conclusion

RightNow shareholders should be clamoring for the immediate termination of the stock repurchase program. Additionally, shareholders should demand that the Board of Directors outline its thinking regarding the program’s inception.

It is critical to understand that Mr. Gianforte, The Board of Directors, and many of RightNow’s executives clearly understand the aforementioned dynamics. Consequently, we must question their integrity. As mentioned earlier, the scheme is probably legal. However, the self-serving nature of it is eerily reminiscent of those schemes perpetrated by the likes of Countrywide’s Angelo Mozilo and Enron’s Kenneth Lay.

Now is the time for COO Wayne Huyard, CFO Jeffrey Davison, or VP Steve Daines to step forward and speak up for their shareholders.

Disclosure: Short RNOW