Cummins (CMI, Financial) Not Quite as Bullish as Caterpillar - Guides Down on Full Year Revenue, Shares Hit

While Caterpillar (CAT, Financial) dominated the headlines, we are seeing a mixed bag in the cyclicals / industrials this week. Yesterday, Eaton (ETN, Financial) was solid although they lowered the high end of their full year profit forecast, while this morning 3M (MMM, Financial) is a bit disappointing and truck engine giant Cummins (CMI) has lowered full year revenue estimates, causing some pain the name.

- The company sees sales in a range of $17.5 billion to $18 billion, compared with its prior guidance of $18 billion. "There is some uncertainty around the macro-economic environment," said President and Chief Operating Officer Tom Linebarger. "Government actions to reduce inflation in India and China have resulted in softer near-term demand than we previously expected.

Cummins has been a long time favorite of FMMF, so we'll take a closer look. Still very impressive figures, but it's all relative to expectations for names like this. Full report here.

Via AP:

- Cummins Inc. third-quarter net income jumped 60 percent on strong sales of engines in North America and Latin America, the company said Tuesday. Although the results were well ahead of Wall Street estimates, the company trimmed its full-year revenue estimate due to uncertainty about the global economy.

- The Columbus, Ind., company earned $452 million, or $2.35 per share, during the quarter, compared with $283 million, or $1.44 per share, a year earlier. Revenue rose 36 percent to $4.63 billion.

- Analysts polled by FactSet expected earnings of $2.26 per share on revenue of $4.63 billion.

- Cummins, which makes diesel engines and power-generation equipment, said sales at its engine segment jumped 43 percent to $2.96 billion with more trucks on highways in North and Latin America. It also reported strong oil and gas mining engine sales worldwide.

- Power generation sales were up 10 percent to $874 million on growth in China, North America and Europe, partially offset by weaker demand in India and Latin America.

- Component sales rose 32 percent to just over $1 billion, driven mainly by highway truck markets in the U.S. and stronger growth in emerging markets, the company said.

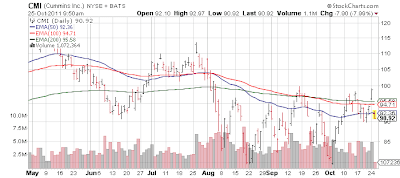

Technically, the stock has struggled along with the rest of the industrial cyclicals the past few months on global growth concerns. Other than a few minor head fakes the stock has been under the 200 day moving average for the past 3 months, so remains an avoid if you buy on relative strength.