Leon Cooperman (Trades, Portfolio)’s Omega Advisors recently released its portfolio updates for the second quarter of 2021, which ended on June 30.

Cooperman is the founder and chairman of the Omega Advisors Family Office. The firm’s investing strategy is a combination of macro views and fundamental valuation. In 2018, the guru converted his hedge fund to a family office, citing in a letter that he did not wish to chase the S&P 500 for the rest of his life.

Based on its investing strategy, the firm’s top buys for the quarter were Lithia Motors Inc. (LAD, Financial) and Finance of America Companies Inc. (FOA, Financial), while its biggest sells were Ferro Corp. (FOE, Financial) and Magnolia Oil & Gas Corp. (MGY, Financial).

Lithia Motors

Omega Advisors established a new holding of 137,500 shares in Lithia Motors (LAD, Financial), impacting the equity portfolio by 2.65%. During the quarter, shares traded for an average price of $362.47.

Lithia Motors is an American automotive retailer based in Medford, Oregon. Though it was founded in 1946, it didn’t really become a growth stock until recent years when it began executing an aggressive dealership acquisition strategy in a bid to become the nation’s top auto dealer.

On Aug. 17, shares of Lithia Motors traded around $339.23 for a market cap of $10.49 billion. According to the Peter Lynch chart, the stock is trading slightly below its intrinsic value and its median historical valuation.

The company has a financial strength rating of 5 out of 10 and a profitability rating of 8 out of 10. The Piotroski F-Score of 7 out of 9 and Altman Z-Score of 3.81 are typical of a very healthy financial situation. The return on invested capital has typically been higher than the weighted average cost of capital in recent quarters, meaning the company is creating value as it grows.

Finance of America Companies

The firm also took a 4,400,000-share stake in Finance of America Companies (FOA, Financial), which had a 1.89% impact on the equity portfolio. Shares traded for an average price of $9.68 during the quarter.

Headquartered in Irving, Texas, Finance of America Companies is a consumer lending company that provides a diverse selection of lending products and services, including home loans and reverse mortgages, commercial real estate loans, student loans and capital management.

On Aug. 17, shares of Finance of America Companies traded around $5.36 for a market cap of $343.79 million. Since it went public at the beginning of April, the stock is down 46%.

Currently, there is not sufficient data to assess the company’s financial strength or profitability, since it is new to the public markets. After going public via special purpose acquisition company, the stock initially popped because it was cheaper than other publicly-traded competitors, but it has since sunk as investors have lost much of their enthusiasm for SPACs amid regulatory fears and the failure of many blank-check companies to deliver on their promises to investors.

Ferro

The firm cut its investment in Ferro Corp. (FOE, Financial) by 3,220,869 shares, or 96.99%, leaving a remaining holding of 100,000 shares. The trade had a -3.38% impact on the equity portfolio. During the quarter, shares traded for an average price of $19.61.

Founded in 1919, Ferro is a producer of technology-based performance materials for manufacturers that operate in four core segments: performance colors and glass; pigments, powders and oxides; porcelain enamel; and tile coatings systems. It is based in Mayfield Heights, Ohio.

On Aug. 17, shares of Ferro traded around $20.14 for a market cap of $1.67 billion. According to the GuruFocus Value chart, the stock is modestly overvalued.

The company has a financial strength rating of 5 out of 10 and a profitability rating of 6 out of 10. While the cash-debt ratio of 0.39 is lower than 67% of industry peers, the Piotroski F-Score of 6 out of 9 is typical of a financially stable company. The ROIC has typically been lower than the WACC in the past, but it has surpassed the WACC in the most recent two quarters, indicating a turn to profitability.

Magnolia Oil & Gas

The firm sold out of its 1,994,548-share stake in Magnolia Oil & Gas (MGY, Financial), which had a -1.43% impact on the equity portfolio. Shares traded for an average price of $12.82 during the quarter.

Magnolia Oil & Gas is a Houston, Texas-based explorer and producer of oil and natural gas. It operates primarily in South Texas in the core of the Eagle Ford Shale and Austin Chalk formations.

On Aug. 17, shares of Magnolia Oil & Gas traded around $13.90 for a market cap of $3.28 billion. According to the GF Value chart, the stock is modestly overvalued.

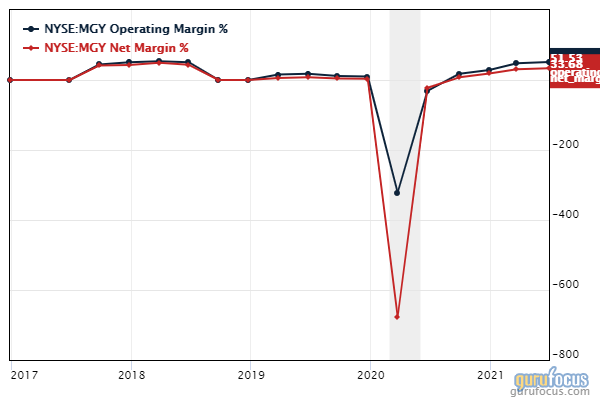

The company has a financial strength rating of 5 out of 10 and a profitability rating of 4 out of 10. The interest coverage ratio of 9.56 is higher than 62% of industry peers, while the Piotroski F-Score of 7 out of 9 indicates a very healthy financial situation. The operating margin of 51.53% and net margin of 33.68% are outperforming 86% of industry peers.

Portfolio overview

As of the quarter’s end, the firm held shares in 67 stocks valued at a total of $1.78 billion. The turnover rate was 12%.

The top holdings were Alphabet Inc. (GOOGL, Financial) with 8.23% of the equity portfolio, Mr. Cooper Group Inc. (COOP, Financial) with 7.89% and Athene Holding Ltd. (ATH, Financial) with 6.58%. In terms of sector weighting, the firm was most invested in financial services, technology and energy.