I've remarked how it's quite impressive how this market is holding up in light of a bevy of the momentum stocks (generally 'leadership' stocks) falling to the wayside the past 60 days. Further, many of the 'growthy' type stocks in my watch lists are more or less doing nothing of late - a few days up, a few days down, but mostly churning or slightly upwards after the big run in October. Wednesday of last week, these stocks were getting hammered much harder than the general market - a lot took 6 to 8% hits.

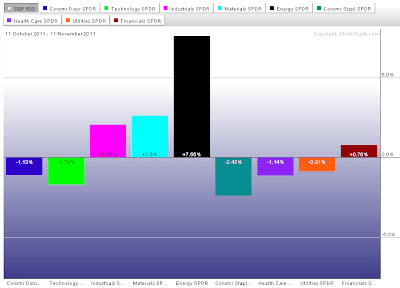

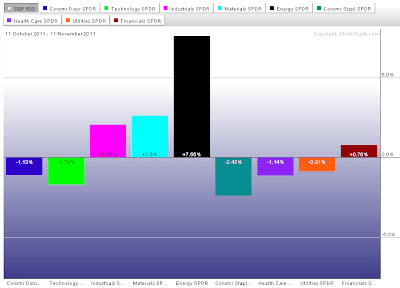

Hence I thought it would be interesting to take a look at the SPDR ETFs to see what has been acting well over the past month. This clearly displays where the money has been flowing - energy stocks. Further note, of the 9 broad sectors, 5 are negative and financials barely positive. It's a narrow market, with many rallies on light volume to boot - once again confounding old school technicians.

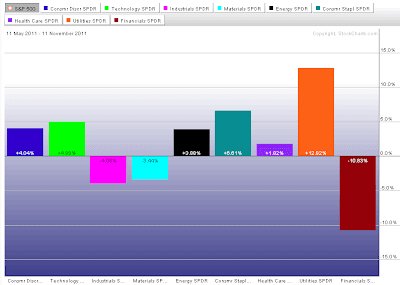

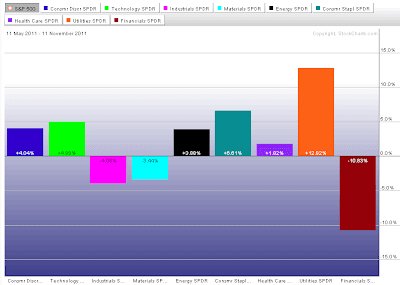

But taking a step back, I have noted Walmart (WMT, Financial) - which is defensive - has been breaking out like an internet stock circa 1999. Further, we are once again seeing the auto retail stocks (Autozone, O'Reilly's, et al) showing a lot of strength of late - this 'do it yourself' strength is again usually a sign of weakness on Main Street. Further as we take a look at what has been the strongest acting over the past 6 months we see utilities leading the tape - another defensive sector.

This indicates a market that can't make up it's mind - and/or a very weird era where we are celebrating strength but going into energy stocks at the same time consumer staples and utilities are being bought.

Hence I thought it would be interesting to take a look at the SPDR ETFs to see what has been acting well over the past month. This clearly displays where the money has been flowing - energy stocks. Further note, of the 9 broad sectors, 5 are negative and financials barely positive. It's a narrow market, with many rallies on light volume to boot - once again confounding old school technicians.

But taking a step back, I have noted Walmart (WMT, Financial) - which is defensive - has been breaking out like an internet stock circa 1999. Further, we are once again seeing the auto retail stocks (Autozone, O'Reilly's, et al) showing a lot of strength of late - this 'do it yourself' strength is again usually a sign of weakness on Main Street. Further as we take a look at what has been the strongest acting over the past 6 months we see utilities leading the tape - another defensive sector.

This indicates a market that can't make up it's mind - and/or a very weird era where we are celebrating strength but going into energy stocks at the same time consumer staples and utilities are being bought.