The SAP deal for SuccessFactors (SFSF, Financial) for $3.4 billion has sparked a frenzy in “cloud” shares today with Salesforce.com (CRM, Financial) up 6%. Let’s put aside that CRM has a $17 billion market cap and is losing money this year and will again next year. Let’s also ignore that a host of competitors are now entering the market full bore (ORCL, SAP, T) and will depress margins and add costs for CRM, further dampening profit potential. If you do not believe me, CRM admits this is their last 10-Q (read it here).

Let’s instead look at what happens when someone makes a bid for CRM:

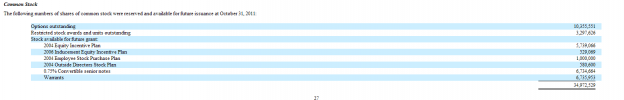

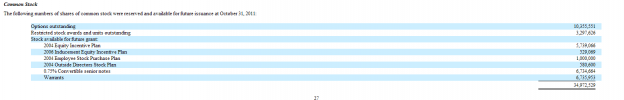

This as of October 31:

We have approximately 13.5 million options/RSUs outstanding and another 20 million just waiting to get thrown out there. Only those already issued (or announced to be issued) would vest.

That means an acquirer would see an additional $1.7 billion in cost added to the transaction assuming they purchased CRM for today’s price. If they paid a 20% premium for the company, that costs rises to $2.1 billion.

We would also have to add the 575,000 shares the company announced for executives for 2012 recently, adding another $88 million to the tally.

Now, all this excludes cash bonuses that would have to be paid out ($3.5 million just to the folks listed in the above-linked 8-k.

Now we have to ask who? Oracle (ORCL, Financial)? Why would they when they have spent millions developing their own version and have already made acquisitions in the field? SAP? I think the above deal tells us where they are at. Microsoft (MSFT, Financial)? If they are going after Yahoo (YHOO, Financial) one has to discount them as a contender.

I just don’t see a scenario in which one of the few contenders ponies up approximately $22 billion (figure 20% premium to today’s price) for a company with negative operating earnings. Think about it. MSFT is being lambasted in the media for toying with making an offer for YHOO. This is a YHOO who will at least have approximately $750 million in TTM operating income. For that $750 million in operating they are rumored to be paying approximately $25 billion. Are they really then going to turn around and pay another approximately $22 billion or so for a company that is losing money?

Again, just because it doesn’t make sense doesn’t mean it won’t happen. I jot this down simply to take a closer look at the possibility than it seems those who are bidding up CRM’s stock price today have done. Paying $3.4 billion for a SuccessFactors is a heck of a lot different that paying $22 billion for CRM. That price tag dramatically shrinks the possible field and has to raise the question, “Why would those who could buy it want to buy it?” Especially at that price. Every one of the possible candidate have spent or are spending millions developing their own cloud products. Now, shrink that price tag 50% and you may suitors lining up. But until then — I doubt it.

Let’s instead look at what happens when someone makes a bid for CRM:

12. CHANGE IN CONTROL.So, what does it all mean? Essentially all outstanding stock awards vest immediately and become payable in either cash or an equal dollar amount of the acquirer's stock. Either way, it is an additional cost. Let’s take a stab at figuring what that would be.

12.1 Definitions.

(a) An “Ownership Change Event” shall be deemed to have occurred if any of the following occurs with respect to the Company: (i) the direct or indirect sale or exchange in a single or series of related transactions by the stockholders of the Company of more than fifty percent (50%) of the voting stock of the Company; (ii) a merger or consolidation in which the Company is a party; (iii) the sale, exchange, or transfer of all or substantially all of the assets of the Company (other than a sale, exchange or transfer to one or more subsidiaries of the Company); or (iv) a liquidation or dissolution of the Company.

(b) A “Change in Control” shall mean an Ownership Change Event or series of related Ownership Change Events (collectively, a “Transaction”) in which the stockholders of the Company immediately before the Transaction do not retain immediately after the Transaction, in substantially the same proportions as their ownership of shares of the Company’s voting stock immediately before the Transaction, direct or indirect beneficial ownership of more than fifty percent (50%) of the total combined voting power of the outstanding voting securities of the Company or, in the case of an Ownership Change Event described in Section 12.1(a)(iii), the entity to which the assets of the Company were transferred (the “Transferee”), as the case may be. For purposes of the preceding sentence, indirect beneficial ownership shall include, without limitation, an interest resulting from ownership of the voting securities of one or more corporations or other business entities which own the Company or the Transferee, as the case may be, either directly or through one or more subsidiary corporations or other business entities. The Committee shall have the right to determine whether multiple sales or exchanges of the voting securities of the Company or multiple Ownership Change Events are related, and its determination shall be final, binding and conclusive.

12.2 Effect of Change in Control on Options and SARs.

(a) Accelerated Vesting. Notwithstanding any other provision of the Plan to the contrary, the Committee, in its sole discretion, may provide in any Award Agreement or, in the event of a Change in Control, may take such actions as it deems appropriate to provide for the acceleration of the exercisability and vesting in connection with such Change in Control of any or all outstanding Options and SARs and shares acquired upon the exercise of such Options and SARs upon such conditions and to such extent as the Committee shall determine.

(b) Assumption or Substitution. In the event of a Change in Control, the surviving, continuing, successor, or purchasing entity or parent thereof, as the case may be (the “Acquiror”), may, without the consent of any Participant, either assume the Company’s rights and obligations under outstanding Options and SARs or substitute for outstanding Options and SARs substantially equivalent options and SARs (as the case may be) for the Acquiror’s stock. Any Options or SARs which are not assumed by the Acquiror in connection with the Change in Control nor exercised as of the time of consummation of the Change in Control shall terminate and cease to be outstanding effective as of the time of consummation of the Change in Control.

(c) Cash-Out of Options. The Committee may, in its sole discretion and without the consent of any Participant, determine that, upon the occurrence of a Change in Control, each or any Option or SAR outstanding immediately prior to the Change in Control shall be canceled in exchange for a payment with respect to each vested share of Stock subject to such canceled Option or SAR in (i) cash; (ii) stock of the Company or of a corporation or other business entity a party to the Change in Control; or (iii) other property which, in any such case, shall be in an amount having a Fair Market Value equal to the excess of the Fair Market Value of the consideration to be paid per share of Stock in the Change in Control over the exercise price per share under such Option or SAR (the “Spread”). In the event such determination is made by the Committee, the Spread (reduced by applicable withholding taxes, if any) shall be paid to Participants in respect of their canceled Options and SARs as soon as practicable following the date of the Change in Control.

12.3 Effect of Change in Control on Restricted Stock Awards. The Committee may, in its discretion, provide in any Award Agreement evidencing a Restricted Stock Award that, in the event of a Change in Control, the lapsing of the Restriction Period applicable to the shares subject to the Restricted Stock Award held by a Participant whose Service has not terminated prior to the Change in Control shall be accelerated effective immediately prior to the consummation of the Change in Control to such extent as specified in such Award Agreement. Any acceleration of the lapsing of the Restriction Period that was permissible solely by reason of this Section 12.3 and the provisions of such Award Agreement shall be conditioned upon the consummation of the Change in Control.

12.4 Effect of Change in Control on Performance Awards. The Committee may, in its discretion, provide in any Award Agreement evidencing a Performance Award that, in the event of a Change in Control, the Performance Award held by a Participant whose Service has not terminated prior to the Change in Control shall become payable effective as of the date of the Change in Control to such extent as specified in such Award Agreement.

12.5 Effect of Change in Control on Restricted Stock Unit Awards. The Committee may, in its discretion, provide in any Award Agreement evidencing a Restricted Stock Unit Award that, in the event of a Change in Control, the Restricted Stock Unit Award held by a Participant whose Service has not terminated prior to such date shall be settled effective as of the date of the Change in Control to such extent as specified in such Award Agreement.

This as of October 31:

We have approximately 13.5 million options/RSUs outstanding and another 20 million just waiting to get thrown out there. Only those already issued (or announced to be issued) would vest.

That means an acquirer would see an additional $1.7 billion in cost added to the transaction assuming they purchased CRM for today’s price. If they paid a 20% premium for the company, that costs rises to $2.1 billion.

We would also have to add the 575,000 shares the company announced for executives for 2012 recently, adding another $88 million to the tally.

Now, all this excludes cash bonuses that would have to be paid out ($3.5 million just to the folks listed in the above-linked 8-k.

Now we have to ask who? Oracle (ORCL, Financial)? Why would they when they have spent millions developing their own version and have already made acquisitions in the field? SAP? I think the above deal tells us where they are at. Microsoft (MSFT, Financial)? If they are going after Yahoo (YHOO, Financial) one has to discount them as a contender.

I just don’t see a scenario in which one of the few contenders ponies up approximately $22 billion (figure 20% premium to today’s price) for a company with negative operating earnings. Think about it. MSFT is being lambasted in the media for toying with making an offer for YHOO. This is a YHOO who will at least have approximately $750 million in TTM operating income. For that $750 million in operating they are rumored to be paying approximately $25 billion. Are they really then going to turn around and pay another approximately $22 billion or so for a company that is losing money?

Again, just because it doesn’t make sense doesn’t mean it won’t happen. I jot this down simply to take a closer look at the possibility than it seems those who are bidding up CRM’s stock price today have done. Paying $3.4 billion for a SuccessFactors is a heck of a lot different that paying $22 billion for CRM. That price tag dramatically shrinks the possible field and has to raise the question, “Why would those who could buy it want to buy it?” Especially at that price. Every one of the possible candidate have spent or are spending millions developing their own cloud products. Now, shrink that price tag 50% and you may suitors lining up. But until then — I doubt it.