Mobile TeleSystems (MBT, Financial) is the largest cellular network operator in Eastern Europe, with 50 million subscribers. The company has licenses in 87 Russian regions, Ukraine, Belarus, Uzbekistan and Turkmenistan, covering a population of more than 233 million. The firm boasts a total subscriber base of more than 100 million.

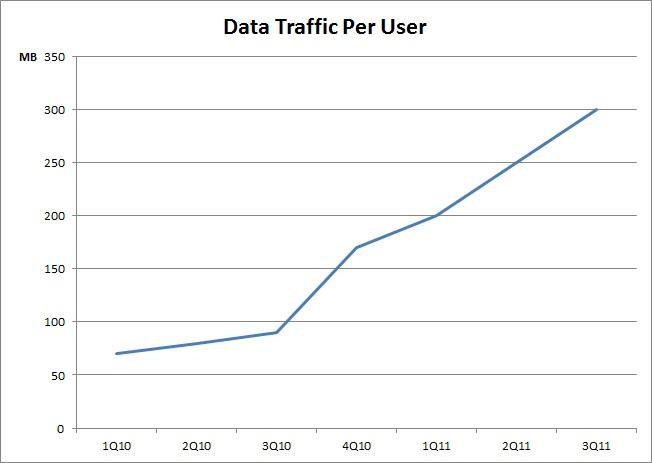

The Russian consumer has increased spending on wireless services, raising the average revenue per user (ARPU) for Russian cellular network operators. The introduction of third generation (3G) services in Russia has also significantly raised demand for Mobile TeleSystems’ data services and value-added services.

The company expects this trend to continue; minutes of usage (MoU) have climbed above 300 per user, compared with 165 MoU per user in 2007.

Russian telecom companies should be able to achieve their forecast growth targets considering that MoU in Russia remains lower than it is in other emerging markets. Unlike many emerging markets, however, Russia’s mobile penetration rate is relatively high, and consequently Russian carriers are focused on retaining subscribers and boosting network usage.

The company’s latest quarterly results were solid, indicating that Mobile TeleSystems remains the leader in the Russian mobile market. Revenue increased by close to 11 percent year over year mainly due to strong growth in voice and data services. Sales of new handsets and modems were also strong. Monthly ARPU increased by 7 percent on a yearly basis to more than USD9.

The company grew faster than its competitors in the wireless data segment, which remains the fastest-growing segment in the market. The capital expenditure-to-sales ratio remains relatively low, making future growth even more reliable.

The company has been executing on its strategy to transform itself from a pure mobile services provider to an integrated telecommunications carrier. Mobile TeleSystems in April completed its acquisition of Comstar, a leading fixed-broadband operator in Moscow and other Russian regions. Mobile TeleSystems also recently finalized the acquisition of MGTS, the Moscow-city fixed-line incumbent operator.

Mobile TeleSystems’ revenue should continue to grow strongly at about 8 percent per year, driven by increasing Internet and smart phone penetration in the regions in which it operates. The company saw revenue from data services jump 50 percent in the third quarter, continuing a year-long trend of rapid growth for this business segment. For these reasons, Mobile TeleSystems remains a good growth stock play.

Source: Mobile TeleSystems

Source: Mobile TeleSystems

Mobile TeleSystems isn’t the first stock that investors should purchase when building a diversified portfolio of overseas stocks. However, I believe that it currently trades at a compelling valuation. What’s more, the company’s dividend yield of 7 percent is sustainable given its strong growth potential.

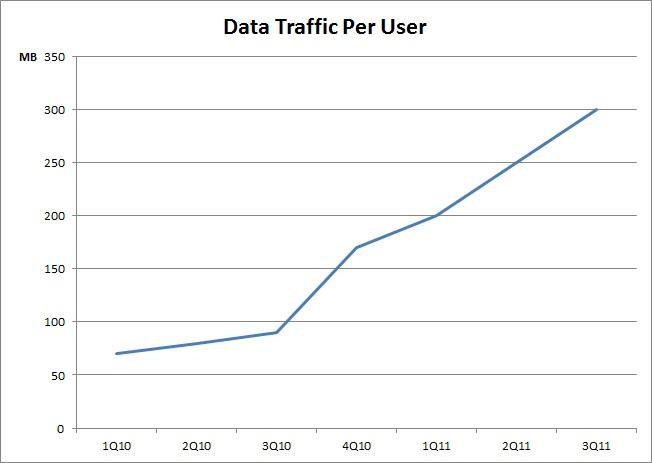

The Russian consumer has increased spending on wireless services, raising the average revenue per user (ARPU) for Russian cellular network operators. The introduction of third generation (3G) services in Russia has also significantly raised demand for Mobile TeleSystems’ data services and value-added services.

The company expects this trend to continue; minutes of usage (MoU) have climbed above 300 per user, compared with 165 MoU per user in 2007.

Russian telecom companies should be able to achieve their forecast growth targets considering that MoU in Russia remains lower than it is in other emerging markets. Unlike many emerging markets, however, Russia’s mobile penetration rate is relatively high, and consequently Russian carriers are focused on retaining subscribers and boosting network usage.

The company’s latest quarterly results were solid, indicating that Mobile TeleSystems remains the leader in the Russian mobile market. Revenue increased by close to 11 percent year over year mainly due to strong growth in voice and data services. Sales of new handsets and modems were also strong. Monthly ARPU increased by 7 percent on a yearly basis to more than USD9.

The company grew faster than its competitors in the wireless data segment, which remains the fastest-growing segment in the market. The capital expenditure-to-sales ratio remains relatively low, making future growth even more reliable.

The company has been executing on its strategy to transform itself from a pure mobile services provider to an integrated telecommunications carrier. Mobile TeleSystems in April completed its acquisition of Comstar, a leading fixed-broadband operator in Moscow and other Russian regions. Mobile TeleSystems also recently finalized the acquisition of MGTS, the Moscow-city fixed-line incumbent operator.

Mobile TeleSystems’ revenue should continue to grow strongly at about 8 percent per year, driven by increasing Internet and smart phone penetration in the regions in which it operates. The company saw revenue from data services jump 50 percent in the third quarter, continuing a year-long trend of rapid growth for this business segment. For these reasons, Mobile TeleSystems remains a good growth stock play.

Source: Mobile TeleSystems

Source: Mobile TeleSystemsMobile TeleSystems isn’t the first stock that investors should purchase when building a diversified portfolio of overseas stocks. However, I believe that it currently trades at a compelling valuation. What’s more, the company’s dividend yield of 7 percent is sustainable given its strong growth potential.