Costco Wholesale (COST, Financial) is a large membership warehouse retailer that sells a variety of bulk goods in several countries.

-Seven year average revenue growth: 9%

-Seven year average EPS growth: 8.6%

-Dividend Yield: 1.18%

-Dividend Growth Rate: 13%

Overall, I think Costco is a fantastic company, but at the current time, it’s fully valued with little or no margin of safety, and doesn’t offer a very appealing dividend yield.

With over 160,000 employees, Costco operates 598 warehouses. Of these, 433 are in the US and Puerto Rico, 82 are in Canada, 32 are in Mexico, 22 are in the UK, 11 are in Japan, 8 are in Taiwan, 7 are in Korea, and 3 are in Australia. In addition, Costco operates its large online retail site.

Sundries (cleaning supplies, tobacco, alcohol, candy, snacks, etc.) accounted for 22% of 2011 sales.

Hardlines (electronics, hardware, office supplies, beauty supplies, furniture, garden, etc.) accounted for 17% of sales.

Food accounted for 21% of sales.

Softlines (clothing, housewares, small appliances, jewelry, etc.) accounted for 10% of sales.

Fresh food accounted for 12% of sales.

Ancillary and other (gas, pharmacy, food court, optical, etc.) accounted for 18% of sales. (This is their fastest growing segment, as they put more of these areas in newer Costcos.)

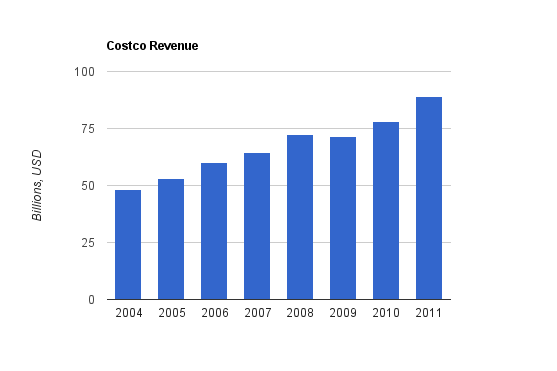

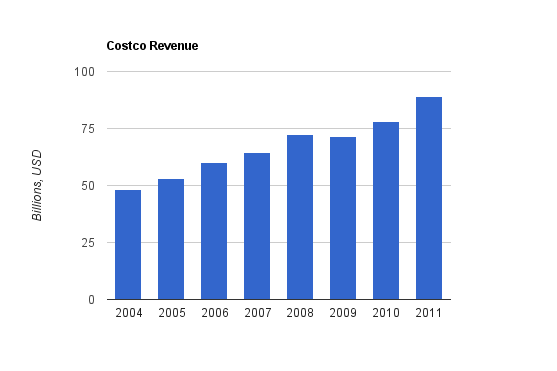

Over this period, revenue growth has averaged over 9% per year on average, which is excellent. The trailing twelve month period boasts over $91 billion in revenue.

Earnings growth has averaged 8.6% over this period, which is reasonable. It’s fairly unusual for a company to have faster revenue growth than EPS growth over this long of a period.

Over this period, operating cash flow grew by 6.2% annually, and free cash flow grew by 4.6% annually. These numbers where somewhat erratic; especially FCF which had a high year in 2004 which lowers the annualized growth calculation over the period. If FCF growth was calculated between 2005 and 2011 instead, the growth rate would have been nearly 16%. The “real” FCF growth rate lies between these numbers.

Price to Free Cash Flow: 20

Price to Book: 3

Return on Equity: 12.5%

Costco began paying a dividend part of the way through 2004. Between 2005 and 2011, Costco grew the dividend by an average rate of nearly 13%.

Share Repurchases

In addition to returning value to shareholders in the form of dividends, Costco repurchases some of its shares. For example, in 2011, Costco spent $398 million on dividends to shareholders, but spent $624 million on net share repurchases. The same can be said for most recent years: Costco spent more on share repurchases than dividends every year from 2005 onwards, with the single exception of 2009. Of course, 2009 was the absolute best time to buy Costco stock, but that’s the year that Costco was pinching pennies instead of buying its stock as it was every other year. They bought stock high, but wouldn’t buy stock low, and this example perfectly highlights a primary critique of share repurchases among dividend investors.

Share repurchases make good supplementary purchases, but in my opinion, dividends should usually be the primary form of shareholder returns, especially for a stable business like Costco. Energy companies and tech companies at least have the viable excuse of being in cyclical industries, and so they have to keep payout ratios low. But with so much free cash flow generation, Costco could easily shift more towards dividends and less towards repurchases.

Costco’s memberships keep customers loyal, and they have a high renewal rate. Costco can keep its prices reasonably competitive with Wal-Mart by maintaining such a low profit margin. The company gets most of its profit from membership fees (which they recently successfully increased by 10%), while its goods are sold at very low markups.

Each year in this snapshot, as well as in many previous years, Costco increased their number of warehouses, and saw an increase in both gold star members and business members. As of the most recent report, Coscto now has 598 warehouses. Costco management has the goal of operating 1000 warehouses by the next 10-12 years, and I think that target is a fairly conservative estimate.

In addition, Costco has been reporting consistent same-store sales growth. In general, as a given Costco exists longer, it gets more sales per year. A year or two after opening, an average Costco will bring in approximately $100 million in annual sales. After ten years, that average number is around $150 million. In fact, between 2010 and 2011, the number of Costco locations with over $200 million in sales jumped from 56 to 93. And, 4 of their Costco locations now bring in over $300 million in sales, including their #1 Costco which brings in an enormous $400+ million.

Despite Costco’s mild setback in 2009 due to the recession, Costco became the 3rd largest retailer in the US compared to its spot at 5th in 2008. It is the 9th largest retailer in the world.

Costco reports that its most recent warehouse openings in Japan, Taiwan, and Korea had record-breaking opening-day sales, and that the warehouse they opened in Australia was particularly well-received. The company expects these countries to be great places for continued expansion.

1. FCF is solid. Costco is currently a business that generates more free cash flow than net income. It’s not as highly valued in terms of FCF as it is net income. DCF analysis with an estimated FCF growth rate of 5% going forward, and a 10% discount rate, gives me an intrinsic value of approximately $32 billion, compared to the current market cap of over $35 billion. Therefore, if the valuation were to decrease by 10%, I’d consider Costco fairly valued. If a lower discount rate is used, Costco is reasonably valued as-is, although without a margin of safety.

2. Revenue growth is outstanding. Most large businesses aren’t growing revenue at nearly the pace of Costco. Costco’s number of stores is growing, their number of members is growing, and they recently boosted membership fees by 10%, and it was well-accepted.

3. Low profit margins can mean eventual upside. Costco is currently sacrificing profitability for solid ethics and outstanding growth. Costco is a viable competitor to even Walmart, and yet has only existed since the 1980”²s. The larger the revenue becomes, the more pricing power they have, and the denser their store locations get, the more efficient they become. I believe Costco will eventually reach a tipping point where net profit margins will improve.

1. Costco completely outperforms Walmart’s comparable warehouse business, Sam’s Club. As of 2011, there were 609 Sam’s Clubs compared to 592 Costcos, Costco had 84 million square feet of retail space compared to 81 million for Sam’s Club, and yet Costco’s sales excluding membership fees were approximately $87 billion compared to Sam’s Clubs $49 billion. Costco is growing more quickly than Sam’s Club (the latter only grew the number of locations from 588 to 609 between 2007 and 2011), and at approximately the same size, Costco completely outshines Sam’s Club in terms of sales.

2. Costco’s balance sheet is far less leveraged than Walmart’s. Costco has a total debt/equity ratio of 0.2, interest coverage of 21, and practically no goodwill, compared to Walmart’s total debt/equity ratio of over 0.8, interest coverage ratio of 11, and goodwill of over $20 billion. They’re both fine balance sheets, but Costco could safely take on more leverage than Walmart currently can, since Walmart is already using more leverage. So far, Costco hasn’t needed much leverage to grow very quickly.

3. Costco has had consistent expansion internationally, and it’s likely only the tip of the iceberg. Their Canadian segment is strong, and their Australian presence recently began in 2009 and has had very good success so far. I expect that to be a very good long term opportunity for them. Both companies have solid international prospects, but Walmart is rather saturated in the US, and has had mixed success internationally, and relies partially on acquisitions for international growth, while Costco has grown organically and is far less saturated.

4. Walmart’s net profit margin is comfortably over 3% and I doubt it’ll go much higher (and may go lower), while Costco’s net profit margin is considerably below 2%. With even modest improvements in profit margin over time, I expect Costco’s EPS and FCF to eventually outpace sales growth.

5. Walmart trades at a lower P/E ratio, but a comparable P/FCF ratio, to Costco. Walmart has a larger dividend yield, and a longer dividend history.

I’m not rocking Walmart here; I even picked them for the Dividend Growth Index (before they jumped to $60/share). But the comparison, in my opinion, really helps to highlight Costco’s strengths.

One, they have focused on having a rather small number of products, meaning they can divide their total purchasing power among fewer products, and therefore increase their purchasing power with those businesses. That’s a wise way to compete when you’re the smaller competitor. Offer fewer products, but offer them at unbeatable prices.

Two, they have maximized efficiency, and they have paid highly for employees to reduce turnover and build morale, and have therefore achieved superior sales per square foot.

Three, they have sacrificed net profit margins in order to compete on pricing power, and therefore have grown revenue at a very strong rate, which will pay literal and figurative dividends over time as they become a larger and larger rival.

Costco’s P/E of 24 and P/FCF of 20 represents a lot of justified optimism. When everyone knows an investment is going to work out; it’s generally too late to get great returns. There is a lot of expectation built into the price, so any long-term disappointment, or any major error in an investment thesis such as this one, can mean sub-par returns.

Excellent companies are worth paying up for, but there’s a limit, and currently Costco’s price is a bit more than I’d be willing to pay. If Costco stock were to drop back to the low $70s, I’d be interested in the stock even though it would still be a bit pricier than most of my portfolio holdings.

Full Disclosure: At the time of this writing, I have no position in COST.

-Seven year average revenue growth: 9%

-Seven year average EPS growth: 8.6%

-Dividend Yield: 1.18%

-Dividend Growth Rate: 13%

Overall, I think Costco is a fantastic company, but at the current time, it’s fully valued with little or no margin of safety, and doesn’t offer a very appealing dividend yield.

Overview

Founded in 1983, Costco Wholesale (NASDAQ: COST) is a large warehouse-based retailer, primarily located throughout North America but with a presence in Europe and Asia as well.With over 160,000 employees, Costco operates 598 warehouses. Of these, 433 are in the US and Puerto Rico, 82 are in Canada, 32 are in Mexico, 22 are in the UK, 11 are in Japan, 8 are in Taiwan, 7 are in Korea, and 3 are in Australia. In addition, Costco operates its large online retail site.

Category Sales

Costco warehouses offer various items, clothes, food, electronics, glasses, pharmacy drugs, gasoline, car-washes, and more. There are bulk items for cheap shopping, but there are select higher-end items.Sundries (cleaning supplies, tobacco, alcohol, candy, snacks, etc.) accounted for 22% of 2011 sales.

Hardlines (electronics, hardware, office supplies, beauty supplies, furniture, garden, etc.) accounted for 17% of sales.

Food accounted for 21% of sales.

Softlines (clothing, housewares, small appliances, jewelry, etc.) accounted for 10% of sales.

Fresh food accounted for 12% of sales.

Ancillary and other (gas, pharmacy, food court, optical, etc.) accounted for 18% of sales. (This is their fastest growing segment, as they put more of these areas in newer Costcos.)

Revenue, Earnings, Cash Flow, and Margin

Costco has been growing revenue at an impressive rate, while earnings and cash flow have grown more slowly.Revenue Growth

| Year | Revenue |

|---|---|

| 2011 | $88.9 billion |

| 2010 | $77.9 billion |

| 2009 | $71.4 billion |

| 2008 | $72.5 billion |

| 2007 | $64.4 billion |

| 2006 | $60.1 billion |

| 2005 | $52.9 billion |

| 2004 | $48.1 billion |

Earnings Growth

| Year | EPS |

|---|---|

| 2011 | $3.30 |

| 2010 | $2.92 |

| 2009 | $2.47 |

| 2008 | $2.89 |

| 2007 | $2.37 |

| 2006 | $2.30 |

| 2005 | $2.18 |

| 2004 | $1.85 |

Cash Flow Growth

| Year | Operating Cash Flow | Free Cash Flow |

|---|---|---|

| 2011 | $3.20 billion | $1.91 billion |

| 2010 | $2.78 billion | $1.73 billion |

| 2009 | $2.09 billion | $0.84 billion |

| 2008 | $2.18 billion | $0.58 billion |

| 2007 | $2.08 billion | $0.69 billion |

| 2006 | $1.83 billion | $0.62 billion |

| 2005 | $1.78 billion | $0.79 billion |

| 2004 | $2.10 billion | $1.39 billion |

Metrics

Price to Earnings: 24Price to Free Cash Flow: 20

Price to Book: 3

Return on Equity: 12.5%

Dividends

Costco currently has a 1.18% dividend yield with a payout ratio of slightly under 30%. The yield is fairly low despite the reasonable payout ratio because the company has a high P/E.Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $0.925 |

| 2010 | $0.795 |

| 2009 | $0.70 |

| 2008 | $0.625 |

| 2007 | $0.565 |

| 2006 | $0.505 |

| 2005 | $0.445 |

| 2004 | $0.30 |

Share Repurchases

In addition to returning value to shareholders in the form of dividends, Costco repurchases some of its shares. For example, in 2011, Costco spent $398 million on dividends to shareholders, but spent $624 million on net share repurchases. The same can be said for most recent years: Costco spent more on share repurchases than dividends every year from 2005 onwards, with the single exception of 2009. Of course, 2009 was the absolute best time to buy Costco stock, but that’s the year that Costco was pinching pennies instead of buying its stock as it was every other year. They bought stock high, but wouldn’t buy stock low, and this example perfectly highlights a primary critique of share repurchases among dividend investors.

Share repurchases make good supplementary purchases, but in my opinion, dividends should usually be the primary form of shareholder returns, especially for a stable business like Costco. Energy companies and tech companies at least have the viable excuse of being in cyclical industries, and so they have to keep payout ratios low. But with so much free cash flow generation, Costco could easily shift more towards dividends and less towards repurchases.

Balance Sheet

Costco has a total debt/equity ratio of under 0.20, and the interest ratio is over 20. The total debt load is only 1.5x annual net income. Since Costco doesn’t rely on acquisitions, goodwill is negligible. Overall, by every metric, Costco has an excellent balance sheet.Investment Thesis

Costco’s business model is meant to maximize efficiency. The warehouse format keeps costs low, as they buy and sell items in bulk. Shoppers (both consumers and small business owners) pay membership fees, and in return receive exceptionally low prices. The warehouse model also generally operates moderately reduced hours compared to typical retailers. Although Costco offers a large range of products, they limit their selections in each category to only the best-selling ones, so the number of individual products is actually lower than many other retailers. This further streamlines their business.Costco’s memberships keep customers loyal, and they have a high renewal rate. Costco can keep its prices reasonably competitive with Wal-Mart by maintaining such a low profit margin. The company gets most of its profit from membership fees (which they recently successfully increased by 10%), while its goods are sold at very low markups.

Growth

| Year | Warehouses | Gold Star Members | Business Members |

|---|---|---|---|

| 2011 | 592 | 25.028 million | 6.352 million |

| 2010 | 540 | 22.539 million | 5.789 million |

| 2009 | 527 | 21.445 million | 5.719 million |

| 2008 | 512 | 20.181 million | 5.594 million |

| 2007 | 488 | 18.619 million | 5.401 million |

In addition, Costco has been reporting consistent same-store sales growth. In general, as a given Costco exists longer, it gets more sales per year. A year or two after opening, an average Costco will bring in approximately $100 million in annual sales. After ten years, that average number is around $150 million. In fact, between 2010 and 2011, the number of Costco locations with over $200 million in sales jumped from 56 to 93. And, 4 of their Costco locations now bring in over $300 million in sales, including their #1 Costco which brings in an enormous $400+ million.

Despite Costco’s mild setback in 2009 due to the recession, Costco became the 3rd largest retailer in the US compared to its spot at 5th in 2008. It is the 9th largest retailer in the world.

Costco reports that its most recent warehouse openings in Japan, Taiwan, and Korea had record-breaking opening-day sales, and that the warehouse they opened in Australia was particularly well-received. The company expects these countries to be great places for continued expansion.

The Three Point Case for Bullishness

There are a few key things I want to highlight that, in my view, makes Costco not (quite) as overvalued as it seems.1. FCF is solid. Costco is currently a business that generates more free cash flow than net income. It’s not as highly valued in terms of FCF as it is net income. DCF analysis with an estimated FCF growth rate of 5% going forward, and a 10% discount rate, gives me an intrinsic value of approximately $32 billion, compared to the current market cap of over $35 billion. Therefore, if the valuation were to decrease by 10%, I’d consider Costco fairly valued. If a lower discount rate is used, Costco is reasonably valued as-is, although without a margin of safety.

2. Revenue growth is outstanding. Most large businesses aren’t growing revenue at nearly the pace of Costco. Costco’s number of stores is growing, their number of members is growing, and they recently boosted membership fees by 10%, and it was well-accepted.

3. Low profit margins can mean eventual upside. Costco is currently sacrificing profitability for solid ethics and outstanding growth. Costco is a viable competitor to even Walmart, and yet has only existed since the 1980”²s. The larger the revenue becomes, the more pricing power they have, and the denser their store locations get, the more efficient they become. I believe Costco will eventually reach a tipping point where net profit margins will improve.

Costco Vs. Walmart

From an investor standpoint, I liked Walmart (WMT, Financial) stock better than Costco stock (despite liking Costco better than Walmart as a business) until the recent 20% increase in Walmart stock from around $50/share to over $60/share. This pushed Walmart’s valuation from undervalued to fairly valued, in my view. Therefore, if I absolutely had to buy one or the other, I’d be buying Costco, and here’s why:1. Costco completely outperforms Walmart’s comparable warehouse business, Sam’s Club. As of 2011, there were 609 Sam’s Clubs compared to 592 Costcos, Costco had 84 million square feet of retail space compared to 81 million for Sam’s Club, and yet Costco’s sales excluding membership fees were approximately $87 billion compared to Sam’s Clubs $49 billion. Costco is growing more quickly than Sam’s Club (the latter only grew the number of locations from 588 to 609 between 2007 and 2011), and at approximately the same size, Costco completely outshines Sam’s Club in terms of sales.

2. Costco’s balance sheet is far less leveraged than Walmart’s. Costco has a total debt/equity ratio of 0.2, interest coverage of 21, and practically no goodwill, compared to Walmart’s total debt/equity ratio of over 0.8, interest coverage ratio of 11, and goodwill of over $20 billion. They’re both fine balance sheets, but Costco could safely take on more leverage than Walmart currently can, since Walmart is already using more leverage. So far, Costco hasn’t needed much leverage to grow very quickly.

3. Costco has had consistent expansion internationally, and it’s likely only the tip of the iceberg. Their Canadian segment is strong, and their Australian presence recently began in 2009 and has had very good success so far. I expect that to be a very good long term opportunity for them. Both companies have solid international prospects, but Walmart is rather saturated in the US, and has had mixed success internationally, and relies partially on acquisitions for international growth, while Costco has grown organically and is far less saturated.

4. Walmart’s net profit margin is comfortably over 3% and I doubt it’ll go much higher (and may go lower), while Costco’s net profit margin is considerably below 2%. With even modest improvements in profit margin over time, I expect Costco’s EPS and FCF to eventually outpace sales growth.

5. Walmart trades at a lower P/E ratio, but a comparable P/FCF ratio, to Costco. Walmart has a larger dividend yield, and a longer dividend history.

I’m not rocking Walmart here; I even picked them for the Dividend Growth Index (before they jumped to $60/share). But the comparison, in my opinion, really helps to highlight Costco’s strengths.

Wrapping Up the Thesis

Overall, my opinion is that Costco has a great business model and is positioned to grow its business for the foreseeable future. Costco is one of my favorite examples of a moat-breaker. Walmart has the quintessential moat of scale; they have such massive purchasing power that translates into pricing power, that they can underprice their competition and attract more customers, in a viciously successful circle. To combat that, Costco has done three main things.One, they have focused on having a rather small number of products, meaning they can divide their total purchasing power among fewer products, and therefore increase their purchasing power with those businesses. That’s a wise way to compete when you’re the smaller competitor. Offer fewer products, but offer them at unbeatable prices.

Two, they have maximized efficiency, and they have paid highly for employees to reduce turnover and build morale, and have therefore achieved superior sales per square foot.

Three, they have sacrificed net profit margins in order to compete on pricing power, and therefore have grown revenue at a very strong rate, which will pay literal and figurative dividends over time as they become a larger and larger rival.

Risks

Costco, like any other company, has risk. As a retailer, Costco is a middle-man, with limited pricing power, and the retail industry is incredibly competitive. Costco faces competition from warehouses like BJ’s and Sam’s Club (owned by Wal-Mart), general retailers like Wal-Mart, Target, and Kohls, as well as from other threats like Amazon. In addition, since the stock has a fairly high valuation, there is considerable risk of poor stock performance if Costco doesn’t continue to outperform as a company. One of Costco’s strengths is its free cash flow, which can be highly variable, and may decrease if the management team spends more. In addition, Costco’s CEO Jim Sinegal has retired from his position. The board and management team of Costco is very experienced, and Sinegal will remain on the board of directors for now, but it is still a transition to be aware of.Conclusion and Valuation

Costco is a fantastic company in my view. Their growth is decent (and their revenue growth is excellent), their business model is very strong, and it’s a very well-respected business that is known for its integrity. I’d wager that an investor 20 years from now probably wouldn’t regret purchasing this stock at these prices, even though shares are rather pricey at the moment. That being said, I do think it’s fully valued with little or no margin of safety. I would not be inclined to pay more than around $72 for the stock. Writing long term puts near the current share price may be a reasonable way to enter a position at a lower cost basis.Costco’s P/E of 24 and P/FCF of 20 represents a lot of justified optimism. When everyone knows an investment is going to work out; it’s generally too late to get great returns. There is a lot of expectation built into the price, so any long-term disappointment, or any major error in an investment thesis such as this one, can mean sub-par returns.

Excellent companies are worth paying up for, but there’s a limit, and currently Costco’s price is a bit more than I’d be willing to pay. If Costco stock were to drop back to the low $70s, I’d be interested in the stock even though it would still be a bit pricier than most of my portfolio holdings.

Full Disclosure: At the time of this writing, I have no position in COST.