3M Company (MMM, Financial) is a diverse conglomerate that produces a broad array of products and materials for both consumers and businesses.

-Seven Year Revenue Growth: 5.5%

-Seven Year EPS Growth: 6.6%

-Seven Year Dividend Growth: 6.2%

-Current Dividend Yield: 2.51%

-Balance Sheet Strength: Very Strong

Taking into account 3M’s growth prospects and their strong financial position, but also their acquisition costs, I find that 3M’s current valuation is a little bit high for a value investment. I think a good stock position could be developed if one can get a cost basis of under $75 for shares of 3M. Currently, shares trade for nearly $88.

3M is a particularly international company; even more than most other U.S. blue-chip companies. The company brings in only 35% of sales from the United States. The rest comes from Asia/Pacific (31%), Europe (23%), and Latin America/Canada (11%)

Industrial and Transportation Business

This segment provides adhesives, abrasives, filtration systems, fasteners, and specialty materials to a variety of industries from renewable energy to aerospace. This is the largest segment, accounting for about 32% of sales.

Health Care Business

This segments provides several products in the areas of wound care, oral care, drug delivery systems, and more. This segment accounts for about 17% of sales.

Consumer and Office Business

This segment provides solutions for the home and office, and includes well-known products like Scotch tape. This segment accounts for about 14% of sales.

Displays and Graphics Business

This segment provides display films, reflective materials, projection systems, and the like. This segment accounts for about 14% of sales. This is also the most troubled segment, as 3M expects continued growth from the other segments, but expects this segment to continue shrinking.

Safety, Security, and Protection Services Business

This segment provides several safety products like respiratory protection, eye and ear protection, building safety solutions, and more, and accounts for about 12% of sales.

Electro and Communications Business

This segment provides solutions for electrical and communications industries by means of tapes, splicing, and connectivity. This is the smallest segment, contributing about 11% of sales.

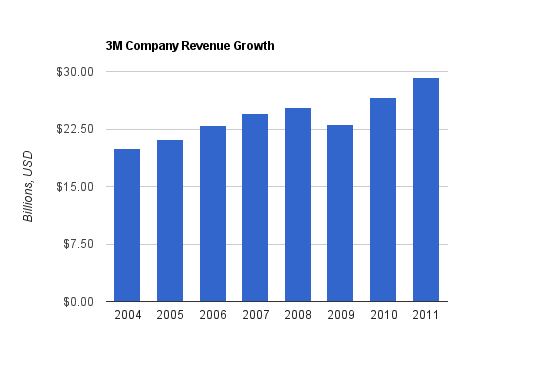

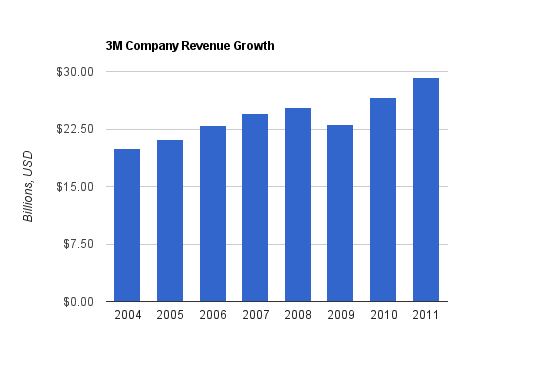

Over this time period, MMM has grown revenue by an annualized rate of 5.5%.

Earnings have been erratic over this period. The annualized EPS growth is calculated to be approximately 6.6%.

Operating cash flow grew by less than 3% annually over this period, and free cash flow grew by less than 2% annually over this period.

Price to Free Cash Flow: 16

Price to Book: 3.9

Return on Equity: 26%

The dividend has grown by 6.2% annually over this period, which is comparable to EPS growth. The dividend growth from 2010 to 2011 was less than 5%. We’ll see how much the dividend grows this year in the first quarter of 2012.

Overall, I think 3M’s dividend is extremely safe, quantitatively speaking. However, the sum of dividend yield and dividend growth is a bit unimpressive, at less than 10.

Because the products are so diverse and so necessary, and the company has built quite the economy of scale, I think 3M has a solid competitive advantage. Unlike many companies, there is no loss of a single industry that could permanently disrupt them, or some new technology that could quickly make them obsolete, or some competitor that could figure out how to do everything 3M does, better.

Some of the key concepts that 3M has been focusing on for growth are:

-Water purification

-Environmental protection, sustainability, renewable energy

-Health care in both developed and developing countries

-Automotive OEM growth

-International/Emerging consumer products

-Increased and sustained unemployment in the developed world

-A long term increase in petty crime resulting from economic problems, and 3M’s corresponding safety, security, and protection businesses

-A trend towards worker protection in emerging markets

-The continued trend toward electronic and software interaction, robotics, communication, and globalization

In 1998, emerging markets contributed 16% to 3M sales. This percentage has approximately doubled as of the current time.

3M is an interesting combination of research and development into new products and an impressive world distribution system. The company regularly spends well over $1 billion per year on research and development. It is a large and stable organization, yet not so big to make significant growth difficult.

Acquisitions have been, and are expected by management to continue to be, an important element of 3M growth. Some recent acquisitions include Arizant (patient and fluid heating), Cogent Systems (biometric identification and mobile scanning systems), Winterthur (abrasives), A-one (labels, Asia market), Attenti (electronic monitoring and GPS tracking hardware/software), and ab (tapes). There is sometimes risk associated with acquisitions, since 3M may have trouble integrating companies or getting good returns from them. (Attenti, for example, has underperformed 3M’s projections). On the other side of the argument, 3M can add its brand to the products of acquired companies to strengthen their market position and pricing, and can potentially obtain synergies or economies of scale.

Discounted cash flow analysis does provide some caution. Using the current free cash flow levels, and assuming conservative growth of 4%, with a discount rate of 11%, I calculate that 3M is approximately fairly valued at the current market capitalization. But if acquisitions are required for the projected levels of growth, then acquisition costs should be deducted from FCF (since if it’s money invested for growth, it’s not really “free”), and this leads to a lower calculated intrinsic value. If, for example, I assume that $1 billion is spent on acquisitions per year going forward, and I increase my expected free cash flow growth to 5%, and use the same 11% discount rate, then I calculate an intrinsic value of closer to $50 billion (rather than the current market cap of over $60 billion). The company predicts 7-8% long term organic revenue growth and 10-12% earnings growth (which combined with a 2-3% dividend yield is rather solid). If those growth targets are reached, then the current valuation looks fair, but without any significant margin of safety.

I think that MMM could make a solid investment if acquired at a cost basis of under $75/share or so. The current price is nearly $88, so it may be prudent to hold a cash position, or to look for other market opportunities.

Full Disclosure: At the time of this writing, I have no position in MMM.

-Seven Year Revenue Growth: 5.5%

-Seven Year EPS Growth: 6.6%

-Seven Year Dividend Growth: 6.2%

-Current Dividend Yield: 2.51%

-Balance Sheet Strength: Very Strong

Taking into account 3M’s growth prospects and their strong financial position, but also their acquisition costs, I find that 3M’s current valuation is a little bit high for a value investment. I think a good stock position could be developed if one can get a cost basis of under $75 for shares of 3M. Currently, shares trade for nearly $88.

Overview

3M Company (NYSE: MMM), once called the Minnesota Mining and Manufacturing Company, was founded in 1902. The company, now with 80,000 employees, produces products like Scotch tape, projector systems, Post-it notes, Tartan track, and Thinsulate. This is a conglomerate that produces products for many industries and for both personal and business use, and their manufacturing, research, and sales offices are all over the world.3M is a particularly international company; even more than most other U.S. blue-chip companies. The company brings in only 35% of sales from the United States. The rest comes from Asia/Pacific (31%), Europe (23%), and Latin America/Canada (11%)

Business Segments

The company is divided into six business segments:Industrial and Transportation Business

This segment provides adhesives, abrasives, filtration systems, fasteners, and specialty materials to a variety of industries from renewable energy to aerospace. This is the largest segment, accounting for about 32% of sales.

Health Care Business

This segments provides several products in the areas of wound care, oral care, drug delivery systems, and more. This segment accounts for about 17% of sales.

Consumer and Office Business

This segment provides solutions for the home and office, and includes well-known products like Scotch tape. This segment accounts for about 14% of sales.

Displays and Graphics Business

This segment provides display films, reflective materials, projection systems, and the like. This segment accounts for about 14% of sales. This is also the most troubled segment, as 3M expects continued growth from the other segments, but expects this segment to continue shrinking.

Safety, Security, and Protection Services Business

This segment provides several safety products like respiratory protection, eye and ear protection, building safety solutions, and more, and accounts for about 12% of sales.

Electro and Communications Business

This segment provides solutions for electrical and communications industries by means of tapes, splicing, and connectivity. This is the smallest segment, contributing about 11% of sales.

Revenue, Earnings, Cash Flow, and Margins

3M has had fairly low growth over this past half-decade. The growth is atypical in part due to the global economic crisis of these past couple years.Revenue Growth

| Year | Revenue |

|---|---|

| TTM | $29.231 billion |

| 2010 | $26.662 billion |

| 2009 | $23.123 billion |

| 2008 | $25.269 billion |

| 2007 | $24.462 billion |

| 2006 | $22.923 billion |

| 2005 | $21.167 billion |

| 2004 | $20.011 billion |

Earnings Growth

| Year | EPS |

|---|---|

| TTM | $5.88 |

| 2010 | $5.63 |

| 2009 | $4.52 |

| 2008 | $4.89 |

| 2007 | $5.60 |

| 2006 | $5.06 |

| 2005 | $4.12 |

| 2004 | $3.75 |

Cash Flow Growth

| Year | Operating Cash Flow | Free Cash Flow |

|---|---|---|

| TTM | $5.177 billion | $3.789 billion |

| 2010 | $5.174 billion | $4.083 billion |

| 2009 | $4.941 billion | $4.038 billion |

| 2008 | $4.533 billion | $3.062 billion |

| 2007 | $4.275 billion | $2.853 billion |

| 2006 | $3.839 billion | $2.671 billion |

| 2005 | $4.258 billion | $3.315 billion |

| 2004 | $4.282 billion | $3.345 billion |

Metrics

Price to Earnings: 14.7Price to Free Cash Flow: 16

Price to Book: 3.9

Return on Equity: 26%

Dividends

The company currently has a dividend yield of 2.51% and has increased its annual dividend every single year for over five consecutive decades. The dividend payout ratio from earnings is currently less than 40%.Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $2.20 |

| 2010 | $2.10 |

| 2009 | $2.04 |

| 2008 | $2.00 |

| 2007 | $1.92 |

| 2006 | $1.84 |

| 2005 | $1.68 |

| 2004 | $1.44 |

Overall, I think 3M’s dividend is extremely safe, quantitatively speaking. However, the sum of dividend yield and dividend growth is a bit unimpressive, at less than 10.

How 3M Spends Its Free Cash

Over the trailing twelve months, 3M spent $1.547 billion on dividends, $2.646 billion on share repurchases (but issued a company record $1.026 billion worth of shares for a total net share repurchase amount of $1.099 billion), and spent $2.313 billion on acquisitions. Overall, from the standpoint of a potential investor, I’m not hugely impressed with this use of money.Balance Sheet

For 3M, the total debt/equity ratio is 0.37, and the interest coverage ratio is over 30. Total debt is only equal to approximately 1.5x annual net income. Goodwill does make up around 40% of shareholder equity, however. Overall, I consider 3M’s balance sheet to be extremely strong.Investment Thesis

3M is a diverse company that provides solutions all over the world. To put it as bluntly as possible, 3M produces the “stuff” that we may take for granted that helps everything else run. They produce the tapes, the materials, the films, and so forth, that allow homes, offices, and equipment to work properly. A lot of people don’t realize how much thought and complexity has to go into things that seem fairly simple, and instead we focus on the final product or the final service. 3M, on the other hand, focuses on the little things in a big way.Because the products are so diverse and so necessary, and the company has built quite the economy of scale, I think 3M has a solid competitive advantage. Unlike many companies, there is no loss of a single industry that could permanently disrupt them, or some new technology that could quickly make them obsolete, or some competitor that could figure out how to do everything 3M does, better.

Some of the key concepts that 3M has been focusing on for growth are:

-Water purification

-Environmental protection, sustainability, renewable energy

-Health care in both developed and developing countries

-Automotive OEM growth

-International/Emerging consumer products

-Increased and sustained unemployment in the developed world

-A long term increase in petty crime resulting from economic problems, and 3M’s corresponding safety, security, and protection businesses

-A trend towards worker protection in emerging markets

-The continued trend toward electronic and software interaction, robotics, communication, and globalization

In 1998, emerging markets contributed 16% to 3M sales. This percentage has approximately doubled as of the current time.

3M is an interesting combination of research and development into new products and an impressive world distribution system. The company regularly spends well over $1 billion per year on research and development. It is a large and stable organization, yet not so big to make significant growth difficult.

Acquisitions have been, and are expected by management to continue to be, an important element of 3M growth. Some recent acquisitions include Arizant (patient and fluid heating), Cogent Systems (biometric identification and mobile scanning systems), Winterthur (abrasives), A-one (labels, Asia market), Attenti (electronic monitoring and GPS tracking hardware/software), and ab (tapes). There is sometimes risk associated with acquisitions, since 3M may have trouble integrating companies or getting good returns from them. (Attenti, for example, has underperformed 3M’s projections). On the other side of the argument, 3M can add its brand to the products of acquired companies to strengthen their market position and pricing, and can potentially obtain synergies or economies of scale.

Risks

Like any company, 3M has risks. As an industrial producer, and specifically a producer primarily of consumables, 3M is very dependent on the health of the global economy. In addition, some of 3M’s businesses become commoditized over time, meaning that their products become rather common and easily replicated by competitors, and so price advantages decline. This has been a problem for their display and graphics segment. The company also faces regulatory risk and currency risk (3M hedges against 50% of currency risk).Conclusion and Valuation

In conclusion, 3M is a diverse company with an excellent dividend history and a reasonable payout. The balance sheet is strong and the valuation is moderate.Discounted cash flow analysis does provide some caution. Using the current free cash flow levels, and assuming conservative growth of 4%, with a discount rate of 11%, I calculate that 3M is approximately fairly valued at the current market capitalization. But if acquisitions are required for the projected levels of growth, then acquisition costs should be deducted from FCF (since if it’s money invested for growth, it’s not really “free”), and this leads to a lower calculated intrinsic value. If, for example, I assume that $1 billion is spent on acquisitions per year going forward, and I increase my expected free cash flow growth to 5%, and use the same 11% discount rate, then I calculate an intrinsic value of closer to $50 billion (rather than the current market cap of over $60 billion). The company predicts 7-8% long term organic revenue growth and 10-12% earnings growth (which combined with a 2-3% dividend yield is rather solid). If those growth targets are reached, then the current valuation looks fair, but without any significant margin of safety.

I think that MMM could make a solid investment if acquired at a cost basis of under $75/share or so. The current price is nearly $88, so it may be prudent to hold a cash position, or to look for other market opportunities.

Full Disclosure: At the time of this writing, I have no position in MMM.