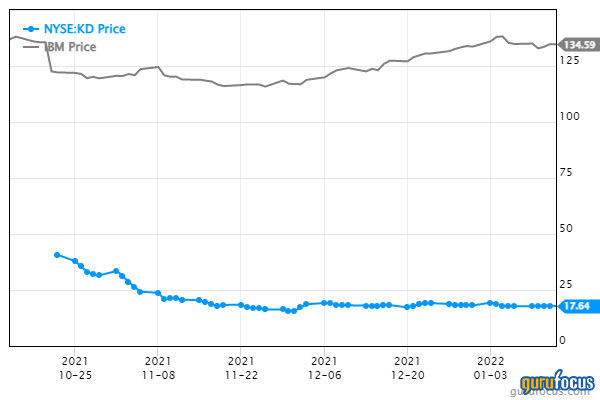

Kyndryl Holdings Inc. (KD, Financial) was spun off of IBM on Oct. 25, 2021. The phrase "spun off" may be too charitable, however, and right word might be "discarded" given the stock has fallen from $40 to below $17 currently.

Kyndryl is a technology and infrastructure services provider, offering advisory, implementation and managed services across a range of technology domains to help customers manage and modernize enterprise IT environments in support of their business and transformation objectives. According to Kyndryl, "We design, build, manage and modernize the mission-critical technology systems that the world depends on every day".

IBM has distributed 80.1% of the total Kendryl stock to IBM shareholders as a tax-free dividend, while still retaining a 19.9% stake. It intends to dispose of the rest in the near future.

| Company Offerings | Competitive Set |

|  |

The company has gotten off to a bad start. IBM was a relatively unattractive stock to begin with and the perception that the company was jettisoning its declining business unit to shareholders is not a great endorsement.

Many shareholders just dumped the stock, creating selling pressure. Disclosures from IBM show that the business has been declining for several years at the rate of about 5% and the business as a standalone entity is unprofitable, though its not clear what is included in previous numbers and what is relevant going forward. Kyndryl's recent quarterly report projects that revenue will continue to decline and the company is expected to be barely profitable in 2021.

However the company does appear to be extraordinarily cheap. The enterprise value is currently indicated to be $4.86 billion and 2021 adjusted Ebitda (from above) is $2.8 billion. This works out to an enterprise value/Ebitda ratio of approximately 1.74. Using GuruFocus's Stock Comparison Table, we can compare it to other peer companies in the managed infrastructure and services business. (Note: EV/Ebitda in the table below is not adjusted).

| Ticker | Company | Market Cap($M) | Enterprise Value ($M) | Revenue($M) | Cash Flow from Operations | PE Ratio | PS Ratio | Price-to-Tangible Book | EV/Ebitda |

| KD | Kyndryl Holdings Inc. | 4,000.83 | 4,858.14 | 14,257 | 628 | At Loss | 0.28 | 0.96 | -8.77 |

| TSE:6702 | Fujitsu Ltd. | 32,238.59 | 30,628.57 | 31,778.83 | 322,987 | 17.87 | 1.03 | 2.75 | 6.96 |

| CTSH | Cognizant Technology Solutions Corp. | 45,442.15 | 45,206.14 | 17,914 | 2,568 | 24.44 | 2.56 | 9.29 | 14.22 |

| XPAR:ATO | Atos SE | 3,970.49 | 6,749.54 | 12,529.12 | 990 | 37.02 | 0.31 | -4.05 | 5.86 |

| DXC | DXC Technology Co. | 8,472.70 | 12,261.82 | 16,841 | 67 | 22.68 | 0.52 | 18.87 | 3.48 |

| UIS | Unisys Corp. | 1,280.93 | 1,290.31 | 2,092 | -290.90 | At Loss | 0.59 | -1.74 | -4.06 |

The balance sheet looks acceptable as well with liabilities and equity showing a decent balance.

Conclusion

Right now, there is too much noise in the numbers due to the separation from IBM. But looking at the competitive set, the company, if managed moderately well, Kyndryl should be able to achieve a net margin of 5% within the next three years. Based off current revenue, and market capitalization, this would translate to a net profit of about $780 million and a projected price-earnings ratio of just over five. Of course, should this occur, it will lead to significant multiple expansion.

| Ticker | Company | Net Margin % |

| KD | Kyndryl Holdings Inc | -12.65 |

| TSE:6702 | Fujitsu Ltd | 5.76 |

| CTSH | Cognizant Technology Solutions Corp | 10.48 |

| XPAR:ATO | Atos SE | 0.84 |

| DXC | DXC Technology Co | 2.32 |

| UIS | Unisys Corp | -23.44 |

Therefore, Kyndryl has multi-bagger potential. This ugly duckling can grow up to be a beautiful swan, but there are significant challenges ahead. It remains to be seen if management is up for the job.