Global Payments Inc. (GPN, Financial) is a payments technology company providing software and services to merchant locations and financial institutions. This stock caught my attention because it is a holding of several of the gurus on GuruFocus, including Bill Nygren (Trades, Portfolio) (though Nygren's position has not yet shown up in his 13F reports - I got this information from his latest shareholder letter). Nygren had the following to say about the company the Oakmark Fund's first-quarter 2022 shareholder letter:

"Global Payments is a leading provider of merchant acquiring services. The company is also one of the largest providers of payment processing and related technology solutions to credit card issuers. We believe Global Payments’ merchant acquiring business is well positioned given its strength in software-driven payments. This is one of the fastest growing parts of the industry as small business customers are increasingly recognizing the efficiency benefits of having payments seamlessly integrated into the software they use to run their businesses. In addition, Global Payments benefits from the broader secular shift away from cash and toward electronic payment methods. Together, these tailwinds have the potential to drive low-double-digit revenue growth and even faster earnings growth. With this strong outlook and with management returning a significant portion of free cash flow to shareholders via repurchase, we think the stock looks attractive at its current valuation of just 12.5x next year’s expected EPS."

In this article, I break down just what it is about Global Payments that I believe makes the stock attractive to so many of the world's top institutional investors.

Segment breakdown

The company operates in three segments: Merchant Solutions, which provides payments technology and software solutions to customers globally; Issuer Solutions, which provides solutions that enable financial institutions and other financial service providers to manage their card portfolios, reduce technical complexity and overhead; and Business and Consumer Solutions, which provides general purpose reloadable prepaid debit and payroll cards, demand deposit accounts and other financial service solutions through its Netspend® brand and other brands.

The following are the details of its segments's revenue and operating income for the most recently reported quarter:

| Revenue | Operating Income | |

| Report Date | 12/31/2021 | 12/31/2021 |

| Currency | USD | USD |

| Scale | Thousands | Thousands |

| Merchant Solutions | 5,665,557 | 1,725,990 |

| Issuer Solutions | 2,065,971 | 301,119 |

| Business & Consumer Solutions | 886,443 | 167,777 |

| Total | 8,617,971 | 2,194,886 |

Revenue grew by 24% per annum over the last three years and operating income grew by 25%. The business and consumer solution's revenue and operating income grew by a spectacular 49% and 66%, respectively, for revenue and operating income.

Global Payments technically operates globally, but most of its revenues are from the Americas:

| Report Date | 12/31/2021 |

| Currency | USD |

| Scale | Thousands |

| Americas | 7,097,925 |

| Europe | 1,180,356 |

| Asia Pacific | 245,481 |

| Total | 8,523,762 |

Valuation

Global Payments is showing up on the GF Value chart as a possible value trap. This warning is triggered because the stock price is too far below its intrinsic value estimate as calculated by the GF Value algorithm. In other words, the stock has a higher chance of being undervalued for good reason.

Looking at the above screenshot from GuruFocus, we see the rather high price-earnings ratio, but the company also has a high business predictability score, which is a positive sign. I like predictable companies because I don't like unpleasant surprises. In the GF Score pentagon, note the high profitability and growth scores but low financial strength, momentum and GF Value scores.

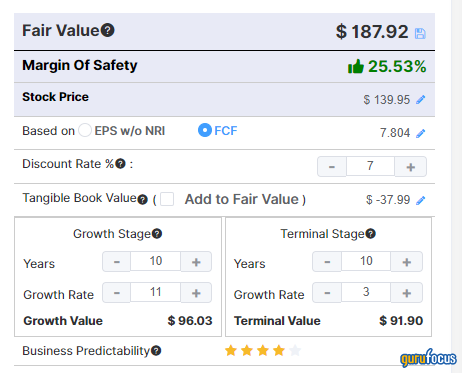

It appears undervalued with a decent margin of safety by my estimate of discounted cash flow (using free cash flow per share rather than earnings). My DCF model is built on the following assumptions:

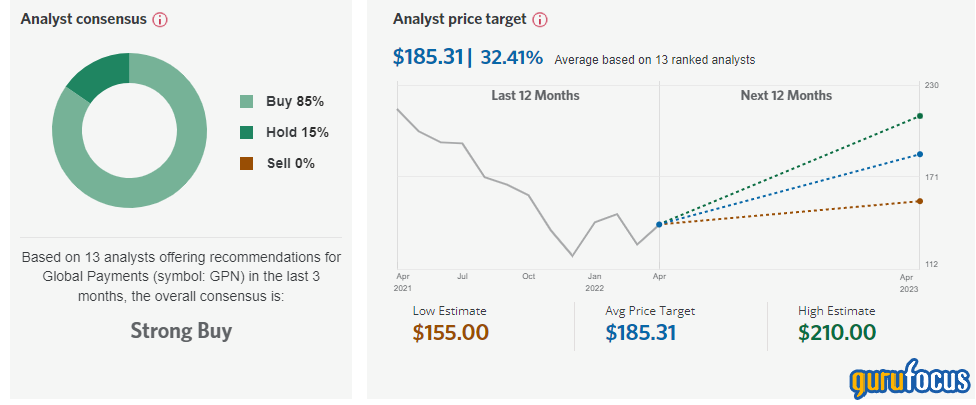

Analyst ratings from 13 analysts as compiled by CIBC are strongly favourable:

Guru ownership

Looking at Oakmark's portfolio, we do not yet see Global Payments listed. It's unclear when exactly Nygren decided to initiate this position; the firm has not yet released its 13F report for the first quarter of 2022, and the second-quarter 13F is not due until after the second quarter ends, so all we have to go on here is a brief mention in Nygren's shareholder letter.

Looking at the guru trades tab for the stock, we see that many other gurus have reported holdings in the stock in the last two quarters. There is one who's sold out, Lee Ainslie (Trades, Portfolio), and four who have reduced their positions, but there are five with new buys and five with adds.

| Guru | Date | Action | Comment | Current Shares |

| Parnassus Endeavor Fund | 2022-03-31 | Add | Add 6.48% | 1,128,745 |

| Parnassus Endeavor Fund | 2021-12-31 | New Buy | New holding | 1,060,066 |

| Jeremy Grantham | 2021-12-31 | Add | Add 38.82% | 1,166,140 |

| Jim Simons | 2021-12-31 | Reduce | Reduce -8.51% | 544,249 |

| Joel Greenblatt | 2021-12-31 | New Buy | New holding | 21,478 |

| Louis Moore Bacon | 2021-12-31 | New Buy | New holding | 164,243 |

| Lee Ainslie | 2021-12-31 | Sold Out | Sold Out | 0 |

| Robert Karr | 2021-12-31 | Add | Add 0.38% | 789,648 |

| Steven Cohen | 2021-12-31 | Add | Add 117.23% | 451,300 |

| Paul Tudor Jones | 2021-12-31 | Reduce | Reduce -37.78% | 39,553 |

| Larry Robbins | 2021-12-31 | Add | Add 56.23% | 2,087,657 |

| Ray Dalio | 2021-12-31 | Add | Add 242.89% | 41,219 |

| David Einhorn | 2021-12-31 | New Buy | New holding | 506,000 |

| Ken Fisher | 2021-12-31 | Reduce | Reduce -3.47% | 628,508 |

| Ron Baron | 2021-12-31 | Reduce | Reduce -9.09% | 4,000 |

Financials

The following is a snapshot of Global Payments' balance sheet. It looks healthy with equity substantially larger than debt. The company does have substantial intangible assets because of its history of acquisitions. The debt-to-Ebitda ratio is less the 4, which does not appear to be problematic. Financial strength appears to be acceptable.

The price-earnings ratio is very high at 43, but the price-to-free-cash-flow ratio is reasonable at 18 for a company growing in the high single digits. We see from the cash flow chart below that the company has very high depreciation, depletion and amortization charges, which are non-cash, so that explains the gap between earnings and cash flow.

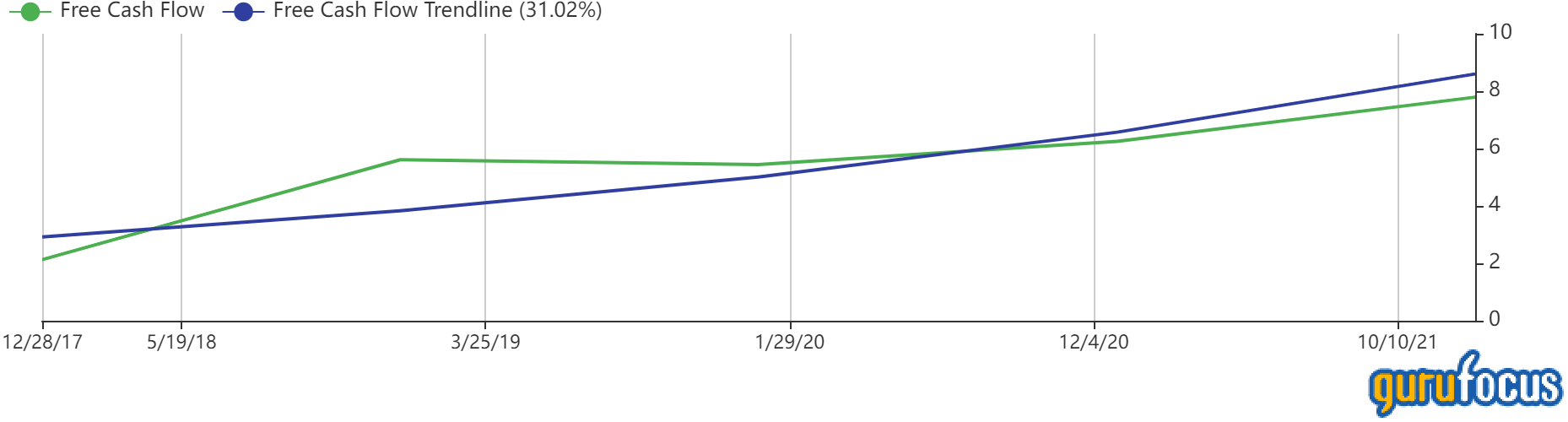

In fact, free cash flow has grown by an impressive 31% per year over the last five years.

The company is buying back shares as well, as shown in the chart below:

| Ticker | Company | 3-Month ShareBuyback Ratio | 6-Month ShareBuyback Ratio | 1-Year Share BuybackRatio |

| GPN | Global Payments Inc | 1.84 | 3.05 | 4.60 |

Conclusion

Overall it does not appear to me that Global Payment has any issue which suggest to me to think its a value trap. It may be that the stock price shot up to over valued territory during the pandemic due to rapid growth in ecommerce accompanies by rapid growth in electronic transactions. With the recent tech bust, payment processors got sold down as well. The industry has strong tail winds behind it as more and more payment volume is going electronic and payment processors like GPN stand to benefit. I think this secular trend is going to continue. The presence of so many Guru's in this name speaks well but the facts support the bullish thesis. I wrote about Fiserv (FISV), another payment processor a few weeks ago (Why Are So Many Gurus Buying F - GuruFocus.com )where Guru's like Seth Klarman (Trades, Portfolio) , Dodge & Cox as well as Nygren were buying. Global Payments seem to be a very similar story. This appears to be a good opportunity to hitch a ride to a secular growth story which still has quite a ways to go.