Becton Dickinson is a global health company that focuses on durable medical supplies and medical devices.

-Seven-year revenue growth rate: 6.8%

-Seven-year EPS growth rate: 18%

-Dividend yield: 2.37%

-Balance sheet: moderately strong but weakening

Becton Dickinson remains a solid long-term pick in my opinion, but the fact that the balance sheet has gone from stellar to mediocre means that the company has given up a particularly strong draw for investors.

Overview

Becton Dickinson (BDX, Financial) is divided into three business segments:

BD Medical

BD Medical contributes by far the largest percent of revenue, with $4.007 billion of Becton Dickinson’s total revenue. A bit over $2 billion of this comes from medical and surgical systems. Slightly over $1 billion comes from pharmaceutical systems, and the remainder comes from diabetes care. These products come in the form of needles, syringes and drug-delivery systems, and the major customers are hospitals, clinics, physicians’ offices, government agencies and healthcare workers.

BD Diagnostics

BD Diagnostics pulls in the second largest amount of revenue, with $2.480 billion of BD’s total revenue. It is about evenly split up, with over $1.2 billion in revenue each from Preanalytical Systems and Diagnostic Systems. This segment concerns specimen collection, identification, testing and specific systems, and the major customers are hospitals, laboratories, blood banks, physicians’ offices and so forth.

BD Biosciences

BD Biosciences is the smallest segment, with $1.341 billion in revenue. From this, a bit over $1 billion comes from cell analysis, and the remaining $300 million comes from discovery lab ware. The products are mainly kits for cell analysis, cell imaging systems and laboratory products.

Stock Metrics

Price to earnings: 14

Price to free cash flow: 18

Price to book: 3.6

Return on equity: 25%

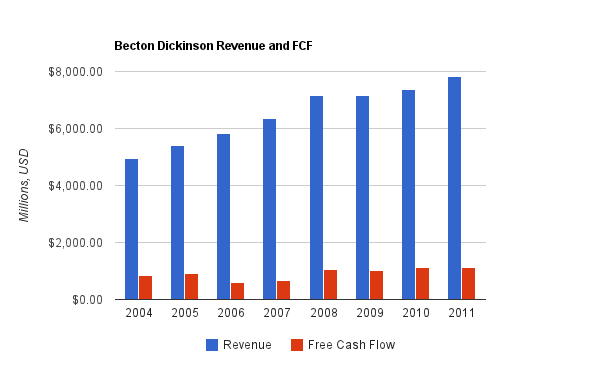

Revenue and Free Cash Flow

BDX has had particularly consistent revenue growth for decades. The revenue growth rate over the last seven years averaged 6.8%. Free cash flow, however, has been more erratic, and has only grown at 4.2% compounded annually over this same period.

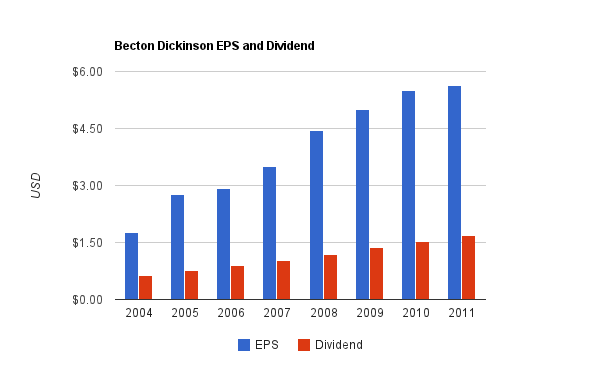

Earnings and Dividends

BDX grew earnings by almost 18% per year over the last seven years, but part of that has to do with 2004 being a low year for EPS. Calculating the eight-year EPS growth rate shows a milder but still impressive 13.3%.

The company has almost four decades of consecutive annual dividend growth, and the current dividend yield is 2.37% with a payout ratio from earnings of under 35%. The dividend growth rate over the last seven years averaged 15% annually.

BDX generally spends around twice the amount of money on net share repurchases as they do on dividends, which decreases the number of shares and therefore increases EPS growth, dividend growth and other per-share metrics. In 2011, however, the company spent around four times as much money on share repurchases as on dividends.

Balance Sheet

When I first published an analysis of Becton Dickinson around two years ago, the balance sheet was particularly strong. BDX management, however, has decided to issue debt to accelerate their share repurchases. Considering that interest rates are artificially low, and I consider BDX stock to be trading near its intrinsic value, this may be a good use of cash in terms of ROI. From a conservative investor standpoint, however, it may be excessive. The company’s pristine balance sheet has been somewhat reduced.

Total debt/equity has risen to 88%, but the interest coverage ratio is currently still over 10, which is strong, and goodwill makes up a fairly small portion of equity. The total debt/income is over 3 now.

Overall, the balance sheet is still strong in an absolute sense, but not when compared relatively to its position two or three years ago. The balance sheet has not deteriorated out of necessity but rather, management has taken advantage of low interest rates to buy assets that should produce better long-term returns: their own stock. While it makes sense in terms of numbers, a decrease in balance sheet strength of this magnitude over this short of a period violates a portion of my original investment thesis in this company, and I’ll be watching their balance sheet carefully from this point forward.

Investment Thesis

Becton Dickinson’s growth has slowed somewhat, but the company remains strong. Their necessary products are used throughout the world, with more than half of sales coming outside of the U.S. Their exposure in emerging markets is solid and grows approximately twice as fast as the company as a whole does.

The company’s products are not particularly unique, so they face substantial competition. But with Becton Dickinson’s long history of producing surgical tools, its large scale and its pioneering of safety-focused equipment, it has a fairly defensive position in my opinion.

Acquisitions

Becton Dickinson generally keeps acquisitions to a fairly modest portion of free cash flow. In 2011, they had a somewhat more aggressive year of acquisitions.

Accuri Cytometers was acquired, which is a low-cost provider of cytometers that BDX hopes will reach a wider audience of scientists and clinicians.

Carmel Pharma AB was also acquired, which deals with the safe handling of health care substances. Worker safety continues to increase in emphasis, worldwide.

In exchange for this, BDX recently announced that it is selling its discovery lab ware unit to Corning (GLW) for $730 million.

Risks

As a global health care provider, Becton Dickinson faces currency risks and litigation risks, as well as regulation risk. Device manufacturers are buffered from the continual concentrated risk of blockbuster patent losses that pharmaceutical companies deal with, but the global regulatory environment for medical devices is still rather strict. Changes in national budgets or health care regulation can substantially affect producers of equipment related to health care.

Conclusion and Valuation

In conclusion, I currently view BDX has a reasonable value at the current price of around $76. With a 2% or higher yield and double-digit dividend and EPS growth, the company is in good shape to produce solid long-term returns.

The downsides are that the yield isn’t particularly high, and the balance sheet has weakened. Other potential buys in this space for a yield include Abbott (ABT, Financial), Johnson and Johnson (JNJ, Financial) and Medtronic (MDT, Financial), and I view all of these businesses as reasonable investments currently.

Full Disclosure: As of this writing, I am long BDX, JNJ, and MDT.

-Seven-year revenue growth rate: 6.8%

-Seven-year EPS growth rate: 18%

-Dividend yield: 2.37%

-Balance sheet: moderately strong but weakening

Becton Dickinson remains a solid long-term pick in my opinion, but the fact that the balance sheet has gone from stellar to mediocre means that the company has given up a particularly strong draw for investors.

Overview

Becton Dickinson (BDX, Financial) is divided into three business segments:

BD Medical

BD Medical contributes by far the largest percent of revenue, with $4.007 billion of Becton Dickinson’s total revenue. A bit over $2 billion of this comes from medical and surgical systems. Slightly over $1 billion comes from pharmaceutical systems, and the remainder comes from diabetes care. These products come in the form of needles, syringes and drug-delivery systems, and the major customers are hospitals, clinics, physicians’ offices, government agencies and healthcare workers.

BD Diagnostics

BD Diagnostics pulls in the second largest amount of revenue, with $2.480 billion of BD’s total revenue. It is about evenly split up, with over $1.2 billion in revenue each from Preanalytical Systems and Diagnostic Systems. This segment concerns specimen collection, identification, testing and specific systems, and the major customers are hospitals, laboratories, blood banks, physicians’ offices and so forth.

BD Biosciences

BD Biosciences is the smallest segment, with $1.341 billion in revenue. From this, a bit over $1 billion comes from cell analysis, and the remaining $300 million comes from discovery lab ware. The products are mainly kits for cell analysis, cell imaging systems and laboratory products.

Stock Metrics

Price to earnings: 14

Price to free cash flow: 18

Price to book: 3.6

Return on equity: 25%

Revenue and Free Cash Flow

BDX has had particularly consistent revenue growth for decades. The revenue growth rate over the last seven years averaged 6.8%. Free cash flow, however, has been more erratic, and has only grown at 4.2% compounded annually over this same period.

Earnings and Dividends

BDX grew earnings by almost 18% per year over the last seven years, but part of that has to do with 2004 being a low year for EPS. Calculating the eight-year EPS growth rate shows a milder but still impressive 13.3%.

The company has almost four decades of consecutive annual dividend growth, and the current dividend yield is 2.37% with a payout ratio from earnings of under 35%. The dividend growth rate over the last seven years averaged 15% annually.

BDX generally spends around twice the amount of money on net share repurchases as they do on dividends, which decreases the number of shares and therefore increases EPS growth, dividend growth and other per-share metrics. In 2011, however, the company spent around four times as much money on share repurchases as on dividends.

Balance Sheet

When I first published an analysis of Becton Dickinson around two years ago, the balance sheet was particularly strong. BDX management, however, has decided to issue debt to accelerate their share repurchases. Considering that interest rates are artificially low, and I consider BDX stock to be trading near its intrinsic value, this may be a good use of cash in terms of ROI. From a conservative investor standpoint, however, it may be excessive. The company’s pristine balance sheet has been somewhat reduced.

Total debt/equity has risen to 88%, but the interest coverage ratio is currently still over 10, which is strong, and goodwill makes up a fairly small portion of equity. The total debt/income is over 3 now.

Overall, the balance sheet is still strong in an absolute sense, but not when compared relatively to its position two or three years ago. The balance sheet has not deteriorated out of necessity but rather, management has taken advantage of low interest rates to buy assets that should produce better long-term returns: their own stock. While it makes sense in terms of numbers, a decrease in balance sheet strength of this magnitude over this short of a period violates a portion of my original investment thesis in this company, and I’ll be watching their balance sheet carefully from this point forward.

Investment Thesis

Becton Dickinson’s growth has slowed somewhat, but the company remains strong. Their necessary products are used throughout the world, with more than half of sales coming outside of the U.S. Their exposure in emerging markets is solid and grows approximately twice as fast as the company as a whole does.

The company’s products are not particularly unique, so they face substantial competition. But with Becton Dickinson’s long history of producing surgical tools, its large scale and its pioneering of safety-focused equipment, it has a fairly defensive position in my opinion.

Acquisitions

Becton Dickinson generally keeps acquisitions to a fairly modest portion of free cash flow. In 2011, they had a somewhat more aggressive year of acquisitions.

Accuri Cytometers was acquired, which is a low-cost provider of cytometers that BDX hopes will reach a wider audience of scientists and clinicians.

Carmel Pharma AB was also acquired, which deals with the safe handling of health care substances. Worker safety continues to increase in emphasis, worldwide.

In exchange for this, BDX recently announced that it is selling its discovery lab ware unit to Corning (GLW) for $730 million.

Risks

As a global health care provider, Becton Dickinson faces currency risks and litigation risks, as well as regulation risk. Device manufacturers are buffered from the continual concentrated risk of blockbuster patent losses that pharmaceutical companies deal with, but the global regulatory environment for medical devices is still rather strict. Changes in national budgets or health care regulation can substantially affect producers of equipment related to health care.

Conclusion and Valuation

In conclusion, I currently view BDX has a reasonable value at the current price of around $76. With a 2% or higher yield and double-digit dividend and EPS growth, the company is in good shape to produce solid long-term returns.

The downsides are that the yield isn’t particularly high, and the balance sheet has weakened. Other potential buys in this space for a yield include Abbott (ABT, Financial), Johnson and Johnson (JNJ, Financial) and Medtronic (MDT, Financial), and I view all of these businesses as reasonable investments currently.

Full Disclosure: As of this writing, I am long BDX, JNJ, and MDT.