Philip Morris International (NYSE: PM) is the largest publicly traded international tobacco company in the world, and a solid dividend payer.

For the 2009-2011 period:

-Revenue Growth Rate: 11.4%

-EPS Growth Rate: 22.3%

-Dividend Growth Rate: 12.2%

-Current Dividend Yield: 3.58%

-Balance Sheet: Significant debt, but very stable

Based on the past growth rate and the long-term growth estimates provided by company management, I calculate that the stock is fairly valued at the current price in the mid-$80”²s. Due to the diversified and defensive nature of the business, and compared to the value of the markets as a whole, I believe the stock currently represents a decent buy.

With 78,000 employees and 56 manufacturing facilities, the company operates 7 of the top 15 global cigarette brands, including the number one brand Marlboro. Their top ten brands by volume are Marlboro, L&M, Fortune, Bond Street, Parliament, Philip Morris, Chesterfield, Sampoerna, Lark, and Dji Sam Soe. According to the company, Marlboro has been the top global cigarette brand for 40 years, and they sold over 300 billion Marlboro cigarettes in 2011, which exceeds the next two largest international cigarette brands combined. Overall, the number of cigarettes sold by Philip Morris International per year is approaching 1 trillion.

In 2011, Philip Morris International reported $9.2 billion in net revenue from the European Union, $7.9 billion in net revenue from the Middle East, $10.7 billion in net revenue from Asia, and $3.3 billion in net revenue from Latin America and Canada. Revenue and income increased in 2011 compared to 2010 for all four of these geographic segments, with Asia leading the pack in terms of growth. Volume, however, has been more mixed. All of the geographic segments besides Asia saw mild declines in volume in 2011 compared to two years ago in 2009, while Asia has seen large volume increases. Total volume is mildly up.

Price to Free Cash Flow: 16

Price to Book: very high*

Return on Equity: very high*

*due to near-zero equity

(Chart Source: DividendMonk.com)

I prefer to review and provide a longer operating history, but the first full year for the company as an independently publicly traded business was in 2009. Over this two year period, Philip Morris International has grown revenue at an annualized 11.4% pace, which based on their large size, should be lower than this over a longer period. The company targets 4-6% long-term annual revenue growth, according to a recent presentation. Excise taxes, which total over $40 billion annually, are not included in the revenue chart because those represent an artificial price increase that goes to governments and are not representative of true profit margins and other ratios.

The company, like many tobacco businesses, generates tremendous free cash flows that exceed net income. Selling an addictive product that is mostly based on brand preference, profit margins can be quite high, there is only modest research and development to do, and capital expenditures are very small compared to operating cash flows.

(Chart Source: DividendMonk.com)

EPS has grown by over 22% annually over this period, but this must come down over a longer period. The company targets 10-12% annual EPS growth over the long-term, according to a recent presentation. The dividend grew by a more modest, but still substantial, 12%.

The current dividend yield is 3.58%, and the payout ratio from earnings is currently around 60%.

Strong balance sheets are a pillar of my investment approach, but strong is relative to the industry. The company has certain lousy debt metrics, such as a total debt/equity ratio of nearly 200 (off the charts, basically), which is due to having close to zero book value and substantial debt levels. The near-zero book value includes nearly $10 billion in goodwill, so the tangible book value is actually negative. But total debt/income is far more reasonable at under 2.5, and the interest coverage ratio is over 15, which is extremely solid. So while the company has substantial debt levels, their overall financial position is quite solid.

In addition, Philip Morris International focuses on premium brands, and so their profit margins are substantial. 7 of the top 15 international cigarette brands are operated by the company, including the world’s flagship cigarette brand Marlboro.

Their free cash flow is enormous due to low amounts of required input costs, and they use this free cash flow basically entirely for dividends and share repurchases.

The company targets 1% long-term volume growth, 4-6% long term annual revenue growth, and 10-12% long term EPS growth. Combined with a 3+% dividend yield, long-term investment returns have solid potential.

For Philip Morris International, the risks are reduced. With global operations in almost every country outside of the U.S., the regulators from any one country only pose a mild threat. When smoking volume falls in one country, it may rise in another. Having such a broad reach reduces each individual risk.

The performance of the company since the spin off has been excellent, the long-term goals are stated, and analysts currently predict a mean of approximately 10% annual EPS growth for 2012 and 2013.

In order to justify the current valuation with discounted cash flow analysis, a 4% long-term free cash flow growth rate and 10% discount rate is sufficient. Using the dividend discount model, sustained dividend growth of 8% per year is necessary to justify the current valuation even with a 12% discount rate. Considering that the company looks for 4-6% revenue growth and 10-12% EPS growth, it appears that the current valuation is therefore tuned to the low end, or slightly below the low-end, of the goals, implying a mild margin of safety on a solid international company.

PM has enjoyed a nice stock run-up over the last few years, but this run-up has been supported by solid performance and growth. Considering that by broad metrics like Capitalization/GDP and Shiller P/E, the market is a bit heated currently in terms of valuation, I think PM represents one of the stronger dividend growth investments out there. The valuation at the current price in the mid-$80”²s, based on the above-described methods of calculation, is currently fair.

Full Disclosure: As of this writing, I have no position in PM.

For the 2009-2011 period:

-Revenue Growth Rate: 11.4%

-EPS Growth Rate: 22.3%

-Dividend Growth Rate: 12.2%

-Current Dividend Yield: 3.58%

-Balance Sheet: Significant debt, but very stable

Based on the past growth rate and the long-term growth estimates provided by company management, I calculate that the stock is fairly valued at the current price in the mid-$80”²s. Due to the diversified and defensive nature of the business, and compared to the value of the markets as a whole, I believe the stock currently represents a decent buy.

Overview

The company’s history stretches back into the 1800”²s, but Philip Morris International (NYSE: PM) is fairly new as an independent publicly traded company. The business was spun off from what is now called Altria in 2008, to focus on international growth and expansion. PM uses Altria’s brands, and is based in the U.S., but does 100% of its business outside of the U.S.With 78,000 employees and 56 manufacturing facilities, the company operates 7 of the top 15 global cigarette brands, including the number one brand Marlboro. Their top ten brands by volume are Marlboro, L&M, Fortune, Bond Street, Parliament, Philip Morris, Chesterfield, Sampoerna, Lark, and Dji Sam Soe. According to the company, Marlboro has been the top global cigarette brand for 40 years, and they sold over 300 billion Marlboro cigarettes in 2011, which exceeds the next two largest international cigarette brands combined. Overall, the number of cigarettes sold by Philip Morris International per year is approaching 1 trillion.

In 2011, Philip Morris International reported $9.2 billion in net revenue from the European Union, $7.9 billion in net revenue from the Middle East, $10.7 billion in net revenue from Asia, and $3.3 billion in net revenue from Latin America and Canada. Revenue and income increased in 2011 compared to 2010 for all four of these geographic segments, with Asia leading the pack in terms of growth. Volume, however, has been more mixed. All of the geographic segments besides Asia saw mild declines in volume in 2011 compared to two years ago in 2009, while Asia has seen large volume increases. Total volume is mildly up.

Ratios

Price to Earnings: 17Price to Free Cash Flow: 16

Price to Book: very high*

Return on Equity: very high*

*due to near-zero equity

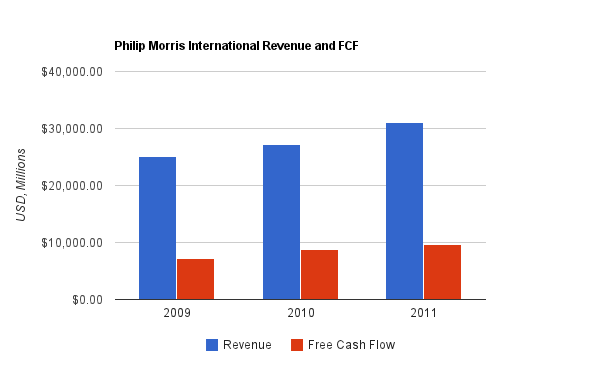

Revenue and Free Cash Flow

(Chart Source: DividendMonk.com)

I prefer to review and provide a longer operating history, but the first full year for the company as an independently publicly traded business was in 2009. Over this two year period, Philip Morris International has grown revenue at an annualized 11.4% pace, which based on their large size, should be lower than this over a longer period. The company targets 4-6% long-term annual revenue growth, according to a recent presentation. Excise taxes, which total over $40 billion annually, are not included in the revenue chart because those represent an artificial price increase that goes to governments and are not representative of true profit margins and other ratios.

The company, like many tobacco businesses, generates tremendous free cash flows that exceed net income. Selling an addictive product that is mostly based on brand preference, profit margins can be quite high, there is only modest research and development to do, and capital expenditures are very small compared to operating cash flows.

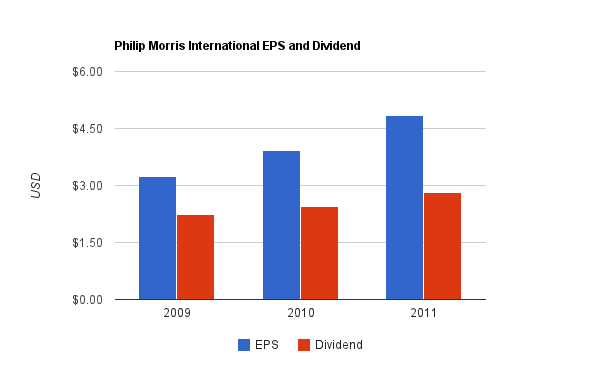

Earnings and Dividends

(Chart Source: DividendMonk.com)

EPS has grown by over 22% annually over this period, but this must come down over a longer period. The company targets 10-12% annual EPS growth over the long-term, according to a recent presentation. The dividend grew by a more modest, but still substantial, 12%.

The current dividend yield is 3.58%, and the payout ratio from earnings is currently around 60%.

How PM Spends its Cash

During 2009, 2010, and 2011, Philip Morris International generated about $25.5 billion in free cash flows, and also issued a bit more debt than it repaid. Over this period, they spent about $13.5 billion in dividends, and about $15.5 billion in net share repurchases (repurchases minus issuance of shares). Only a bit over half a billion was spent on net acquisitions over these three years. Overall, it would be preferable from a dividend investor standpoint to spend a bit more on dividends and a bit less on repurchases, but overall, PM handles its cash fairly well in my view. The free cash flow finds its way to investors in the form of dividend income or greater company ownership.Balance Sheet

Most tobacco companies, including Philip Morris International, have a great deal of debt on their balance sheets. With an addicted customer base, low input costs, and fairly recession-resistant products, they can safely take on substantial leverage.Strong balance sheets are a pillar of my investment approach, but strong is relative to the industry. The company has certain lousy debt metrics, such as a total debt/equity ratio of nearly 200 (off the charts, basically), which is due to having close to zero book value and substantial debt levels. The near-zero book value includes nearly $10 billion in goodwill, so the tangible book value is actually negative. But total debt/income is far more reasonable at under 2.5, and the interest coverage ratio is over 15, which is extremely solid. So while the company has substantial debt levels, their overall financial position is quite solid.

Investment Thesis

Philip Morris International has an envious position. They’re based in the U.S., but their business operates strictly outside of the U.S. So while tobacco companies that operate wholly in the United States, such as Altria, face consolidated regulatory risks, Philip Morris international, with its highly diversified geographic position, is buffered from strong regulatory or litigation risks from any specific region. Advertising limitations, excise taxes, and government relationships with their company, are diverse rather than consolidated, and they have full exposure to international and emerging market growth.In addition, Philip Morris International focuses on premium brands, and so their profit margins are substantial. 7 of the top 15 international cigarette brands are operated by the company, including the world’s flagship cigarette brand Marlboro.

Their free cash flow is enormous due to low amounts of required input costs, and they use this free cash flow basically entirely for dividends and share repurchases.

The company targets 1% long-term volume growth, 4-6% long term annual revenue growth, and 10-12% long term EPS growth. Combined with a 3+% dividend yield, long-term investment returns have solid potential.

Risks

In addition to the usual currency risks and commodity price risks, two key risks for tobacco companies are: reduction in interest in their products, and increases in regulations. In some areas, smoking is on the decline, which of course directly affects the volume of product sales. Regulators can reduce advertising allowance for, increase taxes on, and otherwise impede tobacco companies. In some ways, decreasing advertising can “lock in” the key brands by keeping competition away, but it also makes it difficult to continually establish top brands.For Philip Morris International, the risks are reduced. With global operations in almost every country outside of the U.S., the regulators from any one country only pose a mild threat. When smoking volume falls in one country, it may rise in another. Having such a broad reach reduces each individual risk.

Conclusion and Valuation

The long-term growth targets for the company are appealing. 10-12% annual EPS growth combined with a 3+% dividend yield is ambitious. Only 4-6% annual revenue growth and 1% annual volume growth are estimated to be necessary to produce this result. This highlights the importance of returning cash to shareholders- much of this total return will come from taking the free cash flow and using it to pay dividends or buy back shares, and all of it is based on fairly mild volume growth and moderate price increases on that volume in emerging markets.The performance of the company since the spin off has been excellent, the long-term goals are stated, and analysts currently predict a mean of approximately 10% annual EPS growth for 2012 and 2013.

In order to justify the current valuation with discounted cash flow analysis, a 4% long-term free cash flow growth rate and 10% discount rate is sufficient. Using the dividend discount model, sustained dividend growth of 8% per year is necessary to justify the current valuation even with a 12% discount rate. Considering that the company looks for 4-6% revenue growth and 10-12% EPS growth, it appears that the current valuation is therefore tuned to the low end, or slightly below the low-end, of the goals, implying a mild margin of safety on a solid international company.

PM has enjoyed a nice stock run-up over the last few years, but this run-up has been supported by solid performance and growth. Considering that by broad metrics like Capitalization/GDP and Shiller P/E, the market is a bit heated currently in terms of valuation, I think PM represents one of the stronger dividend growth investments out there. The valuation at the current price in the mid-$80”²s, based on the above-described methods of calculation, is currently fair.

Full Disclosure: As of this writing, I have no position in PM.