Joel Greenblatt’s rationale for a value-weighted index can be paraphrased as follows:

Market Capitalization Weight< Equal Weight< Fundamental Weight< “Value Weight” (Greenblatt’s Magic Formula Weight)

I think this chart is compelling:

It shows the CAGRs for a variety of indices over the 20 years to December 31, 2010. The first thing to note is that the equal weight index – represented by the &P500 Equal Weight TR – has a huge advantage over the market capitalization weighted S&P500 TR. Greenblatt says:

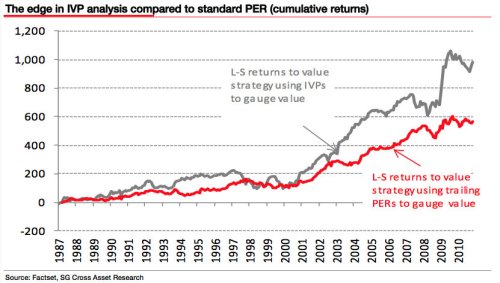

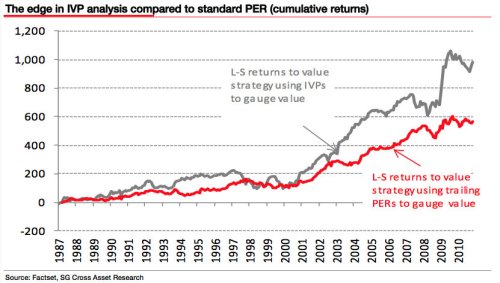

1. I’m not sure that his Magic Formula weighting is genuine “value” weighting. Contrast Greenblatt’s approach with Dylan Grice’s “Intrinsic Value to Price” or “IVP” approach, which is a modified residual income approach, the details of which I’ll discuss in a later post. Grice’s IVP is a true intrinsic value calculation. He explains his approach in a way reminiscent of Buffett’s approach:

Grice actually calculates IVP while Greenblatt does not. Does that actually matter? Probably not. Even if it’s not what I think the average person understands real “value” weighting to be, Greenblatt’s approach seems to work. Why quibble over semantics?

2. As I’ve discussed before, Greenblatt’s Magic Formula return owes a great deal to his selection of EBIT/TEV as the price limb of his model. EBIT/TEV has been very well performed historically. If we were to substitute EBIT/TEV for the P/B, P/E, price-to-dividends, P/S, P/whatever, we’d have seen slightly better performance than the Magic Formula provided, but you might have been out of the game somewhere between 1997 to 2001.

- Most investors, pro’s included, can’t beat the index. Therefore, buying an index fund is better than messing it up yourself or getting an active manager to mess it up for you.

- If you’re going to buy an index, you might as well buy the best one. An index based on the market capitalization-weighted S&P500 will be handily beaten by an equal-weighted index, which will be handily beaten by a fundamentally weighted index, which is in turn handily beaten by a “value-weighted index,” which is what Greenblatt calls his “Magic Formula-weighted index.”

Market Capitalization Weight< Equal Weight< Fundamental Weight< “Value Weight” (Greenblatt’s Magic Formula Weight)

I think this chart is compelling:

It shows the CAGRs for a variety of indices over the 20 years to December 31, 2010. The first thing to note is that the equal weight index – represented by the &P500 Equal Weight TR – has a huge advantage over the market capitalization weighted S&P500 TR. Greenblatt says:

Over time, traditional market-cap weighted indexes such as the S&P 500 and the Russell 1000 have been shown to outperform most active managers. However, market cap weighted indexes suffer from a systematic flaw. The problem is that market-cap weighted indexes increase the amount they own of a particular company as that company’s stock price increases. As a company’s stock falls, its market capitalization falls and a market cap-weighted index will automatically own less of that company. However, over the short term, stock prices can often be affected by emotion. A market index that bases its investment weights solely on market capitalization (and therefore market price) will systematically invest too much in stocks when they are overpriced and too little in stocks when they are priced at bargain levels. (In the internet bubble, for example, as internet stocks went up in price, market cap-weighted indexes became too heavily concentrated in this overpriced sector and too underweighted in the stocks of established companies in less exciting industries.) This systematic flaw appears to cost market-cap weighted indexes approximately 2% per year in return over long periods.The equal weight index corrects this systematic flaw to a degree (the small correction is still worth 2.7 percent per year in additional performance). Greenblatt describes it as randomizing the errors made by the market capitalization weighted index:

One way to avoid the problem of buying too much of overpriced stocks and too little of bargain stocks in a market-cap weighted index is to create an index that weights each stock in the index equally. An equally-weighted index will still own too much of overpriced stocks and too little of bargain-priced stocks, but in other cases, it will own more of bargain stocks and less of overpriced stocks. Since stocks in the index aren’t affected by price, errors will be random and average out over time. For this reason, equally weighted indexes should add back the approximately 2% per year lost to the inefficiencies of market-cap weighting.While the errors are randomized in the equal weight index, they are still systematic – it still owns too much of the expensive stocks and too little of the cheap ones. Fundamental weighting corrects this error (again to a small degree). Fundamentally-weighted indexes weight companies based on their economic size using price ratios such as sales, book value, cash flow and dividends. The surprising thing is that this change is worth only 0.4 percent per year over equal weighting (still 3.1 percent per year over market capitalization weighting).

Similar to equally-weighted indexes, company weights are not affected by market price and therefore pricing errors are also random. By correcting for the systematic errors caused by weighting solely by market-cap, as tested over the last 40+ years, fundamentally-weighted indexes can also add back the approximately 2% lost each year due to the inefficiencies of market-cap weighting (with the last 20 years adding back even more!).The Magic Formula / “value” weighted index has a huge advantage over fundamental weighting (+3.9 percent per year), and is a massive improvement over the market capitalization index (+7 percent per year). Greenblatt describes it as follows:

On the other hand, value-weighted indexes seek not only to avoid the losses due to the inefficiencies of market-cap weighting, but to add performance by buying more of stocks when they are available at bargain prices. Value-weighted indexes are continually rebalanced to weight most heavily those stocks that are priced at the largest discount to various measures of value. Over time, these indexes can significantly outperform active managers, market cap-weighted indexes, equally-weighted indexes, and fundamentally-weighted indexes.I like Greenblatt’s approach. I’ve got two small criticisms:

1. I’m not sure that his Magic Formula weighting is genuine “value” weighting. Contrast Greenblatt’s approach with Dylan Grice’s “Intrinsic Value to Price” or “IVP” approach, which is a modified residual income approach, the details of which I’ll discuss in a later post. Grice’s IVP is a true intrinsic value calculation. He explains his approach in a way reminiscent of Buffett’s approach:

[How] is intrinsic value estimated? To answer, think first about how much you should pay for a going concern. The simplest such example would be that of a bank account containing $100, earning 5% per year interest. This asset is highly liquid. It also provides a stable income. And if I reinvest that income forever, it provides stable growth too. What’s it worth?And it seems to work:

Let’s assume my desired return is 5%. The bank account is worth only its book value of $100 (the annual interest payment of $5 divided by my desired return of 5%). It may be liquid, stable and even growing, but since it’s not generating any value over and above my required return, it deserves no premium to book value.

This focus on an asset’s earnings power and, in particular, the ability of assets to earn returns in excess of desired returns is the essence of my intrinsic valuation, which is based on Steven Penman’s residual income model.1 The basic idea is that if a company is not earning a return in excess of our desired return, that company, like the bank account example above, deserves no premium to book value.

Grice actually calculates IVP while Greenblatt does not. Does that actually matter? Probably not. Even if it’s not what I think the average person understands real “value” weighting to be, Greenblatt’s approach seems to work. Why quibble over semantics?

2. As I’ve discussed before, Greenblatt’s Magic Formula return owes a great deal to his selection of EBIT/TEV as the price limb of his model. EBIT/TEV has been very well performed historically. If we were to substitute EBIT/TEV for the P/B, P/E, price-to-dividends, P/S, P/whatever, we’d have seen slightly better performance than the Magic Formula provided, but you might have been out of the game somewhere between 1997 to 2001.