I have recently read Vitaliy Katsenelson‘s excellent The Little Book of Sideways Markets. Vitaliy’s thesis is that equity markets are characterised by periods of valuation expansion (“bull market”) and contraction (“bear market” or “sideways market”). I think it’s a compelling thesis, but I am well and truly in the choir. I’m open to counterarguments. Here’s the Cliff Notes version of Vitaliy’s thesis:

Sideways Markets

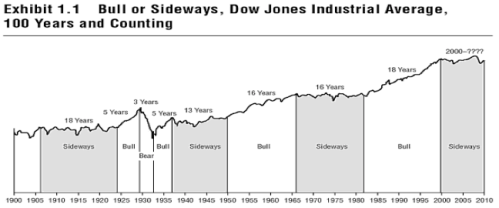

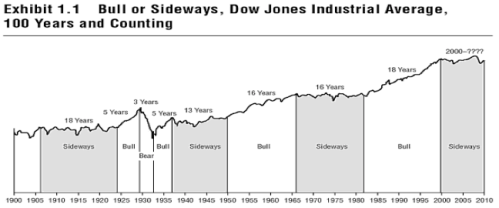

A sideways market is the result of earnings increasing while valuation drops. Historically, they are common (this is one of many charts Vitaliy provides in support of his thesis):

Equity markets are going sideways

Equity markets are presently experiencing an extended period of valuation contraction, manifesting as increasing earnings, falling cyclically adjusted price-to-earning ratios (“CAPE”) and a sideways market.

While the S&P500 TR is approximately flat for the period from December 1999 to the present, valuations have fallen 52 percent, from a CAPE of 44 in December 1999 to a CAPE of 20.56 presently (via Multpl).

20.56 is not cheap.

Despite over a decade of dropping valuations, a CAPE of 20.56 is presently still well-above long-term averages (the long-run mean is 16.43 and the long-run median is 15.84), indicating that the market is still 25 percent to 30 percent above those averages.

The market probably wont stop at the averages. CAPE has in the past typically fallen to a single-digit low following a cyclical peak

Sideways markets can continue for some time. The last time a sideways market traded on a CAPE of ~21 (1969) it took ~13 years to bottom (1982). The all-time peak US CAPE of 44.2 occurred in December 1999, all-time low US CAPE of 4.78 occurred in December 1920. The most recent CAPE low of 6.6 occurred in August 1982.

What Would Vitaliy Do? Buy and Sell

Vitaliy advocates a systematic approach, buying stocks that meet his “QVG” or “Quality, Value, Growth,” framework, and selling, rather than holding. He deals with this in some detail in the book.

The book is excellent. I highly recommend it. You can purchase a copy here.

Full Disclosure: I received from the publisher a copy of Vitaliy’s book gratis. I would have bought it if I had not.

Sideways Markets

A sideways market is the result of earnings increasing while valuation drops. Historically, they are common (this is one of many charts Vitaliy provides in support of his thesis):

Equity markets are going sideways

Equity markets are presently experiencing an extended period of valuation contraction, manifesting as increasing earnings, falling cyclically adjusted price-to-earning ratios (“CAPE”) and a sideways market.

While the S&P500 TR is approximately flat for the period from December 1999 to the present, valuations have fallen 52 percent, from a CAPE of 44 in December 1999 to a CAPE of 20.56 presently (via Multpl).

20.56 is not cheap.

Despite over a decade of dropping valuations, a CAPE of 20.56 is presently still well-above long-term averages (the long-run mean is 16.43 and the long-run median is 15.84), indicating that the market is still 25 percent to 30 percent above those averages.

The market probably wont stop at the averages. CAPE has in the past typically fallen to a single-digit low following a cyclical peak

Sideways markets can continue for some time. The last time a sideways market traded on a CAPE of ~21 (1969) it took ~13 years to bottom (1982). The all-time peak US CAPE of 44.2 occurred in December 1999, all-time low US CAPE of 4.78 occurred in December 1920. The most recent CAPE low of 6.6 occurred in August 1982.

What Would Vitaliy Do? Buy and Sell

Vitaliy advocates a systematic approach, buying stocks that meet his “QVG” or “Quality, Value, Growth,” framework, and selling, rather than holding. He deals with this in some detail in the book.

The book is excellent. I highly recommend it. You can purchase a copy here.

Full Disclosure: I received from the publisher a copy of Vitaliy’s book gratis. I would have bought it if I had not.