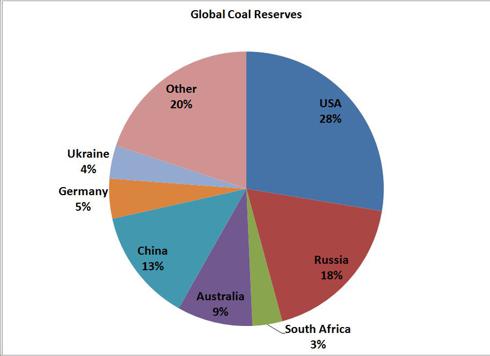

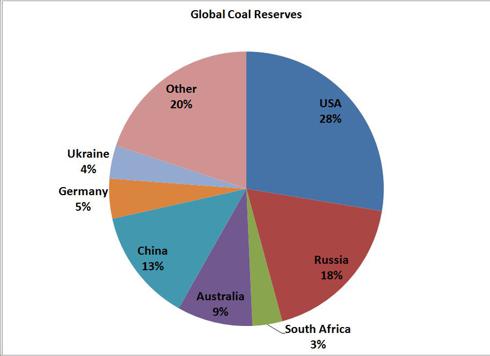

The U.S. boasts the world’s largest reserves of steam coal and is a leading producer of this commodity, though the majority of this output is destined for domestic consumption.

Source: BP Statistical Review of World Energy 2011

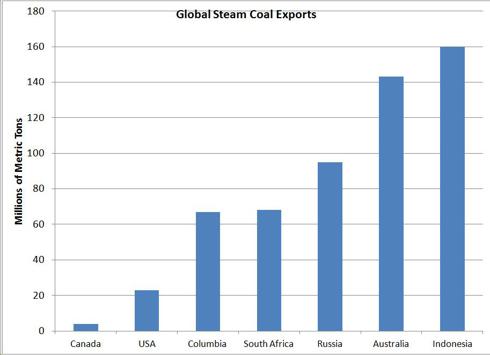

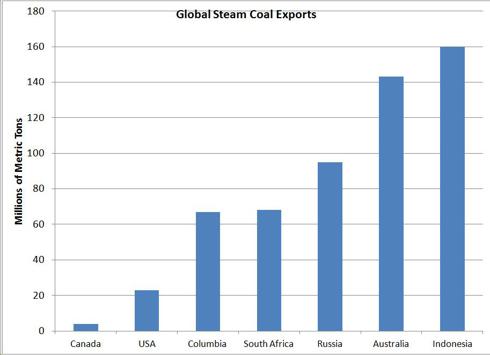

In 2011 U.S. shipments of steam coal to international customers ranked sixth in the world, trailing Indonesia, Australia, Russia, South Africa and Colombia.

Source: World Coal Council

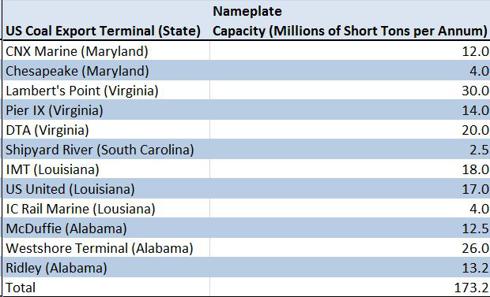

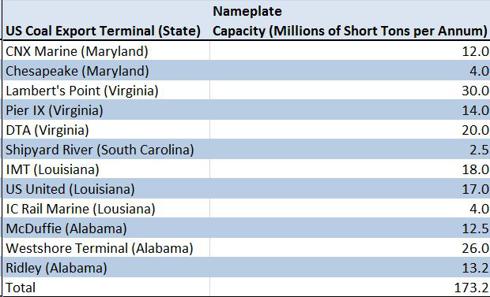

As U.S. coal exports account for 10 percent or less of global demand, supply and demand conditions in the international market for steam coal have little influence on North American prices. In the near term, U.S. producers have limited scope to ramp up international shipments of steam coal and alleviate the domestic supply glut. The nation’s operating export terminals have a total capacity of 173 million short tons per annum–equivalent to roughly 16 percent of the industry’s annual output.

Source: Reuters

Moreover, shipments of metallurgiucal (met) coal – the kind used in steelmaking – usually command a higher price than the variety burned in power plants; steam coal accounts for only two-thirds of U.S. coal exports. Although the industry’s long-range plans include several export terminals on the West Coast to take advantage of Asia’s demand for met coal, these projects remain in their nascent stages and won’t ameliorate the current supply overhang.

A similar situation prevails in Canada, where met coal accounts for 90 percent of annual exports.

In short, investors shouldn’t assume that supply and demand conditions in the North America prevail in international markets. The U.S. steam coal market hinges on domestic demand for electricity, while the seaborne market for this kind of coal depends on growing power consumption in emerging markets such as China and India.

The coal-to-gas switching that’s plaguing U.S. coal producers hasn’t come in to play in most international markets because the price of natural gas is often four to five times higher than in North America.

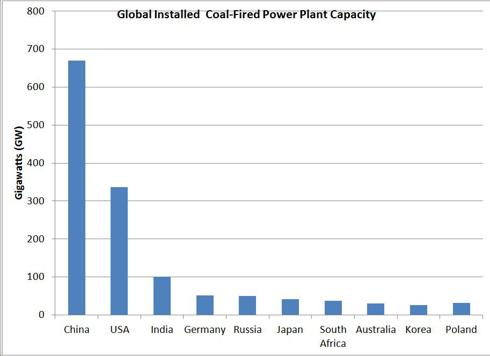

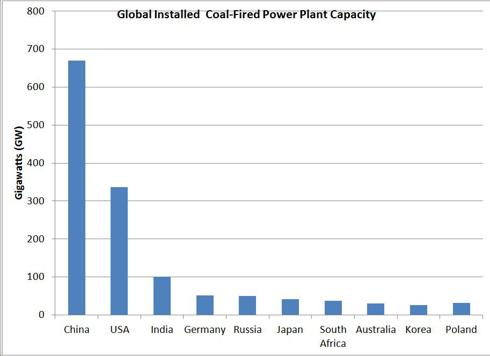

The world’s top 10 countries in terms of coal-fired generation capacity account for 80 percent of the world’s installed base. China, home to the largest fleet of coal-fired plants, makes up more than 40 percent of the world’s total capacity.

Source: International Energy Agency

Of the major coal-consuming nations, China and India will drive the seaborne market in the near term and long term. The insular U.S. market depends primarily on domestic production and has little capacity to ramp up exports, while the weak EU economy will weigh on Germany’ electricity demand in the near term. Over the long term, environmental concerns will likely stymie the construction of additional coal-fired power plants in Germany and other EU member states.

In contrast, demand for electricity will continue to surge as China and India industrialize. Coal’s cost advantages should ensure that the fuel remains the dominant feedstock in these emerging markets. Liquefied natural gas prices in Asia hovered around USD15 per million British thermal units at the end of May, while the cost of steam coal delivered Australia’s port of Newcastle amounted to less than $5 per million British thermal unit.

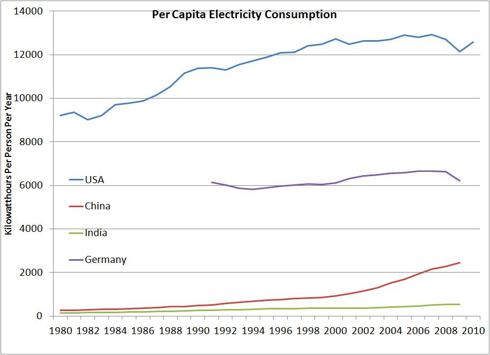

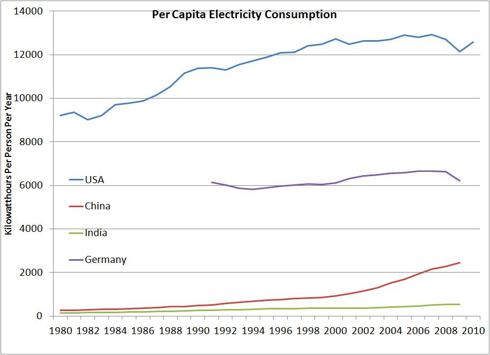

Rapid economic growth and development in China and India has fueled growing demand for electricity, as increased urbanization tends to increase power consumption.

Source: Energy Information Administration, World Bank

China’s electricity consumption grew more than twelve-fold between 1980 and 2009, while per-capita electricity demand increased nine-fold. Over the same period, India’s electricity demand increased by more than 6.5 times and per-capita power consumption quadrupled. These growth rates dwarf the 78 percent increase in total U.S. electricity demand over these 20 years.

Moreover, China and India have a long way to go before per-capita power demand reaches levels that prevail in the U.S. and Western Europe. China’s per-capita power demand would need to increase by an additional 150 percent to equal per-capita electricity use in Germany and by almost 500 percent to match the U.S.

When you consider that China’s population is about four times that of the U.S., even a modest increase in the Mainland’s power consumption implies a substantial upsurge in demand for steam coal and other energy commodities.

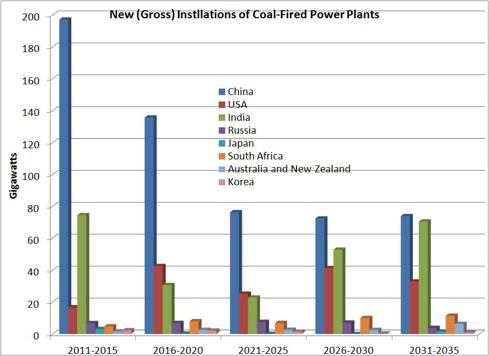

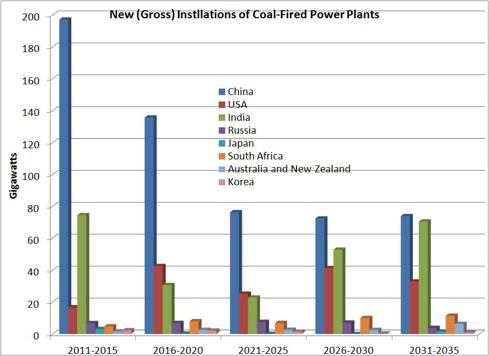

Not surprisingly, China and India dominate the league tables for new coal-fired generation capacity. Although Western investors often fret that the retirement of older, coal-burning power plants in the U.S. and Europe will weigh on global coal prices, Asia’s emerging markets will continue to drive growth in the seaborne coal trade.

Investors should also disabuse themselves of the misconception that China’s coal-fired power plants are older, less efficient and more harmful to the environment than their counterparts in the US and other developed countries. Whereas 8 percent of coal-burning plants in the U.S. are less than 20 years old, 90 percent of China’s coal-fired facilities were built within the last two decades.

Roughly 75 percent of China’s electric power plants have a nameplate capacity of more than 300 megawatts, on par with the U.S. and Germany. These larger plants usually operate at higher efficiency rates and have superior environmental controls than smaller facilities. China’s base of newer, highly efficient coal-fired power plants is testament to the country’s commitment to this oft-maligned feedstock.

Source: International Energy Agency

In each of the five-year periods depicted on this graph, the International Energy Agency (IEA) expects China to add the most coal-fired capacity, with India following closely on its heels. Although the U.S. will build some coal-burning power plants, most of these additions will occur in the near term and will be offset by the closure of older facilities.

Factoring in plant retirements, the IEA’s forecast calls for China to add 488 gigawatts of generative capacity by 2035–a roughly 75 percent increase to its current base. Over the same time frame, India is expected to grow its generative capacity to 225 gigawatts from 101 gigawatts. At this rate, India will overtake the U.S. as the second-largest consumer of steam coal within the next 15 years.

How will China, India and other emerging markets obtain the coal to fuel these power plants? Imports will be a big part of the equation. Although China is the world’s leading producer of steam coal and India ranks third, domestic production won’t keep pace with demand growth.

Over the past five years, China’s output of steam coal has increased by 38 percent, while demand has surged by 41 percent. India’s production of steam coal has grown an impressive 33 percent, falling short of the 50 percent increase in consumption. These supply gaps appear relatively minor, but the size of these markets translates into substantial demand for imported steam coal.

Although investors tend to focus on China’s insatiable appetite for oil, iron ore and other commodities, India’s demand for imported steam and met coal will likely increase at a much faster rate. Not only are the country’s domestic coal reserves of relatively low quality, but the country has also struggled to grow production because of government restrictions on land use. India’s transportation infrastructure also makes it difficult to deliver this output to the marketplace. The government has effectively acknowledged that these challenges will persist by citing most of its newly built power plants near the coast, a location that facilitates seaborne imports.

In recent years, Australia and Indonesia have battled for the title of the world’s leading exporter of steam coal. Together, the two nations supply about 45 percent of the global market for seaborne steam coal. In coming years, I expect Australia’s efforts to expand terminal capacity to enable it to hold the top position. According to the Australia’s Department of Resources, Energy and Tourism, the country’s total export capacity will increase to about 448 million metric tons per annum (mmtpa) from 333 mmtpa at the end of 2008.

Indonesia has grown its exports of steam coal considerably in recent years, benefiting from the predominance of relatively inexpensive-to-produce surface mines that are located near waterways. Meanwhile, the nation’s rapidly expanding economy has fueled an almost threefold increase in domestic coal demand between 2000 and 2010, prompting the government to debate new laws that would restrict exports.

Colombia, Russia and South Africa also have the capacity to export significant amounts of steam coal. Although reserves of steam coal are more widely distributed throughout the world than the metallurgical variety, rising import demand in emerging markets should support the price of seaborne steam coal over the long term.

Based on these long-term trends, I expect coal remain the world’s leading source of electricity for at least 15 more years.

energy stock in the sector. The stock has pulled back significantly over the past year, stung by declining coal prices and short-term concerns about Chinese demand.

However, Peabody Energy is well-positioned to navigate the current environment. The company in October 2007 spun off its coal mining assets in Central Appalachia (CAPP), a region where rising costs remain a permanent headwind, with the initial public offering of Patriot Coal (PCX). Not only did Peabody Energy monetize these mature assets in a bull market for coal, but the move also enabled the firm to focus on building its exposure to growing its production in Australia.

Although the U.S. market for thermal coal faces undeniable headwinds, investors haven’t given Peabody Energy enough credit for its domestic asset base and substantial operations in Australia. Trading at only 0.8 times revenue, the stock has more than priced in any additional bad news. In fact, the shares command a lower valuation than they did at the height of the 2008 to 2009 financial crisis.

The key upside catalyst for the stock will be a turn in sentiment regarding Chinese steel demand, which I expect to occur in the back half of the year.

Source: BP Statistical Review of World Energy 2011

In 2011 U.S. shipments of steam coal to international customers ranked sixth in the world, trailing Indonesia, Australia, Russia, South Africa and Colombia.

Source: World Coal Council

As U.S. coal exports account for 10 percent or less of global demand, supply and demand conditions in the international market for steam coal have little influence on North American prices. In the near term, U.S. producers have limited scope to ramp up international shipments of steam coal and alleviate the domestic supply glut. The nation’s operating export terminals have a total capacity of 173 million short tons per annum–equivalent to roughly 16 percent of the industry’s annual output.

Source: Reuters

Moreover, shipments of metallurgiucal (met) coal – the kind used in steelmaking – usually command a higher price than the variety burned in power plants; steam coal accounts for only two-thirds of U.S. coal exports. Although the industry’s long-range plans include several export terminals on the West Coast to take advantage of Asia’s demand for met coal, these projects remain in their nascent stages and won’t ameliorate the current supply overhang.

A similar situation prevails in Canada, where met coal accounts for 90 percent of annual exports.

In short, investors shouldn’t assume that supply and demand conditions in the North America prevail in international markets. The U.S. steam coal market hinges on domestic demand for electricity, while the seaborne market for this kind of coal depends on growing power consumption in emerging markets such as China and India.

The coal-to-gas switching that’s plaguing U.S. coal producers hasn’t come in to play in most international markets because the price of natural gas is often four to five times higher than in North America.

The world’s top 10 countries in terms of coal-fired generation capacity account for 80 percent of the world’s installed base. China, home to the largest fleet of coal-fired plants, makes up more than 40 percent of the world’s total capacity.

Source: International Energy Agency

Of the major coal-consuming nations, China and India will drive the seaborne market in the near term and long term. The insular U.S. market depends primarily on domestic production and has little capacity to ramp up exports, while the weak EU economy will weigh on Germany’ electricity demand in the near term. Over the long term, environmental concerns will likely stymie the construction of additional coal-fired power plants in Germany and other EU member states.

In contrast, demand for electricity will continue to surge as China and India industrialize. Coal’s cost advantages should ensure that the fuel remains the dominant feedstock in these emerging markets. Liquefied natural gas prices in Asia hovered around USD15 per million British thermal units at the end of May, while the cost of steam coal delivered Australia’s port of Newcastle amounted to less than $5 per million British thermal unit.

Rapid economic growth and development in China and India has fueled growing demand for electricity, as increased urbanization tends to increase power consumption.

Source: Energy Information Administration, World Bank

China’s electricity consumption grew more than twelve-fold between 1980 and 2009, while per-capita electricity demand increased nine-fold. Over the same period, India’s electricity demand increased by more than 6.5 times and per-capita power consumption quadrupled. These growth rates dwarf the 78 percent increase in total U.S. electricity demand over these 20 years.

Moreover, China and India have a long way to go before per-capita power demand reaches levels that prevail in the U.S. and Western Europe. China’s per-capita power demand would need to increase by an additional 150 percent to equal per-capita electricity use in Germany and by almost 500 percent to match the U.S.

When you consider that China’s population is about four times that of the U.S., even a modest increase in the Mainland’s power consumption implies a substantial upsurge in demand for steam coal and other energy commodities.

Not surprisingly, China and India dominate the league tables for new coal-fired generation capacity. Although Western investors often fret that the retirement of older, coal-burning power plants in the U.S. and Europe will weigh on global coal prices, Asia’s emerging markets will continue to drive growth in the seaborne coal trade.

Investors should also disabuse themselves of the misconception that China’s coal-fired power plants are older, less efficient and more harmful to the environment than their counterparts in the US and other developed countries. Whereas 8 percent of coal-burning plants in the U.S. are less than 20 years old, 90 percent of China’s coal-fired facilities were built within the last two decades.

Roughly 75 percent of China’s electric power plants have a nameplate capacity of more than 300 megawatts, on par with the U.S. and Germany. These larger plants usually operate at higher efficiency rates and have superior environmental controls than smaller facilities. China’s base of newer, highly efficient coal-fired power plants is testament to the country’s commitment to this oft-maligned feedstock.

Source: International Energy Agency

In each of the five-year periods depicted on this graph, the International Energy Agency (IEA) expects China to add the most coal-fired capacity, with India following closely on its heels. Although the U.S. will build some coal-burning power plants, most of these additions will occur in the near term and will be offset by the closure of older facilities.

Factoring in plant retirements, the IEA’s forecast calls for China to add 488 gigawatts of generative capacity by 2035–a roughly 75 percent increase to its current base. Over the same time frame, India is expected to grow its generative capacity to 225 gigawatts from 101 gigawatts. At this rate, India will overtake the U.S. as the second-largest consumer of steam coal within the next 15 years.

How will China, India and other emerging markets obtain the coal to fuel these power plants? Imports will be a big part of the equation. Although China is the world’s leading producer of steam coal and India ranks third, domestic production won’t keep pace with demand growth.

Over the past five years, China’s output of steam coal has increased by 38 percent, while demand has surged by 41 percent. India’s production of steam coal has grown an impressive 33 percent, falling short of the 50 percent increase in consumption. These supply gaps appear relatively minor, but the size of these markets translates into substantial demand for imported steam coal.

Although investors tend to focus on China’s insatiable appetite for oil, iron ore and other commodities, India’s demand for imported steam and met coal will likely increase at a much faster rate. Not only are the country’s domestic coal reserves of relatively low quality, but the country has also struggled to grow production because of government restrictions on land use. India’s transportation infrastructure also makes it difficult to deliver this output to the marketplace. The government has effectively acknowledged that these challenges will persist by citing most of its newly built power plants near the coast, a location that facilitates seaborne imports.

In recent years, Australia and Indonesia have battled for the title of the world’s leading exporter of steam coal. Together, the two nations supply about 45 percent of the global market for seaborne steam coal. In coming years, I expect Australia’s efforts to expand terminal capacity to enable it to hold the top position. According to the Australia’s Department of Resources, Energy and Tourism, the country’s total export capacity will increase to about 448 million metric tons per annum (mmtpa) from 333 mmtpa at the end of 2008.

Indonesia has grown its exports of steam coal considerably in recent years, benefiting from the predominance of relatively inexpensive-to-produce surface mines that are located near waterways. Meanwhile, the nation’s rapidly expanding economy has fueled an almost threefold increase in domestic coal demand between 2000 and 2010, prompting the government to debate new laws that would restrict exports.

Colombia, Russia and South Africa also have the capacity to export significant amounts of steam coal. Although reserves of steam coal are more widely distributed throughout the world than the metallurgical variety, rising import demand in emerging markets should support the price of seaborne steam coal over the long term.

Based on these long-term trends, I expect coal remain the world’s leading source of electricity for at least 15 more years.

energy stock in the sector. The stock has pulled back significantly over the past year, stung by declining coal prices and short-term concerns about Chinese demand.

However, Peabody Energy is well-positioned to navigate the current environment. The company in October 2007 spun off its coal mining assets in Central Appalachia (CAPP), a region where rising costs remain a permanent headwind, with the initial public offering of Patriot Coal (PCX). Not only did Peabody Energy monetize these mature assets in a bull market for coal, but the move also enabled the firm to focus on building its exposure to growing its production in Australia.

Although the U.S. market for thermal coal faces undeniable headwinds, investors haven’t given Peabody Energy enough credit for its domestic asset base and substantial operations in Australia. Trading at only 0.8 times revenue, the stock has more than priced in any additional bad news. In fact, the shares command a lower valuation than they did at the height of the 2008 to 2009 financial crisis.

The key upside catalyst for the stock will be a turn in sentiment regarding Chinese steel demand, which I expect to occur in the back half of the year.