Social networking kingpin Facebook (FB, Financial) reported strong third quarter results Tuesday afternoon as the company navigates the shift towards mobile computing. Revenue surged 32% year over year to $1.2 billion, while earnings were flat at $0.12 per share as operating margins fell. However, both numbers exceeded consensus estimates and were surprisingly strong given the weakness we saw recently from Google (GOOG, Financial).

Facebook continues to win eyeballs as usage and users continue to surge. Monthly active users increased 26% year over year to 1.01 billion, daily active users grew 28% year over year to 584 million, and mobile active users grew 61% year over year to 604 million. Facebook remains the number one application for both Android and iOS. Despite widespread concerns, the firm doesn't seem to be having many issues making its application relevant on the mobile platform. If anything, we think mobile computing should lead to additional Facebook consumption thanks to the ability to easily upload pictures and videos, as well as the ease of viewing on a mobile device.

Even though PC ad sales are falling, according to CEO Mark Zuckerberg, he expects mobile to eventually eclipse PC as a revenue driver. Regardless, ad sales grew 36% year over year to $1.09 billion, though ad sales would have grown an even more impressive 43% if it weren't for currency fluctuations. The company's move toward sponsored stories ads is delivering a greater return on investment, according to COO Sheryl Sandberg. Not only is the real estate better than the tiny corner on a desktop ad, but it translates well to a mobile device.

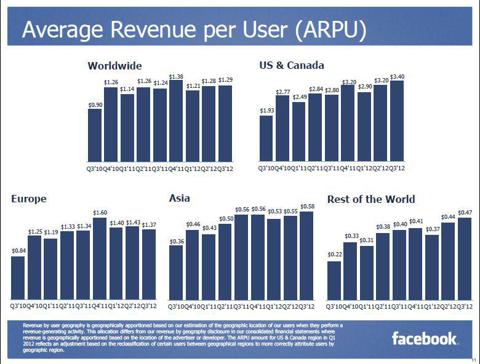

Average revenue per user (ARPU) remains much higher in the U.S. and Canada than the rest of the world.

Image Source: Facebook's 3Q slide deck

We think this is a major opportunity for Facebook, particularly in Asia where advertisers will be competing for booming middle class incomes. The website is blocked in China, but we think this could change over time. Meanwhile, India, South Korea and Vietnam all represent massive opportunities.

Payments and other fees revenue grew just 13% year over year to $176 million, and declined 9% sequentially. We're not too surprised, and it seems as though users are less willing to pay for incremental gaming upgrades. Regardless, we don't expect payments to be a significant growth driver going forward, so we're willing to look past this area of weakness for now.

Overall, we thought the quarter was reasonably strong, though operating margins tumbled to 42% from the 51% achieved during the same period a year ago. Facebook is still heavily investing in expansion projects, as headcount grew 9%. The firm's execution and its focus on revenue growth are improving, but we think shares remain fairly valued at current levels. We prefer Google in our Best Ideas portfolio instead on the basis of its significant valuation upside potential from today's levels. Please click here for our valuation of Google.

Facebook continues to win eyeballs as usage and users continue to surge. Monthly active users increased 26% year over year to 1.01 billion, daily active users grew 28% year over year to 584 million, and mobile active users grew 61% year over year to 604 million. Facebook remains the number one application for both Android and iOS. Despite widespread concerns, the firm doesn't seem to be having many issues making its application relevant on the mobile platform. If anything, we think mobile computing should lead to additional Facebook consumption thanks to the ability to easily upload pictures and videos, as well as the ease of viewing on a mobile device.

Even though PC ad sales are falling, according to CEO Mark Zuckerberg, he expects mobile to eventually eclipse PC as a revenue driver. Regardless, ad sales grew 36% year over year to $1.09 billion, though ad sales would have grown an even more impressive 43% if it weren't for currency fluctuations. The company's move toward sponsored stories ads is delivering a greater return on investment, according to COO Sheryl Sandberg. Not only is the real estate better than the tiny corner on a desktop ad, but it translates well to a mobile device.

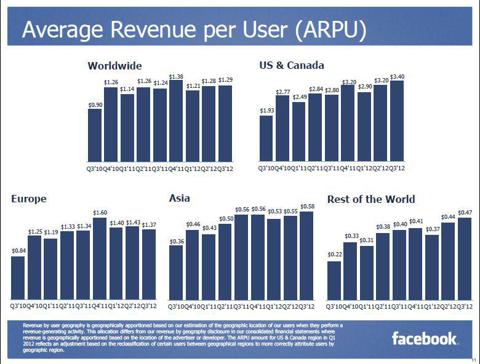

Average revenue per user (ARPU) remains much higher in the U.S. and Canada than the rest of the world.

Image Source: Facebook's 3Q slide deck

We think this is a major opportunity for Facebook, particularly in Asia where advertisers will be competing for booming middle class incomes. The website is blocked in China, but we think this could change over time. Meanwhile, India, South Korea and Vietnam all represent massive opportunities.

Payments and other fees revenue grew just 13% year over year to $176 million, and declined 9% sequentially. We're not too surprised, and it seems as though users are less willing to pay for incremental gaming upgrades. Regardless, we don't expect payments to be a significant growth driver going forward, so we're willing to look past this area of weakness for now.

Overall, we thought the quarter was reasonably strong, though operating margins tumbled to 42% from the 51% achieved during the same period a year ago. Facebook is still heavily investing in expansion projects, as headcount grew 9%. The firm's execution and its focus on revenue growth are improving, but we think shares remain fairly valued at current levels. We prefer Google in our Best Ideas portfolio instead on the basis of its significant valuation upside potential from today's levels. Please click here for our valuation of Google.