Darden Restaurants owns several brands of restaurant chains including Olive Garden and Red Lobster.

-Seven Year Revenue Growth Rate: 6.1%

-Seven Year EPS Growth Rate: 10.4%

-Latest Dividend Increase: 16.2%

-Current Dividend Yield: 3.81%

-Balance Sheet Strength: Leveraged, Stable

The company offers a substantial dividend yield and specific five-year plans for growth, which should be appealing to investors. The current price in the low $50”²s is fair for the long term, assuming that the company is able to meet the low end of its 2017 goals.

Olive Garden

Olive Garden is a large Italian food chain of casual restaurants. The segment has nearly 800 locations, generates $4.7 million in average sales per location, and generates over $3.6 billion in total sales for Darden.

Red Lobster

Red Lobster is Darden’s second largest brand, with over 700 locations, over $3.8 billion in sales per average location, and therefore about $2.7 billion in total sales. Red Lobster is the original brand under Darden.

Longhorn Steakhouse

In 2007, Darden Restaurants acquired Longhorn Steakhouse. The brand currently has 400 units, $3 million in sales per location on average, and around $1.1 billion in total sales. Longhorn is the smallest of Darden’s three core brands but is the fastest growing one.

Specialty Group

Rounding out the three core brands for Darden is the specialty group, which is a collection of smaller brands with 110 total locations as of the end of fiscal year 2012.

The brands include:

-Bahama Breeze, a Caribean-styled restaurant

-Capital Grille, a restaurant originally aimed at business people and politicians, with a large wine selection

-Seasons 52, a grill and wine bar focusing on healthy selections

-Eddie V’s, a restaurant focusing on seafood, steaks, and live music

-Yard House, a casual restaurant with an assortment of beer offerings and classic rock

The specialty group has fast-growth characteristics and generates over $0.6 billion in sales. Due to the size and slightly higher scale or specialization of these locations, the average annual sales figure per location is $6.4 million.

Price to Free Cash Flow: 27

Price to Book: 3.6

Return on Equity: 25%

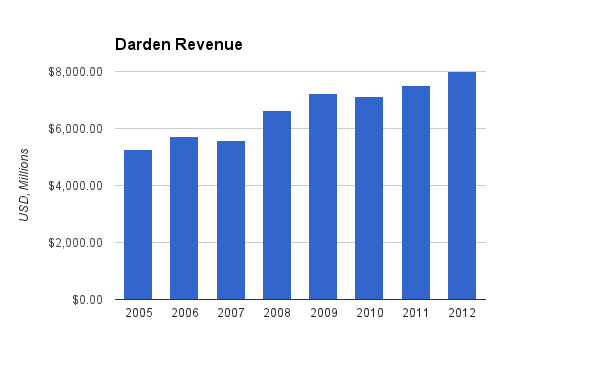

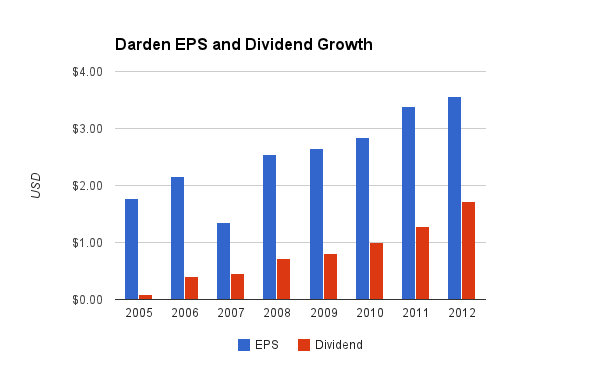

(Chart Source: DividendMonk.com)

Revenue grew by 6.1% per year over this period. Part of this was organic growth but significant portions were due to acquisitions of LongHorn and some of their smaller brands.

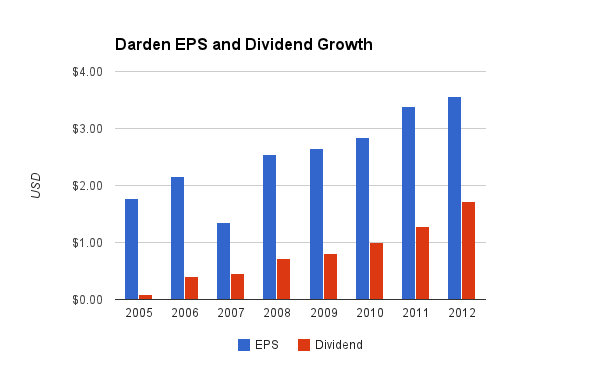

(Chart Source: DividendMonk.com)

Earnings grew by 10.4% per year on average over this period. With the exception of the year 2007 when Longhorn was acquired, EPS growth has been rather smooth.

Darden is gaining traction as a dividend stock with a 3.81% yield and double-digit dividend growth. Prior to 2006 the company wasn’t much of a dividend stock but since that year, the annual dividend has grown from $0.40 to $2.00 per share. The most recent quarterly increase was from $0.43 to $0.50, and the payout ratio is moderate at 55%.

Because the company is moderately sized and does not yet have a multi-decade dividend growth history, I view the company has an income-producing total return stock that may offer an above average yield but that has not proven enough stability to be foundation of growing passive income, or a “core holding”.

Approximate historical dividend yield at beginning of each year:

How Does Darden Spend Its Cash?

Over the past three years, the company generated over $930 million in free cash flow. Roughly $540 million was spent on dividends, while nearly $650 million was spent on net stock buybacks (value bought back minus value issued). The share count over the last decade has decreased from a bit under 180 million to around 130 million.

Darden spent $1+ billion to acquire LongHorn, and recently spent $585 million to acquire Yard House.

The total debt/income ratio is over 4x, and the interest coverage ratio is only around 6.5x.

While these figures are stable, it does show that the company is using a significant degree of leverage. Particularly with regards to the interest coverage ratio, I generally look for a ratio of 10+ in all but the most stable companies (utilities, landfill owners, MLPs, etc.)

I generally view anything that aims at the middle economic range as on inherently thin ice. The U.S. has a very polarized economic divide, so businesses that focus on high-end experiences, and businesses that focus on being the low cost provider of budget experiences, have room to excel. A dangerous place is in the middle, where a company’s products or services are neither of top-notch quality or at the cheapest price.

Unique Selling Proposition

Fortunately for Darden, their brands do have strong unique selling propositions (USPs), which seems to be a defining characteristic of their success. Some casual restaurants aren’t particularly known for focusing on anything, and consequently there is rarely a reason to specifically pick them for a Friday night dinner out. Each Darden brand has a fairly specific focus, which means rather than competing with every restaurant in town, they’re only competing with restaurants that focus on those niches.

Olive Garden, for example, is the biggest full-service Italian restaurant chain. Red Lobster is the biggest seafood chain. Longhorn focuses on steaks, so rather than competing with every restaurant in town, they compete with businesses like Outback Steakhouse for when consumers are specifically looking to go out for a steak dinner. Capital Grille has an extensive wine selection, Yard House has a casual atmosphere complete with beer and classic rock, and Bahama Breeze focuses on Caribbean offerings. Each major brand is distinct.

Diverse Returns

The objectives of Darden are to provide solid total shareholder returns in several ways. The dividend yield of 3.81% is above average, and they have quickly increased the payout ratio over the last several years to transform into a solid dividend stock. Meanwhile, the company continually buys back its stock and reduces the share count at reasonable valuations with the remaining free cash flow. The company also expands existing brands and occasionally makes acquisitions of new brands.

Specific Goals

Darden management has put forth specific five year targets in the 2012 annual report. The company plans to increase sales from $8 billion in 2012 to $11-$12.5 billion in 2017, which would mean better than 6.5% revenue growth per year over this period. They also plan to increase EPS from $3.58 in 2012 to $5.75-$7.25, which would mean an EPS growth rate of 10% per year at the low end to 15% on the high end, while paying an above average dividend yield on top of that. The sum of dividends and share repurchases for the period of 2013-2017 is estimated by the company to be $2.9 billion to $3.6 billion.

The company, according to the 2012 report, is aiming to open 500 more restaurants in the next five years. Red Lobster will be slowing down growth, Olive Garden will be aiming to open 125 locations by 2017, Longhorn will be aiming to open 200 locations by 2017, and the Specialty Group will be aiming to open up over 100 locations by 2017. So overall, Darden expects to expand from around 2,000 total locations to around 2,500, and each location on average is expected to increase sales by 2-4% per year over that period (which largely amounts to an index to inflation).

Olive Garden had a 0.3% decrease in same-restaurant guest traffic between 2010 and 2011, which accelerated to a 1.2% decrease in same-restaurant guest traffic between 2011-2012. Increases in prices and new Olive Garden restaurant openings, along with the fact that Olive Garden is only one brand of several for Darden, meant that these declines did not drastically affect Darden’s bottom line. But overall, if the company’s largest brand is leaking guests, it’s a concern.

It’s hard to say exactly what could be causing the decline in a strong brand. I do think it’s worth pointing out a trend.

According to Google Adwords, 2.2 million people use the search term “Atkins” per month. In addition, 1.5 million people use the search term “low carb”. Another 1.8 million search for “paleo”, and then there is a tail of words like “cave man diet” at 60k/month. These are various diet-types that focus on eating a low amount of carbohydrates, and wheat is often viewed as the primary food to avoid.

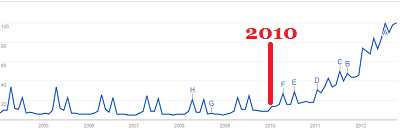

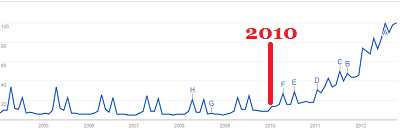

This is the change in search trends for searches in Google that contain the word “Paleo”:

Now, because search terms including “Atkins” and “Low Carb” have decreased from their highs, to some extent it appears to be a change in terminology. However, while those two terms have decreased over the long term, they have remained fairly flat over the 2010-present period during the huge spike in searches for “Paleo”. So over the last three years, the largest terms in the category appear to have collectively increased.

The term “gluten free” has also dramatically increased, reaching 3.3 million searches per month. (Gluten is a protein in wheat.) And the growth has been a lot more steady and long-term than that “Paleo” search spike in recent years.

Overall, it appears that interest in these sorts of dietary approaches has gained momentum. Probably more important is that for every person searching Google for “Paleo” or “Low Carb” or “Atkins”, and for every person treating these sorts of approaches as a lifestyle, there are others that are probably just watching their carbs a bit.

If an additional 1-5% of the U.S. population over a given period becomes moderately or seriously interested in reducing their carb and specifically wheat intake, could that reduce guest traffic to the largest full-service Italian restaurant chain in the country (with a rather large focus on wheat-based bread and pasta) by 1% in a year? I think it could play a role.

Depending on the longevity of this interest, Olive Garden may continue to face headwinds. This is by no means certain; the brand-specific guest decreases could be due to other factors. Red Lobster, for example, had a decrease in guests between 2010 and 2011, but an increase in guests between 2011 and 2012.

Furthermore, a large portion of the returns are rather straightforward to predict and difficult to disrupt. With a moderate dividend payout ratio and consistent share buybacks, much of the returns will be due to internal use of cash rather than expansion. And as far as expansion is concerned, most of that growth is due to the plan to open 500 more locations. So the one key variable that could offset these rather predictable uses of cash, would be the realization of consistently poor same-location growth. If their major brands have modest declines in the number of customers per location, then it will modestly impact the results. If any brands were to face major downturns in customers, then this would substantially affect business.

The company is taking measures to improve its largest brands, including remodeling and large Spanish advertising campaigns for Red Lobster and an increase in Olive Garden’s take-out offerings.

Overall, with a moderate stock valuation, an above average dividend yield, and a very specific five-year plan, Darden looks solid at today’s prices in the low $50”²s.

Full Disclosure: As of this writing, I have no position in DRI.

-Seven Year Revenue Growth Rate: 6.1%

-Seven Year EPS Growth Rate: 10.4%

-Latest Dividend Increase: 16.2%

-Current Dividend Yield: 3.81%

-Balance Sheet Strength: Leveraged, Stable

The company offers a substantial dividend yield and specific five-year plans for growth, which should be appealing to investors. The current price in the low $50”²s is fair for the long term, assuming that the company is able to meet the low end of its 2017 goals.

Overview

Darden Restaurants Inc. (DRI, Financial) operates Olive Garden, Red Lobster, Longhorn Steakhouse, and other restaurant chains throughout the United States. The company generated nearly $8 billion in sales during fiscal year 2012 and currently has a market cap of a bit under $7 billion. Darden was once part of General Mills but was spun off in the mid-1990”²s as its own company.Olive Garden

Olive Garden is a large Italian food chain of casual restaurants. The segment has nearly 800 locations, generates $4.7 million in average sales per location, and generates over $3.6 billion in total sales for Darden.

Red Lobster

Red Lobster is Darden’s second largest brand, with over 700 locations, over $3.8 billion in sales per average location, and therefore about $2.7 billion in total sales. Red Lobster is the original brand under Darden.

Longhorn Steakhouse

In 2007, Darden Restaurants acquired Longhorn Steakhouse. The brand currently has 400 units, $3 million in sales per location on average, and around $1.1 billion in total sales. Longhorn is the smallest of Darden’s three core brands but is the fastest growing one.

Specialty Group

Rounding out the three core brands for Darden is the specialty group, which is a collection of smaller brands with 110 total locations as of the end of fiscal year 2012.

The brands include:

-Bahama Breeze, a Caribean-styled restaurant

-Capital Grille, a restaurant originally aimed at business people and politicians, with a large wine selection

-Seasons 52, a grill and wine bar focusing on healthy selections

-Eddie V’s, a restaurant focusing on seafood, steaks, and live music

-Yard House, a casual restaurant with an assortment of beer offerings and classic rock

The specialty group has fast-growth characteristics and generates over $0.6 billion in sales. Due to the size and slightly higher scale or specialization of these locations, the average annual sales figure per location is $6.4 million.

Ratios

Price to Earnings: 14Price to Free Cash Flow: 27

Price to Book: 3.6

Return on Equity: 25%

Revenue

(Chart Source: DividendMonk.com)

Revenue grew by 6.1% per year over this period. Part of this was organic growth but significant portions were due to acquisitions of LongHorn and some of their smaller brands.

Earnings and Dividends

(Chart Source: DividendMonk.com)

Earnings grew by 10.4% per year on average over this period. With the exception of the year 2007 when Longhorn was acquired, EPS growth has been rather smooth.

Darden is gaining traction as a dividend stock with a 3.81% yield and double-digit dividend growth. Prior to 2006 the company wasn’t much of a dividend stock but since that year, the annual dividend has grown from $0.40 to $2.00 per share. The most recent quarterly increase was from $0.43 to $0.50, and the payout ratio is moderate at 55%.

Because the company is moderately sized and does not yet have a multi-decade dividend growth history, I view the company has an income-producing total return stock that may offer an above average yield but that has not proven enough stability to be foundation of growing passive income, or a “core holding”.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 3.81% |

| 2012 | 3.8% |

| 2011 | 2.7% |

| 2010 | 2.9% |

| 2009 | 2.7% |

| 2008 | 2.6% |

How Does Darden Spend Its Cash?

Over the past three years, the company generated over $930 million in free cash flow. Roughly $540 million was spent on dividends, while nearly $650 million was spent on net stock buybacks (value bought back minus value issued). The share count over the last decade has decreased from a bit under 180 million to around 130 million.

Darden spent $1+ billion to acquire LongHorn, and recently spent $585 million to acquire Yard House.

Balance Sheet

Total debt/equity is around 110%, and around 30% of existing equity consists of goodwill.The total debt/income ratio is over 4x, and the interest coverage ratio is only around 6.5x.

While these figures are stable, it does show that the company is using a significant degree of leverage. Particularly with regards to the interest coverage ratio, I generally look for a ratio of 10+ in all but the most stable companies (utilities, landfill owners, MLPs, etc.)

Investment Thesis

Darden Restaurants came up in the particularly good interview with Chuck Carnevale as part of the October issue of the strategic dividend newsletter as one of his picks, so I decided to take a closer look at it and publish an analysis.I generally view anything that aims at the middle economic range as on inherently thin ice. The U.S. has a very polarized economic divide, so businesses that focus on high-end experiences, and businesses that focus on being the low cost provider of budget experiences, have room to excel. A dangerous place is in the middle, where a company’s products or services are neither of top-notch quality or at the cheapest price.

Unique Selling Proposition

Fortunately for Darden, their brands do have strong unique selling propositions (USPs), which seems to be a defining characteristic of their success. Some casual restaurants aren’t particularly known for focusing on anything, and consequently there is rarely a reason to specifically pick them for a Friday night dinner out. Each Darden brand has a fairly specific focus, which means rather than competing with every restaurant in town, they’re only competing with restaurants that focus on those niches.

Olive Garden, for example, is the biggest full-service Italian restaurant chain. Red Lobster is the biggest seafood chain. Longhorn focuses on steaks, so rather than competing with every restaurant in town, they compete with businesses like Outback Steakhouse for when consumers are specifically looking to go out for a steak dinner. Capital Grille has an extensive wine selection, Yard House has a casual atmosphere complete with beer and classic rock, and Bahama Breeze focuses on Caribbean offerings. Each major brand is distinct.

Diverse Returns

The objectives of Darden are to provide solid total shareholder returns in several ways. The dividend yield of 3.81% is above average, and they have quickly increased the payout ratio over the last several years to transform into a solid dividend stock. Meanwhile, the company continually buys back its stock and reduces the share count at reasonable valuations with the remaining free cash flow. The company also expands existing brands and occasionally makes acquisitions of new brands.

Specific Goals

Darden management has put forth specific five year targets in the 2012 annual report. The company plans to increase sales from $8 billion in 2012 to $11-$12.5 billion in 2017, which would mean better than 6.5% revenue growth per year over this period. They also plan to increase EPS from $3.58 in 2012 to $5.75-$7.25, which would mean an EPS growth rate of 10% per year at the low end to 15% on the high end, while paying an above average dividend yield on top of that. The sum of dividends and share repurchases for the period of 2013-2017 is estimated by the company to be $2.9 billion to $3.6 billion.

The company, according to the 2012 report, is aiming to open 500 more restaurants in the next five years. Red Lobster will be slowing down growth, Olive Garden will be aiming to open 125 locations by 2017, Longhorn will be aiming to open 200 locations by 2017, and the Specialty Group will be aiming to open up over 100 locations by 2017. So overall, Darden expects to expand from around 2,000 total locations to around 2,500, and each location on average is expected to increase sales by 2-4% per year over that period (which largely amounts to an index to inflation).

Risks

With a fairly substantial amount of leverage, an exclusive focus on the United States market, an economic target of the middle class, and a dividend growth history that is fairly short, Darden does have risk.Olive Garden had a 0.3% decrease in same-restaurant guest traffic between 2010 and 2011, which accelerated to a 1.2% decrease in same-restaurant guest traffic between 2011-2012. Increases in prices and new Olive Garden restaurant openings, along with the fact that Olive Garden is only one brand of several for Darden, meant that these declines did not drastically affect Darden’s bottom line. But overall, if the company’s largest brand is leaking guests, it’s a concern.

It’s hard to say exactly what could be causing the decline in a strong brand. I do think it’s worth pointing out a trend.

According to Google Adwords, 2.2 million people use the search term “Atkins” per month. In addition, 1.5 million people use the search term “low carb”. Another 1.8 million search for “paleo”, and then there is a tail of words like “cave man diet” at 60k/month. These are various diet-types that focus on eating a low amount of carbohydrates, and wheat is often viewed as the primary food to avoid.

This is the change in search trends for searches in Google that contain the word “Paleo”:

Now, because search terms including “Atkins” and “Low Carb” have decreased from their highs, to some extent it appears to be a change in terminology. However, while those two terms have decreased over the long term, they have remained fairly flat over the 2010-present period during the huge spike in searches for “Paleo”. So over the last three years, the largest terms in the category appear to have collectively increased.

The term “gluten free” has also dramatically increased, reaching 3.3 million searches per month. (Gluten is a protein in wheat.) And the growth has been a lot more steady and long-term than that “Paleo” search spike in recent years.

Overall, it appears that interest in these sorts of dietary approaches has gained momentum. Probably more important is that for every person searching Google for “Paleo” or “Low Carb” or “Atkins”, and for every person treating these sorts of approaches as a lifestyle, there are others that are probably just watching their carbs a bit.

If an additional 1-5% of the U.S. population over a given period becomes moderately or seriously interested in reducing their carb and specifically wheat intake, could that reduce guest traffic to the largest full-service Italian restaurant chain in the country (with a rather large focus on wheat-based bread and pasta) by 1% in a year? I think it could play a role.

Depending on the longevity of this interest, Olive Garden may continue to face headwinds. This is by no means certain; the brand-specific guest decreases could be due to other factors. Red Lobster, for example, had a decrease in guests between 2010 and 2011, but an increase in guests between 2011 and 2012.

Conclusion and Valuation

What it comes down to is, if Darden meets the bottom range of their five-year plan, then an investment in the stock today will be a good one. At a P/E of a bit over 14, management is targeting 10-15% EPS growth while offering an above average dividend yield, so even if the fairly modest stock valuation were to slip a bit between now and then, returns should be quite reasonable.Furthermore, a large portion of the returns are rather straightforward to predict and difficult to disrupt. With a moderate dividend payout ratio and consistent share buybacks, much of the returns will be due to internal use of cash rather than expansion. And as far as expansion is concerned, most of that growth is due to the plan to open 500 more locations. So the one key variable that could offset these rather predictable uses of cash, would be the realization of consistently poor same-location growth. If their major brands have modest declines in the number of customers per location, then it will modestly impact the results. If any brands were to face major downturns in customers, then this would substantially affect business.

The company is taking measures to improve its largest brands, including remodeling and large Spanish advertising campaigns for Red Lobster and an increase in Olive Garden’s take-out offerings.

Overall, with a moderate stock valuation, an above average dividend yield, and a very specific five-year plan, Darden looks solid at today’s prices in the low $50”²s.

Full Disclosure: As of this writing, I have no position in DRI.