The Class I operators in the United States appear to be reasonably valued for long-term returns. The balance sheets are in solid condition, they all have competitive advantages against new competitors entering the market, and some of them pay decent dividend yields.

Investors have different approaches to stocks that have performed well. Some investors believe that buying stocks in an uptrend is a smart buying approach, while other investors believe the exact opposite, and instead look to enter positions after big setbacks.

A more fundamental approach is to ignore previous stock movements, and simply focus on the question of whether the current price is fundamentally undervalued, fairly valued, or overvalued compared to the intrinsic value calculated by estimates of forward-looking performance.

Despite the fact that many of these railroad stocks have already outperformed, some of the most-followed value investors that buy with very long-term horizons are the biggest owners in these companies. Bill Gates, and more specifically through his value-investing chief investment officer Michael Larson, is the largest shareholder of Canadian National Railway (CNI, Financial). Warren Buffett took it a step further and acquired the entirety of the Burlington Northern Sante Fe railroad in 2010, and this was his largest acquisition ever.

Based on valuation methods such as the Dividend Discount Model (DDM), many of these stocks appear poised to offer returns in the low double-digit range.

The shareholder yield of a stock is the sum of dividends and share buybacks divided by market capitalization.

In other words, if a company pays a 3% yield and buys back 4% of its shares each year (net of shares issued), then the shareholder yield is 7%. That’s essentially the expected long-term rate of return the investor gets when 0% core growth is expected. When there is growth, it is on top of the shareholder yield, and the shareholder yield is the internal rate of return the company can keep giving shareholders as long as it has stable free cash flows. If the railroad can boost actual volume by 1-2% per year over the long-term (they’ve been going a lot faster than that lately, but it’s part of a rebound and won’t continue indefinitely), and then maintain pricing power of 2-3% increase per year (or in line with whatever the inflation rate is over the period), then another 3-5% rate of return is added onto the shareholder yield.

Investing for the long-term in these railroad stocks, in other words, is basically a bet or estimate that they won’t decline in business. As long as they perform flatly, or have 1-2% growth and maintain pricing power, returns can be in the high single digits or low double digits over the next decade. There won’t be tremendous growth as there was over the last 25 years, but the industry appears to be a good one to put some capital. The companies can just keep chugging along, reducing the share count and raising their dividends, so that long-term investors can own larger and larger portions of the company and increase the yield on cost.

During the unprofitable period of regulation of railroad stocks, the companies had to serve places that were not profitable to serve. The government proponents of high speed rail currently have to work with the freight companies to use some of their infrastructure, which can impact the efficiency of freight shipping.

It’s not a sure-fire problem. With proper planning, passenger trains and freight rail can coexist profitably. Nonetheless, it remains a risk for the industry.

If you like the fundamentals of the industry but want to increase your margin of safety and enter positions with a lower cost basis, selling put options can reduce the cost basis by 10% or so.

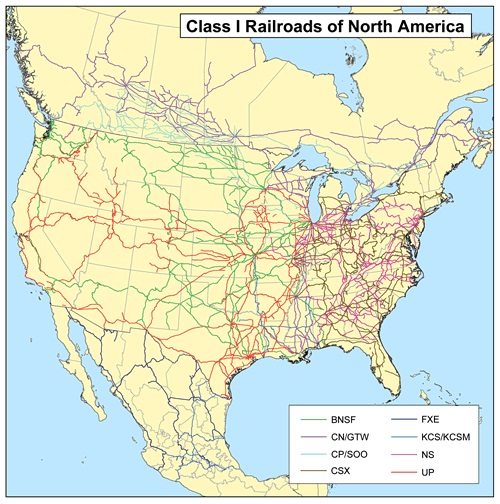

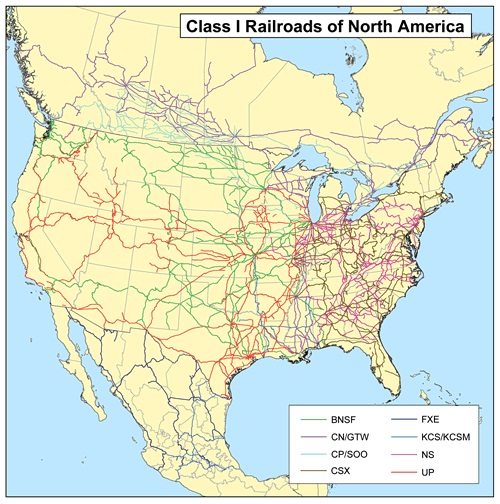

Image Source

Focusing on the U.S. rail lines, the railroad stocks are divided into two or three groups.

Eastern Group

The eastern group consists of CSX Corporation (CSX) and Norfolk Southern (NSC). They share very similar geographic positions across the eastern half of the United States. What you’ll see if you look at the stock price history is that they both took large recent stock price hits (especially NSC), because their coal volumes dropped substantially. There appears to be a long-term trend of natural gas replacing coal for electricity generation, and since three out of the top five states for coal production are in the eastern third of the country, these rail lines have a disproportionate share.

These two companies are also a bit more leveraged than their western counterparts. They took on a bit more debt to buy back shares more aggressively. Still, since they don’t have goodwill from acquisitions and their interest coverage ratios are comfortable, their balance sheets are fair.

The coal headwind and the slightly more leveraged positions have resulted in earnings multiples of only around 11 for both of these companies. These two can be considered the “value plays” out of the five companies.

Western Group

The western railroad stocks are significantly larger than the eastern ones, and their track systems cover two-thirds of the country rather than one-third. These two are Union Pacific (UNP) and BNSF (owned by Berkshire Hathaway).

Union Pacific has the largest track system in the country, has a strong balance sheet, and therefore has a higher earnings multiple at around 15. The company does have exposure to coal from Wyoming (the #1 coal-producing state), but since the overall track system and revenue are so much larger than the eastern rail networks, they have less relative exposure, and therefore despite taking a hit from their coal segment in the last quarter, their overall trend is up.

BNSF is not a pure play since it’s owned by Buffett’s Berkshire Hathaway. If you’d like exposure to the railroad along with insurance holdings, exposure to housing markets, and large stakes in Coca Cola, Wells Faro, IBM, American Express, and other stocks, then Berkshire may be a solid pick. The specifics of BNSF are largely the same as UNP.

Canadian Group

While CSX and NSC are rather similar companies on the east side, and UNP and BNSF are rather similar companies on the west side, Canadian National Railway (CNI) has a distinct position.

There are other Canadian railways, but CNI is the one that has an impact in the United States. They have the privileged position of owning rail lines that stretch from the Atlantic ocean to the Pacific ocean, and then a line that extends perpendicular to that system down to the Gulf of Mexico. They have complete access to all three coasts.

In terms of financials, the company is in similar shape to UNP with a strong balance sheet and a large operation. The operating margins of CNI are the best in the business, but this comes with an earnings multiple of 15. I view this stock as a bit pricey compared to the rest (mainly because its operating margins are already the highest and so there is less room for improvement), but nonetheless I would hold CNI if I currently had a position.

A decent play to add or increase exposure to railroad stocks is to diversify across an eastern and a western railroad, or CNI and one of the eastern or western railroads.

Here’s an overview of the current dividends of each stock:

Full Disclosure: As of this writing, I have no position in any stocks mentioned. NSC is on my watch list for a long position.

The Rail Renaissance

Ever since the 1980”²s when deregulation allowed the rail companies to operate more profitability, railroad stocks in general have enjoyed market-beating returns. Improved automation technologies, increasing congestion of highways (which haven’t kept up with increases in car and truck traffic since the construction was initiated under President Eisenhower), and changes in energy costs (railroads are far more efficient with fuel than trucks are), have allowed railroads to improve their operating margins over time.Investors have different approaches to stocks that have performed well. Some investors believe that buying stocks in an uptrend is a smart buying approach, while other investors believe the exact opposite, and instead look to enter positions after big setbacks.

A more fundamental approach is to ignore previous stock movements, and simply focus on the question of whether the current price is fundamentally undervalued, fairly valued, or overvalued compared to the intrinsic value calculated by estimates of forward-looking performance.

Despite the fact that many of these railroad stocks have already outperformed, some of the most-followed value investors that buy with very long-term horizons are the biggest owners in these companies. Bill Gates, and more specifically through his value-investing chief investment officer Michael Larson, is the largest shareholder of Canadian National Railway (CNI, Financial). Warren Buffett took it a step further and acquired the entirety of the Burlington Northern Sante Fe railroad in 2010, and this was his largest acquisition ever.

Based on valuation methods such as the Dividend Discount Model (DDM), many of these stocks appear poised to offer returns in the low double-digit range.

Returns Come Mostly From Shareholder Yield, Not Growth

One thing all of the railroad companies have in common is that they are using their free cash flow to buy back their own shares in large numbers and pay moderate-yielding dividends.The shareholder yield of a stock is the sum of dividends and share buybacks divided by market capitalization.

In other words, if a company pays a 3% yield and buys back 4% of its shares each year (net of shares issued), then the shareholder yield is 7%. That’s essentially the expected long-term rate of return the investor gets when 0% core growth is expected. When there is growth, it is on top of the shareholder yield, and the shareholder yield is the internal rate of return the company can keep giving shareholders as long as it has stable free cash flows. If the railroad can boost actual volume by 1-2% per year over the long-term (they’ve been going a lot faster than that lately, but it’s part of a rebound and won’t continue indefinitely), and then maintain pricing power of 2-3% increase per year (or in line with whatever the inflation rate is over the period), then another 3-5% rate of return is added onto the shareholder yield.

Investing for the long-term in these railroad stocks, in other words, is basically a bet or estimate that they won’t decline in business. As long as they perform flatly, or have 1-2% growth and maintain pricing power, returns can be in the high single digits or low double digits over the next decade. There won’t be tremendous growth as there was over the last 25 years, but the industry appears to be a good one to put some capital. The companies can just keep chugging along, reducing the share count and raising their dividends, so that long-term investors can own larger and larger portions of the company and increase the yield on cost.

Risks that Could Threaten the Industry

Authors of articles such as this, this, this, and this (in chronological order), have voiced concerns over the risk that high-speed passenger lines, desired by the federal government, may harm freight railroad companies, or at least show the involvement government has to have with these freight lines in order to proceed.During the unprofitable period of regulation of railroad stocks, the companies had to serve places that were not profitable to serve. The government proponents of high speed rail currently have to work with the freight companies to use some of their infrastructure, which can impact the efficiency of freight shipping.

It’s not a sure-fire problem. With proper planning, passenger trains and freight rail can coexist profitably. Nonetheless, it remains a risk for the industry.

If you like the fundamentals of the industry but want to increase your margin of safety and enter positions with a lower cost basis, selling put options can reduce the cost basis by 10% or so.

How to Play It

The Class I railroads in the United States are Norfolk Southern (NSC, Financial), CSX Corporation (CSX, Financial), BNSF (owned by BRK.B), Union Pacific (UNP, Financial), and Canadian National Railway (CNI).

Image Source

Focusing on the U.S. rail lines, the railroad stocks are divided into two or three groups.

Eastern Group

The eastern group consists of CSX Corporation (CSX) and Norfolk Southern (NSC). They share very similar geographic positions across the eastern half of the United States. What you’ll see if you look at the stock price history is that they both took large recent stock price hits (especially NSC), because their coal volumes dropped substantially. There appears to be a long-term trend of natural gas replacing coal for electricity generation, and since three out of the top five states for coal production are in the eastern third of the country, these rail lines have a disproportionate share.

These two companies are also a bit more leveraged than their western counterparts. They took on a bit more debt to buy back shares more aggressively. Still, since they don’t have goodwill from acquisitions and their interest coverage ratios are comfortable, their balance sheets are fair.

The coal headwind and the slightly more leveraged positions have resulted in earnings multiples of only around 11 for both of these companies. These two can be considered the “value plays” out of the five companies.

Western Group

The western railroad stocks are significantly larger than the eastern ones, and their track systems cover two-thirds of the country rather than one-third. These two are Union Pacific (UNP) and BNSF (owned by Berkshire Hathaway).

Union Pacific has the largest track system in the country, has a strong balance sheet, and therefore has a higher earnings multiple at around 15. The company does have exposure to coal from Wyoming (the #1 coal-producing state), but since the overall track system and revenue are so much larger than the eastern rail networks, they have less relative exposure, and therefore despite taking a hit from their coal segment in the last quarter, their overall trend is up.

BNSF is not a pure play since it’s owned by Buffett’s Berkshire Hathaway. If you’d like exposure to the railroad along with insurance holdings, exposure to housing markets, and large stakes in Coca Cola, Wells Faro, IBM, American Express, and other stocks, then Berkshire may be a solid pick. The specifics of BNSF are largely the same as UNP.

Canadian Group

While CSX and NSC are rather similar companies on the east side, and UNP and BNSF are rather similar companies on the west side, Canadian National Railway (CNI) has a distinct position.

There are other Canadian railways, but CNI is the one that has an impact in the United States. They have the privileged position of owning rail lines that stretch from the Atlantic ocean to the Pacific ocean, and then a line that extends perpendicular to that system down to the Gulf of Mexico. They have complete access to all three coasts.

In terms of financials, the company is in similar shape to UNP with a strong balance sheet and a large operation. The operating margins of CNI are the best in the business, but this comes with an earnings multiple of 15. I view this stock as a bit pricey compared to the rest (mainly because its operating margins are already the highest and so there is less room for improvement), but nonetheless I would hold CNI if I currently had a position.

A decent play to add or increase exposure to railroad stocks is to diversify across an eastern and a western railroad, or CNI and one of the eastern or western railroads.

Here’s an overview of the current dividends of each stock:

| Company | Yield | Payout Ratio |

|---|---|---|

| BNSF (Berkshire Hathaway) | 0% | 0% |

| Canadian National Railway | 1.65% | 25% |

| Union Pacific Corporation | 2.23% | 34% |

| CSX Corporation | 2.81% | 31% |

| Norfolk Southern | 3.25% | 36% |

Full Disclosure: As of this writing, I have no position in any stocks mentioned. NSC is on my watch list for a long position.