In The Equity Q Ratio: How Overvaluation Leads To Low Returns and Extreme Losses I examined Universa Chief Investment Officer Mark Spitznagel’s June 2011 working paper The Dao of Corporate Finance, Q Ratios, and Stock Market Crashes (.pdf), and the May 2012 update The Austrians and the Swan: Birds of a Different Feather (.pdf), which discuss the “clear and rigorous evidence of a direct relationship“between overvaluation measured by the equity q ratio and “subsequent extreme losses in the stock market.”

Spitznagel argues that at valuations where the equity q ratio exceeds 0.9, the 110-year relationship points to an “expected (median) drawdown of 20%, and a 20% chance of a larger than 40% correction in the S&P500 within the next few years; these probabilities continually reset as valuations remain elevated, making an eventual deep drawdown from current levels highly likely.”

In his 2011 and 2012 papers, Spitznagel describes the equity q ratio as the “most robust aggregate overvaluation metric, which isolates the key drivers of valuation.” It is also useful in identifying “susceptibility to shifts from any extreme consensus,” which is important because “such shifts of extreme consensus are naturally among the predominant mechanics of stock market crashes.”

He observes that the aggregate US stock market has suffered very few sizeable annual losses (which Spitznagel defines as “20% or more”). Extreme stock market losses are by definition “tail events” as Figure 1 demonstrates.

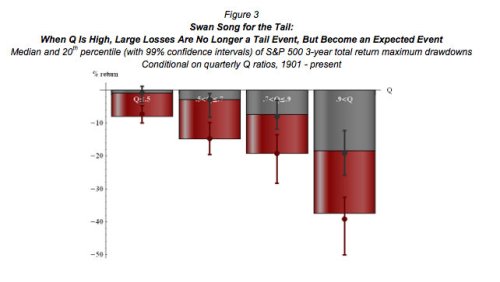

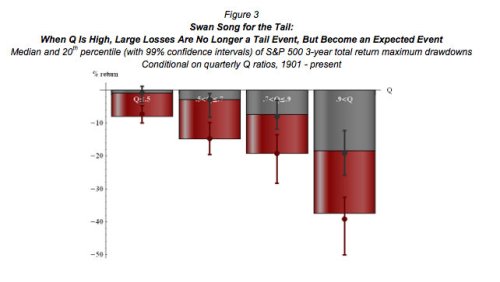

Figure 1 shows how infrequently large drawdowns occur. However, when the equity q ratio is high, large losses are “no longer a tail event, but become an expected event.”

Figure 3 shows the magnitude of potential losses at various equity q ratios. In the last bucket (equity q > 0.9), the expected (median) drawdown is 20 percent, with a 1/5 chance of a greater than 40 percent correction in the S&P500 within the next few years. Spitznagel describes Figure 3 as “[t]he best picture I have ever seen depicting the endogenous risk control to be had from Benjamin Graham’s margin of safety principle (which insists on cheapness to conservative fundamental assumptions in one’s equity exposures, and thus provides added protection against errors in those assumptions).“

Equity q ratios over 0.9 lead to some very ugly results. So where are we now? I’ll discuss it later this week.

Spitznagel argues that at valuations where the equity q ratio exceeds 0.9, the 110-year relationship points to an “expected (median) drawdown of 20%, and a 20% chance of a larger than 40% correction in the S&P500 within the next few years; these probabilities continually reset as valuations remain elevated, making an eventual deep drawdown from current levels highly likely.”

In his 2011 and 2012 papers, Spitznagel describes the equity q ratio as the “most robust aggregate overvaluation metric, which isolates the key drivers of valuation.” It is also useful in identifying “susceptibility to shifts from any extreme consensus,” which is important because “such shifts of extreme consensus are naturally among the predominant mechanics of stock market crashes.”

He observes that the aggregate US stock market has suffered very few sizeable annual losses (which Spitznagel defines as “20% or more”). Extreme stock market losses are by definition “tail events” as Figure 1 demonstrates.

Figure 1 shows how infrequently large drawdowns occur. However, when the equity q ratio is high, large losses are “no longer a tail event, but become an expected event.”

Figure 3 shows the magnitude of potential losses at various equity q ratios. In the last bucket (equity q > 0.9), the expected (median) drawdown is 20 percent, with a 1/5 chance of a greater than 40 percent correction in the S&P500 within the next few years. Spitznagel describes Figure 3 as “[t]he best picture I have ever seen depicting the endogenous risk control to be had from Benjamin Graham’s margin of safety principle (which insists on cheapness to conservative fundamental assumptions in one’s equity exposures, and thus provides added protection against errors in those assumptions).“

Equity q ratios over 0.9 lead to some very ugly results. So where are we now? I’ll discuss it later this week.