Key Points:

It is no surprise to the average investor that dividends are hot. According to Lipper $20.8 billion flowed into Equity Income Funds in 2012.2 In a world of two-ish percent U.S. Treasury yields, who can blame them? Our team has long been a proponent of dividend yield as an investment factor. It works well in the U.S., but phenomenally on a global basis. Despite the rise in valuations of popular domestic dividend payers, we are unwavering in our belief that dividend yield will continue to be an effective character-is tic for stock selection long term. Our historical research indicates that global high-quality, undervalued dividend payers tend to produce strong yield and risk-adjusted return.

But how does this historical evidence translate to the current environment? In the first half of the year, many dividend disciples have watched their portfolios fail to keep pace with the market. In the face of this seeming headwind, several questions have surfaced in our client conversations that are worth further examination.

Generally, those questions are:

The Dividend Trade Has Lots of Room to Run—Globally

The reality of our demographic situation is that ten thousand baby boomers

per day will be retiring through 2030 and the vast majority of them need to generate income in retirement. One often hears that as time goes on investors may gradually move their portfolios towards fixed income investments—leaving equities without a supportive investor. We do not believe this should be the case. As noted by Jim O’Shaughnessy in his recent commentary “A Generational Selling Opportunity for the U.S. Long Bond”, fixed income could prove to be a difficult asset class with which to generate income in retirement, let alone total return.3 Meanwhile, continued financial liberalization and emerging middle classes in populous countries, like China, will likely provide ample buyers of global equities for the next several decades.

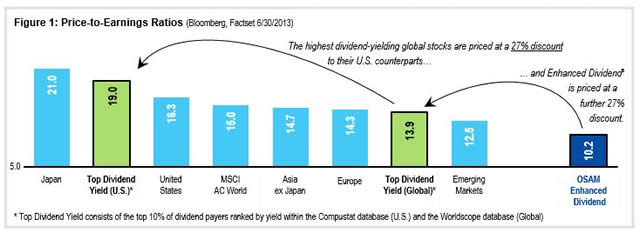

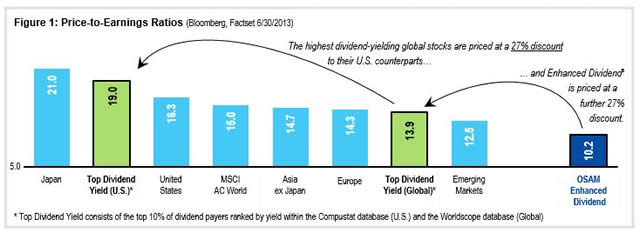

From a current perspective, dividend payers in the U.S. have become expensive relative to the U.S. equity markets. The highest divided payers in the U.S. are currently trading at a price-to-earnings ratio of 19.0✕, which is a 17 percent premium to the U.S. market. When we analyze dividend payers on a global basis, we find that they are 27 percent cheaper than their U.S. counterparts.

We believe these large valuation discounts justify a continuation of the dividend trade—globally. In our own global equity portfolio (Enhanced Dividend®) we have been able to find high-quality stocks at even greater discounts. The portfolio is priced on average at a price-to-earnings ratio of just 10.2✕ with a gross indicated yield of 5.1 percent.4

The Impact of Interest Rate Increases on Dividend Payers

The million dollar question of the day: “What impact do increasing interest rates have on dividend paying stocks?” Mathematically, we know that rising interest rates spell trouble for fixed income investments—notably long-term U.S. Treasurys. Even for “spread” product that provide yield premiums above Treasurys, like corporate or municipal bonds, rapidly rising rates can cause significant issues.

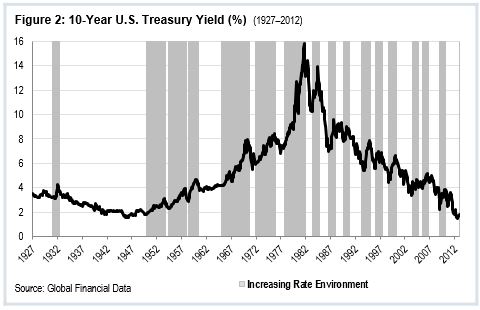

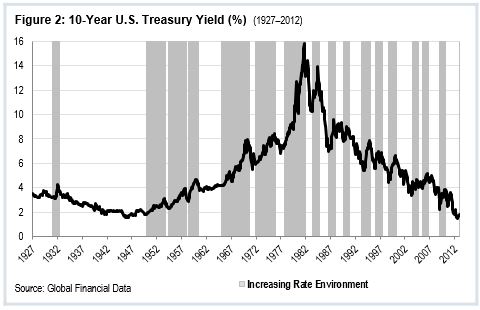

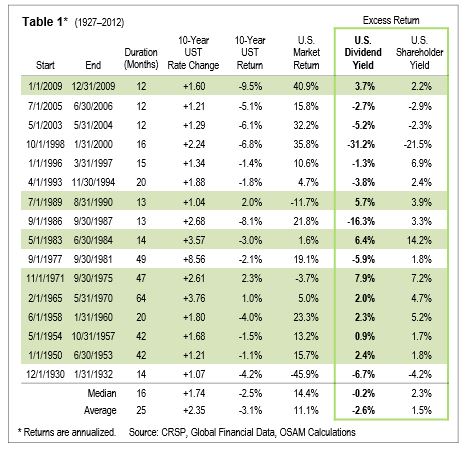

Given the importance of U.S. Treasury rates on asset prices and the global economy, we looked at 10-year U.S. Treasury yields from 1927 through 2012 to identify periods where the yield increased greater than one percent in a 12-month period. There are 16 such instances since 1926, as is shown in the shaded areas of Table 1.

To determine the impact of rising rates, we review the performance of the highest yielding stocks in the U.S. and globally. First, we review stocks in the highest decile of dividend yield and shareholder yield from 1927–2012 in the U.S.5 Next, we perform the same analysis on the highest decile of dividend yield and shareholder yield on global stocks from 1970–2012.6

Shareholder yield is a stock selection concept used in our portfolios that incorporates both share buybacks and also dividend yield in its assessment of yield.

U.S. Dividend Payers—A Fifty-Fifty Track Record with Rising Rates

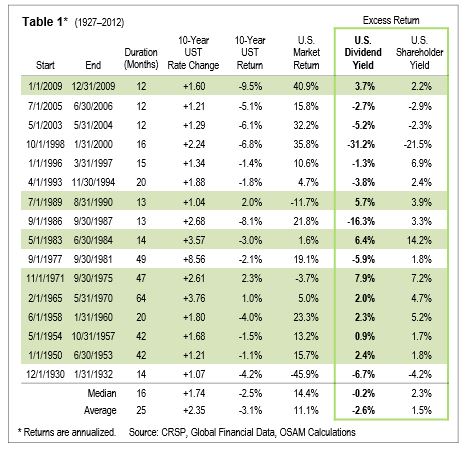

In our analysis, the highest decile of dividend yield in the U.S. outperformed the market in eight of the 16 rising rate environments identified. The average annualized excess return to the top decile of dividend yield was -2.6 per-cent (as shown in Table 1).

As can be expected, a number of different factors have bearing on the performance of dividend payers—secular trends in interest rates, inflation, corporate profitability, valuations, etc. For example, the significant under- performance of dividend yield in the 1998–2000 occurrence may have been more attributable to the bullish fervor which drove equity valuations to extreme levels. By late 2000, the price-to-earnings ratio on the S&P 500 Index rose to 30✕ trailing earnings. Dividend yield, which tends to favor value-oriented investments, would logically lag its high-flying growth counterparts during similar periods.

Also interesting is that the duration of rising rate environments is distinctly shorter after 1982. The average duration declines to 14 months from 40 months prior to 1982. A possible explanation could be changes in the monetary mechanism influencing interest rates. In 1982, the Federal Open Market Committee (FOMC) first referenced a targeted federal funds rate.7

Alternatively, rate increases may simply manifest themselves over longer periods in secular bond bear markets, as was the case prior to 1982. During the more gradual pre-1982 rising rate environments, dividend yield in the U.S. seems to do slightly better. However, our research leads us to believe there is a better stock selection factor in the U.S. to access yield in these rising rate environments.

A “Yield” Alternative to Dividends in the U.S.

Whereas the results for dividend yield in the U.S. in Table 1 suggest underperformance, shareholder yield historically produces positive excess returns on average more consistently across rising rate environments back to 1927. Shareholder yield outperformed in 12 of the 16 rising rate environments in Table 1 by on average +1.5 percent, making it the more consistent performer of the two yield factors during rate increases.

On a longer term basis—and for the reasons outlined in our white paper “Why U.S. Investors Should Look Beyond Dividend Yield”—our team prefers shareholder yield as a stock selection factor in the U.S.8 From 1927–2012, stocks in the best decile of shareholder yield outperformed the U.S. market by +2.8 percent on average per year with a superior risk adjusted return. This compares favor-ably with dividend yield which outperforms the U.S. market by just +1.3 percent per year on average over the same time frame. We believe this is partly because, at least over the last 25 years, U.S. companies have moved away from issuing dividends in favor of share buybacks. Shareholder yield is agnostic to the chosen form of dividend/buyback policy which allows a broader opportunity set.

Given these results and our historical research on the factor, we believe shareholder yield should be used as a primary stock selection factor in the U.S., instead of dividend yield alone. We now turn to the performance of dividend yield on a global basis in rising rate environments.

Global Dividend Yield Historically Outperforms in Rising Rate Environments

Domestic investors have traditionally allocated significant portions of their equity investments to the U.S. because of a cognitive bias towards their home country, but doing so may place them at a significant disadvantage. According to the International Monetary Fund, the U.S. represents just 19 percent of global economic output on a purchasing power basis. Thus, indicating that investors are omitting a significant portion of the global economy from their portfolios—effectively operating with one hand tied behind their backs.9

This same home bias also causes us to extrapolate domestic perceptions and events onto the global market-place. The very question, “How will rising interest rates impact dividend payers?” betrays this bias. The simple answer is that rising U.S. interest rates can impact other countries and regions in myriad different ways.

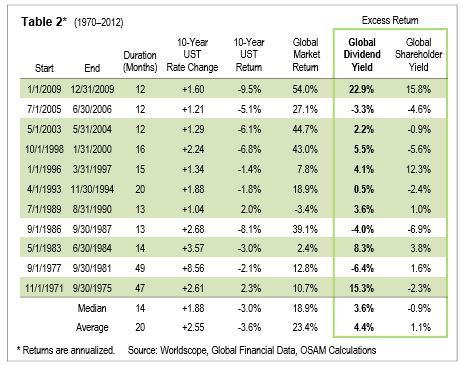

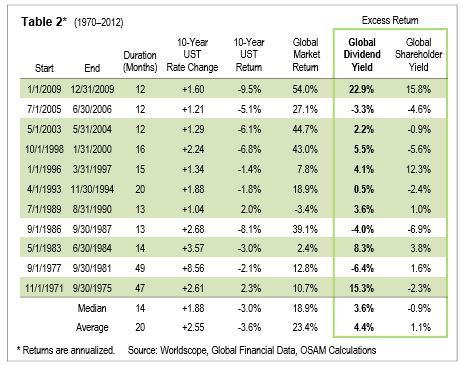

To demonstrate, we perform the same rising rate analysis on the highest decile of dividend yield and shareholder yield in the global equity market from 1970–2012. The analysis includes 11 periods where U.S. Treasury yields increased greater than one percent in a 12-month period. In eight out of the 11 periods, the top decile of dividend yield outperforms the global market by on average +4.4 percent annualized.

Whereas, rising U.S. interest rates may have an impact on U.S. dividend payers, the historical evidence suggests that return benefits exist for portfolio exposure across multiple countries in rising rate environments. We believe this to be the case because individual economies are driven by economic, interest rate, inflation and currency regimes that operate some-what independently of each other.

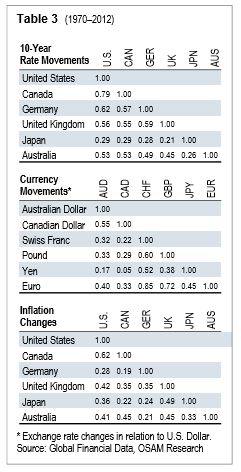

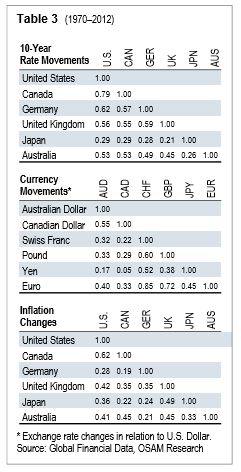

As shown in Table 3, changes in these key economic metrics are lowly correlated across individual economies.

An Opportunistic Approach to Global Yield & Valuation

So far, we have established that global dividend payers are significantly undervalued relative to their U.S. counterparts and global dividend payers fair better in rising rate environments. The next question logically is how to separate the wheat from the chaff in the global equity marketplace. Though there are clearly benefits to broad global diversification in seeking yield, we believe portfolio allocations should ultimately be dictated from a bottom up perspective by underlying company fundamentals—not by geopolitical events, sovereign issues, or arbitrary benchmark constraints.

Our research has generally found that the freedom to make strategic allocations to areas of the market which demonstrate the best opportunities in the characteristics we favor—value, quality, and yield—can be a significant source of long-term outperformance. Currently, we believe that there exist longer-termopportunities in high quality, undervalued names in Emerging Markets and Europe on the basis of geography, and Energy and Telecom on a sector basis.10This view is based on the discounted valuations as shown in Figures 1 and Table 4. Quite simply, these are relatively undervalued areas of the market with strong yields.

At times a benchmark agnostic approach characterized by high Active Share, such as ours, may result in what appear to be concentrated exposures in a given region or sector.11 We argue, however, that in the context of a global portfolio, there often exists an under-appreciated level of diversification.

Take the Telecommunications sector for example—a significant overweight in our client portfolios because of its cheapness relative to other sectors and its high yields. Viewed through the lens of our Value Composite as shown in Table 4, the Telecom sector is cheaper than 70 percent of stocks in the global equity market. Only the Energy sector—another sector we favor in client portfolios—is less expensive on a global basis. Names in the Energy sector are on average cheaper than 73 percent of stocks in the global marketplace.12

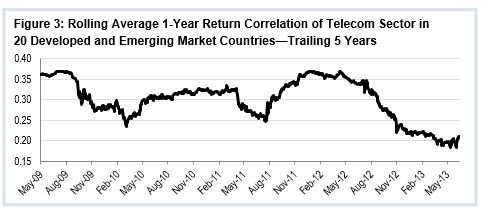

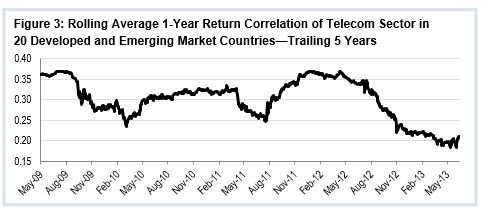

Should investors view exposure to the global Telecom sector as a whole in the same way exposure to the domestic Telecom sector is viewed? The evidence suggests no. A break-down of the Telecom sector across 20 developed and emerging countries reveals that the correlation of returns with U.S. Telecoms is actually fairly low, an average of 0.21 since 1995 and currently also at 0.21 (see Figure 3). This low correlation suggests that even portfolios with high allocations to a single global sector can offer underlying diversification driven by multiple geographic exposures.

For example, during the 1998–2001 period of rising interest rates shown in Tables 1 & 2 for U.S. and global dividend payers, respectively, U.S. dividend payers struggled mightily while global dividend payers outperformed. During that instance the U.S. Telecom sector underperformed the global market by -1.1 percent. Mean-while, French, United Kingdom, and Japanese Telecoms outperformed by +33.4, +13.7, and +4.3 percent respectively. In other words, do not let the diversification tail wag the investment dog. Our team believes that taking advantage of mispricings in the market is a key to long-term investment success.

CONCLUSION

Given significantly discounted valuations of the top decile of stocks by global dividend yield relative to U.S. counterparts, we believe a continuation of the dividend trade is justified. As it relates to the prospect of increasing interest rates, historical evidence is inconclusive on the performance of U.S. dividend payers in rising rate environments. Other factors, like valuation, quality, and yield, likely have greater influence on future returns. A more effective total return factor in the U.S. over the long term, and in rising rate environments, is shareholder yield. Shareholder yield is the driving stock selection factor in our Market Leaders Value strategy. The strategy has a shareholder yield of 7.6 percent—200 percent greater than the Russell 1000 Value benchmark, and is priced at a 15 percent discount based on price-to-earnings ratio (as of 6/30/2013).

For those investors looking to maintain, or enhance, their equity income stream in a rising interest rate environment, our research suggests that a diversified exposure to dividend yield across the global equity marketplace could be a potential solution. Our Enhanced Dividend strategy seeks these high-quality global dividend payers and currently offers a dividend yield of 5.1 percent while priced at a 32 percent discount to the MSCI All Country World Index benchmark.

An unemotional approach to stock selection, based on valuation and devoid of consideration for news flow or geopolitical events, currently suggests a strategic allocation to select names in Emerging Markets and Europe, and Energy and Telecom.

See the original here.

- Global dividend payers are undervalued relative to U.S. counterparts

- Valuations indicate the dividend trade has room to run—globally

- In rising rate environments:

- U.S. dividends historically underperform

- U.S. shareholder yield historically outperforms

- Global dividends historically outperform

The S&P 500 Index has risen over 150 percent since March 9, 2009 in what could arguably be deemed the most hated equity rally of all time. The MSCI All Country World Index, one of the broadest global indices, has risen “just” 110 percent since its March 2009 nadir. Evidence indicates that United States (U.S.) investors have not participated in this rally—a truly sad state of affairs.1 It is worthy of noting that over the last several years a number of well known market pundits have viscerally rejected the equity rally due to macroeconomic concerns. The reality, however, is that stock returns are more highly correlated with the price you pay than macroeconomic events. The one place U.S. investors seem to have nibbled as they tip-toe back into the equity market is in U.S. dividend paying equities.

- A focus on valuation and yield currently favors investments in Europe, Emerging Markets, global Telecom, and Energy

It is no surprise to the average investor that dividends are hot. According to Lipper $20.8 billion flowed into Equity Income Funds in 2012.2 In a world of two-ish percent U.S. Treasury yields, who can blame them? Our team has long been a proponent of dividend yield as an investment factor. It works well in the U.S., but phenomenally on a global basis. Despite the rise in valuations of popular domestic dividend payers, we are unwavering in our belief that dividend yield will continue to be an effective character-is tic for stock selection long term. Our historical research indicates that global high-quality, undervalued dividend payers tend to produce strong yield and risk-adjusted return.

But how does this historical evidence translate to the current environment? In the first half of the year, many dividend disciples have watched their portfolios fail to keep pace with the market. In the face of this seeming headwind, several questions have surfaced in our client conversations that are worth further examination.

Generally, those questions are:

- Is the dividend trade over?

- How will rising interest rates impact dividend-paying stocks?

Below, we address each of these issues. And we think you will find the results intuitive yet surprising.

- What opportunities exist in the global equity markets?

The Dividend Trade Has Lots of Room to Run—Globally

The reality of our demographic situation is that ten thousand baby boomers

per day will be retiring through 2030 and the vast majority of them need to generate income in retirement. One often hears that as time goes on investors may gradually move their portfolios towards fixed income investments—leaving equities without a supportive investor. We do not believe this should be the case. As noted by Jim O’Shaughnessy in his recent commentary “A Generational Selling Opportunity for the U.S. Long Bond”, fixed income could prove to be a difficult asset class with which to generate income in retirement, let alone total return.3 Meanwhile, continued financial liberalization and emerging middle classes in populous countries, like China, will likely provide ample buyers of global equities for the next several decades.

From a current perspective, dividend payers in the U.S. have become expensive relative to the U.S. equity markets. The highest divided payers in the U.S. are currently trading at a price-to-earnings ratio of 19.0✕, which is a 17 percent premium to the U.S. market. When we analyze dividend payers on a global basis, we find that they are 27 percent cheaper than their U.S. counterparts.

We believe these large valuation discounts justify a continuation of the dividend trade—globally. In our own global equity portfolio (Enhanced Dividend®) we have been able to find high-quality stocks at even greater discounts. The portfolio is priced on average at a price-to-earnings ratio of just 10.2✕ with a gross indicated yield of 5.1 percent.4

The Impact of Interest Rate Increases on Dividend Payers

The million dollar question of the day: “What impact do increasing interest rates have on dividend paying stocks?” Mathematically, we know that rising interest rates spell trouble for fixed income investments—notably long-term U.S. Treasurys. Even for “spread” product that provide yield premiums above Treasurys, like corporate or municipal bonds, rapidly rising rates can cause significant issues.

Given the importance of U.S. Treasury rates on asset prices and the global economy, we looked at 10-year U.S. Treasury yields from 1927 through 2012 to identify periods where the yield increased greater than one percent in a 12-month period. There are 16 such instances since 1926, as is shown in the shaded areas of Table 1.

To determine the impact of rising rates, we review the performance of the highest yielding stocks in the U.S. and globally. First, we review stocks in the highest decile of dividend yield and shareholder yield from 1927–2012 in the U.S.5 Next, we perform the same analysis on the highest decile of dividend yield and shareholder yield on global stocks from 1970–2012.6

Shareholder yield is a stock selection concept used in our portfolios that incorporates both share buybacks and also dividend yield in its assessment of yield.

U.S. Dividend Payers—A Fifty-Fifty Track Record with Rising Rates

In our analysis, the highest decile of dividend yield in the U.S. outperformed the market in eight of the 16 rising rate environments identified. The average annualized excess return to the top decile of dividend yield was -2.6 per-cent (as shown in Table 1).

As can be expected, a number of different factors have bearing on the performance of dividend payers—secular trends in interest rates, inflation, corporate profitability, valuations, etc. For example, the significant under- performance of dividend yield in the 1998–2000 occurrence may have been more attributable to the bullish fervor which drove equity valuations to extreme levels. By late 2000, the price-to-earnings ratio on the S&P 500 Index rose to 30✕ trailing earnings. Dividend yield, which tends to favor value-oriented investments, would logically lag its high-flying growth counterparts during similar periods.

Also interesting is that the duration of rising rate environments is distinctly shorter after 1982. The average duration declines to 14 months from 40 months prior to 1982. A possible explanation could be changes in the monetary mechanism influencing interest rates. In 1982, the Federal Open Market Committee (FOMC) first referenced a targeted federal funds rate.7

Alternatively, rate increases may simply manifest themselves over longer periods in secular bond bear markets, as was the case prior to 1982. During the more gradual pre-1982 rising rate environments, dividend yield in the U.S. seems to do slightly better. However, our research leads us to believe there is a better stock selection factor in the U.S. to access yield in these rising rate environments.

A “Yield” Alternative to Dividends in the U.S.

Whereas the results for dividend yield in the U.S. in Table 1 suggest underperformance, shareholder yield historically produces positive excess returns on average more consistently across rising rate environments back to 1927. Shareholder yield outperformed in 12 of the 16 rising rate environments in Table 1 by on average +1.5 percent, making it the more consistent performer of the two yield factors during rate increases.

On a longer term basis—and for the reasons outlined in our white paper “Why U.S. Investors Should Look Beyond Dividend Yield”—our team prefers shareholder yield as a stock selection factor in the U.S.8 From 1927–2012, stocks in the best decile of shareholder yield outperformed the U.S. market by +2.8 percent on average per year with a superior risk adjusted return. This compares favor-ably with dividend yield which outperforms the U.S. market by just +1.3 percent per year on average over the same time frame. We believe this is partly because, at least over the last 25 years, U.S. companies have moved away from issuing dividends in favor of share buybacks. Shareholder yield is agnostic to the chosen form of dividend/buyback policy which allows a broader opportunity set.

Given these results and our historical research on the factor, we believe shareholder yield should be used as a primary stock selection factor in the U.S., instead of dividend yield alone. We now turn to the performance of dividend yield on a global basis in rising rate environments.

Global Dividend Yield Historically Outperforms in Rising Rate Environments

Domestic investors have traditionally allocated significant portions of their equity investments to the U.S. because of a cognitive bias towards their home country, but doing so may place them at a significant disadvantage. According to the International Monetary Fund, the U.S. represents just 19 percent of global economic output on a purchasing power basis. Thus, indicating that investors are omitting a significant portion of the global economy from their portfolios—effectively operating with one hand tied behind their backs.9

This same home bias also causes us to extrapolate domestic perceptions and events onto the global market-place. The very question, “How will rising interest rates impact dividend payers?” betrays this bias. The simple answer is that rising U.S. interest rates can impact other countries and regions in myriad different ways.

To demonstrate, we perform the same rising rate analysis on the highest decile of dividend yield and shareholder yield in the global equity market from 1970–2012. The analysis includes 11 periods where U.S. Treasury yields increased greater than one percent in a 12-month period. In eight out of the 11 periods, the top decile of dividend yield outperforms the global market by on average +4.4 percent annualized.

Whereas, rising U.S. interest rates may have an impact on U.S. dividend payers, the historical evidence suggests that return benefits exist for portfolio exposure across multiple countries in rising rate environments. We believe this to be the case because individual economies are driven by economic, interest rate, inflation and currency regimes that operate some-what independently of each other.

As shown in Table 3, changes in these key economic metrics are lowly correlated across individual economies.

An Opportunistic Approach to Global Yield & Valuation

So far, we have established that global dividend payers are significantly undervalued relative to their U.S. counterparts and global dividend payers fair better in rising rate environments. The next question logically is how to separate the wheat from the chaff in the global equity marketplace. Though there are clearly benefits to broad global diversification in seeking yield, we believe portfolio allocations should ultimately be dictated from a bottom up perspective by underlying company fundamentals—not by geopolitical events, sovereign issues, or arbitrary benchmark constraints.

Our research has generally found that the freedom to make strategic allocations to areas of the market which demonstrate the best opportunities in the characteristics we favor—value, quality, and yield—can be a significant source of long-term outperformance. Currently, we believe that there exist longer-termopportunities in high quality, undervalued names in Emerging Markets and Europe on the basis of geography, and Energy and Telecom on a sector basis.10This view is based on the discounted valuations as shown in Figures 1 and Table 4. Quite simply, these are relatively undervalued areas of the market with strong yields.

At times a benchmark agnostic approach characterized by high Active Share, such as ours, may result in what appear to be concentrated exposures in a given region or sector.11 We argue, however, that in the context of a global portfolio, there often exists an under-appreciated level of diversification.

Take the Telecommunications sector for example—a significant overweight in our client portfolios because of its cheapness relative to other sectors and its high yields. Viewed through the lens of our Value Composite as shown in Table 4, the Telecom sector is cheaper than 70 percent of stocks in the global equity market. Only the Energy sector—another sector we favor in client portfolios—is less expensive on a global basis. Names in the Energy sector are on average cheaper than 73 percent of stocks in the global marketplace.12

Should investors view exposure to the global Telecom sector as a whole in the same way exposure to the domestic Telecom sector is viewed? The evidence suggests no. A break-down of the Telecom sector across 20 developed and emerging countries reveals that the correlation of returns with U.S. Telecoms is actually fairly low, an average of 0.21 since 1995 and currently also at 0.21 (see Figure 3). This low correlation suggests that even portfolios with high allocations to a single global sector can offer underlying diversification driven by multiple geographic exposures.

For example, during the 1998–2001 period of rising interest rates shown in Tables 1 & 2 for U.S. and global dividend payers, respectively, U.S. dividend payers struggled mightily while global dividend payers outperformed. During that instance the U.S. Telecom sector underperformed the global market by -1.1 percent. Mean-while, French, United Kingdom, and Japanese Telecoms outperformed by +33.4, +13.7, and +4.3 percent respectively. In other words, do not let the diversification tail wag the investment dog. Our team believes that taking advantage of mispricings in the market is a key to long-term investment success.

CONCLUSION

Given significantly discounted valuations of the top decile of stocks by global dividend yield relative to U.S. counterparts, we believe a continuation of the dividend trade is justified. As it relates to the prospect of increasing interest rates, historical evidence is inconclusive on the performance of U.S. dividend payers in rising rate environments. Other factors, like valuation, quality, and yield, likely have greater influence on future returns. A more effective total return factor in the U.S. over the long term, and in rising rate environments, is shareholder yield. Shareholder yield is the driving stock selection factor in our Market Leaders Value strategy. The strategy has a shareholder yield of 7.6 percent—200 percent greater than the Russell 1000 Value benchmark, and is priced at a 15 percent discount based on price-to-earnings ratio (as of 6/30/2013).

For those investors looking to maintain, or enhance, their equity income stream in a rising interest rate environment, our research suggests that a diversified exposure to dividend yield across the global equity marketplace could be a potential solution. Our Enhanced Dividend strategy seeks these high-quality global dividend payers and currently offers a dividend yield of 5.1 percent while priced at a 32 percent discount to the MSCI All Country World Index benchmark.

An unemotional approach to stock selection, based on valuation and devoid of consideration for news flow or geopolitical events, currently suggests a strategic allocation to select names in Emerging Markets and Europe, and Energy and Telecom.

See the original here.