The PowerShares CEF Income Composite Portfolio ETF (PCEF) is currently down 0.75% year to date.

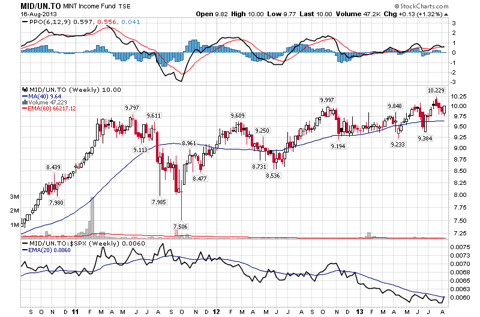

(click to enlarge)

In this article, I will feature one closed-end fund that has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

(click to enlarge)

Insider Buying by Insider (Last 30 Days)

Here is a table of MINT Income Fund's insider-trading activity by calendar month.

There have been 57,718 shares purchased and there have been zero shares sold by the insiders since March 2013.

Top 10 Holdings

MINT Income Fund's top 10 holdings as of June 30 were:

1. Magna International (MGA)

2. Peyto Exploration & Development (PEYUF.PK)

3. Perpetual Energy (PMGYF.PK) 8.75% due March 15, 2018

4. Trilogy Energy (TETZF.PK)

5. ARC Resources (AETUF.PK)

6. Canexus (CXUSF.PK)

7. Labrador Iron Ore Royalty Corporation (LIFZF.PK)

8. ADT Corporation (ADT)

9. JPMorgan Chase & Co. (JPM)

10. E.I. du Pont de Nemours and Company (DuPont) (DD, Financial)

Peyto Exploration & Development, JPMorgan and DuPont have seen insider selling during the past 30 days. Perpetual Energy, Canexus and ADT Corporation have seen insider buying during the past 30 days. ARC Resources has seen both insider buying and selling during the past 30 days.

Conclusion

There have been three different insiders buying MINT Income Fund and there have not been any insiders selling MINT Income Fund during the past 30 days. All three of these insiders increased their holdings by more than 10%. MINT Income Fund has a dividend yield of 7.2%. As of Aug. 15 MINT Income Fund had a net asset value of $9.83 per share. The stock is currently trading at $10, which could be a good entry point for the stock.

Disclosure: I have no positions in any stocks mentioned

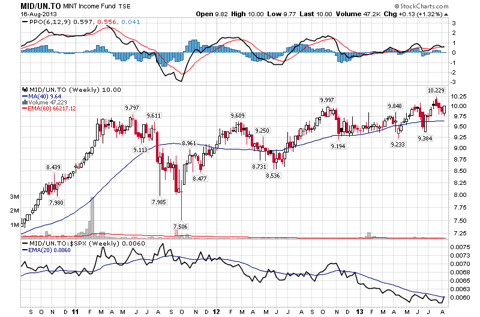

(click to enlarge)

In this article, I will feature one closed-end fund that has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

- The stock is purchased by three or more insiders within one month.

- The stock is sold by no insiders in the month of intensive purchasing.

- At least two purchasers increase their holdings by more than 10%.

(click to enlarge)

Insider Buying by Insider (Last 30 Days)

- Jeremy Brasseur purchased 9,600 shares on August 14-15 and currently holds 9,600 shares or less than 0.1% of the company. Jeremy Brasseur is an insider of the company.

- Robert Lauzon purchased 1,000 shares on August 13 pursuant to a public offering. Robert Lauzon currently holds 1,000 shares or less than 0.1% of the company. Robert Lauzon is Chairman of the Board, President of Middlefield Fund Management Limited.

- Dean Orrico purchased 12,118 shares on August 12-13 and currently controls 39,434 shares or 0.3% of the company. Dean Orrico serves as a director.

Here is a table of MINT Income Fund's insider-trading activity by calendar month.

| Month | Insider buying / shares | Insider selling / shares |

| August 2013 | 22,718 | 0 |

| July 2013 | 0 | 0 |

| June 2013 | 10,200 | 0 |

| May 2013 | 7,900 | 0 |

| April 2013 | 5,600 | 0 |

| March 2013 | 11,300 | 0 |

Top 10 Holdings

MINT Income Fund's top 10 holdings as of June 30 were:

1. Magna International (MGA)

2. Peyto Exploration & Development (PEYUF.PK)

3. Perpetual Energy (PMGYF.PK) 8.75% due March 15, 2018

4. Trilogy Energy (TETZF.PK)

5. ARC Resources (AETUF.PK)

6. Canexus (CXUSF.PK)

7. Labrador Iron Ore Royalty Corporation (LIFZF.PK)

8. ADT Corporation (ADT)

9. JPMorgan Chase & Co. (JPM)

10. E.I. du Pont de Nemours and Company (DuPont) (DD, Financial)

Peyto Exploration & Development, JPMorgan and DuPont have seen insider selling during the past 30 days. Perpetual Energy, Canexus and ADT Corporation have seen insider buying during the past 30 days. ARC Resources has seen both insider buying and selling during the past 30 days.

Conclusion

There have been three different insiders buying MINT Income Fund and there have not been any insiders selling MINT Income Fund during the past 30 days. All three of these insiders increased their holdings by more than 10%. MINT Income Fund has a dividend yield of 7.2%. As of Aug. 15 MINT Income Fund had a net asset value of $9.83 per share. The stock is currently trading at $10, which could be a good entry point for the stock.

Disclosure: I have no positions in any stocks mentioned