One real estate investment trust has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

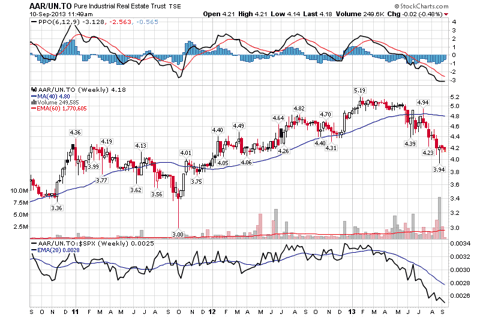

(click to enlarge)

Insider Buying During the Last 30 Days

Here is a table of Pure Industrial Real Estate Trust's insider-trading activity by calendar month.

There have been 87,400 shares purchased and there have been 5,000 shares sold by insiders since March 2013.

Financials

Pure Industrial Real Estate Trust reported the second-quarter financial results on Aug. 12 with the following highlights:

Outlook

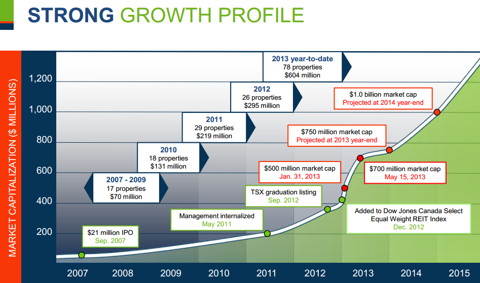

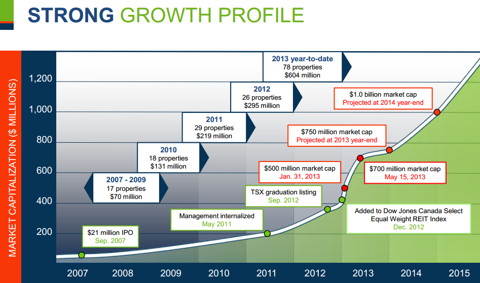

Pure Industrial Real Estate Trust has projected a $1.0 billion market cap by the end of 2014.

(click to enlarge)

Competition

Pure Industrial Real Estate Trust's competitors include Dundee Industrial REIT (TSX:DIR.UN), Summit Industrial Income REIT (TSX:SMU.UN) and WPT Industrial REIT (TSX:WIR.U). Dundee Industrial REIT has seen 23 insider buy transactions and one insider sell transaction during the past six months. Dundee Industrial REIT has a dividend yield of 8.4%. Summit Industrial Income REIT has seen 64 insider buy transactions during the past six months. Summit Industrial Income REIT has a dividend yield of 8.6%.

Peer analysis

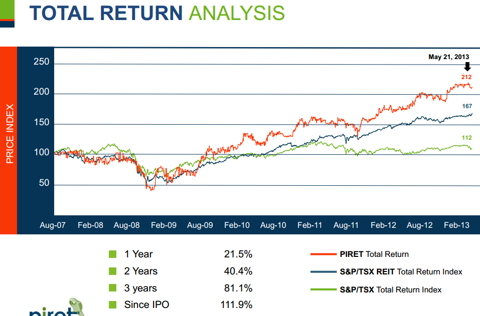

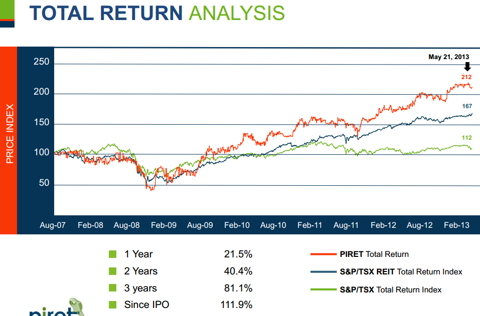

Pure Industrial Real Estate Trust has outperformed the peer group since its IPO in September 2007.

(click to enlarge)

Conclusion

There have been three different insiders buying Pure Industrial Real Estate Trust and there have not been any insiders selling Pure Industrial Real Estate Trust during the last 30 days. Two out of these three insiders increased their holdings by more than 10%.

There are five analyst buy ratings, one neutral rating and zero sell ratings with an average target price of $5.75. Pure Industrial Real Estate Trust has a book value of $4.42 per share and the stock has a dividend yield of 7.5%. I believe the stock could be a good pick below the book value of $4.42 per share.

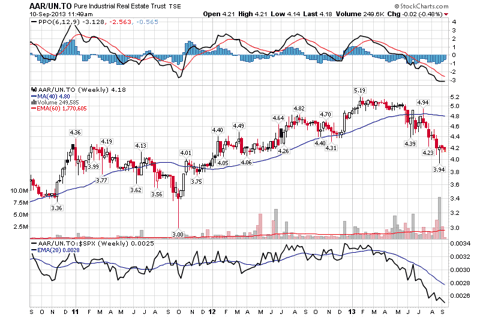

(click to enlarge)

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

- The stock is purchased by three or more insiders within one month.

- The stock is sold by no insiders in the month of intensive purchasing.

- At least two purchasers increase their holdings by more than 10%.

(click to enlarge)

Insider Buying During the Last 30 Days

- Darren Latoski purchased 4,500 shares on Aug. 27 and currently holds 14,077 shares or less than 0.1% of the company. Darren Latoski is Trustee and co-chief executive officer. Darren Latoski increased his holdings by 47.0% in August.

- Douglas Scott purchased 1,600 shares on August 27 and currently controls 57,251 shares or less than 0.1% of the company. Douglas Scott serves as a director of the company. Douglas Scott increased his holdings by 2.9% in August.

- Francis Tam purchased 45,000 shares on Sept. 3 and currently holds 51,800 shares or less than 0.1% of the company. Francis Tam is chief financial officer of the company. Francis Tam increased his holdings by 661.8% in August.

Here is a table of Pure Industrial Real Estate Trust's insider-trading activity by calendar month.

| Month | Insider buying / shares | Insider selling / shares |

| September 2013 | 45,000 | 0 |

| August 2013 | 6,100 | 0 |

| July 2013 | 0 | 0 |

| June 2013 | 19,300 | 0 |

| May 2013 | 3,000 | 0 |

| April 2013 | 0 | 0 |

| March 2013 | 14,000 | 5,000 |

There have been 87,400 shares purchased and there have been 5,000 shares sold by insiders since March 2013.

Financials

Pure Industrial Real Estate Trust reported the second-quarter financial results on Aug. 12 with the following highlights:

| Revenue | $25.8 million |

| Funds from operations | $21.5 million |

| Cash | $9.8 million |

| Debt | $720.5 million |

Outlook

Pure Industrial Real Estate Trust has projected a $1.0 billion market cap by the end of 2014.

(click to enlarge)

Competition

Pure Industrial Real Estate Trust's competitors include Dundee Industrial REIT (TSX:DIR.UN), Summit Industrial Income REIT (TSX:SMU.UN) and WPT Industrial REIT (TSX:WIR.U). Dundee Industrial REIT has seen 23 insider buy transactions and one insider sell transaction during the past six months. Dundee Industrial REIT has a dividend yield of 8.4%. Summit Industrial Income REIT has seen 64 insider buy transactions during the past six months. Summit Industrial Income REIT has a dividend yield of 8.6%.

Peer analysis

Pure Industrial Real Estate Trust has outperformed the peer group since its IPO in September 2007.

(click to enlarge)

Conclusion

There have been three different insiders buying Pure Industrial Real Estate Trust and there have not been any insiders selling Pure Industrial Real Estate Trust during the last 30 days. Two out of these three insiders increased their holdings by more than 10%.

There are five analyst buy ratings, one neutral rating and zero sell ratings with an average target price of $5.75. Pure Industrial Real Estate Trust has a book value of $4.42 per share and the stock has a dividend yield of 7.5%. I believe the stock could be a good pick below the book value of $4.42 per share.

(click to enlarge)

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.