One electric utility has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

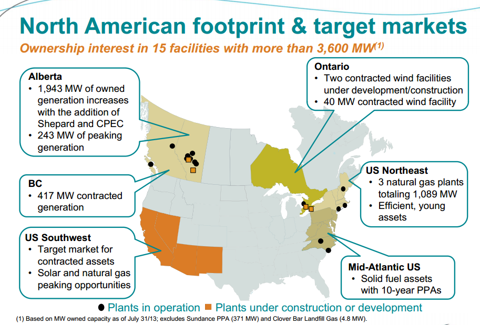

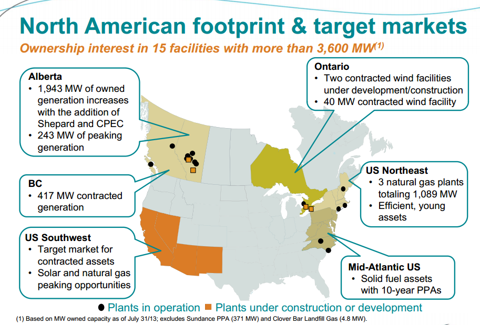

Capital Power Corporation (TSX:CPX, Financial), an independent power producer, acquires, develops and operates power generation facilities in Canada and the U.S.

(click to enlarge)

Insider Buying During the Last 30 Days

Here is a table of Capital Power's insider-trading activity by calendar month.

There have been 17,741 shares purchased and there have been zero shares sold by insiders since March 2013.

Financials

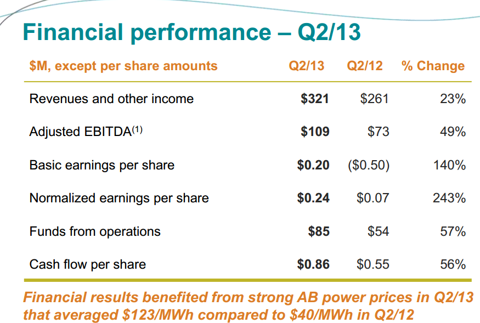

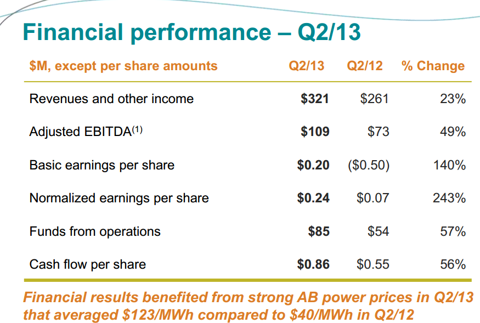

Capital Power reported the second-quarter financial results on July 26 with the following highlights:

(click to enlarge)

Outlook

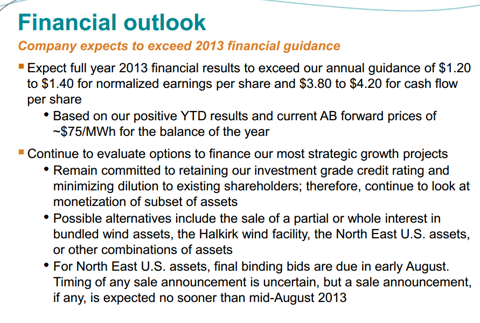

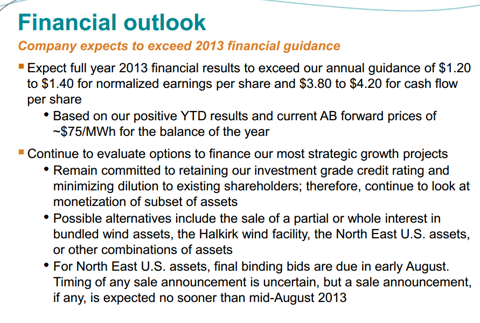

Capital Power expects full year 2013 financial results to exceed the high end of its annual guidance of $1.20 to $1.40 for normalized earnings per share and $3.80 to $4.20 for cash flow per share.

(click to enlarge)

Competition

Capital Power's competitors include TransAlta Corp. (TAC, Financial) and Calpine Corp. (CPN, Financial). TransAlta has not seen any insider buy transactions during the past six months. TransAlta has a dividend yield of 8.4%. Calpine has seen five insider sell transactions and one insider buy transaction this year.

Conclusion

There have been three different insiders buying Capital Power and there have not been any insiders selling Capital Power during the last 30 days. All three of these insiders increased their holdings by more than 10%.

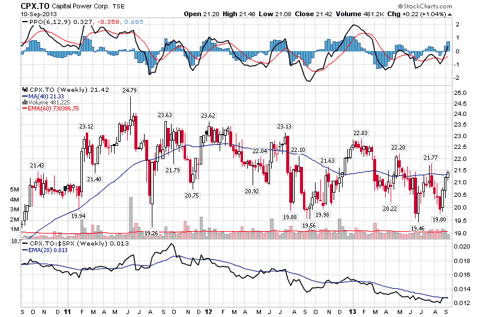

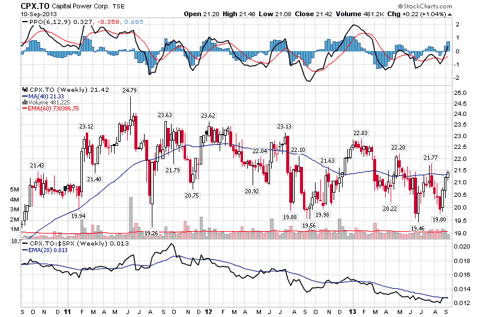

There are three analyst buy ratings, five neutral ratings and two sell ratings with an average target price of $23.68. Capital Power has a book value of $30.22 per share and the stock has a dividend yield of 5.9%. I believe the stock could be a good pick below the book value of $30.22 per share.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

Capital Power Corporation (TSX:CPX, Financial), an independent power producer, acquires, develops and operates power generation facilities in Canada and the U.S.

(click to enlarge)

Insider Buying During the Last 30 Days

- Bryan DeNeve purchased 2,385 shares on Aug. 30 and currently holds 8,362 shares or less than 0.1% of the company. Bryan DeNeve is responsible for commercial services, commodity portfolio management and corporate strategy. Bryan DeNeve increased his holdings by 39.9% in August.

- Philip Lachambre purchased 5,000 shares on Sept. 3 and currently holds 10,000 shares or less than 0.1% of the company. Philip Lachambre serves as a director of the company. Philip Lachambre increased his holdings by 100% in September.

- Brian Vaasjo purchased 8,000 shares on Sept. 9 and currently holds 65,800 shares or less than 0.1% of the company. Brian Vaasjo is president and chief executive officer. Brian Vaasjo increased his holdings by 13.8% in September.

Here is a table of Capital Power's insider-trading activity by calendar month.

| Month | Insider buying / shares | Insider selling / shares |

| September 2013 | 13,000 | 0 |

| August 2013 | 2,385 | 0 |

| July 2013 | 0 | 0 |

| June 2013 | 0 | 0 |

| May 2013 | 0 | 0 |

| April 2013 | 0 | 0 |

| March 2013 | 2,356 | 0 |

There have been 17,741 shares purchased and there have been zero shares sold by insiders since March 2013.

Financials

Capital Power reported the second-quarter financial results on July 26 with the following highlights:

| Revenue | $321 million |

| Funds from operations | $85 million |

| Net income | $20 million |

| Net debt | $1.7 billion |

(click to enlarge)

Outlook

Capital Power expects full year 2013 financial results to exceed the high end of its annual guidance of $1.20 to $1.40 for normalized earnings per share and $3.80 to $4.20 for cash flow per share.

(click to enlarge)

Competition

Capital Power's competitors include TransAlta Corp. (TAC, Financial) and Calpine Corp. (CPN, Financial). TransAlta has not seen any insider buy transactions during the past six months. TransAlta has a dividend yield of 8.4%. Calpine has seen five insider sell transactions and one insider buy transaction this year.

Conclusion

There have been three different insiders buying Capital Power and there have not been any insiders selling Capital Power during the last 30 days. All three of these insiders increased their holdings by more than 10%.

There are three analyst buy ratings, five neutral ratings and two sell ratings with an average target price of $23.68. Capital Power has a book value of $30.22 per share and the stock has a dividend yield of 5.9%. I believe the stock could be a good pick below the book value of $30.22 per share.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.