One real estate investment trust has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

Partners Real Estate Investment Trust (TSX:PAR.UN, Financial) (Partners REIT), formerly Charter Real Estate Investment Trust, is an open-end real estate investment trust. It focuses on managing a portfolio of retail and mixed-use community and neighborhood shopping centers located in both primary and secondary markets across Canada.

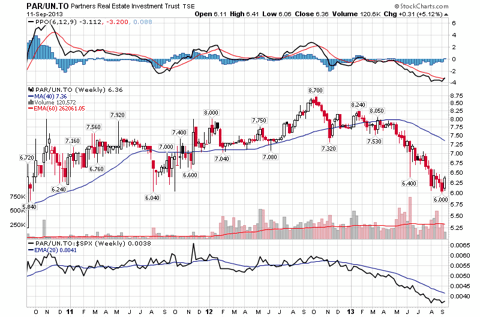

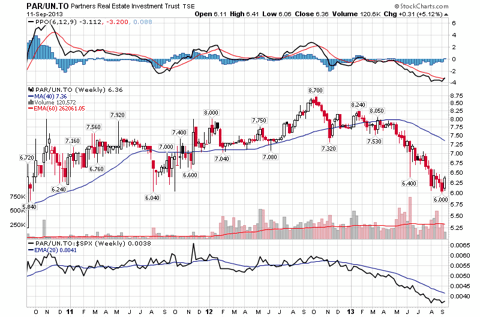

(click to enlarge)

Insider Buying During the Last 30 Days

Here is a table of Partners REIT's insider-trading activity by calendar month.

There have been 699,136 shares purchased and there have been 84,600 shares sold by insiders since April 2013.

Financials

Partners REIT reported the second-quarter financial results on August 14 with the following highlights:

Outlook

Over the next two years, Partners REIT has approximately $26.3 million of debt maturing which carries an average contractual interest rate of 4.59%. Refinancing at current market rates would reduce Partners REIT's cost of debt and would positively impact Partners REIT's earnings potential. Interest expense savings from refinancing at current market rates are anticipated to continue through 2014 and into the following years.

Lease expirations in 2013, 2014 and 2015 are 5.9%, 10.9% and 9.5%, respectively. Partners REIT's management believes that there is strong demand for these spaces and is working with leasing agents to ensure that these spaces are filled quickly and with high-quality tenants. Furthermore, 2014 lease rates are materially below both market rates and those realized by the overall portfolio. The re-leasing of this square footage is expected to increase revenues at those properties. Partners REIT's management believes that the current environment is conducive to lease rate increases.

News

Partners REIT announced on Aug. 21 that it intends to repurchase up to 400,000 of its shares.

Competition

Partners REIT's competitors include Dundee International REIT (TSX:DI.UN, Financial), Agellan Commercial REIT (TSX:ACR.UN, Financial) and Canadian REIT (TSX:REF.UN, Financial). Dundee International REIT has seen seven insider buy transactions and one insider sell transaction during the past six months. Dundee International REIT has a dividend yield of 9.0%. Agellan Commercial REIT has seen 14 insider buy transactions during the past six months. Agellan Commercial REIT has a dividend yield of 9.0%. Canadian REIT has seen 42 insider buy transactions during the past six months. Canadian REIT has a dividend yield of 4.0%.

Conclusion

There have been three different insiders buying Partners REIT and there have not been any insiders selling Partners REIT during the last 30 days. All three of these insiders increased their holdings by more than 10%.

Partners REIT has a net asset value of $7.67 per share and the stock has a dividend yield of 10.1%. I believe the stock could be a good pick below the net asset value of $7.67 per share.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

Partners Real Estate Investment Trust (TSX:PAR.UN, Financial) (Partners REIT), formerly Charter Real Estate Investment Trust, is an open-end real estate investment trust. It focuses on managing a portfolio of retail and mixed-use community and neighborhood shopping centers located in both primary and secondary markets across Canada.

(click to enlarge)

Insider Buying During the Last 30 Days

- Edward Boomer purchased 10,000 shares on Sept. 3 to 5 and currently holds 10,000 shares or less than 0.1% of the company. Edward Boomer is president and chief investment officer. Edward Boomer increased his holdings from zero shares to 10,000 shares in September.

- Patrick Miniutti purchased 2,500 shares on Sept. 6 and currently holds 8,750 shares or less than 0.1% of the company. Patrick Miniutti is chief executive officer at Partners REIT. Patrick Miniutti increased his holdings by 40% in September.

- Angus Sinclair purchased 1,000 shares on Aug. 21 and currently holds 2,000 shares or less than 0.1% of the company. Angus Sinclair is a senior officer of the company. Angus Sinclair increased his holdings by 100% in August.

Here is a table of Partners REIT's insider-trading activity by calendar month.

| Month | Insider buying / shares | Insider selling / shares |

| September 2013 | 12,500 | 0 |

| August 2013 | 1,000 | 0 |

| July 2013 | 0 | 0 |

| June 2013 | 4,986 | 84,600 |

| May 2013 | 105,650 | 0 |

| April 2013 | 575,000 | 0 |

Financials

Partners REIT reported the second-quarter financial results on August 14 with the following highlights:

| Revenue | $14.1 million |

| Funds From Operations | $3.9 million |

| Net income | $2.4 million |

| Net Asset Value | $7.67 per share |

Outlook

Over the next two years, Partners REIT has approximately $26.3 million of debt maturing which carries an average contractual interest rate of 4.59%. Refinancing at current market rates would reduce Partners REIT's cost of debt and would positively impact Partners REIT's earnings potential. Interest expense savings from refinancing at current market rates are anticipated to continue through 2014 and into the following years.

Lease expirations in 2013, 2014 and 2015 are 5.9%, 10.9% and 9.5%, respectively. Partners REIT's management believes that there is strong demand for these spaces and is working with leasing agents to ensure that these spaces are filled quickly and with high-quality tenants. Furthermore, 2014 lease rates are materially below both market rates and those realized by the overall portfolio. The re-leasing of this square footage is expected to increase revenues at those properties. Partners REIT's management believes that the current environment is conducive to lease rate increases.

News

Partners REIT announced on Aug. 21 that it intends to repurchase up to 400,000 of its shares.

Competition

Partners REIT's competitors include Dundee International REIT (TSX:DI.UN, Financial), Agellan Commercial REIT (TSX:ACR.UN, Financial) and Canadian REIT (TSX:REF.UN, Financial). Dundee International REIT has seen seven insider buy transactions and one insider sell transaction during the past six months. Dundee International REIT has a dividend yield of 9.0%. Agellan Commercial REIT has seen 14 insider buy transactions during the past six months. Agellan Commercial REIT has a dividend yield of 9.0%. Canadian REIT has seen 42 insider buy transactions during the past six months. Canadian REIT has a dividend yield of 4.0%.

Conclusion

There have been three different insiders buying Partners REIT and there have not been any insiders selling Partners REIT during the last 30 days. All three of these insiders increased their holdings by more than 10%.

Partners REIT has a net asset value of $7.67 per share and the stock has a dividend yield of 10.1%. I believe the stock could be a good pick below the net asset value of $7.67 per share.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.