One real estate investment trust has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

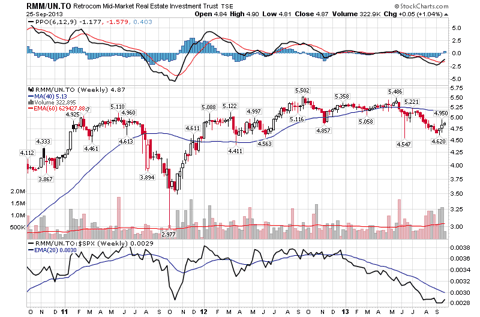

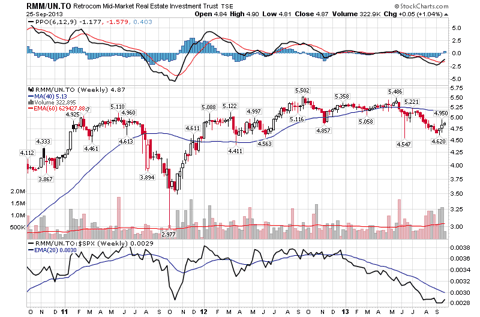

Retrocom Real Estate Investment Trust (TSX:RMM.UN, Financial), formerly Retrocom Mid Market Real Estate Investment Trust, is an open-ended real estate investment trust (REIT). Its portfolio of retail properties is geographically diversified across Canada.

Insider Buying During the Last 30 Days

Here is a table of Retrocom REIT's insider-trading activity by calendar month.

There have been 94,710 shares purchased and there have been zero shares sold by insiders this year.

Financials

Retrocom REIT reported the second-quarter financial results on August 8 with the following highlights:

Competition

Retrocom REIT's competitors include Riocan REIT (TSX:REI.UN, Financial), Crombie REIT (TSX:CRR.UN, Financial), and Morguard REIT (TSX:MRT.UN, Financial).

Here is a table of these competitors' insider-trading activities during the last six months.

Only Retrocom REIT has seen intensive insider buying during the last 30 days.

Conclusion

There have been three different insiders buying Retrocom REIT and there have not been any insiders selling Retrocom REIT during the last 30 days. Two of these three insiders increased their holdings by more than 10%.

Retrocom REIT has a book value of $5.40 per share and the stock has a dividend yield of 9.3%. I believe the stock could be a good pick below the book value of $5.40 per share based on the intensive insider buying.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

Retrocom Real Estate Investment Trust (TSX:RMM.UN, Financial), formerly Retrocom Mid Market Real Estate Investment Trust, is an open-ended real estate investment trust (REIT). Its portfolio of retail properties is geographically diversified across Canada.

Insider Buying During the Last 30 Days

- Christopher Cann purchased 2,750 shares on Sept. 24 and currently controls 25,000 shares or less than 0.1% of the company. Christopher Cann serves as a director of the company. Christopher Cann increased his holdings by 12.4% in September.

- Patrick Lavelle purchased 5,000 shares on Sept. 20 and currently holds 83,270 shares or 0.1% of the company. Patrick Lavelle is chairman of the board. Patrick Lavelle increased his holdings by 6.4% in September.

- David Schiffer purchased 1,060 shares on Sept. 6 and currently holds 6,660 shares or less than 0.1% of the company. David Schiffer serves as a director of the company. David Schiffer increased his holdings by 18.9% in September.

Here is a table of Retrocom REIT's insider-trading activity by calendar month.

| Month | Insider buying / shares | Insider selling / shares |

| September 2013 | 8,810 | 0 |

| August 2013 | 20,000 | 0 |

| July 2013 | 0 | 0 |

| June 2013 | 0 | 0 |

| May 2013 | 65,900 | 0 |

| April 2013 | 0 | 0 |

| March 2013 | 0 | 0 |

| February 2013 | 0 | 0 |

| January 2013 | 0 | 0 |

There have been 94,710 shares purchased and there have been zero shares sold by insiders this year.

Financials

Retrocom REIT reported the second-quarter financial results on August 8 with the following highlights:

| Revenue | $22.8 million |

| Funds from operations | $6.7 million |

| Cash | $31.6 million |

| Debt | $561.1 million |

Retrocom REIT's competitors include Riocan REIT (TSX:REI.UN, Financial), Crombie REIT (TSX:CRR.UN, Financial), and Morguard REIT (TSX:MRT.UN, Financial).

Here is a table of these competitors' insider-trading activities during the last six months.

| Company | Insider buying / shares | Insider selling / shares |

| REI.UN | 17,107 | 242,491 |

| CRR.UN | 105,272 | 2,200 |

| MRT.UN | 185,020 | 0 |

Only Retrocom REIT has seen intensive insider buying during the last 30 days.

Conclusion

There have been three different insiders buying Retrocom REIT and there have not been any insiders selling Retrocom REIT during the last 30 days. Two of these three insiders increased their holdings by more than 10%.

Retrocom REIT has a book value of $5.40 per share and the stock has a dividend yield of 9.3%. I believe the stock could be a good pick below the book value of $5.40 per share based on the intensive insider buying.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.