One energy trust has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

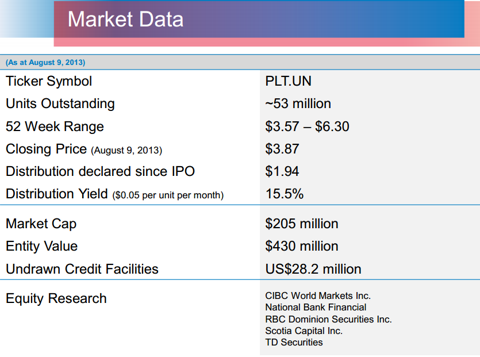

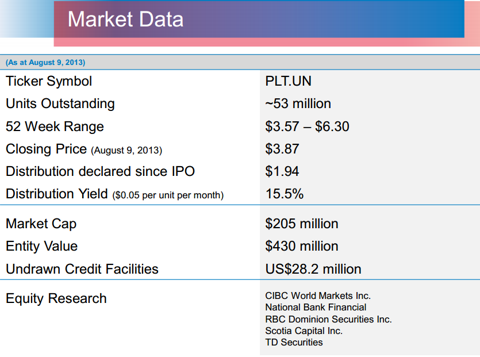

Parallel Energy Trust (TSX:PLT.UN, Financial) is an unincorporated open-ended limited purpose trust. The trust's objective is to create stable, consistent returns for investors through the acquisition and development of conventional oil and natural gas reserves and production with unexploited low risk potential, located in certain regions of the U.S.

Insider Buying During the Last 30 Days

Here is a table of Parallel Energy's insider-trading activity by calendar month.

There have been 145,000 shares purchased and there have been zero shares sold by insiders since May 2013.

Financials

Parallel reported the second-quarter financial results on Aug. 12 with the following highlights:

Outlook

Parallel reported on October 1 that during the third quarter of 2013, the trust's daily production averaged approximately 7,100 boe/day based on field data, which results in a record nine month daily production rate of approximately 7,100 boe/day.

As a result of the trust's improved annual decline rate and operational performance, Parallel increased its 2013 exit rate production target from 7,100 boe/day to 7,300 boe/day.

Competition

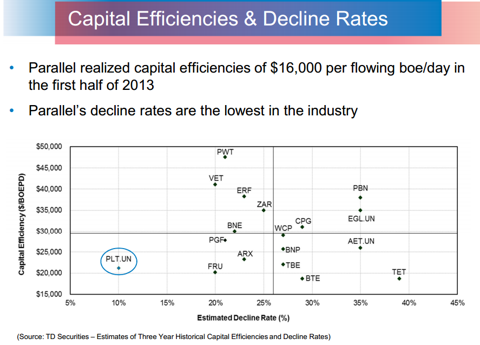

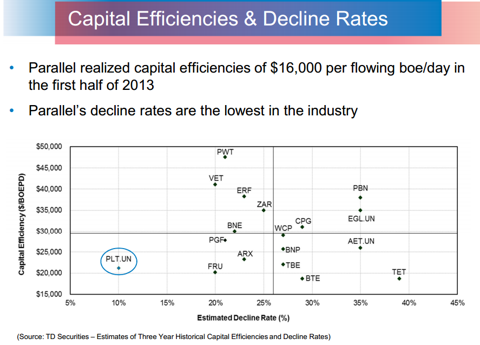

Parallel's competitors include Argent Energy Trust (TSX:AET.UN, Financial), Pengrowth Energy (TSX:PGH, Financial), Zargon Oil & Gas (TSX:ZAR, Financial), Arc Resources (TSX:ARX, Financial), Baytex Energy (TSX:BTE), Lightstream Resources (TSX:LTS), Crescent Point Energy (TSX:CPG), Bonavista Energy (TSX:BNP), Freehold Royalties (TSX:FRU), Penn West Petroleum (TSX:PWT), Eagle Energy Trust (TSX:EGL.UN), Enerplus Corporation (TSX:ERF), Trilogy Energy (TSX:TET), Bonterra Energy (TSX:BNE), Vermilion Energy (TSX:VET), Whitecap Resources (TSX:WCP), and Twin Butte Energy (TSX:TBE). Here is a picture of these companies' capital efficiencies and decline rates.

Parallel's decline rates are the lowest in the industry.

Conclusion

There have been three different insiders buying Parallel and there have not been any insiders selling Parallel during the last 30 days. Two of these three insiders increased their holdings by more than 10%.

Parallel has a book value of $5.55 per share and the stock has a dividend yield of 15.2%. The stock could be a good pick below the book value based on the intensive insider buying.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

Parallel Energy Trust (TSX:PLT.UN, Financial) is an unincorporated open-ended limited purpose trust. The trust's objective is to create stable, consistent returns for investors through the acquisition and development of conventional oil and natural gas reserves and production with unexploited low risk potential, located in certain regions of the U.S.

Insider Buying During the Last 30 Days

- Richard Alexander purchased 20,000 shares on Sept. 9 to 11 and currently holds 160,000 shares or 0.3% of the company. Richard Alexander is president & chief executive officer and director. Richard Alexander increased his holdings by 14.3% during the last 30 days.

- Philip Scherman purchased 12,500 shares on Sept. 25 and currently holds 12,500 shares or less than 0.1% of the company. Philip Scherman serves as a director of the company. Philip Scherman increased his holdings from zero shares to 12,500 shares during the last 30 days.

- Henry Sykes purchased 2,500 shares on Sept. 6 and currently holds 95,480 shares or 0.2% of the company. Henry Sykes is executive chairman of the board. Henry Sykes increased his holdings by 2.7% during the last 30 days.

Here is a table of Parallel Energy's insider-trading activity by calendar month.

| Month | Insider buying / shares | Insider selling / shares |

| September 2013 | 35,000 | 0 |

| August 2013 | 25,000 | 0 |

| July 2013 | 0 | 0 |

| June 2013 | 25,000 | 0 |

| May 2013 | 60,000 | 0 |

There have been 145,000 shares purchased and there have been zero shares sold by insiders since May 2013.

Financials

Parallel reported the second-quarter financial results on Aug. 12 with the following highlights:

| Revenue | $22.8 million |

| Funds from operations | $11.3 million |

| Net income | $4.0 million |

| Net debt | $224.2 million |

| Production | 7,459 boe/d |

Outlook

Parallel reported on October 1 that during the third quarter of 2013, the trust's daily production averaged approximately 7,100 boe/day based on field data, which results in a record nine month daily production rate of approximately 7,100 boe/day.

As a result of the trust's improved annual decline rate and operational performance, Parallel increased its 2013 exit rate production target from 7,100 boe/day to 7,300 boe/day.

Competition

Parallel's competitors include Argent Energy Trust (TSX:AET.UN, Financial), Pengrowth Energy (TSX:PGH, Financial), Zargon Oil & Gas (TSX:ZAR, Financial), Arc Resources (TSX:ARX, Financial), Baytex Energy (TSX:BTE), Lightstream Resources (TSX:LTS), Crescent Point Energy (TSX:CPG), Bonavista Energy (TSX:BNP), Freehold Royalties (TSX:FRU), Penn West Petroleum (TSX:PWT), Eagle Energy Trust (TSX:EGL.UN), Enerplus Corporation (TSX:ERF), Trilogy Energy (TSX:TET), Bonterra Energy (TSX:BNE), Vermilion Energy (TSX:VET), Whitecap Resources (TSX:WCP), and Twin Butte Energy (TSX:TBE). Here is a picture of these companies' capital efficiencies and decline rates.

Parallel's decline rates are the lowest in the industry.

Conclusion

There have been three different insiders buying Parallel and there have not been any insiders selling Parallel during the last 30 days. Two of these three insiders increased their holdings by more than 10%.

Parallel has a book value of $5.55 per share and the stock has a dividend yield of 15.2%. The stock could be a good pick below the book value based on the intensive insider buying.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.