One consumer goods company has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

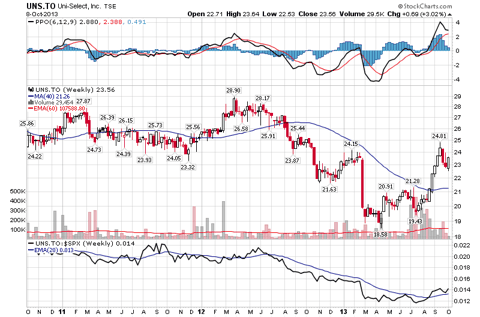

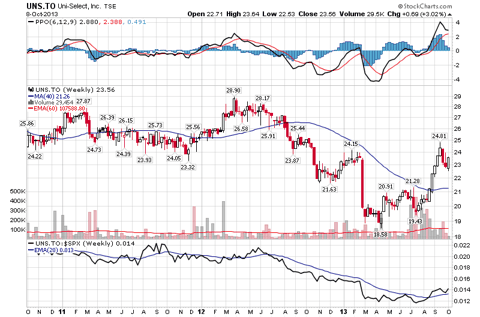

Uni-Sélect (TSX:UNS, Financial) engages in the distribution of replacement parts, equipment, tools, and accessories for motor vehicles in North America.

Insider Buying During the Last 30 Days

Here is a table of Uni-Sélect's insider-trading activity during the last 30 days by insider.

There have been 16,600 shares purchased by insiders during the last 30 days.

Insider Buying by Calendar Month

Here is a table of Uni-Sélect's insider-trading activity by calendar month.

There have been 45,650 shares purchased and there have been zero shares sold by insiders since May 2013.

Financials

The company reported the second-quarter financial results on July 31 with the following highlights:

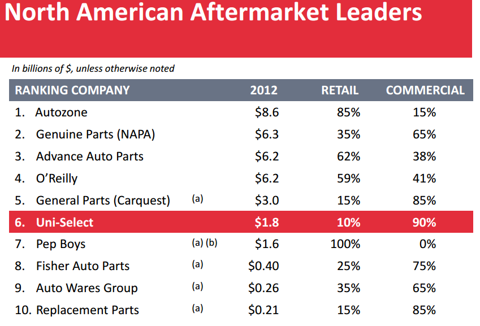

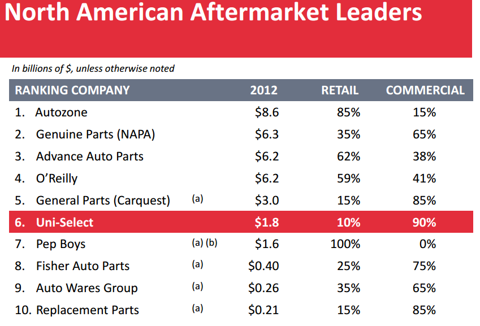

Competition

Uni-Sélect's competitors include AutoZone (AZO, Financial), Genuine Parts Company (GPC, Financial), Advance Auto Parts (AAP, Financial) and O'Reilly Automotive (ORLY, Financial).

Here is a table of these competitors' insider-trading activities this year.

Only Uni-Sélect has seen intensive insider buying during the past 30 days.

Conclusion

There have been three different insiders buying Uni-Sélect and there have not been any insiders selling Uni-Sélect during the past 30 days. Two of these three insiders increased their holdings by more than 10%.

There are two analyst buy ratings, three neutral ratings and zero sell ratings with an average price target of $23.54. Uni-Sélect is trading at a P/E ratio of 589.00 and a forward P/E ratio of 9.66.

Uni-Sélect has a book value of $22.07 per share and the stock has a dividend yield of 2.2%. I believe the stock could be a good pick at the book value based on the intensive insider buying.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

Uni-Sélect (TSX:UNS, Financial) engages in the distribution of replacement parts, equipment, tools, and accessories for motor vehicles in North America.

Insider Buying During the Last 30 Days

Here is a table of Uni-Sélect's insider-trading activity during the last 30 days by insider.

| Name | Title | Trade Date | Shares Purchased | Current Ownership (Direct+Indirect) | Increase In Shares |

| Robert Chevrier | Director | Sep 13-26 | 10,000 | 27,500 | 57.1% |

| Richard Keister | Director | Oct 3-4 | 6,000 | 9,000 | 200% |

| Denis Mathieu | CFO | Sep 30 | 600 | 21,600 | 2.9% |

Insider Buying by Calendar Month

Here is a table of Uni-Sélect's insider-trading activity by calendar month.

| Month | Insider buying / shares | Insider selling / shares |

| October 2013 | 6,000 | 0 |

| September 2013 | 10,600 | 0 |

| August 2013 | 29,050 | 0 |

| July 2013 | 0 | 0 |

| June 2013 | 0 | 0 |

| May 2013 | 0 | 0 |

Financials

The company reported the second-quarter financial results on July 31 with the following highlights:

| Revenue | $476.2 million |

| Adjusted earnings | $15.6 million |

| Net debt | $284.5 million |

Uni-Sélect's competitors include AutoZone (AZO, Financial), Genuine Parts Company (GPC, Financial), Advance Auto Parts (AAP, Financial) and O'Reilly Automotive (ORLY, Financial).

Here is a table of these competitors' insider-trading activities this year.

Only Uni-Sélect has seen intensive insider buying during the past 30 days.

Conclusion

There have been three different insiders buying Uni-Sélect and there have not been any insiders selling Uni-Sélect during the past 30 days. Two of these three insiders increased their holdings by more than 10%.

There are two analyst buy ratings, three neutral ratings and zero sell ratings with an average price target of $23.54. Uni-Sélect is trading at a P/E ratio of 589.00 and a forward P/E ratio of 9.66.

Uni-Sélect has a book value of $22.07 per share and the stock has a dividend yield of 2.2%. I believe the stock could be a good pick at the book value based on the intensive insider buying.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.