One gold company has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

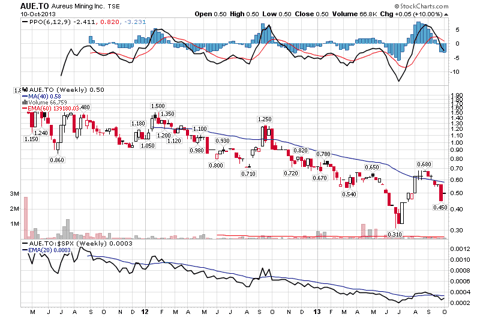

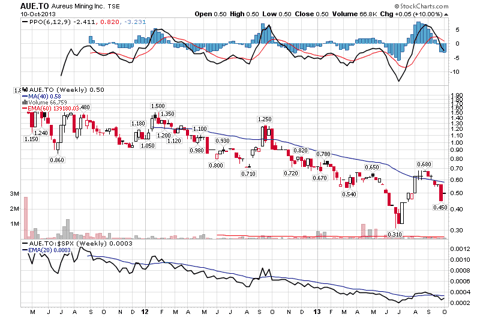

Aureus Mining (TSX:AUE, Financial) is engaged in the exploration and development of gold deposits in highly prospective and under-explored areas of Liberia and Cameroon.

Insider Buying During the Last 30 Days

Here is a table of Aureus Mining's insider-trading activity during the last 30 days by insider.

There have been 73,000 shares purchased by insiders during the last 30 days. The shares were purchased pursuant to a public offering.

Financials

Aureus Mining reported the second-quarter financial results on August 6 with the following highlights:

Aureus Mining closed approximately $16.0 million at the public offering on October 10.

Outlook

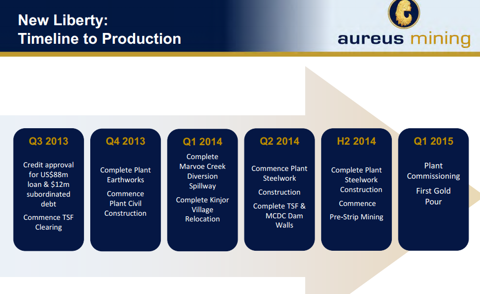

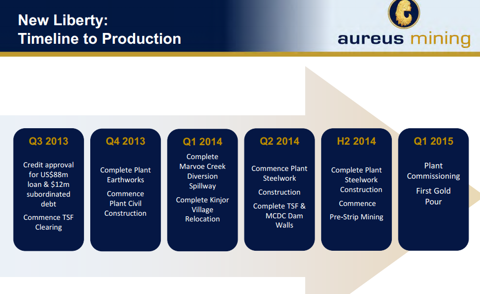

Construction continues at Aureus' 100% owned New Liberty gold project in Liberia with first gold pour expected in Q4 2014 / Q1 2015.

Competition

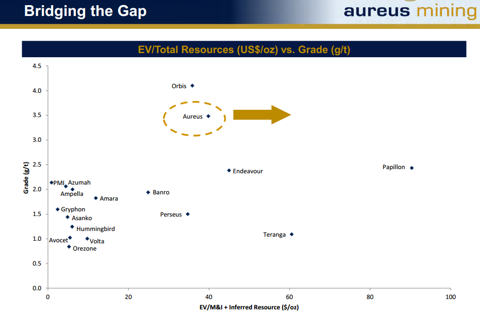

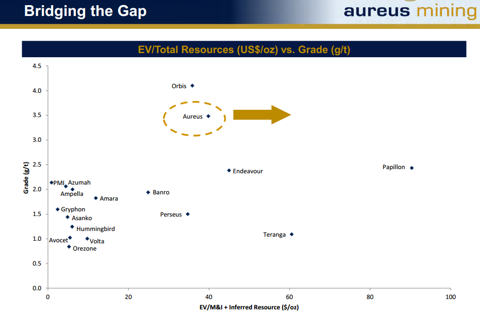

Aureus' competitors in Africa include Banro (BAA, Financial), Endeavour Mining (TSX:EDV, Financial) and Perseus Mining (TSX:PRU, Financial).

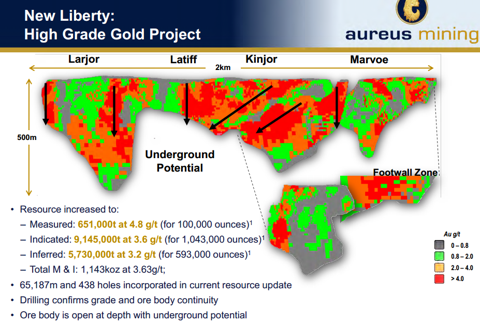

Aureus has one of the highest grade projects in Africa.

Here is a table of these competitors' insider-trading activities during the past six months.

Only Aureus has seen intensive insider buying during the past 30 days.

Conclusion

There have been four different insiders buying Aureus and there have not been any insiders selling Aureus during the last 30 days. Three of these four insiders increased their holdings by more than 10%.

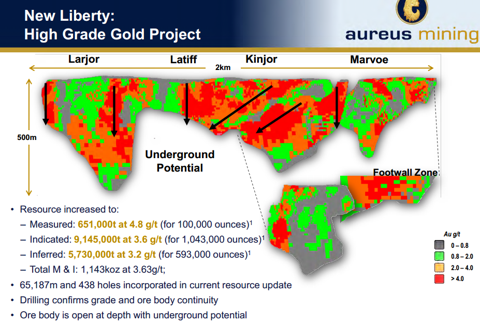

Aureus' New Liberty gold project has a pre-tax NPV of $230 million at $1,400/oz gold price and cash costs of $668/oz. The project contains Measured and Indicated gold resources of 1,143koz at 3.63g/t.

I believe Aureus could be a good pick at the current price level based on the intensive insider buying.

Disclosure: I am long BAA, TSX:EDV

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

Aureus Mining (TSX:AUE, Financial) is engaged in the exploration and development of gold deposits in highly prospective and under-explored areas of Liberia and Cameroon.

Insider Buying During the Last 30 Days

Here is a table of Aureus Mining's insider-trading activity during the last 30 days by insider.

| Name | Title | Trade Date | Shares Purchased | Current Ownership | Increase In Shares |

| Luis da Silva | Director | Oct 10 | 16,000 | 55,176 | +40.8% |

| Jean-Guy Martin | Director | Oct 10 | 5,000 | 5,000 | from 0 to 5,000 shares |

| David Netherway | Director | Oct 10 | 37,000 | 176,595 | +26.5% |

| David Reading | Director | Oct 10 | 15,000 | 348,334 | +4.5% |

There have been 73,000 shares purchased by insiders during the last 30 days. The shares were purchased pursuant to a public offering.

Financials

Aureus Mining reported the second-quarter financial results on August 6 with the following highlights:

| Revenue | $0 |

| Net loss | $1.1 million |

| Cash | $53.9 million |

Aureus Mining closed approximately $16.0 million at the public offering on October 10.

Outlook

Construction continues at Aureus' 100% owned New Liberty gold project in Liberia with first gold pour expected in Q4 2014 / Q1 2015.

Competition

Aureus' competitors in Africa include Banro (BAA, Financial), Endeavour Mining (TSX:EDV, Financial) and Perseus Mining (TSX:PRU, Financial).

Aureus has one of the highest grade projects in Africa.

Here is a table of these competitors' insider-trading activities during the past six months.

Only Aureus has seen intensive insider buying during the past 30 days.

Conclusion

There have been four different insiders buying Aureus and there have not been any insiders selling Aureus during the last 30 days. Three of these four insiders increased their holdings by more than 10%.

Aureus' New Liberty gold project has a pre-tax NPV of $230 million at $1,400/oz gold price and cash costs of $668/oz. The project contains Measured and Indicated gold resources of 1,143koz at 3.63g/t.

I believe Aureus could be a good pick at the current price level based on the intensive insider buying.

Disclosure: I am long BAA, TSX:EDV