I’ve been reading John F. Wasik’s Keynes’s Way to Wealth: Timeless Investment Lessons from The Great Economist, a book about British economist John Maynard Keynes’s life as an investor. Keynes started out as a foreign currency and commodity speculator in 1919, was wiped out twice in 1922, and 1929, and went on to become a Buffett-style concentrated value investor by around 1932. In 1991, Buffett, who noted in an earlier Chairman’s letter that Keynes had “began as a market-timer (leaning on business and credit-cycle theory) and converted, after much thought, to value investing,” described Keynes’s end-point as an investor thus:

John Maynard Keynes, whose brilliance as a practicing investor matched his brilliance in thought, wrote a letter to a business associate, F. C. Scott, on August 15, 1934 that says it all: “As time goes on, I get more and more convinced that the right method in investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes. It is a mistake to think that one limits one’s risk by spreading too much between enterprises about which one knows little and has no reason for special confidence. . . .

One’s knowledge and experience are definitely limited and there are seldom more than two or three enterprises at any given time in which I personally feel myself entitled to put full confidence.”

Wasik reports that Keynes died in 1946 with a net worth of about £500,000, equivalent to about $36 million today, not including his extensive collection of artwork and rare manuscripts.

What is most remarkable about Keynes is that he was a self-taught Buffett-style concentrated value investor before Buffett. He wrote the letter to Scott around the time that Benjamin Graham published Security Analysis, but there is little evidence that he read it. Like Graham, Keynes had to contend with perhaps the most difficult period in modern history to be an investor, one that encompassed the second World War, the 1929 stock market crash, and the Great Depression. Throughout that 18-year period, while the UK stock market fell 15 percent, and the US market fell 21 percent, the discretionary portfolio he managed on behalf of King’s College, Cambridge grew fivefold.

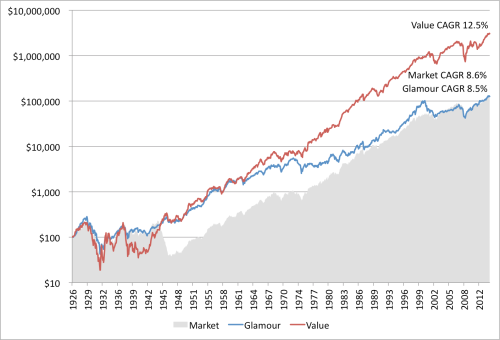

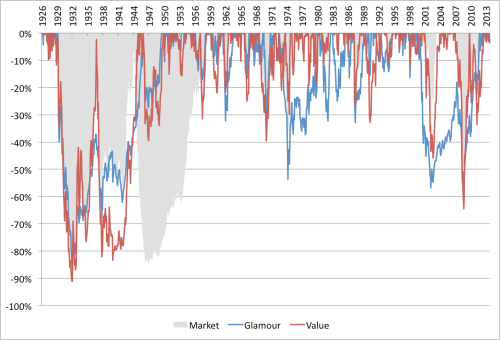

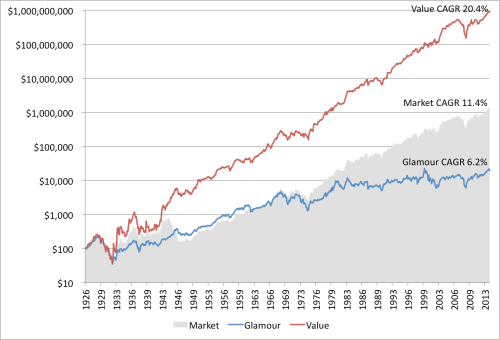

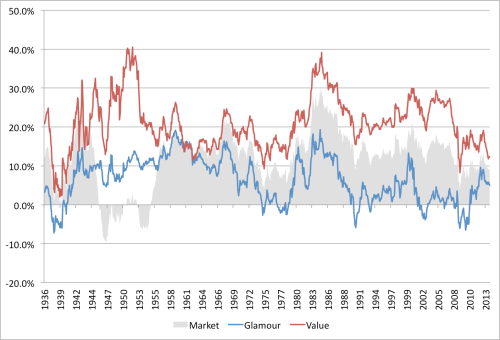

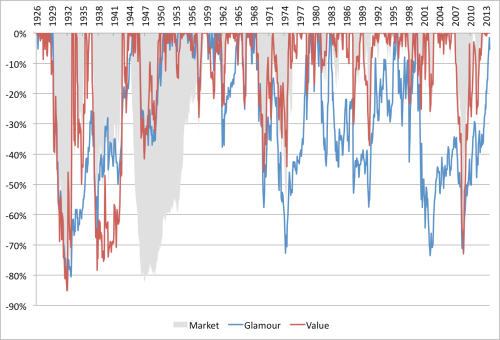

The charts below, which begin in 1926 and continue through to April 2014, show how unusually difficult the period was. The charts use Fama and French backtests of the book value-to-market equity (the inverse of the PB ratio) data from 1926 to 2014. As at April 2014, there were 3,175 firms in the sample. The value decile contained the 459 stocks with the highest earnings yield, and the glamour decile contained the 404 stocks with the lowest earnings yield. The average size of the glamour stocks is $7.48 billion and the value stocks $2.54 billion. (Note that the average is heavily skewed up by the biggest companies. For context, the 3,175th company has a market capitalization today of approximately $400 million, which is smaller than the average, but still investable for most investors). Portfolios are formed on June 30 and rebalanced annually.

Compound Returns 1926 to April 2014 (Market Capitalization Weight)

The 1938 crash also hit Keynes hard. At the end of the year, his King’s College discretionary portfolio was down 40.1 percent.

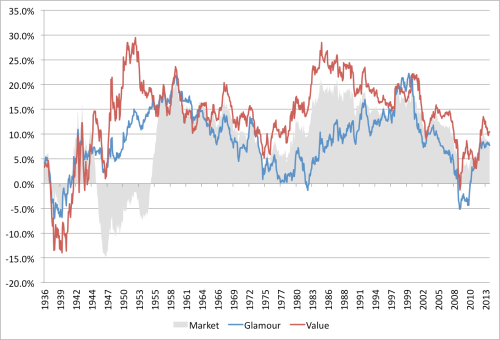

10-Year Rolling Returns (Market Capitalization Weight)

Drawdowns (Market Capitalization Weight)

Compound Returns 1926 to April 2014 (Equal Weight)

10-Year Rolling Returns (Equal Weight)

Drawdowns (Equal Weight)

As these charts demonstrate, volatility and drawdowns are part and parcel of investing, but, over the long term, value has comprehensively beaten out the market and glamour stocks. To generate the extraordinary returns of the value deciles, it was necessary to remain fully invested in those value stocks through thick and thin.