Is it just me or did we not just spend 10 months worrying about inflation? Why, then am I seeing stories like this?

From the NY Times:

As dozens of countries slip deeper into financial distress, a new threat may be gathering force within the American economy — the prospect that goods will pile up waiting for buyers and prices will fall, suffocating fresh investment and worsening joblessness for months or even years.

The word for this is deflation, or declining prices, a term that gives economists chills.

Deflation accompanied the Depression of the 1930s. Persistently falling prices also were at the heart of Japan’s so-called lost decade after the catastrophic collapse of its real estate bubble at the end of the 1980s — a period in which some experts now find parallels to the American predicament.

Here is the problem with the latest panic. If prices, due to the surge in commodities have risen above trend, then some "deflation" would be preferable as it would cause those artificially high prices to come back to normalized levels.

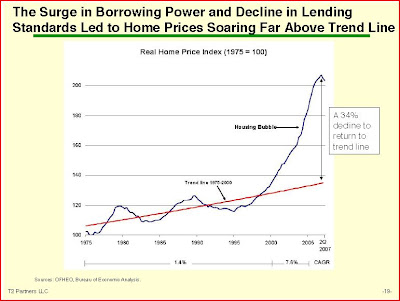

Look no further than housing. Note the following graph:

Can anyone argue some "deflation" in the housing market would not be a good thing? You could place up a graph of oil, wheat, corn, copper or almost any other commodity that goes into either making our food or the items we use and see the same graph.

When prices surge like they have, the best things is for them to then fall back to a historical norm. That, is deflation. Is anyone going to argue the deflation at the gas pump we have seen is not good for consumers?

Does this mean the process is simple and easy? No. It is quite often painful, especially for those who bought houses at the top of the market. But, it is good for the long run. Berkshire's Warren Buffett (BRK.A) has called inflation the "silent tax". It decreases the spending power of the consumer with little notice. If that is true (it is) then deflation must be a "silent tax break" as it accomplishes the opposite.

Warren says, "if does not matter how many dollars I have, what matter is how many cheeseburgers I can buy with those dollars". In other words Buffett argue to value of the dollar, in relation to what it can buy is more important than how many of them are out there. From this, we can then say Buffett think inflation, rather than deflation is more of a concern, especially to investors.

Now again, everything in moderation. Price collapses are just as bad a price spikes. The reason is that the market needs to adjust to either trend and sudden movements eliminate that ability. Housing is the current example of that. Gas, and its slow steady decline is the other. One hurt, one helps....

Those of you who follow Rep. Ron Paul know he is a supported of the "Austrian School of Economics". Here is their take on the deflation argument.

We are in "crisis" mode now. The MSM is simply walking around looking for the next one..

From the NY Times:

As dozens of countries slip deeper into financial distress, a new threat may be gathering force within the American economy — the prospect that goods will pile up waiting for buyers and prices will fall, suffocating fresh investment and worsening joblessness for months or even years.

The word for this is deflation, or declining prices, a term that gives economists chills.

Deflation accompanied the Depression of the 1930s. Persistently falling prices also were at the heart of Japan’s so-called lost decade after the catastrophic collapse of its real estate bubble at the end of the 1980s — a period in which some experts now find parallels to the American predicament.

Here is the problem with the latest panic. If prices, due to the surge in commodities have risen above trend, then some "deflation" would be preferable as it would cause those artificially high prices to come back to normalized levels.

Look no further than housing. Note the following graph:

Can anyone argue some "deflation" in the housing market would not be a good thing? You could place up a graph of oil, wheat, corn, copper or almost any other commodity that goes into either making our food or the items we use and see the same graph.

When prices surge like they have, the best things is for them to then fall back to a historical norm. That, is deflation. Is anyone going to argue the deflation at the gas pump we have seen is not good for consumers?

Does this mean the process is simple and easy? No. It is quite often painful, especially for those who bought houses at the top of the market. But, it is good for the long run. Berkshire's Warren Buffett (BRK.A) has called inflation the "silent tax". It decreases the spending power of the consumer with little notice. If that is true (it is) then deflation must be a "silent tax break" as it accomplishes the opposite.

Warren says, "if does not matter how many dollars I have, what matter is how many cheeseburgers I can buy with those dollars". In other words Buffett argue to value of the dollar, in relation to what it can buy is more important than how many of them are out there. From this, we can then say Buffett think inflation, rather than deflation is more of a concern, especially to investors.

Now again, everything in moderation. Price collapses are just as bad a price spikes. The reason is that the market needs to adjust to either trend and sudden movements eliminate that ability. Housing is the current example of that. Gas, and its slow steady decline is the other. One hurt, one helps....

Those of you who follow Rep. Ron Paul know he is a supported of the "Austrian School of Economics". Here is their take on the deflation argument.

We are in "crisis" mode now. The MSM is simply walking around looking for the next one..