Stocks rose yesterday — a lot. With a 2% jump, the Dow reached 10,226, its highest level of 2009. The S&P 500 fared even better.

As we briefly mentioned Monday, it wasn’t earnings or economic data that sent stocks to new highs. Instead traders got the nod from the G-20, whose members hinted that they will likely keep ultra-low global interest rates for the foreseeable future.

“Rather than a rebound in jobs and household income,” writes Dan Amoss, “the stock market seems to be pinning its hopes on limitless free money from the Federal Reserve. But with an undercapitalized banking system, most of this zero-interest-rate money is not working its way out into the economy.

“Instead, this zero-interest rate policy is prompting rational investors — including foreign creditors who hold trillions in U.S. Treasuries and agency bonds — to accelerate their moves into inflation hedges like gold and commodities. The Fed may think it has ultimate control over its monetary policy, but those who already hold dollar-denominated assets play an important role. And many of them, after putting up with lots of abuse, and the promise of zero rates of interest on their savings, are voting with their feet.”

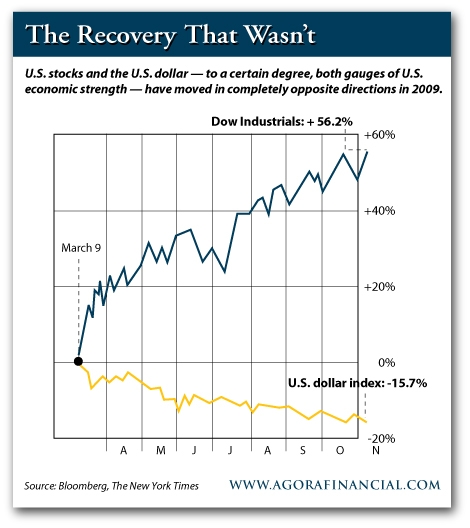

Thus, perversely, the “American rebound” stock trade is more and more dependent on a steadily weakening dollar. As stocks soared yesterday, the dollar index found its own 2009 benchmark… a yearly low of 74.9. Looking at both together… hmmm… something is wrong with this picture.

“There are indications that the U.S. dollar is now serving as the funding currency for carry trades,” reads an IMF report from the weekend, confirming a suspicion we shared last month. The IMF report was meant as a warning to its clients and colleagues… the group noted that distorted dollar values here have contributed to “upward pressure on the euro and some emerging-economy currencies.”

As Nouriel Roubini has recently hinted, we suspect cheap dollars are contributing to a rise in nearly everything.

Ian Mathias

The Daily Reckoning

As we briefly mentioned Monday, it wasn’t earnings or economic data that sent stocks to new highs. Instead traders got the nod from the G-20, whose members hinted that they will likely keep ultra-low global interest rates for the foreseeable future.

“Rather than a rebound in jobs and household income,” writes Dan Amoss, “the stock market seems to be pinning its hopes on limitless free money from the Federal Reserve. But with an undercapitalized banking system, most of this zero-interest-rate money is not working its way out into the economy.

“Instead, this zero-interest rate policy is prompting rational investors — including foreign creditors who hold trillions in U.S. Treasuries and agency bonds — to accelerate their moves into inflation hedges like gold and commodities. The Fed may think it has ultimate control over its monetary policy, but those who already hold dollar-denominated assets play an important role. And many of them, after putting up with lots of abuse, and the promise of zero rates of interest on their savings, are voting with their feet.”

Thus, perversely, the “American rebound” stock trade is more and more dependent on a steadily weakening dollar. As stocks soared yesterday, the dollar index found its own 2009 benchmark… a yearly low of 74.9. Looking at both together… hmmm… something is wrong with this picture.

“There are indications that the U.S. dollar is now serving as the funding currency for carry trades,” reads an IMF report from the weekend, confirming a suspicion we shared last month. The IMF report was meant as a warning to its clients and colleagues… the group noted that distorted dollar values here have contributed to “upward pressure on the euro and some emerging-economy currencies.”

As Nouriel Roubini has recently hinted, we suspect cheap dollars are contributing to a rise in nearly everything.

Ian Mathias

The Daily Reckoning