It takes considerable energy to put this together, if you post these articles on your website(s) I ask that you kindly include a reference to this post. Thanks

Miguel Barbosa

Founder of

http://www.simoleonsense.com/

Reinflating the bubble: (Via Yes & Not Yes)

[b]

[/quote]Weekly Joke (Via Cushico)

2. Lightbulb Jokes

Q: How many Chicago School economists does it take to change a light bulb?

A: None. If the light bulb needed changing the market would have already done it.

Most Important Article Of The Week!!!!

Elizabeth Warren – What Has the Troubled Asset Relief Program Achieved? - Via COP- Because so many different forces and programs have influenced financial markets over the last year, TARP’s effects are impossible to isolate. Even so, there is broad consensus that the TARP was an important part of a broader government strategy that stabilized the U.S. financial system by renewing the flow of credit and averting a more acute crisis. Although the government’s response to the crisis was at first haphazard and uncertain, it eventually proved decisive enough to stop the panic and restore market confidence. Despite significant improvement in the financial markets, however, the broader economy is only beginning to recover from a deep recession, and the TARP’s impact on the underlying weaknesses in the financial system that led to last fall’s crisis is less clear.

Miguel’s Weekly Favorites:[url=http://www.mindhacks.com/blog/2010/01/the_psychology_of_s.html][/url]

The psychology of ’super-human strength’ - Via MindHacks – Vladimir Zatsiorsky, a professor of kinesiology at Penn State who has extensively studied the biomechanics of weightlifting, draws the distinction between the force that our muscles are able to theoretically apply, which he calls “absolute strength,” and the maximum force that they can generate through the conscious exertion of will, which he calls “maximal strength.” An ordinary person, he has found, can only summon about 65 percent of their absolute power in a training session, while a trained weightlifter can exceed 80 percent…

The economics of happiness - Via Washington Post - Last year was not a happy one. Economic crisis. Job losses. Wars. Yet, while we can quantify things such as gross domestic product or home foreclosures, it’s harder to measure their impact on our collective happiness. One way to gauge that effect is through what has become known as the economics of happiness — a set of new techniques and data to measure well-being and contentment. Hundreds of thousands of people are surveyed and asked how happy or satisfied they are with their lives, with possible answers on a scale between very unhappy and very happy.

How to Train the Aging Brain – Via NYT – The problem is, as much as I’ve enjoyed these books, I don’t really remember reading any of them. Certainly I know the main points. But didn’t I, after underlining all those interesting parts, retain anything else? It’s maddening and, sorry to say, not all that unusual for a brain at middle age: I don’t just forget whole books, but movies I just saw, breakfasts I just ate, and the names, oh, the names are awful. Who are you?

Risk & Return may be approximated by a positional utility model - Via Nick Gogerty – Here is an interesting and pretty lengthy paper by Eric Falkenstein. It consists of 2 major parts a synopsis of failures of the typical risk reward relationship assumed in finance and an explanatory thesis involving individual agents who have envy in the pursuit of positional goods.

What’s my brain’s motivation? – Via BBC -For an actor, the performance conditions weren’t exactly ideal: flat on her back in a large machine, under strict instructions to lie as still as possible, speaking in short bursts interspersed with the shrill sound of a magnetic resonance imaging scanner.

Choice, Social Class, & Agency- Via Situationist – Across disciplines we tend to assume that choice is a fundamental or “basic” unit of human behavior, and that behavior is a product of individual choice. In my talk, I will present a series of lab and field studies that question these assumptions about behavior, and suggest that these assumptions reflect primarily the experiences of college-educated, or middle-class, Americans, who tend to have access to a wealth of choices and an array of quality options among which to choose. I will discuss the implications of these assumptions for the (mis)understanding of behavior across diverse contexts.

Phys Ed: How Little Exercise Can You Get Away With? – Via NYT – Recently researchers trawled through a vast database of survey information about the health and habits of men and women in Scotland, hoping to determine how much exercise is needed to keep the Scots from feeling gloomy (or in technical terms, experiencing “psychological distress”). The answer, according to a study published in this month’s British Journal of Sports Medicine: a mere 20 minutes a week of any physical activity, whether sports, walking, gardening or even housecleaning, the last not usually associated with bringing out the sunshine. The researchers found that more activity conferred more mental-health benefits and that “participation in vigorous sports activities” tended to be the “most beneficial for mental health.” But their overall conclusion was that being active for as little as 20 minutes a week is sufficient, if your specific goal is mental health.

Free Institutional Research- Via World Beta – While I use Hedge Fund Letters for my hedge commentary fix, I was wondering a little about where to go for the best free institutional research published online. I’m thinking in the vein of GMO, Hussman, PIMCO, Research Affiliates, etc. I’m going to start a list below, feel free to make some comments and I’ll add as they come in. Only requirement is the author(s) have to be institutional money managers:

“Entrepreneurs are accustomed to a manic-depressive economy” - Via Mises – If we are to emerge from the crisis, “politicians must resist implementing grandiloquent rescue plans,” warns Jesús Huerta de Soto (Madrid 1956). Professor of Economics and one of the foremost current representatives of the Austrian School, Huerta de Soto, who recently delivered a lecture at the Madrid Association of Family Businesses (AMEF), is certain that “the great social crisis of our time is statolatry.” In other words, it is the tendency to expect the state to resolve any problem that arises. In an interview with Expansión, he confidently stated that once the economy is back on its feet, “we will again enter into a phase of credit expansion which will give rise to widespread malinvestment.” Thus, the seeds of a new recession will be sown.

Why your boss is incompetent – Via New Scientist Life – In This season of goodwill, spare a thought for that much-maligned bunch, the men and women at the top of the management tree. Yes, the murky machinations of the banking bosses might have needlessly plunged millions into penury. Yes, the actions of our political leaders might seem to be informed more by dubious wheeler-dealing than by Socratic wisdom. And yes, the high-ups in your own company might well be the self-important time-wasters you’ve always held them for.

Using Bayesian Analysis to find a lost nuclear weapon - via Hackensack – Ten years ago I picked this book up at an airport bookstore, Blind Man’s Bluff: The Untold Story of American Submarine Espionage, by Sherry Sontag and Christopher Drew. Some thinking I’ve been doing recently related to a project reminded me of this example of Bayesian Analysis described in the book:

Exclusive Features :

Food Fighter:Does Whole Foods’ C.E.O. know what’s best for you?- Via New Yorker -John Mackey, the co-founder and chief executive of Whole Foods Market, refers to the company as his child—not just his creation but the thing on earth whose difficulties or downfall it pains him most to contemplate. He also sees himself as a “daddy” to his fifty-four thousand employees, who are known as “team members,” but they may occasionally consider him to be more like a crazy uncle. To the extent that a child inherits or adopts a parent’s traits, Whole Foods is an embodiment of many of Mackey’s. A Whole Foods store, in some respects, is like Mackey’s mind turned inside out. Certainly, the evolution of the corporation has often traced his own as a man; it has been an incarnation of his dreams and quirks, his contradictions and trespasses, and whatever he happened to be reading and eating, or not eating.

China: Russia’s Land of Opportunity- Via FP -Demographically, it makes sense that Chinese people would flock to Russia. Look at it in economic terms, though: China’s economy is booming, and its prospects seem limitless. Meanwhile, Russia is highly dependent on uncertain oil and natural gas reserves. Professionals already make more money in China than they do in Russia, and as China’s economy grows, blue-collar wages will likely outpace Russian pay. So, rather than Chinese people moving to Russia, isn’t it more likely that Russians would move to China?

Nobel Laureate Joseph Stiglitz: ‘Harsh lessons we may need to learn again’ – Via Manual Of Ideas – The best that can be said for 2009 is that it could have been worse, that we pulled back from the precipice on which we seemed to be perched in late 2008, and that 2010 will almost surely be better for most countries around the world. The world has also learned some valuable lessons, though at great cost both to current and future prosperity – costs that were unnecessarily high given that we should already have learned them.

Nial Ferguson: The Decade The World Tilted East - Via Financial Times – I am trying to remember now where it was, and when it was, that it hit me. Was it during my first walk along the Bund in Shanghai in 2005? Was it amid the smog and dust of Chonqing, listening to a local Communist party official describe a vast mound of rubble as the future financial centre of south-west China? That was last year, and somehow it impressed me more than all the synchronised razzamatazz of the Olympic opening ceremony in Beijing. Or was it at Carnegie Hall only last month, as I sat mesmerised by the music of Angel Lam, the dazzlingly gifted young Chinese composer who personifies the Orientalisation of classical music? I think maybe it was only then that I really got the point about this decade, just as it was drawing to a close: that we are living through the end of 500 years of western ascendancy.

And the worst footnote of 2009 was… – Via Footnoted - Voting for the worst footnote of 2009 ended last night and footnoted readers have chosen the disclosure by Chesapeake Energy (CHK) that it had spent $12.1 million to purchase Chairman and CEO Aubrey McClendon’s antique map collection. Here’s the disclosure in all of its glory from the April 30 proxy statement.

Secrets of the Economist’s Trade: First, Purchase a Piggy Bank- Via WSJ – Academic economists gather in Atlanta this weekend for their annual meetings, always held the first weekend after New Year’s Day. That’s not only because it coincides with holidays at most universities. A post-holiday lull in business travel also puts hotel rates near the lowest point of the year.

The economic ‘experts’ who stopped making sense – Via Telegraph.co.uk – Why, despite the financial crisis, do we still put our faith in economists, asks Edmund Conway. In much the same way, economics is a science which employs some of the world’s most intelligent people and most powerful computers in order to prove the bleeding obvious. When I first started writing about the subject, one excited academic told me to look into behavioural economics, which he described as the most “exciting and radical” of all the fields of economic research. Its most edgy, controversial finding? That people occasionally behave irrationally, driven by emotion rather than reason. Well, duh.

“This Time It’s Different” – It never is – In both poker and investing (ref Kid Dynamite)- Via Texas Holdem Investing.com – Kid Dynamite of the Friday In Vegas blog posted an excellent article – “Synthetic CDO’s, Spanish 21 and Sports Betting” (also posted on SeekingAlpha and Clusterstock) – which uses gambling, sports betting, and even references to Susquehanna in an effort to explain why perhaps Goldman Sachs and other financial institutions are not totally at fault for some of the recent investment losses suffered through so-called CDOs – Collateralized Debt Obligations. The CDOs were backed by so-called sub-prime mortgages which were made to borrowers with questionable credit histories.

Year in Review: Lessons from History–No Way Back to Cheap, Easy Credit- Via IMF Direct – The world economy is beginning to awaken from a nightmare. What hit us, and what was the tossing and turning all about? The popular simile is a comparison with the Great Depression, as in “This is the worst downturn since the 1930s.”

Features:

The Worst of ‘08 Have Been the Best of ‘09 – Via Bespoke Investment Group – With the year coming to an end today, we broke the S&P 500 into deciles (10 groups of 50 stocks) based on stock performance in 2008 to see what impact it had on performance in 2009. Many of the stocks that got hit the hardest last year came roaring back this year, and the numbers below help quantify this. As shown, the 50 stocks in the S&P 500 that did the worst in 2008 are up an average of 101% in 2009! The 50 stocks that did the best in 2008 are up an average of just 9% in 2009. 2009 was definitely a year when buying the losers worked.

The Bloody Battle to Save Broadcast Television – Via Paul Kedrosky & Broadcasting Cable- Broadcast television is fighting for its life, and one massive battle taking place now could define how the war may be won. The carriage agreements between Time Warner Cable (TWC) and News Corp. for Fox-owned stations, cable networks and regional sports networks expire Dec. 31. The executives working on those agreements—otherwise known as retransmission deals—are expected to remain at the negotiating table into the wee hours of the holiday season.

Information Arbitrage How I Invest - Via Information Arbitrage - From a process perspective, this generally means that I have a vision of the future “at infinity” and work backwards to identify potential investment candidates. The key for me is once a candidate is identified, are they close enough to the rapid growth phase and is the market sufficiently ready for this growth to take place? How many times have you heard an entrepreneur say “We were just too early.” The road is littered with great ideas whose time had not yet come from a commercial perspective. It is this timing issue where I spend a tremendous amount of time on due diligence, reaching out to industry contacts and testing their receptivity (and willingness to buy) the product/technology in question. Does this approach mean I’ll miss some huge ideas that were simply on nobody’s radar screen? Sure. But is it a more risk controlled way of reaching for big gains? I think so.

Money Can’t Buy Happiness – Via Psyfi Blog – Often the quest for the illusory bird of happiness is equated with the accumulation of ever increasing amounts of money. If only we had more wonga, moula, spondoolies we’d be so much more cheerful. Only when we get the extra dough our partners find that we’re still the same miserable gits that we were before and elope with the gardener, most of our money and the garden gnome collection.

How Measuring Misery and Happiness can Alter Policy - Via Big Think – When it comes to emotion, most people don’t deal in shades of gray. We’re either happy, miserable or (in some cases) embedded with enough pharmacology to render us aloof and indifferent. But in a world constantly in pursuit of a self-help quick-fix, what if we could statistically measure levels of misery and happiness? And how would they affect the way the world operates? And perhaps most importantly, how are you feeling today? You good?

5 Prediction Errors Made By The Atlantic Monthly -via Atlantic - The last decade has been no exception: we’ve published some 2,000 articles, and many turned out to be eerily prophetic. Nine years after James Fallows’s cover story “The 51st State,” Uncle Sam is, as our cover image anticipated, staggering under the weight of a smoldering Iraq. But inevitably, our crystal ball has its flaws. Here are five thoughtfully argued Atlanticpredictions that never quite came to pass.

Finance & Investing:[url=http://www.distressed-debt-investing.com/2010/01/distressed-debt-research-tronox.html][/url]

Real Estate Tycoon Tom Barrack Says Just Show Up- Via Colony Capital – I have surprised most of you by maintaining my silence and not waxing poetic on the parade of inconsistencies in our markets over the past few months. During the fundraising of our public REIT, I was bound and gagged to keep my mouth shut and my pen dry. Now I am unleashed and re-engaged in the financial version of “The World of Warcraft.”

Distressed Debt Research – Tronox- Via Distressed Debt Investing – Every few months, I am going to take a recent submission from the Distressed Debt Investors Club and post it to the blog. This week, Tronox, a distressed debt situation authored by member jnahas, will be presented. This allows readers to see the quality / type of ideas being posted to the site which will help you decide if you would like to apply as a member or a guest. Currently, there are over 200 guest membership requests for the site – I have not approved them yet as we add some new and exciting functionality – member requests are being processed as they come in (we are up to 75 high caliber members posting a number of ideas each week). I will write an “Inside Look” post on the DDIC later on in the week for all that are curious.

Martin Capital Management – Fireside Chat No. 7: Among the Last Skeptics Standing - Via Value Investing World – Rather, the question that should be on everyone’s mind is whether the reflation in the prices of stocks and lower-quality bonds is a false-positive error, one born of excessive credulity. If the markets in risky assets are correct in forecasting a sustainable economic recovery enabled by a smoothly functioning financial system, that prospect has already been priced into the markets with the Shiller PE pushing a “bubble territory” 20 times earnings

Credit models and the crisis, or how I learned to stop worrying and love the CDOs – Via MoneyScience – We follow a long path for Credit Derivatives and Collateralized Debt Obligations (CDOs) in particular, from the introduction of the Gaussian copula model and the related implied correlations to the introduction of arbitrage-free dynamic loss models capable of calibrating all the tranches for all the maturities at the same time. En passant, we also illustrate the implied copula, a method that can consistently account for CDOs with different attachment and detachment points but not for different maturities. The discussion is abundantly supported by market examples through history. The dangers and critics we present to the use of the Gaussian copula and of implied correlation had all been published by us, among others, in 2006, showing that the quantitative community was aware of the model limitations before the crisis. We also explain why the Gaussian copula model is still used in its base correlation formulation, although under some possible extensions such as random recovery. Overall we conclude that the modeling effort in this area of the derivatives market is unfinished, partly for the lack of an operationally attractive single-name consistent dynamic loss model, and partly because of the diminished investment in this research area.

Advanced Distressed Debt Lesson #4 - Via Distressed Debt Investing - A friend asked me my opinion of something Whitney Tilson said in his most recent email regarding GGP. Here is the relevant text.

Why Buffett is Betting on the Railroads – Via Value Investing World – A great find by Shai at the Reflections blog. There are some interesting thoughts in the article on Burlington’s moat and the long-term nature of its cap-ex – which may help to explain Mr. Buffett’s purchase in light of his more recent comments on higher inflation expectations and his past comments about how severe inflation hurts businesses that have to keep reinvesting in cap-ex during inflationary times. Maybe the business categories aren’t just ‘capital intensive businesses’ versus ‘non-capital intensive businesses’ and that during times when there is a significant risk of inflation within a few years, the nature of cap-ex is almost as important as the cap-ex itself. The end of the article discusses some of the cap-ex Burlington has made since 1995.

Negative Enterprise Value Stocks for 2010- Via Old School Value – Since enterprise value accounts for debt and subtracts the excess cash from the equation, if the formula above results in a negative number, the conclusion is that the company is loaded with excess cash, hence a cash rich company trading for less than it’s value.

Videos & Presentations:

Who Owns America: Major Foreign Holders Of Treasuries -Via Vimeo –

[/b]

[b]Academic Papers:

Coarse Thinking and Persuasion - Via Harvard – We present a model of coarse thinking, in which individuals group situations into categories, and transfer the informational content of a given message from situations in a category where it is useful to those where it is not. The model explains how uninformative messages can be persuasive, particularly in low involvement situations, and how objectively informative messages can be dropped by the persuader without the audience assuming the worst. The model sheds light on product branding, the structure of product attributes, and several puzzling aspects of mutual fund advertising.

What’s Psychology Worth? A Field Experiment in the Consumer Credit Market- Via Harvard – Numerous laboratory studies find that minor nuances of presentation and description change behavior in ways that are inconsistent with standard economic models. How much do these context effects matter in natural settings, when consumers make large, real decisions and have the opportunity to learn from experience? We report on a field experiment designed to address this question. A South African lender sent letters offering incumbent clients large, short-term loans at randomly chosen interest rates. The letters also contained independently randomized psychological “features” that were motivated by specific types of frames and cues shown to be powerful in the lab, but which, from a normative perspective, ought to have no impact. Consistent with standard economics, the interest rate significantly affected loan take-up. Inconsistent with standard economics, some of the psychological features also significantly affected take-up. The average effect of a psychological manipulation was equivalent to a one half percentage point change in the monthly interest rate. Interestingly, the psychological features appear to have greater impact in the context of less advantageous offers and persist across different income and education levels. In short, even in a market setting with large stakes and experienced customers, subtle psychological features appear to be powerful drivers of behavior. The findings pose a challenge for the social sciences: they suggest that psychological nuance matters but may be inherently difficult to predict given the impact of context. Successful incorporation of psychological features into field studies is likely to prove a vital, but nontrivial, addition to the formation of more general theories on when, why, and how frames and cues influence important decisions.

Sticking with Your Vote: Cognitive Dissonance and Voting- Via Harvard – In traditional models, votes are an expression of preferences and beliefs. Psychological theories of cognitive dissonance suggest, however, that behavior may shape preferences. In this view, the very act of voting may influence political attitudes. A vote for a candidate may lead to more favorable interpretations of his actions in the future. We test the empirical relevance of cognitive dissonance in US Presidential elections. The key problem in such a test is the endogeneity of voter choice which leads to a mechanical relationship between voting and preferences. We use the voting age restrictions to help surmount this difficulty. We examine the Presidential opinion ratings of nineteen and twenty year olds two years after the President’s election. Consistent with cognitive dissonance, we find that twenty year olds (who were eligible to vote in the election) show greater polarization of opinions than comparable nineteen year olds (who were ineligible to vote). We rule out that aging drives these results in two ways. First, we find no polarization differences in years in which twenty and nineteen year olds would not have differed in their eligibility to vote in the prior Presidential election. Second, we show a similar effect when we compare polarization (for all age groups) in opinions of Senators elected during high turnout Presidential campaign years with Senators elected during low turnout non- Presidential campaign years. Thus we find empirical support for the relevance of cognitive dissonance to voting behavior. This finding has at least three implications for the dynamics of voting behavior. First, it offers a new rationale for the incumbency advantage. Second, it suggests that there is an efficiency argument for term limits. And finally, our results demonstrate that efficiency may not be increasing in turnout level.

Natural Resources in Côte d’Ivoire: Fostering Crisis or Peace?- Via Policy Pointers – This 84-page German brief investigates the extent to which natural resources have contributed to causing and sustaining this armed conflict and how natural resource exploitation can contribute to peace and development in Côte d’Ivoire

Other Interesting Articles:

Are we really in a narcissism epidemic? The concerns about Generation Me. - Via Social Psychology Eye – According to psychological professor Jean M. Twenge, Generation Me describes anyone born in the 1970s, 1980s, or 1990s — in the approaching 2010, this will mean people between the ages of 11 and 40. These are today’s young people, those who while remarkably diverse in many respects, share a unifying aspect: they are “unapologetically focused on the individual,” a trait inherited from their Boomer parents and fanned to extremes by the culture they engendered.

Can Microfinance Make It in America? – Via Time – Emily Medina isn’t running a pyramid scheme, despite what people often think. As the petite 26-year-old works her way through some of New York City’s poorer neighborhoods, she approaches women selling food and trinkets on the street and offers to lend them money to grow their businesses. The organization Medina works for, Grameen, is one of the world’s largest microfinance outfits and has a Nobel Prize to its name for this work. But in New York neighborhoods where loans to street vendors tend to come with interest rates north of 40%, it can take a while to build trust. “I didn’t believe it until I had the $1,500 check in my hand,” says jewelry seller Rosa Lopez.

On Prediction Markets and Self-Fulfilling Prophecies- Via Rajiv Sethi – There is an entirely different class of events that may be termed endogenous: their likelihood of occurrence is sensitive to beliefs about this likelihood. Political campaigns, especially for party nominations in major elections, have this character. A candidate who is considered to be a prohibitive favorite will have a major fund-raising advantage, for instance if early donors believe that they will be rewarded with access, perks, or appointments. George W. Bush leveraged an aura of inevitability into a massive financial advantage in the contest for the Republican nomination in 2000, and Hillary Clinton attempted to do the same eight years later. By the same token, a campaign that is perceived to have little chance of success may never get off the ground at all, regardless of the strengths of the candidate in question. Hence managing expectations about the likelihood of success is often a major campaign priority.

Book Review – Makeover TV – Via Global Sociology – And a big chunk of the show is occupied by the process of transformation, showing the hard work and/or suffering that subjects go through to achieve results defined by the experts as stand-in for social standards. There are moments of resistance by the subjects that are swiftly dealt with by the experts. Ultimately, submission to expertise and self-discipline brings the expected results. A nicely packaged morality play. A disciplined and regulated self, that displays its conformity to white, heterosexual, middle-class standards of appearance as neo-liberal subject is well-adapted to (and fulfilled within) the risk society. This disciplined (in Foucault’s sense) after-self contrasts with the undisciplined (fat, sloppy) and socially or ethnically over-signified before-self. The before self is, by definition, self-indulgent (too much food, too much sexiness, especially in non-white subjects) or lazy (dirty house, unruly children). The promise of happiness in personal life and success in the professional domain is the price to be obtained through the disciplining of the self.

Can you Control your Cravings – Via stuartschneiderman. – As long as there have been ethics, thinkers have wondered why people take actions that they know are contrary to their self-interest.

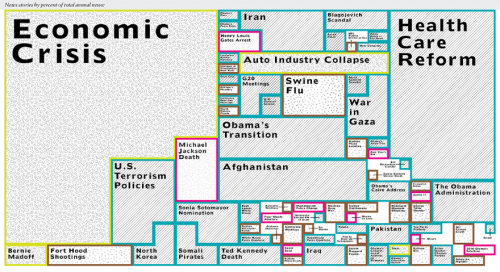

Infographics: (Click On Image For Larger Version)

What Stories Are The Media Covering – Via Sociological Images

Miguel Barbosa

Founder of

http://www.simoleonsense.com/

Reinflating the bubble: (Via Yes & Not Yes)

[b]

[/quote]Weekly Joke (Via Cushico)

1. MOST IMPORTANT PROFESSION

Someone told me recently about an architect, a surgeon, and economist. The surgeon said, ‘Look, we’re the most important. God’s a surgeon because the very first thing God did was to extract Eve from Adam’s rib.’ Th e architect said, ‘No, wait a minute, God is an architect. God made the world in seven days out of chaos.’ The economist smiled, ‘And who made the chaos?’2. Lightbulb Jokes

Q: How many Chicago School economists does it take to change a light bulb?

A: None. If the light bulb needed changing the market would have already done it.

Most Important Article Of The Week!!!!

Elizabeth Warren – What Has the Troubled Asset Relief Program Achieved? - Via COP- Because so many different forces and programs have influenced financial markets over the last year, TARP’s effects are impossible to isolate. Even so, there is broad consensus that the TARP was an important part of a broader government strategy that stabilized the U.S. financial system by renewing the flow of credit and averting a more acute crisis. Although the government’s response to the crisis was at first haphazard and uncertain, it eventually proved decisive enough to stop the panic and restore market confidence. Despite significant improvement in the financial markets, however, the broader economy is only beginning to recover from a deep recession, and the TARP’s impact on the underlying weaknesses in the financial system that led to last fall’s crisis is less clear.

Miguel’s Weekly Favorites:[url=http://www.mindhacks.com/blog/2010/01/the_psychology_of_s.html][/url]

The psychology of ’super-human strength’ - Via MindHacks – Vladimir Zatsiorsky, a professor of kinesiology at Penn State who has extensively studied the biomechanics of weightlifting, draws the distinction between the force that our muscles are able to theoretically apply, which he calls “absolute strength,” and the maximum force that they can generate through the conscious exertion of will, which he calls “maximal strength.” An ordinary person, he has found, can only summon about 65 percent of their absolute power in a training session, while a trained weightlifter can exceed 80 percent…

The economics of happiness - Via Washington Post - Last year was not a happy one. Economic crisis. Job losses. Wars. Yet, while we can quantify things such as gross domestic product or home foreclosures, it’s harder to measure their impact on our collective happiness. One way to gauge that effect is through what has become known as the economics of happiness — a set of new techniques and data to measure well-being and contentment. Hundreds of thousands of people are surveyed and asked how happy or satisfied they are with their lives, with possible answers on a scale between very unhappy and very happy.

How to Train the Aging Brain – Via NYT – The problem is, as much as I’ve enjoyed these books, I don’t really remember reading any of them. Certainly I know the main points. But didn’t I, after underlining all those interesting parts, retain anything else? It’s maddening and, sorry to say, not all that unusual for a brain at middle age: I don’t just forget whole books, but movies I just saw, breakfasts I just ate, and the names, oh, the names are awful. Who are you?

Risk & Return may be approximated by a positional utility model - Via Nick Gogerty – Here is an interesting and pretty lengthy paper by Eric Falkenstein. It consists of 2 major parts a synopsis of failures of the typical risk reward relationship assumed in finance and an explanatory thesis involving individual agents who have envy in the pursuit of positional goods.

What’s my brain’s motivation? – Via BBC -For an actor, the performance conditions weren’t exactly ideal: flat on her back in a large machine, under strict instructions to lie as still as possible, speaking in short bursts interspersed with the shrill sound of a magnetic resonance imaging scanner.

Choice, Social Class, & Agency- Via Situationist – Across disciplines we tend to assume that choice is a fundamental or “basic” unit of human behavior, and that behavior is a product of individual choice. In my talk, I will present a series of lab and field studies that question these assumptions about behavior, and suggest that these assumptions reflect primarily the experiences of college-educated, or middle-class, Americans, who tend to have access to a wealth of choices and an array of quality options among which to choose. I will discuss the implications of these assumptions for the (mis)understanding of behavior across diverse contexts.

Phys Ed: How Little Exercise Can You Get Away With? – Via NYT – Recently researchers trawled through a vast database of survey information about the health and habits of men and women in Scotland, hoping to determine how much exercise is needed to keep the Scots from feeling gloomy (or in technical terms, experiencing “psychological distress”). The answer, according to a study published in this month’s British Journal of Sports Medicine: a mere 20 minutes a week of any physical activity, whether sports, walking, gardening or even housecleaning, the last not usually associated with bringing out the sunshine. The researchers found that more activity conferred more mental-health benefits and that “participation in vigorous sports activities” tended to be the “most beneficial for mental health.” But their overall conclusion was that being active for as little as 20 minutes a week is sufficient, if your specific goal is mental health.

Free Institutional Research- Via World Beta – While I use Hedge Fund Letters for my hedge commentary fix, I was wondering a little about where to go for the best free institutional research published online. I’m thinking in the vein of GMO, Hussman, PIMCO, Research Affiliates, etc. I’m going to start a list below, feel free to make some comments and I’ll add as they come in. Only requirement is the author(s) have to be institutional money managers:

“Entrepreneurs are accustomed to a manic-depressive economy” - Via Mises – If we are to emerge from the crisis, “politicians must resist implementing grandiloquent rescue plans,” warns Jesús Huerta de Soto (Madrid 1956). Professor of Economics and one of the foremost current representatives of the Austrian School, Huerta de Soto, who recently delivered a lecture at the Madrid Association of Family Businesses (AMEF), is certain that “the great social crisis of our time is statolatry.” In other words, it is the tendency to expect the state to resolve any problem that arises. In an interview with Expansión, he confidently stated that once the economy is back on its feet, “we will again enter into a phase of credit expansion which will give rise to widespread malinvestment.” Thus, the seeds of a new recession will be sown.

Why your boss is incompetent – Via New Scientist Life – In This season of goodwill, spare a thought for that much-maligned bunch, the men and women at the top of the management tree. Yes, the murky machinations of the banking bosses might have needlessly plunged millions into penury. Yes, the actions of our political leaders might seem to be informed more by dubious wheeler-dealing than by Socratic wisdom. And yes, the high-ups in your own company might well be the self-important time-wasters you’ve always held them for.

Using Bayesian Analysis to find a lost nuclear weapon - via Hackensack – Ten years ago I picked this book up at an airport bookstore, Blind Man’s Bluff: The Untold Story of American Submarine Espionage, by Sherry Sontag and Christopher Drew. Some thinking I’ve been doing recently related to a project reminded me of this example of Bayesian Analysis described in the book:

Exclusive Features :

Food Fighter:Does Whole Foods’ C.E.O. know what’s best for you?- Via New Yorker -John Mackey, the co-founder and chief executive of Whole Foods Market, refers to the company as his child—not just his creation but the thing on earth whose difficulties or downfall it pains him most to contemplate. He also sees himself as a “daddy” to his fifty-four thousand employees, who are known as “team members,” but they may occasionally consider him to be more like a crazy uncle. To the extent that a child inherits or adopts a parent’s traits, Whole Foods is an embodiment of many of Mackey’s. A Whole Foods store, in some respects, is like Mackey’s mind turned inside out. Certainly, the evolution of the corporation has often traced his own as a man; it has been an incarnation of his dreams and quirks, his contradictions and trespasses, and whatever he happened to be reading and eating, or not eating.

China: Russia’s Land of Opportunity- Via FP -Demographically, it makes sense that Chinese people would flock to Russia. Look at it in economic terms, though: China’s economy is booming, and its prospects seem limitless. Meanwhile, Russia is highly dependent on uncertain oil and natural gas reserves. Professionals already make more money in China than they do in Russia, and as China’s economy grows, blue-collar wages will likely outpace Russian pay. So, rather than Chinese people moving to Russia, isn’t it more likely that Russians would move to China?

Nobel Laureate Joseph Stiglitz: ‘Harsh lessons we may need to learn again’ – Via Manual Of Ideas – The best that can be said for 2009 is that it could have been worse, that we pulled back from the precipice on which we seemed to be perched in late 2008, and that 2010 will almost surely be better for most countries around the world. The world has also learned some valuable lessons, though at great cost both to current and future prosperity – costs that were unnecessarily high given that we should already have learned them.

Nial Ferguson: The Decade The World Tilted East - Via Financial Times – I am trying to remember now where it was, and when it was, that it hit me. Was it during my first walk along the Bund in Shanghai in 2005? Was it amid the smog and dust of Chonqing, listening to a local Communist party official describe a vast mound of rubble as the future financial centre of south-west China? That was last year, and somehow it impressed me more than all the synchronised razzamatazz of the Olympic opening ceremony in Beijing. Or was it at Carnegie Hall only last month, as I sat mesmerised by the music of Angel Lam, the dazzlingly gifted young Chinese composer who personifies the Orientalisation of classical music? I think maybe it was only then that I really got the point about this decade, just as it was drawing to a close: that we are living through the end of 500 years of western ascendancy.

And the worst footnote of 2009 was… – Via Footnoted - Voting for the worst footnote of 2009 ended last night and footnoted readers have chosen the disclosure by Chesapeake Energy (CHK) that it had spent $12.1 million to purchase Chairman and CEO Aubrey McClendon’s antique map collection. Here’s the disclosure in all of its glory from the April 30 proxy statement.

Secrets of the Economist’s Trade: First, Purchase a Piggy Bank- Via WSJ – Academic economists gather in Atlanta this weekend for their annual meetings, always held the first weekend after New Year’s Day. That’s not only because it coincides with holidays at most universities. A post-holiday lull in business travel also puts hotel rates near the lowest point of the year.

The economic ‘experts’ who stopped making sense – Via Telegraph.co.uk – Why, despite the financial crisis, do we still put our faith in economists, asks Edmund Conway. In much the same way, economics is a science which employs some of the world’s most intelligent people and most powerful computers in order to prove the bleeding obvious. When I first started writing about the subject, one excited academic told me to look into behavioural economics, which he described as the most “exciting and radical” of all the fields of economic research. Its most edgy, controversial finding? That people occasionally behave irrationally, driven by emotion rather than reason. Well, duh.

“This Time It’s Different” – It never is – In both poker and investing (ref Kid Dynamite)- Via Texas Holdem Investing.com – Kid Dynamite of the Friday In Vegas blog posted an excellent article – “Synthetic CDO’s, Spanish 21 and Sports Betting” (also posted on SeekingAlpha and Clusterstock) – which uses gambling, sports betting, and even references to Susquehanna in an effort to explain why perhaps Goldman Sachs and other financial institutions are not totally at fault for some of the recent investment losses suffered through so-called CDOs – Collateralized Debt Obligations. The CDOs were backed by so-called sub-prime mortgages which were made to borrowers with questionable credit histories.

Year in Review: Lessons from History–No Way Back to Cheap, Easy Credit- Via IMF Direct – The world economy is beginning to awaken from a nightmare. What hit us, and what was the tossing and turning all about? The popular simile is a comparison with the Great Depression, as in “This is the worst downturn since the 1930s.”

Features:

The Worst of ‘08 Have Been the Best of ‘09 – Via Bespoke Investment Group – With the year coming to an end today, we broke the S&P 500 into deciles (10 groups of 50 stocks) based on stock performance in 2008 to see what impact it had on performance in 2009. Many of the stocks that got hit the hardest last year came roaring back this year, and the numbers below help quantify this. As shown, the 50 stocks in the S&P 500 that did the worst in 2008 are up an average of 101% in 2009! The 50 stocks that did the best in 2008 are up an average of just 9% in 2009. 2009 was definitely a year when buying the losers worked.

The Bloody Battle to Save Broadcast Television – Via Paul Kedrosky & Broadcasting Cable- Broadcast television is fighting for its life, and one massive battle taking place now could define how the war may be won. The carriage agreements between Time Warner Cable (TWC) and News Corp. for Fox-owned stations, cable networks and regional sports networks expire Dec. 31. The executives working on those agreements—otherwise known as retransmission deals—are expected to remain at the negotiating table into the wee hours of the holiday season.

Information Arbitrage How I Invest - Via Information Arbitrage - From a process perspective, this generally means that I have a vision of the future “at infinity” and work backwards to identify potential investment candidates. The key for me is once a candidate is identified, are they close enough to the rapid growth phase and is the market sufficiently ready for this growth to take place? How many times have you heard an entrepreneur say “We were just too early.” The road is littered with great ideas whose time had not yet come from a commercial perspective. It is this timing issue where I spend a tremendous amount of time on due diligence, reaching out to industry contacts and testing their receptivity (and willingness to buy) the product/technology in question. Does this approach mean I’ll miss some huge ideas that were simply on nobody’s radar screen? Sure. But is it a more risk controlled way of reaching for big gains? I think so.

Money Can’t Buy Happiness – Via Psyfi Blog – Often the quest for the illusory bird of happiness is equated with the accumulation of ever increasing amounts of money. If only we had more wonga, moula, spondoolies we’d be so much more cheerful. Only when we get the extra dough our partners find that we’re still the same miserable gits that we were before and elope with the gardener, most of our money and the garden gnome collection.

How Measuring Misery and Happiness can Alter Policy - Via Big Think – When it comes to emotion, most people don’t deal in shades of gray. We’re either happy, miserable or (in some cases) embedded with enough pharmacology to render us aloof and indifferent. But in a world constantly in pursuit of a self-help quick-fix, what if we could statistically measure levels of misery and happiness? And how would they affect the way the world operates? And perhaps most importantly, how are you feeling today? You good?

5 Prediction Errors Made By The Atlantic Monthly -via Atlantic - The last decade has been no exception: we’ve published some 2,000 articles, and many turned out to be eerily prophetic. Nine years after James Fallows’s cover story “The 51st State,” Uncle Sam is, as our cover image anticipated, staggering under the weight of a smoldering Iraq. But inevitably, our crystal ball has its flaws. Here are five thoughtfully argued Atlanticpredictions that never quite came to pass.

Finance & Investing:[url=http://www.distressed-debt-investing.com/2010/01/distressed-debt-research-tronox.html][/url]

Real Estate Tycoon Tom Barrack Says Just Show Up- Via Colony Capital – I have surprised most of you by maintaining my silence and not waxing poetic on the parade of inconsistencies in our markets over the past few months. During the fundraising of our public REIT, I was bound and gagged to keep my mouth shut and my pen dry. Now I am unleashed and re-engaged in the financial version of “The World of Warcraft.”

Distressed Debt Research – Tronox- Via Distressed Debt Investing – Every few months, I am going to take a recent submission from the Distressed Debt Investors Club and post it to the blog. This week, Tronox, a distressed debt situation authored by member jnahas, will be presented. This allows readers to see the quality / type of ideas being posted to the site which will help you decide if you would like to apply as a member or a guest. Currently, there are over 200 guest membership requests for the site – I have not approved them yet as we add some new and exciting functionality – member requests are being processed as they come in (we are up to 75 high caliber members posting a number of ideas each week). I will write an “Inside Look” post on the DDIC later on in the week for all that are curious.

Martin Capital Management – Fireside Chat No. 7: Among the Last Skeptics Standing - Via Value Investing World – Rather, the question that should be on everyone’s mind is whether the reflation in the prices of stocks and lower-quality bonds is a false-positive error, one born of excessive credulity. If the markets in risky assets are correct in forecasting a sustainable economic recovery enabled by a smoothly functioning financial system, that prospect has already been priced into the markets with the Shiller PE pushing a “bubble territory” 20 times earnings

Credit models and the crisis, or how I learned to stop worrying and love the CDOs – Via MoneyScience – We follow a long path for Credit Derivatives and Collateralized Debt Obligations (CDOs) in particular, from the introduction of the Gaussian copula model and the related implied correlations to the introduction of arbitrage-free dynamic loss models capable of calibrating all the tranches for all the maturities at the same time. En passant, we also illustrate the implied copula, a method that can consistently account for CDOs with different attachment and detachment points but not for different maturities. The discussion is abundantly supported by market examples through history. The dangers and critics we present to the use of the Gaussian copula and of implied correlation had all been published by us, among others, in 2006, showing that the quantitative community was aware of the model limitations before the crisis. We also explain why the Gaussian copula model is still used in its base correlation formulation, although under some possible extensions such as random recovery. Overall we conclude that the modeling effort in this area of the derivatives market is unfinished, partly for the lack of an operationally attractive single-name consistent dynamic loss model, and partly because of the diminished investment in this research area.

Advanced Distressed Debt Lesson #4 - Via Distressed Debt Investing - A friend asked me my opinion of something Whitney Tilson said in his most recent email regarding GGP. Here is the relevant text.

Why Buffett is Betting on the Railroads – Via Value Investing World – A great find by Shai at the Reflections blog. There are some interesting thoughts in the article on Burlington’s moat and the long-term nature of its cap-ex – which may help to explain Mr. Buffett’s purchase in light of his more recent comments on higher inflation expectations and his past comments about how severe inflation hurts businesses that have to keep reinvesting in cap-ex during inflationary times. Maybe the business categories aren’t just ‘capital intensive businesses’ versus ‘non-capital intensive businesses’ and that during times when there is a significant risk of inflation within a few years, the nature of cap-ex is almost as important as the cap-ex itself. The end of the article discusses some of the cap-ex Burlington has made since 1995.

Negative Enterprise Value Stocks for 2010- Via Old School Value – Since enterprise value accounts for debt and subtracts the excess cash from the equation, if the formula above results in a negative number, the conclusion is that the company is loaded with excess cash, hence a cash rich company trading for less than it’s value.

Videos & Presentations:

Who Owns America: Major Foreign Holders Of Treasuries -Via Vimeo –

[/b]

[b]Academic Papers:

Coarse Thinking and Persuasion - Via Harvard – We present a model of coarse thinking, in which individuals group situations into categories, and transfer the informational content of a given message from situations in a category where it is useful to those where it is not. The model explains how uninformative messages can be persuasive, particularly in low involvement situations, and how objectively informative messages can be dropped by the persuader without the audience assuming the worst. The model sheds light on product branding, the structure of product attributes, and several puzzling aspects of mutual fund advertising.

What’s Psychology Worth? A Field Experiment in the Consumer Credit Market- Via Harvard – Numerous laboratory studies find that minor nuances of presentation and description change behavior in ways that are inconsistent with standard economic models. How much do these context effects matter in natural settings, when consumers make large, real decisions and have the opportunity to learn from experience? We report on a field experiment designed to address this question. A South African lender sent letters offering incumbent clients large, short-term loans at randomly chosen interest rates. The letters also contained independently randomized psychological “features” that were motivated by specific types of frames and cues shown to be powerful in the lab, but which, from a normative perspective, ought to have no impact. Consistent with standard economics, the interest rate significantly affected loan take-up. Inconsistent with standard economics, some of the psychological features also significantly affected take-up. The average effect of a psychological manipulation was equivalent to a one half percentage point change in the monthly interest rate. Interestingly, the psychological features appear to have greater impact in the context of less advantageous offers and persist across different income and education levels. In short, even in a market setting with large stakes and experienced customers, subtle psychological features appear to be powerful drivers of behavior. The findings pose a challenge for the social sciences: they suggest that psychological nuance matters but may be inherently difficult to predict given the impact of context. Successful incorporation of psychological features into field studies is likely to prove a vital, but nontrivial, addition to the formation of more general theories on when, why, and how frames and cues influence important decisions.

Sticking with Your Vote: Cognitive Dissonance and Voting- Via Harvard – In traditional models, votes are an expression of preferences and beliefs. Psychological theories of cognitive dissonance suggest, however, that behavior may shape preferences. In this view, the very act of voting may influence political attitudes. A vote for a candidate may lead to more favorable interpretations of his actions in the future. We test the empirical relevance of cognitive dissonance in US Presidential elections. The key problem in such a test is the endogeneity of voter choice which leads to a mechanical relationship between voting and preferences. We use the voting age restrictions to help surmount this difficulty. We examine the Presidential opinion ratings of nineteen and twenty year olds two years after the President’s election. Consistent with cognitive dissonance, we find that twenty year olds (who were eligible to vote in the election) show greater polarization of opinions than comparable nineteen year olds (who were ineligible to vote). We rule out that aging drives these results in two ways. First, we find no polarization differences in years in which twenty and nineteen year olds would not have differed in their eligibility to vote in the prior Presidential election. Second, we show a similar effect when we compare polarization (for all age groups) in opinions of Senators elected during high turnout Presidential campaign years with Senators elected during low turnout non- Presidential campaign years. Thus we find empirical support for the relevance of cognitive dissonance to voting behavior. This finding has at least three implications for the dynamics of voting behavior. First, it offers a new rationale for the incumbency advantage. Second, it suggests that there is an efficiency argument for term limits. And finally, our results demonstrate that efficiency may not be increasing in turnout level.

Natural Resources in Côte d’Ivoire: Fostering Crisis or Peace?- Via Policy Pointers – This 84-page German brief investigates the extent to which natural resources have contributed to causing and sustaining this armed conflict and how natural resource exploitation can contribute to peace and development in Côte d’Ivoire

Other Interesting Articles:

Are we really in a narcissism epidemic? The concerns about Generation Me. - Via Social Psychology Eye – According to psychological professor Jean M. Twenge, Generation Me describes anyone born in the 1970s, 1980s, or 1990s — in the approaching 2010, this will mean people between the ages of 11 and 40. These are today’s young people, those who while remarkably diverse in many respects, share a unifying aspect: they are “unapologetically focused on the individual,” a trait inherited from their Boomer parents and fanned to extremes by the culture they engendered.

Can Microfinance Make It in America? – Via Time – Emily Medina isn’t running a pyramid scheme, despite what people often think. As the petite 26-year-old works her way through some of New York City’s poorer neighborhoods, she approaches women selling food and trinkets on the street and offers to lend them money to grow their businesses. The organization Medina works for, Grameen, is one of the world’s largest microfinance outfits and has a Nobel Prize to its name for this work. But in New York neighborhoods where loans to street vendors tend to come with interest rates north of 40%, it can take a while to build trust. “I didn’t believe it until I had the $1,500 check in my hand,” says jewelry seller Rosa Lopez.

On Prediction Markets and Self-Fulfilling Prophecies- Via Rajiv Sethi – There is an entirely different class of events that may be termed endogenous: their likelihood of occurrence is sensitive to beliefs about this likelihood. Political campaigns, especially for party nominations in major elections, have this character. A candidate who is considered to be a prohibitive favorite will have a major fund-raising advantage, for instance if early donors believe that they will be rewarded with access, perks, or appointments. George W. Bush leveraged an aura of inevitability into a massive financial advantage in the contest for the Republican nomination in 2000, and Hillary Clinton attempted to do the same eight years later. By the same token, a campaign that is perceived to have little chance of success may never get off the ground at all, regardless of the strengths of the candidate in question. Hence managing expectations about the likelihood of success is often a major campaign priority.

Book Review – Makeover TV – Via Global Sociology – And a big chunk of the show is occupied by the process of transformation, showing the hard work and/or suffering that subjects go through to achieve results defined by the experts as stand-in for social standards. There are moments of resistance by the subjects that are swiftly dealt with by the experts. Ultimately, submission to expertise and self-discipline brings the expected results. A nicely packaged morality play. A disciplined and regulated self, that displays its conformity to white, heterosexual, middle-class standards of appearance as neo-liberal subject is well-adapted to (and fulfilled within) the risk society. This disciplined (in Foucault’s sense) after-self contrasts with the undisciplined (fat, sloppy) and socially or ethnically over-signified before-self. The before self is, by definition, self-indulgent (too much food, too much sexiness, especially in non-white subjects) or lazy (dirty house, unruly children). The promise of happiness in personal life and success in the professional domain is the price to be obtained through the disciplining of the self.

Can you Control your Cravings – Via stuartschneiderman. – As long as there have been ethics, thinkers have wondered why people take actions that they know are contrary to their self-interest.

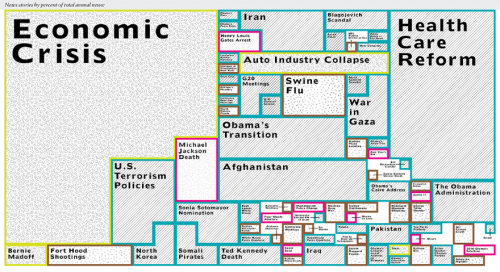

Infographics: (Click On Image For Larger Version)

What Stories Are The Media Covering – Via Sociological Images