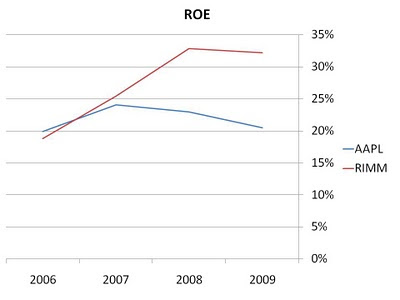

Apple (AAPL, Financial) and Research In Motion (RIMM, Financial) are clearly two of the best companies around. A quick look at their returns on equity over the last several years shows just how successful the companies' investments in research, production, and marketing have proven to be:

These are exactly the kinds of companies that Philip Fisher would want to own. (Philip Fisher was Warren Buffetts mentor when it came to growth stocks.) So why don't these stocks appeal to value investors? Quite simply, because of the price.

While the stellar returns on equity depicted in the chart above are clearly attractive, one must consider how much one has to pay for that equity. As we saw when we compared investments in Office Depot and Staples, adjusting returns for the price of the equity can have a dramatic effect on the attractiveness of a stock from an investor's perspective.

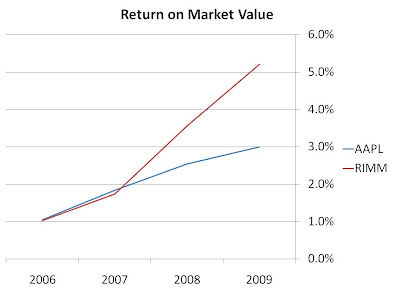

AAPL has a price to book value of almost 7 (meaning investors have to pay almost $7 for every $1 of equity that is in the company), while RIMM has a price to book above 5. Adjusting the above chart to reflect each companies' returns based on the market value of equity yields the following chart:

Clearly, things have to go very right for these companies in the future to justify an investment at current price levels. While the companies are extraordinary and it is quite possible that they will continue to grow and innovate and thus reward shareholders even at these price levels, downside risks are also present. Unexpected negative occurrences could take a large bite out of stock prices when they are at such high levels. If future products are not as successful as past products, or if competition and new entrants are able to slow the growth of these companies, the stock prices will have to correct dramatically.

On the other hand, there are plenty of companies with strong returns on equity (albeit not as strong as those of AAPL and RIMM), but which trade near their book values. As such, if things go wrong, the stocks don't have as far to fall. In many cases, the stocks even trade at levels such that the companies' assets offer investors protection from downside risks. This is the space in which the individual investor, who is not limited to companies of a certain size, should be playing.

Disclosure: None

Saj Karsan

http://www.barelkarsan.com/

These are exactly the kinds of companies that Philip Fisher would want to own. (Philip Fisher was Warren Buffetts mentor when it came to growth stocks.) So why don't these stocks appeal to value investors? Quite simply, because of the price.

While the stellar returns on equity depicted in the chart above are clearly attractive, one must consider how much one has to pay for that equity. As we saw when we compared investments in Office Depot and Staples, adjusting returns for the price of the equity can have a dramatic effect on the attractiveness of a stock from an investor's perspective.

AAPL has a price to book value of almost 7 (meaning investors have to pay almost $7 for every $1 of equity that is in the company), while RIMM has a price to book above 5. Adjusting the above chart to reflect each companies' returns based on the market value of equity yields the following chart:

Clearly, things have to go very right for these companies in the future to justify an investment at current price levels. While the companies are extraordinary and it is quite possible that they will continue to grow and innovate and thus reward shareholders even at these price levels, downside risks are also present. Unexpected negative occurrences could take a large bite out of stock prices when they are at such high levels. If future products are not as successful as past products, or if competition and new entrants are able to slow the growth of these companies, the stock prices will have to correct dramatically.

On the other hand, there are plenty of companies with strong returns on equity (albeit not as strong as those of AAPL and RIMM), but which trade near their book values. As such, if things go wrong, the stocks don't have as far to fall. In many cases, the stocks even trade at levels such that the companies' assets offer investors protection from downside risks. This is the space in which the individual investor, who is not limited to companies of a certain size, should be playing.

Disclosure: None

Saj Karsan

http://www.barelkarsan.com/