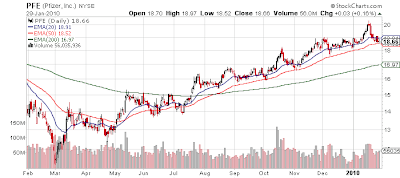

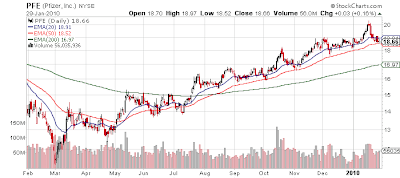

Fresh off his "Morningstar Manager of the Decade", we have some update's on the moves of the very schrewd Bruce Berkowitz in relation to his Fairholme Fund (FAIRX). The biggest change is his massive stake in Pfizer (PFE, Financial) has been cut back severely; since the data is as of Nov 30th it looks like he sold a bit early but as always, you need not catch the top or the bottom in a stock. If you are correct, you can make a lot of money over the long run simply capturing the middle of the move.

While completely opposite in style to me, I laud the concentrated portfolio style and excellent long term record - one of the few funds I have recommended to people in my offline life the past 3-4 years. [Feb 3, 2009: Fairholme Funds (FAIRX, Financial) 2008 Report] My only worry now is the "herd effect" - asset growth is going to explode as he has done very well, and at some asset level it becomes nearly impossible to keep up performance. FAIRX is up to $11B and I am sure getting tens of millions a week.

His latest fact sheet can be found here.

While completely opposite in style to me, I laud the concentrated portfolio style and excellent long term record - one of the few funds I have recommended to people in my offline life the past 3-4 years. [Feb 3, 2009: Fairholme Funds (FAIRX, Financial) 2008 Report] My only worry now is the "herd effect" - asset growth is going to explode as he has done very well, and at some asset level it becomes nearly impossible to keep up performance. FAIRX is up to $11B and I am sure getting tens of millions a week.

His latest fact sheet can be found here.

Top 10 holdings:

Via Bloomberg:

Position: Admiration

Trader Mark

http://www.fundmymutualfund.com/

- Sears Holding (SHLD) 10.6%

- Berkshire Hathaway (not sure which share class) 10.1%

- AmeriCredit (ACF) 7.0%

- The St Joe Company (JOE) 5.4%

- Humana (HUM) 5.4%

- Wellpoint (WLP) 5.2%

- Burlington Northern Santa Fe (BNI) 4.6%

- Hertz Global Holdings (HTZ) 4.6%

- General Growth Properties (GGWPQ) 4.2%

- Citigroup (C) 4.2%

Via Bloomberg:

- Bruce R. Berkowitz, named this month as U.S. stock mutual-fund manager of the decade, scaled back on former top holding Pfizer Inc. and increased his stake in Berkshire Hathaway Inc. at the $11.2 billion Fairholme Fund. Fairholme slashed its investment in New York-based Pfizer to 17.3 million shares from 76.5 million in the three months ended Nov. 30, according to a semi-annual report filed yesterday with the U.S. Securities and Exchange Commission. The drugmaker comprised almost 13 percent of Fairholme’s net assets as of Aug. 31.

- The Miami-based fund raised its stake in billionaire Warren Buffett’s Berkshire Hathaway to 10.1 percent of net assets on Nov. 30 from 5.8 percent. Fairholme also acquired a $493 million stake in Burlington Northern Santa Fe Corp., the railroad Berkshire is buying for cash and stock.

- Fairholme sold much of its defense and drug holdings during the three months through November. In addition to the Pfizer sale, the fund divested all of its stock in Boeing Co. and the Northrop Grumman Corp., the filing shows.

- Sears Holdings Corp. was the Fairholme fund’s largest stake as of Nov. 30, at 10.6 percent of assets, while Omaha, Nebraska- based Berkshire Hathaway ranked second, the SEC filing shows. Berkshire Hathaway would become No. 1 if Fairholme elects to take stock in Buffett’s holding company as payment for its Burlington Northern shares.

- The fund returned 39 percent in 2009, compared with the 26 percent gain by the Standard & Poor’s 500 Index, including dividends. It beat 74 percent of similarly managed funds, according to data compiled by Bloomberg. Fairholme, as a non- diversified fund, can invest in fewer securities and devote a larger percentage of its assets to a specific company than a diversified fund is allowed to under U.S. securities laws.

Position: Admiration

Trader Mark

http://www.fundmymutualfund.com/