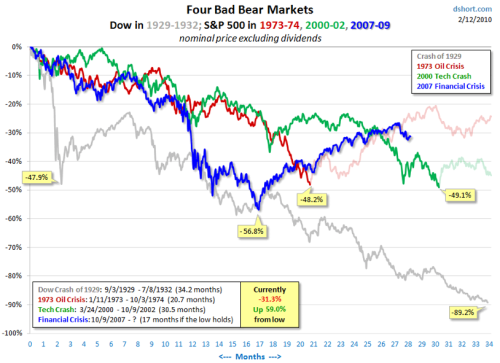

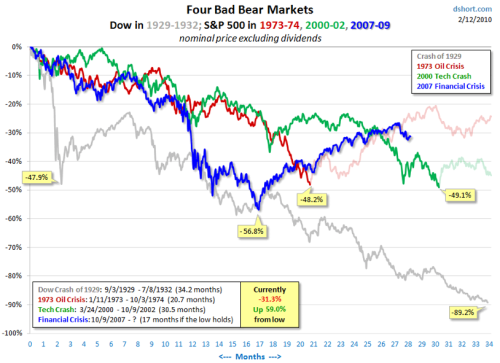

Speculating about the level of the market is a pastime for fools and knaves, as I have amply demonstrated in the past (or, as Edgar Allen Poe would have it, “I have great faith in fools — self-confidence my friends will call it.”). In April last year I ran a post, Three ghosts of bear markets past, on DShort.com’s series of charts showing how the current bear market compared to three other bear markets: the Dow Crash of 1929 (1929-1932), the Oil Crisis (1973-1974) and the Tech Wreck (2000-2002). At that time the market was up 24.4% from its low, and I said,

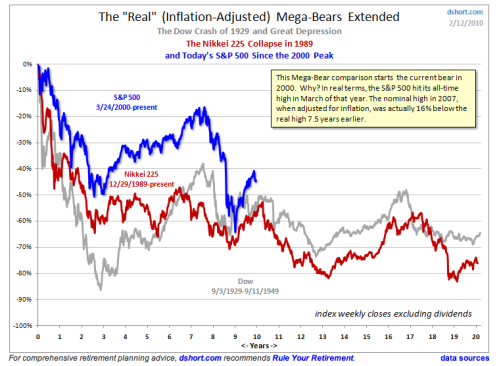

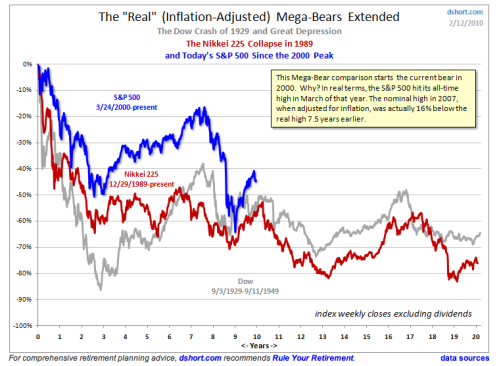

While none of us are actually investing with regard to the level of the market – we’re all analyzing individual securities – I still find it interesting to see how the present aggregate experience compares to the experience in other epochs in investing. One other chart by DShort.com worth seeing is the “Three Mega-Bears” chart, which treats the recent decline as part of the decline from the “Tech Wreck” on the basis that the peak pre-August 2007 did not exceed the peak pre-Tech Wreck after adjusting for inflation:

It’s interesting for me because it compares the Dow Crash of 1929 (from which Graham forged his “Net Net” strategy) to the present experience in the US and Japan (both of which offer the most Net-Net opportunities globally). Where are we going from here? Que sais-je? The one thing I do know is that 10 more years of a down or sideways market is, unfortunately, a real possibility.

Greenbackd

http://www.greenbackd.com/

Anyone who thinks that the bounce means that the current bear market is over would do well to study the behavior of bear markets past (quite aside from simply looking at the plethora of data about the economy in general, the cyclical nature of long-run corporate earnings and price-earnings multiples over the same cycle). They might find it a sobering experience.Now the market is up almost 60% from its low, which just goes to show what little I know:

While none of us are actually investing with regard to the level of the market – we’re all analyzing individual securities – I still find it interesting to see how the present aggregate experience compares to the experience in other epochs in investing. One other chart by DShort.com worth seeing is the “Three Mega-Bears” chart, which treats the recent decline as part of the decline from the “Tech Wreck” on the basis that the peak pre-August 2007 did not exceed the peak pre-Tech Wreck after adjusting for inflation:

It’s interesting for me because it compares the Dow Crash of 1929 (from which Graham forged his “Net Net” strategy) to the present experience in the US and Japan (both of which offer the most Net-Net opportunities globally). Where are we going from here? Que sais-je? The one thing I do know is that 10 more years of a down or sideways market is, unfortunately, a real possibility.

Greenbackd

http://www.greenbackd.com/