On Friday, Acme United (ACU, Financial) reported year-end results. While their customer markets are still soft, Acme was able to grow revenues by expanding their product lines and customer base. While many companies do this by slashing prices resulting in reduced margins and profitability, Acme has proven itself to be a superior company, maintaining strong profitability as it grows.

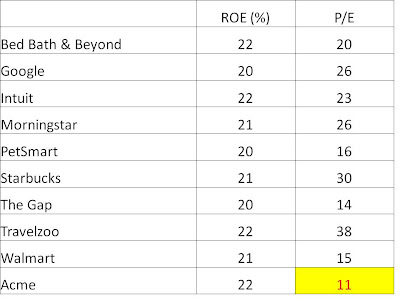

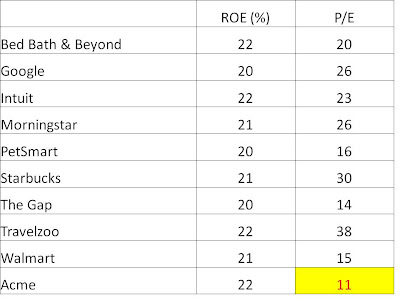

You wouldn't know it from looking at Acme's stock price, however. The company trades with a P/E of just 11, despite excellent returns on equity. To see the company's valuation in perspective, consider the P/E ratios of the following companies with similar returns on equity over the last five years:

Acme is not as recognizable as the rest of the names, but this is precisely why investors are offered this company at a discount. Many would argue that because the company is small, its riskiness is higher than the companies above. While that may be true to some extent (for example, three customers each exceed 10% of Acme's sales), the upside is also higher as the company has room to grow. Acme has an on-going goal of generating 30% of its sales from products developed in the last 3 years. This is something that the large companies listed above would have great difficulty achieving.

Acme is not as recognizable as the rest of the names, but this is precisely why investors are offered this company at a discount. Many would argue that because the company is small, its riskiness is higher than the companies above. While that may be true to some extent (for example, three customers each exceed 10% of Acme's sales), the upside is also higher as the company has room to grow. Acme has an on-going goal of generating 30% of its sales from products developed in the last 3 years. This is something that the large companies listed above would have great difficulty achieving.

In his book, The Little Book That Beats The Market, Joel Greenblatt discusses how the key to beating the market is to invest in companies with strong returns on capital when they trade at low P/E's. Acme fits this description well.

Readers interested in more information on Acme may want to give a listen to aninterview CEO Walter Johnsen granted Smallcaps.us a couple of weeks ago.

Of course, investors cannot buy simply on the basis of a company's P/E. Further investigation of a company's risks and opportunities is necessary, as well as a careful reading of the company's notes to its financial statements.

Disclosure: Author has a long position in shares of ACU

Saj Karsan

http://www.barelkarsan.com

Saj Karsan

http://www.barelkarsan.com