After a few weeks of absence, and back by popular demand, here's the top 5 graphs of the week. This week we look at the Asian powerhouses; China's PMI, Japan's influential quarterly Tankan survey and February international trade stats. Then we look at the western powers with EU unemployment and inflation, and a review of the US employment numbers.

To boil it down a little, there's further signs of strength and improvement in China, slightly positive signs in Japan's slow and fragile recovery; ominous signs in the EU with inflation and unemployment rising; and a positive result in the US employment figures even spurring some to call an official end to the recession...

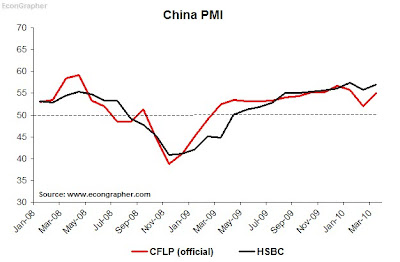

1. China PMI signals a robust manufacturing sector

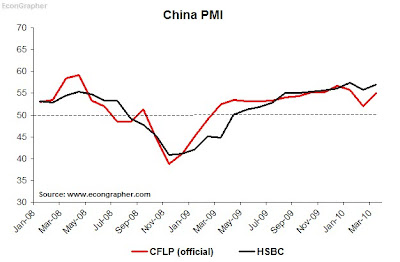

The Chinese economy showed signs of further strengthening with the release of the March PMI; the official CFLP figure was 55.1, up from 52 in Feb. The figure was in line with estimates, and in the same direction as the HSBC PMI index (57 vs 55.8). The positive figure in some ways confirms the reversal of some stimulus measures thus far and will likely add justification to further removal of stimulus as concerns of overheating certainly trump concerns about the strength of the economy. It may even add to the case of moving on the CNY, which is likely to occur this year - perhaps sometime around mid-year.

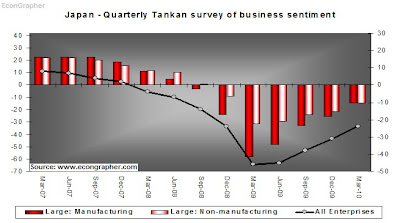

2. Japan Tankan survey shows firms less pessimistic

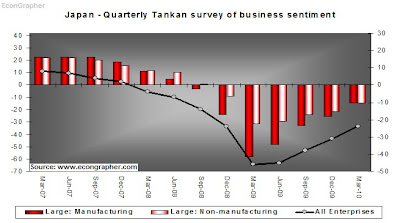

The Tankan survey showed Japanese firms had become significantly less pessimistic about business prospects and the state of the Japanese economy in the March quarter this year. This was especially evident in large manufacturers; obviously much of the improvement is driven by a recovery in trade (see the next chart), with demand from China and inventory rebuilding throughout the world. Japan's economy is very much reliant on international demand because the pesky consumers just wont spend, but that's OK because trade is starting to pick up again. But the facts are there is still the big fiscal and deflation challenges besetting Japan.

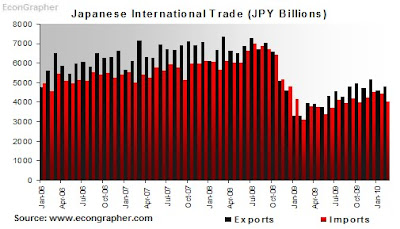

3. Japan International Trade continues its slow recovery

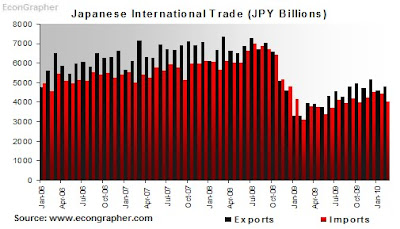

As mentioned Japanese trade volumes in both imports and exports have started a slow recovery (much slower than what the Chinese have experience on both imports and exports). In February exports were up 45% year on year (though the comparator figure was the worse in about 5 years or so). Japan has also begun persistently turning trade surpluses since Feb last year. Japan benefits in this area from the fact that much of its key exports are electronics etc, i.e. much of the kinds of things that are impacted by inventory re-stocking; but at the same time are vulnerable to drop-offs in global (US) consumption.

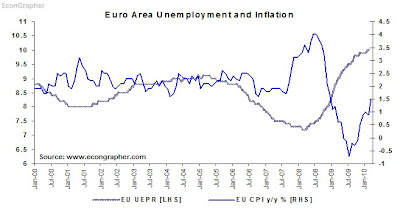

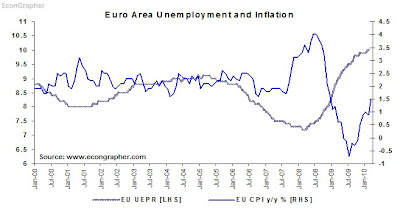

4. EU Inflation and Unemployment both rising

Over in the EU, the week saw inflation and unemployment figures released. Unemployment crept up from 9.9% in Nov through Jan to 10% in February. Likewise annual headline CPI inflation climbed to 1.5% from 0.9% in February; continuing a cyclical resurgence in inflation. As I've mentioned in other articles, the EU economic recovery is one that is very much mixed and fragile. Within the results there are some countries with much worse figures (e.g. Spain), but anyway, rising unemployment and inflation is generally not a good thing. But to be fair there are some bright spots in the EU - so the message is that you can still invest there, but you need to pick and choose between individual member states.

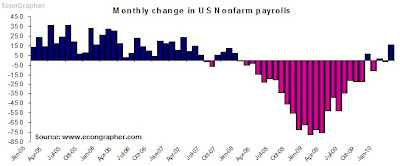

5. US Nonfarm Payrolls finally show genuine improvement

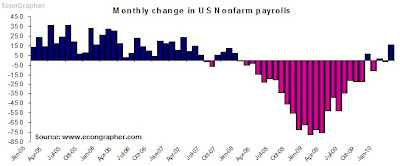

Now for the data point that spurred the NBER's Hall to proclaim the US recession over. US Nonfarm payrolls came in up 162k in March (this lines up with comments I noted a few days ago), against -14k in February, and consensus of 184k. The unemployment rate was reported at 9.7%, the same as February, and consensus estimates. Overall this was a pretty positive result, sure the number could have been higher, but some genuine and significant job growth has been a long time coming (especially if you note all the down pink bars below). Is the US recession over? still a big call but, I guess I'd be comfortable with saying that the first part of it is. From here there are a few scenarios that could unfold.

Summary

Starting with Asia; the power house of Asian economic growth, China, showed it's manufacturing sector was alive and kicking with strengthening PMI figures. But at the same time it will likely herald further stimulus withdrawal measures - which is actually positive for longer term growth prospects. In Japan pessimism is abating, but still present; the recovery in international trade and the inventory cycle are blessings for Japan's export oriented economy. Meanwhile it's still struggling on with its fiscal deficit and debt problems and the persistent deflation problem.

In the western world the EU is muddling through a fragile and uneven recovery, and the recent data shows unemployment still at high levels and climbing; at the same time headline inflation is tracking higher (though there are short-term cyclical factors affecting this). Meanwhile in the US the positive employment results give hope for further improvement in what is still the worlds largest economy. And with that it's probably safe to say that - at least for now - the US recession is over.

Sources

1. CFLP: www.chinawuliu.com.cn & Markit/HSBC: www.markiteconomics.com

2. Bank of Japan: www.boj.or.jp

3. Japan External Trade Organization www.jetro.go.jp

4. Eurostat: ec.europa.eu/eurostat

5. Bureau of Labour Statistics: www.bls.gov

Article Source: http://www.econgrapher.com/top5graphs3apr.html

To boil it down a little, there's further signs of strength and improvement in China, slightly positive signs in Japan's slow and fragile recovery; ominous signs in the EU with inflation and unemployment rising; and a positive result in the US employment figures even spurring some to call an official end to the recession...

1. China PMI signals a robust manufacturing sector

The Chinese economy showed signs of further strengthening with the release of the March PMI; the official CFLP figure was 55.1, up from 52 in Feb. The figure was in line with estimates, and in the same direction as the HSBC PMI index (57 vs 55.8). The positive figure in some ways confirms the reversal of some stimulus measures thus far and will likely add justification to further removal of stimulus as concerns of overheating certainly trump concerns about the strength of the economy. It may even add to the case of moving on the CNY, which is likely to occur this year - perhaps sometime around mid-year.

2. Japan Tankan survey shows firms less pessimistic

The Tankan survey showed Japanese firms had become significantly less pessimistic about business prospects and the state of the Japanese economy in the March quarter this year. This was especially evident in large manufacturers; obviously much of the improvement is driven by a recovery in trade (see the next chart), with demand from China and inventory rebuilding throughout the world. Japan's economy is very much reliant on international demand because the pesky consumers just wont spend, but that's OK because trade is starting to pick up again. But the facts are there is still the big fiscal and deflation challenges besetting Japan.

3. Japan International Trade continues its slow recovery

As mentioned Japanese trade volumes in both imports and exports have started a slow recovery (much slower than what the Chinese have experience on both imports and exports). In February exports were up 45% year on year (though the comparator figure was the worse in about 5 years or so). Japan has also begun persistently turning trade surpluses since Feb last year. Japan benefits in this area from the fact that much of its key exports are electronics etc, i.e. much of the kinds of things that are impacted by inventory re-stocking; but at the same time are vulnerable to drop-offs in global (US) consumption.

4. EU Inflation and Unemployment both rising

Over in the EU, the week saw inflation and unemployment figures released. Unemployment crept up from 9.9% in Nov through Jan to 10% in February. Likewise annual headline CPI inflation climbed to 1.5% from 0.9% in February; continuing a cyclical resurgence in inflation. As I've mentioned in other articles, the EU economic recovery is one that is very much mixed and fragile. Within the results there are some countries with much worse figures (e.g. Spain), but anyway, rising unemployment and inflation is generally not a good thing. But to be fair there are some bright spots in the EU - so the message is that you can still invest there, but you need to pick and choose between individual member states.

5. US Nonfarm Payrolls finally show genuine improvement

Now for the data point that spurred the NBER's Hall to proclaim the US recession over. US Nonfarm payrolls came in up 162k in March (this lines up with comments I noted a few days ago), against -14k in February, and consensus of 184k. The unemployment rate was reported at 9.7%, the same as February, and consensus estimates. Overall this was a pretty positive result, sure the number could have been higher, but some genuine and significant job growth has been a long time coming (especially if you note all the down pink bars below). Is the US recession over? still a big call but, I guess I'd be comfortable with saying that the first part of it is. From here there are a few scenarios that could unfold.

Summary

Starting with Asia; the power house of Asian economic growth, China, showed it's manufacturing sector was alive and kicking with strengthening PMI figures. But at the same time it will likely herald further stimulus withdrawal measures - which is actually positive for longer term growth prospects. In Japan pessimism is abating, but still present; the recovery in international trade and the inventory cycle are blessings for Japan's export oriented economy. Meanwhile it's still struggling on with its fiscal deficit and debt problems and the persistent deflation problem.

In the western world the EU is muddling through a fragile and uneven recovery, and the recent data shows unemployment still at high levels and climbing; at the same time headline inflation is tracking higher (though there are short-term cyclical factors affecting this). Meanwhile in the US the positive employment results give hope for further improvement in what is still the worlds largest economy. And with that it's probably safe to say that - at least for now - the US recession is over.

Sources

1. CFLP: www.chinawuliu.com.cn & Markit/HSBC: www.markiteconomics.com

2. Bank of Japan: www.boj.or.jp

3. Japan External Trade Organization www.jetro.go.jp

4. Eurostat: ec.europa.eu/eurostat

5. Bureau of Labour Statistics: www.bls.gov

Article Source: http://www.econgrapher.com/top5graphs3apr.html